-

Bitcoin Sentiment Turns Neutral As BTC Plunges Below $29,000

Hououin Kyouma

Hououin Kyouma 2023-04-21

2023-04-21 2977

2977 BTC

BTC

-

Summary:Data shows the Bitcoin market sentiment has turned neutral today as the price of the cryptocurrency has taken a plunge below the $29,000 level.Bitcoin

According to the data, with the price of Bitcoin plummeting below $29000, the market sentiment of Bitcoin sales has become neutral today.

The Bitcoin Fear and Greed Index has fallen back to a "neutral" region

The 'Fear and Greed Index' is an indicator value that warns us of the overall sentiment of investors in Bitcoin and the wider cryptocurrency market. This indicator should use a data scale ranging from 0 to 100 to describe such emotions.

All values above 50 in this index indicate that investors are currently very greedy, while values below 50 indicate that the sales market has been very anxious recently.

However, this disintegration is theoretically likely to be an even number, but the territory within these category boundaries is often perceived as belonging to the sentiment of "maintaining neutrality". More specifically, the median value between 46 and 54 is likely to indicate a neutral sales market.

In addition to these three emotions, there are actually two "extreme" emotions, namely "extreme fear" and "extreme greed". The former has a usage value of less than 25, and as a digital currency, it has played a crucial role in generating regular bottoms in history.

Similarly, the latter region appears above 75 in value in use, which is generally the region generated at the top of the industry. Due to this significant correlation with price, some investors feel that it is best to buy in extreme fear and sell in extreme greed.

Followers of this concept are referred to as "contrarian investors" because they act against the fundamentals. Warren Buffett's classic quote echoes the same philosophy: "When someone is greedy, worry, and when someone is worried, be greedy

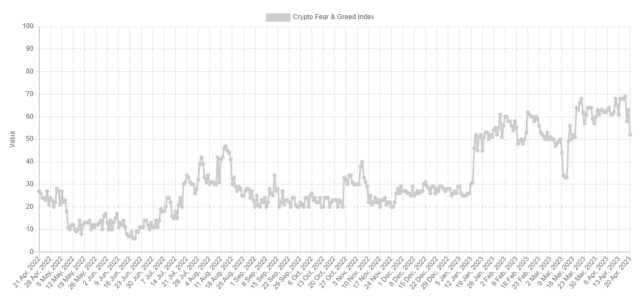

Now, here is a data chart that shows how the quality of the Fear and Greed Index in Bitcoin and the wider cryptocurrency market changed last year:

As shown in the figure, the Bitcoin Fear and Greed Index was mostly in the fear and extreme fear range during the bear market period, but with the rebound starting this year, the index significantly returned to its normal neutral value.

Since then, except for the temporary drop to the fear zone in the previous month, this indicator has been able to maintain a neutral value or above. However, in the past few weeks, with the strong upward trend of asset prices, the sales market has maintained an insatiable greed.

During the past period, the price of BTC plummeted below $30000, and now it has dropped below $29000, severely hitting investors' attitudes.

At present, the value of this indicator is still 52, indicating that the public's sentiment is still very close to the industry of insatiable greed. However, special attention should still be paid to such changes towards neutrality, as the last time this indicator had a similar value was more than a month ago.

It remains to be seen whether the sales market can repair the optimistic mood, or whether the decrease in mood will occur again in the near future, and whether the indicator values will fall within the fear zone.

BTC Price

At the time of writing, the transaction price of Bitcoin was approximately $28800, which increased by 5% last week.

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Alternative.meDisclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.