-

Bitcoin Derivatives Market Volumes Show Bullish Trend After 2022 Downturn

olowoinc

olowoinc 2023-02-05

2023-02-05 2426

2426 BTC

BTC

-

Summary:Bitcoin continues to see a bullish uptrend across the board, with the derivatives market volume witnessing an upturn in fortunes. BTC prices in future

Bitcoin once again showed an upward trend of all-round rise, and the trading volume of the derivatives market turned. The BTC price in the stock index futures contract has gradually exceeded the price in the commodity trading market, which indicates that the confidence of the traders in the derivatives market has increased

Bitcoin derivatives trading volume plummeted in 2022

In 2022, Bitcoin has a continuous bullish development trend, resulting in a 60% drop in its price, and a significant decline in the trading volume of Bitcoin futures and stock index futures. The collapse of FTX in November of last year further lowered the market mentality, and the derivatives market withdrew significantly, accompanied by long-term settlement and strong bullish trend

basisdataAccording to TheBlock, the trading volume of Bitcoin futures in December 2021 is about US $130 million. In November 2022, this figure dropped by more than 50% to US $620 million, indicating a sharp decline in the trading volume of key exchanges.

However, this changed in January 2023, and the reversal of Bitcoin's fate is a key factor. The price of Bitcoin has risen steadily recently, reaching US $24000 earlier this week. The derivatives market shows a clear upward trend

Extended reading:Improvement: Bitcoin will break through $24000 for the first time in 2023

On-chain data shows positive growth in 2023

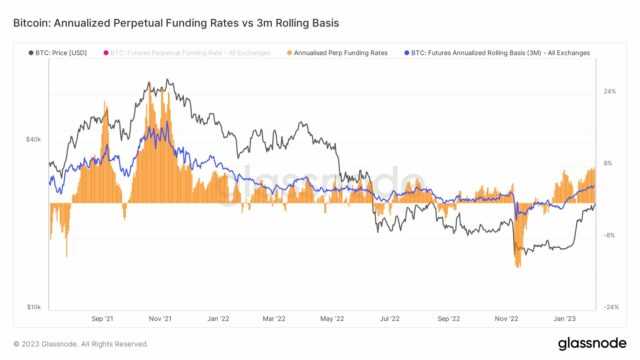

According to market investment analyst ProfChaineTwitter account,The derivatives market has reversed, and the short-selling behavior of individuals is strong, with a significant upward trend. It further applies her view with a series of data charts, which show the basic evolution of the annual interest rate of the movement of Bitcoin futures in March (shown in blue below)

This indicator indicates the percentage adjustment of the average price of the stock index futures contract compared with the futures price. If investors take the stock index futures contract higher than the futures price as the main target, the interest rate is also coincidental. If the expected price will fall, the interest rate is negative

As shown in the figure, at the beginning of November, along with the withdrawal of traders from commodity futures, the sharp fall of FTX caused the index to be negative. However, due to the rise in the use value of Bitcoin, there was an obvious upward trend in January

Extended reading:Long-term holders of Bitcoin now have 78% of the supply, a record high

Another indicator is the leverage ratio of Bitcoin futures open interest rate, which indicates the total number of outstanding derivative contracts within a given period. The increase of the announced interest rate represents that a new investor has bought and sold a new trading position in the derivatives market

The figure shows that since the beginning of the year, the total number of financial leverage not forced to close positions has increased. This is in sharp contrast to the decrease in the market trading volume in 2022 when it is relatively lowThe increase of futures trading volume represents the rise and fall data signal of the market, which is generally an indicator value, indicating that we may enter a long-term bull market

Featured pictures of Unsplash.com/data charts of TradingView and Glassnode

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.