-

Why is Ethereum (ETH) price up today?

Kyle White

Kyle White 2023-04-16

2023-04-16 4850

4850 Market

Market

-

Summary:Ethereum price is up today and now with the Shapella hardfork in the background, traders are taking a much closer look at ETH

In the context of the successful renewal of Shanghai urban area and Shapella, ETH has confirmed the price increase. The rising sentiment after the upgrade caused the price of Ethereum to set a new record of $2123 within the year on April 14th.

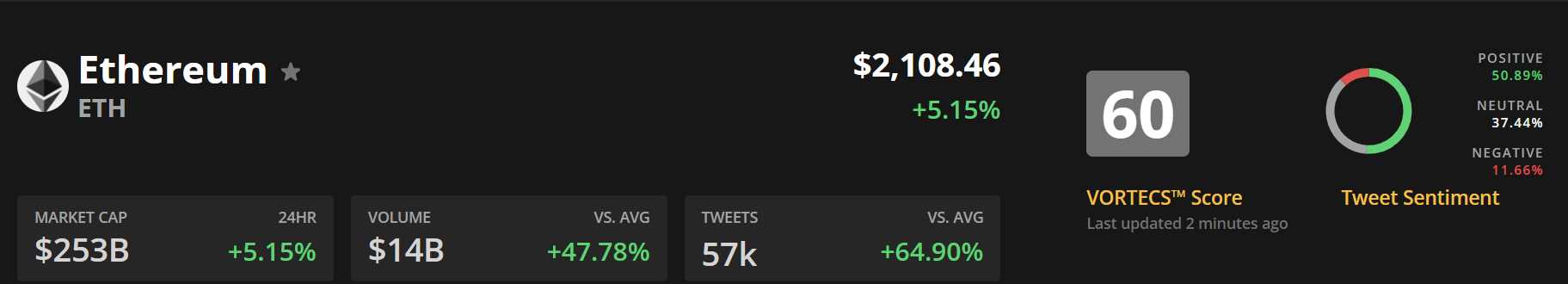

Ethereum price and emotional dashboard in the car. Material origin: Coindegraph Markets Pro The Ethereum Decentralized Finance (DeFi) ecosystem received more daily expenses, increasing by 30% within 24 hours on April 14th, in line with the price increase of Ethereum. With the increase in Ethereum costs, Ethereum's Proof of Equity (PoS) token economy has already shifted towards deflation, with revenue increasing by 32% in the past 24 hours

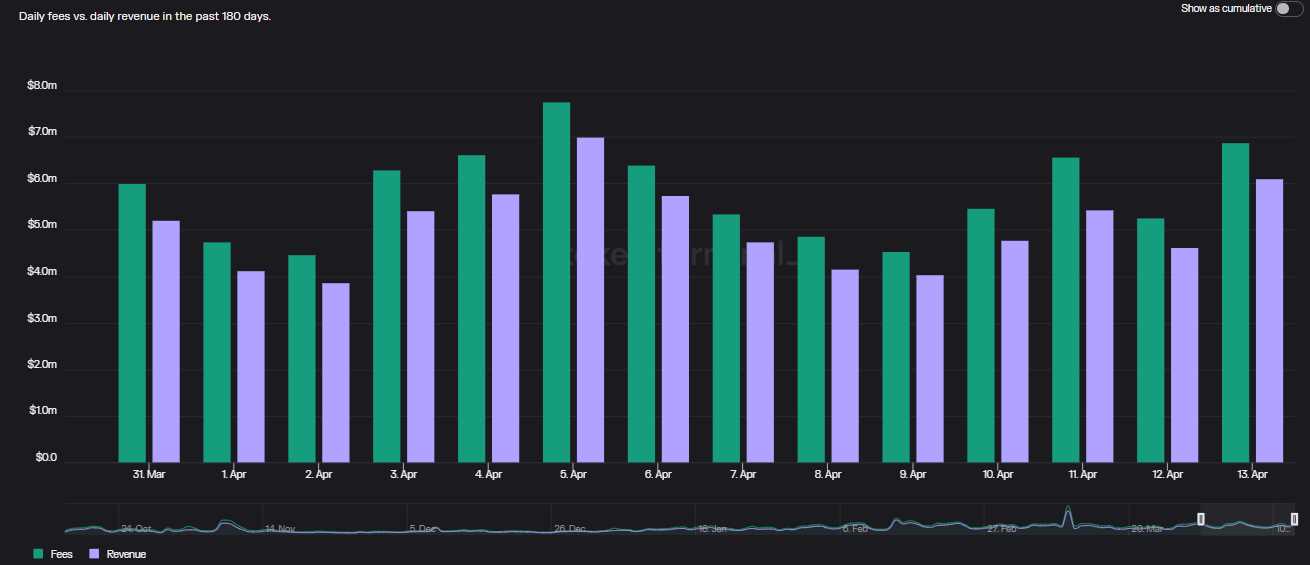

Ethereum network fee income. Origin: TokenTerminal Although Ethereum Internet is showing a proactive momentum, regulatory authorities are focusing on quickly taking action in the cryptocurrency sector. The debate over whether Ethereum is a security token tested by Howell continues, while an Ethereum researcher suggests that data encryption can leak IP addresses

Let's review some of the reasons for the new rise of Ethereum.

