-

Grayscale Bitcoin Trust Discount Shrinks To 38% As Gemini Deadline Goes Unanswered

Jake Simmons

Jake Simmons 2023-01-11

2023-01-11 3484

3484 BTC

BTC

-

Summary:The Grayscale Bitcoin Trust (GBTC) took a surprising development yesterday, Monday, January 9, when the world’s largest private BTC fund rose 12% in p

Grayscale Bitcoin Trust (GBTC) made a surprising progress yesterday (Monday, January 9), with the price of the world's largest individual BTC stock fund rising by 12%. According to TradeingView data, the stock price of GBTC was $8.65 at the close of the market on Friday. However, in the process of Monday, GBTC saw unexpected pressure in purchasing and pushed the price to $9.72.

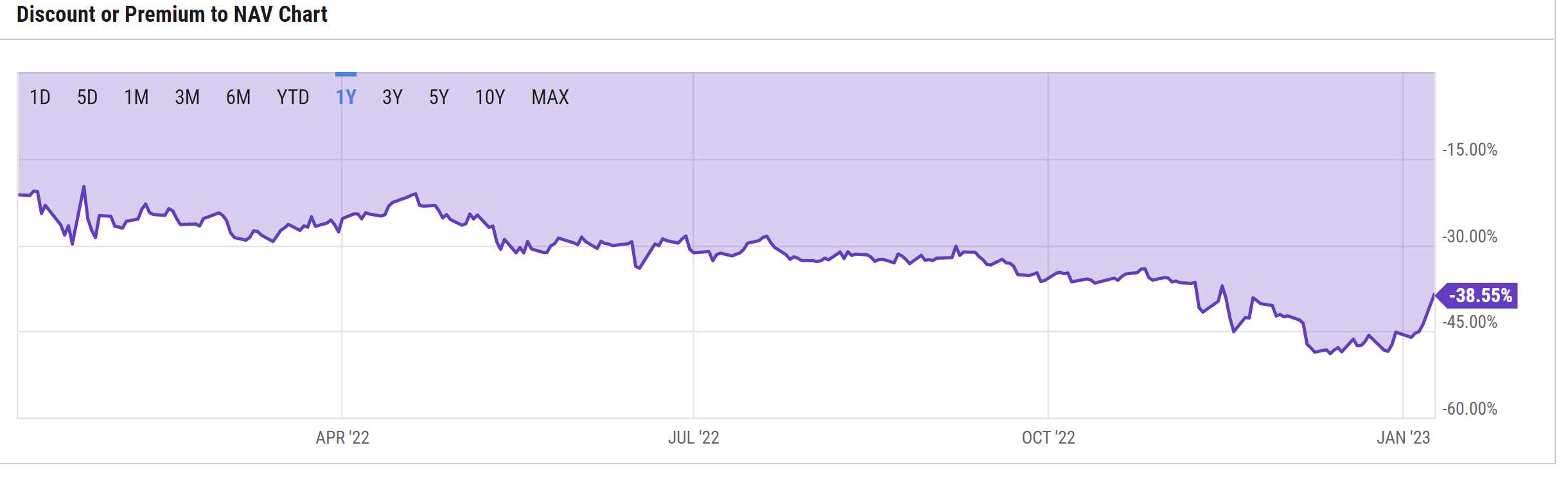

By comparison, the price of Bitcoin futures stagnated at around $17200 yesterday. Such things have led to a substantial reduction in the GBTC discount. Compared with the spot trading market, GBTC has increased in the first few days of this year. Although the discount on December 30 was 49%, yesterday's discount was reduced to 38%.

Strange opportunities for GBTC to take off

This development trend is likely to surprise many people. Because in the past few days, the phenomenon of closely surrounding Digital Currency Group (DCG) has not been alleviated, but has worsened again.

It is noteworthy that yesterday's gathering was held without the deadline for DCGCEO's Barry Hilbert transformation being evaluated by Gemini founder Cameron Winklevoss. Winklevoss gave Hilbert a Sunday deadline to release the $900 million Gemini Earn customer assets of Genesis Trading.

However, Cameron Winklevoss did not reply to the deadline yesterday, although she seemed very belligerent in her letter on January 2. As Ram Ahluwalia of Lumida Digital Assets Advisors explained in the Unchained blog, Gemini can now clearly put forward his personal will to Genesis when the deadline expires Chapter 11 bankruptcy to drive the enterprise to repay the outstanding debt of the debtor.

In this case, Genesis will be unable to pay off the debt and transfer the debt to DCG. DCG itself has a liquidity problem, which may even be large. It is uncertain whether Winklevos will do this, because everything around him was quiet yesterday. According to Samuel Andrew, an investment analyst, in the original tweet, it is reported that the debtor of Genesis 1 transaction indicated that:

[W] I understood the SEC a month ago, but EDNY (DOJ) is a thorny issue, which makes everyone stop at the weekend.

According to the authoritative Bitcoin expert, the British government is dealing with the structure migration between the data encryption departments rather than the data encryption group company that uses billions of dollars. As identified by McGinnis, the investigation and analysis of the Department of Justice of the East District of New York City (EDNY) is "another reason, that is, everyone who expects to completely solve the problems related to Genesis/Gemini should adjust this expectation."

Bitcoin theme activity in exchange for Grayscale has a strong momentum

When Barry Silbert trained procrastination tactics, David Bailey, a senior person in the field, launched "redeem GBTC fitness" to give shareholders a voice. The shareholder group company looks forward to ensuring that the trust is managed in a way that maximizes the use value of all shareholders.

The campaign has three objectives: a "reliable" way to redeem, minimize the harm to the Bitcoin market, reduce the cost of the period, change senior executives, and the competitive bidding process for new initiators of private equity funds.

Bailey revealed in a recent tweet that the campaign has got a very big trend. He said, "We have received letters from 2000 investors, who account for about 25% of the shares. Now is the time to influence." Bailey added:

DCG sold a novel to Wall Street in the United States. They feel that they will never lose control, so these shares are so common among 85000 shareholders. They make fun of retail and retired workers. They didn't know we would fight back. They made a show of 85000 people.

The main reason for the soaring price of GBTC yesterday was inference. But one reason may also be that arbitrageurs use very large discounts.

By the time of submission, the price of Bitcoin was $17194, following the trend of small increase in the past 10 days.

Dmitry Demidko's featured image | Unsplash, TradeView.com's data chart

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.