-

Bitcoin Open Interest Falls 8%, Can BTC Still Finish Strong?

Best Owie

Best Owie 2022-12-20

2022-12-20 2755

2755 BTC

BTC

-

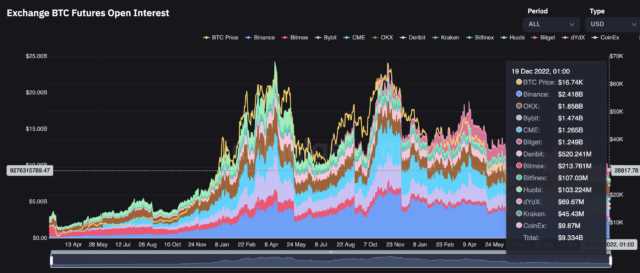

Summary:Bitcoin open interest has been on a steady decline since last week. After hitting a peak of $10.2 billion in early December, a swift reversal has seen

Since last week, the opening interest rate of Bitcoin has been steadily decreasing. After reaching the highest value of US $10.2 billion at the beginning of December, the opening interest rate reversed rapidly and fell to the bottom of the monthly summary. Now, in less than a week, this decline has added some work pressure to the price of Xianfeng Digital Currency.

Bitcoin announced an 8.8% rise in interest rates

In December, the market's sentiment towards Bitcoin was generally not ideal, which caused the stagnating growth of Bitcoin's open interest rate. Even so, taking full account of the encouraging CPI data release and the interest rate rise that the Federal Reserve meeting lowered in response to this situation, there were some positive changes last week. However, most of these improvements will fade rapidly in a few days.

From last Monday to Sunday, the volume of open positions in Bitcoin futures trading increased by about 8%. With the gradual recovery of the price, it is close to the highest value of the month again. But on Monday, it was only four days after the local peak was reached, which would decrease by 8.8%.

As of Monday morning, the total open positions of all trading centers at this stage are 9.353 billion US dollars. Now, there is a long way to go before the $23.805 billion created in April 2021 is higher. The last open interest rate was as low as two years ago in January 2021.

BTC looks bad

As far as Bitcoin is concerned, the year 2022 will end with a strong momentum, which is undoubtedly a good news for digital currency. However, the indicator value once again shows that the main performance is weak after the end of trading, and the reduction of the open interest rate of Bitcoin futures trading in the trading center has also played a very important role in this.

First of all, Bitcoin was unable to break through the $16000 dilemma. It is estimated that the digital currency will be continuously affected after falling below the support level of 17000 dollars, but there is no sign of recovery at present. At this stage, even the strong support of US $16500 is unstable at most.

Unless the momentum picks up in the next few days, Bitcoin may fall below 16000 dollars at the end of this year. Of course, this will also be promoted by the peace triggered by the holiday season, because most people will temporarily withdraw from the market. In addition, the liquidity withdrawal of holiday spending will also affect the financial system, as will Bitcoin.

Improving the friction resistance of $17000 at this stage is undoubtedly the fuse needed for Bitcoin's strong and perfect ending. Since then, $17500 is still a good overall goal, and both sides can easily maintain this momentum into the new year.

Featured image from NewsBTC, chart from TradingView.comDisclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.