-

Bitcoin To Reach $161,800, According To Fibonacci Extension, Elliott Wave Theory

Tony Spilotro

Tony Spilotro 2023-01-20

2023-01-20 2486

2486 BTC

BTC

-

Summary:Bitcoin price is struggling to maintain above $20,000 per coin — a level that few expected the top cryptocurrency to trade at ever again once it passe

The price of Bitcoin is slowly keeping above $20000 per coin, which is hardly expected. Once the key friction resistance is broken for the first time, the top digital currencies will be bought and sold again.

In the new forecast, the next goal of BTCUSD may also reach the level that few people have considered or expected at this stage. howeverThe time-honored mathematics and Eliot Gann's theory are likely to show that the next cycle is actually much faster than many people think - the price is $161800 per piece.

Use Fibonacci's supernatural power to explore the price target

Cryptocurrency traders usually use Fibonacci sweepback and expansion to determine whether to buy or sell on any occasion.At this stage, it is not clear why the price is skewed to this level, but of course there will be such a proportion in the world.

For example, Uranus orbits the sun for 224.6 days, while the Earth orbits for 365.2 days. This forms an 8/13 ratio - two Fibonacci numbers - about 0.618.This is why the golden ratio is also called the noble proportion.This is almost fantastic.

Fibonacci sequence is a series of data, in which the next number in the sequence is the sum of the previous numbers. The coding sequence is loaded with 0, 1, 1, 2, 3, 5, 8, 13, 21, etc.

Although this coding sequence is named after a famous Spanish mathematician in marketing and promotion, its use can be traced back to the mathematics class in India in A.D. 200. In short, this is a math class with a long history.

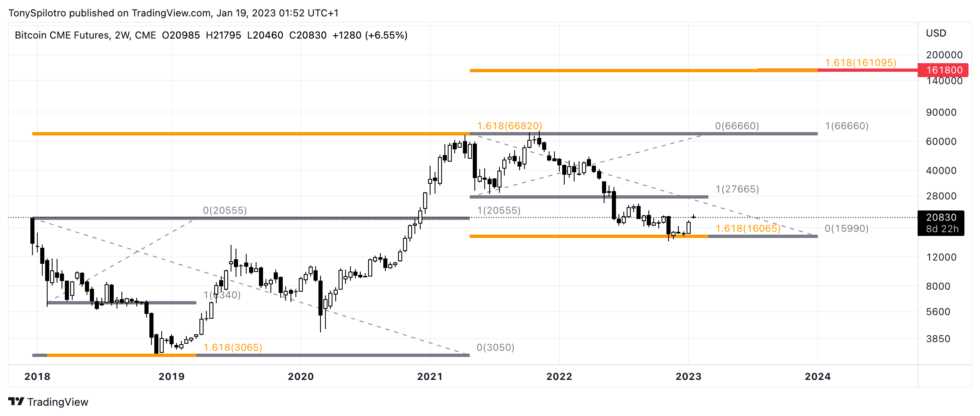

BTC has achieved 1.618 Fibonacci extension several times in the time period | CME-BTC! On TradeView.com

Using Elliot's basic theory of volatility to detect market cycle

Ralph Nelson Elliott trained Eliot Gann's theory in the 1930s, but this research may be the key to find out what happened to Bitcoin.

Elliott's volatility theory believes that the market cycle is divided into five key links. The first, third and fifth links change with the development trend, and the second and fourth links are used as correction links.

In Eliot Gann's theory, the relationship with Fibonacci is omnipresent. The pulse wave rise will often be ineffective at the Fibonacci extension, while the adjustment will stop at the Fibonacci position reduction ability and extension.

The five-wave dynamic wave carries out one cycle in five independent waves according to three single pulses and two adjustments. A complete Eliot wave pattern coding sequence consists of 21 fitness exercises, with a total of 21 correction methods. Every data is Fibonacci number.

Why can Bitcoin reach US $161800 per coin

With all these environments, you can pay attention to the price of Bitcoin. As a foreign exchange speculative property, it is vulnerable to the impact of mind-driven price fluctuations, which makes it very sensitive to the Fibonacci ratio and Eliot's basic theory of volatility.

Using the BTC CME futures trading data chart, we can calculate the driving force wave of the Bitcoin Elliott Wave that is still in progress. If the peak position is accurate, it is possible to predict the driving force wave and the rising cycle based on the use of Fibonacci to extend the overall goal.

The price of Bitcoin may reach 1.618 Fibonacci extension, about US $161800 per BTC. Interestingly, when you multiply $100000 by the gold ratio, you can get $161800. At the highest value in 2021, when Fibonacci expanded from the very open BTC CME data chart to the bottom of the stock market in 2018, the top digital currency reached the overall goal of gold proportion.

The overall goal is that the price of Bitcoin has ended the almost adjustment of the fourth wave of increase and officially started the fifth wave of shock. Although the fifth wave is also consistent with the first wave in terms of earthquake magnitude and compressive strength, they can also imitate the third wave, which is usually the most powerful.

Find the circulatory system in the cryptographic algorithm

In the video on the wall, Tony "the Bull" walks through every fluctuation count in Bitcoin step by step, and uses the Elliott wave example in the textbook to describe how the market price develops.

In the in-depth analysis of exclusive agents, each of them stopped at the key Fibonacci level, which can be traced back to the beginning of the bear market in Bitcoin stock market. The application of safe channel technology to predict the highest value of the next cycle is likely to achieve the bold goal in the next six months to one year.

Finally, applying Hurst's cycle theory, the regularity of BTC may be further confirmed. This basic theory shows that BTC has a nearly perfect sense of regular bottoming rhythm since 2015. Each key bottom end also occurs in most of the buying regions, and the top of each cycle time also occurs in the selling regions.

Subsequently, Fisher conversion was used to determine the existence of another important turning point in BTCUSD, which should be the last rising single pulse before the beginning and end of the cycle time.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice. Featured image from iStockPhoto, Charts from TradingView.comDisclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.