-

Healthy Bitcoin rally: What does a margin lending ratio drop mean for BTC price?

Marcel Pechman

Marcel Pechman 2023-04-16

2023-04-16 4776

4776 Market

Market

-

Summary:Will $30,000 BTC price hold? Bitcoin market structure remains bullish with another 10% gain on the table as sellers refrain from shorting.

Bitcoin prices rose by more than 10% between April 9th and April 14th, setting their highest daily closing price in over a decade. Although some investment analysts may believe that this move validates the rationalization of linking to traditional channels, both the S&P 500 index and gold are close to their highest levels in over six months.

Despite encountering macroeconomic friction and resistance, the price of Bitcoin still increased by $30000

Bitcoin rose and bounced back above $30000, while considering the USD strengthening index (DYX) against a basket of foreign exchange transactions, it reached its lowest level in December.

This indicator has decreased from 104.7 a month ago to 100.8 on April 14th, as investors feel that the probability of further introducing liquidity at the Federal Reserve meeting is higher.

Related: Bitcoin prices plummeted by $30000 before the foreign consumer price index and the minutes of the Federal Open Market Committee meeting

On April 12th, the latest released minutes of the Federal Reserve's fiscal policy meeting confirmed that due to the difficulties of commercial banks, it is estimated that there will be a "slight decline" in the later period of 2023. Even if inflation is no longer a key issue, monetary authorities have little room for further interest rate hikes without exacerbating the financial crisis.

Even if inflation is no longer a key issue, monetary authorities have little room for further interest rate hikes without exacerbating the financial crisis.

Strong macroeconomic data illustrates investors' optimistic mindset

Although the world economy is likely to undergo a vicious transformation in the near future, recent macroeconomic data is generally proactive. For example, the EU National Audit Office report pointed out that industrial production in 20 member states increased by 1.5% year-on-year in February, while economists surveyed by the Associated Press estimated an increase of 1.0%.

In addition, the latest macroeconomic data in China shows an encouraging trend, with imports and exports increasing by 14.8% year-on-year in March, ending a five month decline and surprising economists who estimate a 7% decrease. Therefore, the balance of China's trade account in March was $89.2 billion, far exceeding the widely recognized $39.2 billion in the sales market.

The current economic development trend is in stark contrast to the upcoming decline caused by increased equity financing costs and reduced equity investment risks for borrowers, causing Bitcoin investors to doubt the sustainability of the $30000 support.

Let's take a look at the indicator values of Bitcoin derivative products together to better understand the precise positioning of technical professionals in the current market environment.

BTC derivative products do not indicate excessive financial leverage from both sides

Margin users provide insights into how technical traders are positioned, as it allows investors to raise funds in cryptocurrency to utilize their trading positions.

For example, OKX provides a margin loan indicator value based on the stable currency/BTC ratio. Traders can increase their leverage ratio by raising funds to purchase stable coins and Bitcoin. On the other hand, Bitcoin lenders can only bet on the decline in cryptocurrency prices.

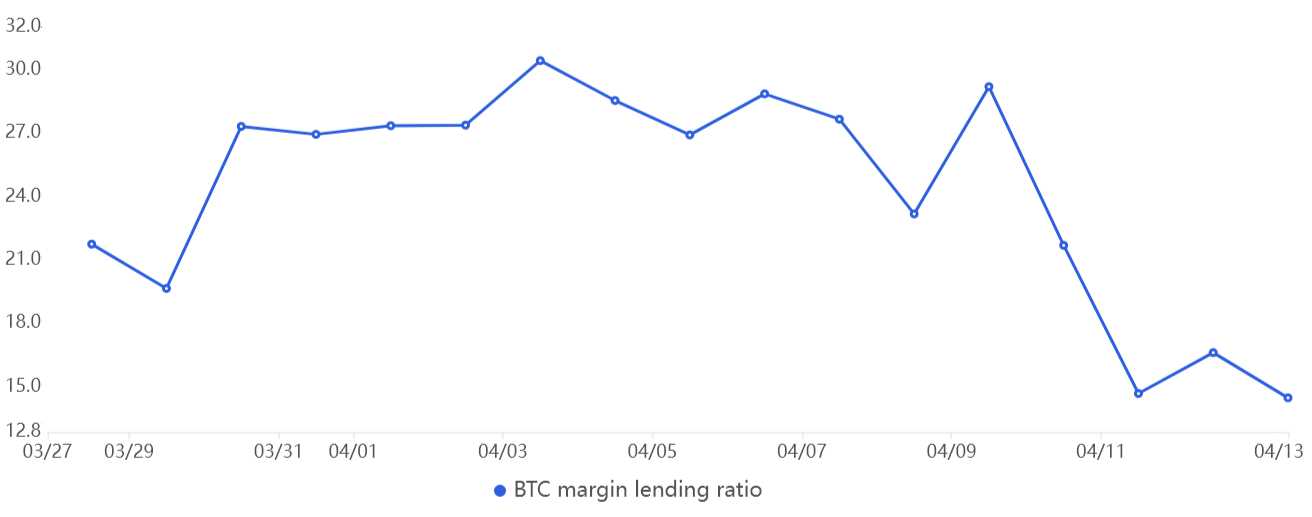

OKX stable currency/BTC margin loan ratio. Origin: OKX The figure shows that the margin borrowing ratio of OKX traders significantly decreased from April 9th to April 11th. This is a very healthy life because it indicates that financial leverage has not been used to support the rise in Bitcoin prices, at least in the margin sales market. In addition, fully considering the common optimistic attitude of cryptocurrency traders, the margin borrowing ratio of 15 is relatively neutral at this stage.

The length evaluation index does not include external factors that may harm the margin market. In addition, it also collects information from spot trading, permanent, and Q1 stock index futures contract trading positions of trading center customers, providing stronger information on how to position relevant technical professionals.

Sometimes there may be differences in communication methods, so readers should detect changes rather than confirming data.

The long short ratio of Bitcoin, the top trader in the trading center. Origin: Coinglas Interestingly, based on the long short indicator, although Bitcoin has broken below $30000 for the first time in 10 months, the financial leverage long positions of technical professionals remain consistent.

For example, from April 9th to April 14th, the proportion of Huobi traders remained around 0.98. In addition, on the cryptocurrency trading center Coin On Net, there has been a slight increase in short to double orders, which is beneficial for both sides, rising from 1.12 on April 9 to 1.14 at the current stage. Finally, at the cryptocurrency trading center OKX, the long short ratio slightly decreased, from 1.00 on April 9th to 0.91 at the current stage.

ofTesla Motors sold Bitcoin for $500 million last year, which is incorrect

In addition, Bitcoin futures traders do not have a certain level of confidence to increase their financial leverage and trading positions. Therefore, even if the Bitcoin price is retested at the derivative level for $29000, the duo should not care, as short buyers have very few requirements and customers do not have too much financial leverage.

That is to say, the demand for Bitcoin in the market is on the rise. Considering that merchants are currently afraid of short selling Bitcoin, Bitcoin prices can easily increase by another 10% to reach $33000.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.