Ethereum Shanghai Achieves Success

The long-awaited Shapella update was announced on April 12th to be implemented on the main network.

The initial setting for Sharpela's hard fork is March 14th. At that time, on chain data showed that the hard fork in Shanghai was not easy to bring significant sales pressure, but some analysts believed that the newly opened market supply would interfere with the price of Ethereum.

The current development trend after the launch of Shapella indicates that most validators only receive chip rewards, rather than the 32 Ethereum required to operate the connection point again. As of April 14th, the total number of owners of Ethereum has only decreased by 0.2%.

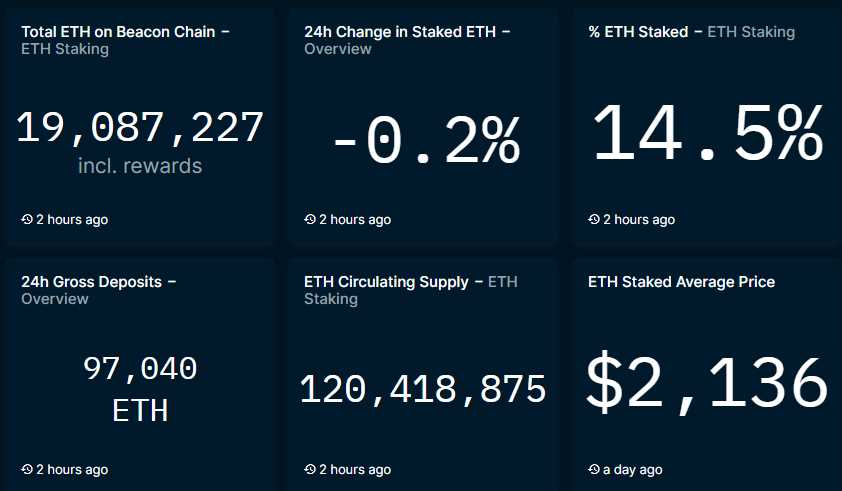

Ethereum car dashboard with stakes. Material origin: Nansen Ethereum savings skyrocketed after hard forking

Although the total withdrawal exceeded the savings of the Ethereum ecosystem, 97040 Ethereum coins had already been bet within the 24 hours before April 14th. The increase in savings from Ethereum pledged loans is a positive and proactive sign for the future development of Ethereum in the post Shapella era

Savings and withdrawals from Ethereum business merger. Material origin: Nansen On April 13th, over 70% of Ethereum coin holders were in the water. After withdrawing funds from the new depositor, the average chip price in Ethereum at this stage is $2136. The difference between the average chip price and the existing Ethereum coin has become smaller, which means that most Ethereum ecosystem chips are likely to make profits soon

ofUS law enforcement agencies have strengthened their penalties for cryptocurrency related violations and crimes

Ethereum prices are rising, and the cryptocurrency sales market is rapidly rising

The final price trends of BTC (BTC), Ethereum, and AltCoins have led some investment analysts to announce that the bottom has arrived. On April 14th, the BTC price set a new record for the year of $31014, surpassing the critical psychological level of $31000

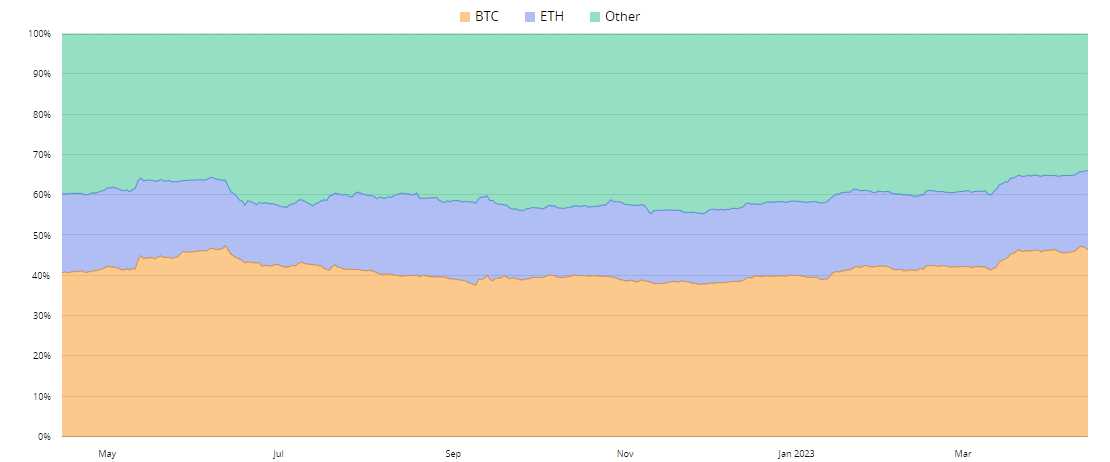

Although the prices of Bitcoin and Ethereum are both increasing, Ethereum has become dominant compared to Bitcoin and AltCoins. From April 13th, the strength of Ethereum gradually increased to 19.37%, an increase of 0.54% within 24 hours.

BTC and Ethereum Advantages Data Chart. Origin: BTCTools Ethereum's dominance over Bitcoin was very difficult in early 2023, but it has quickly overcome obstacles

Investors' Estimates for Ethereum and Cryptocurrency Markets in 2023

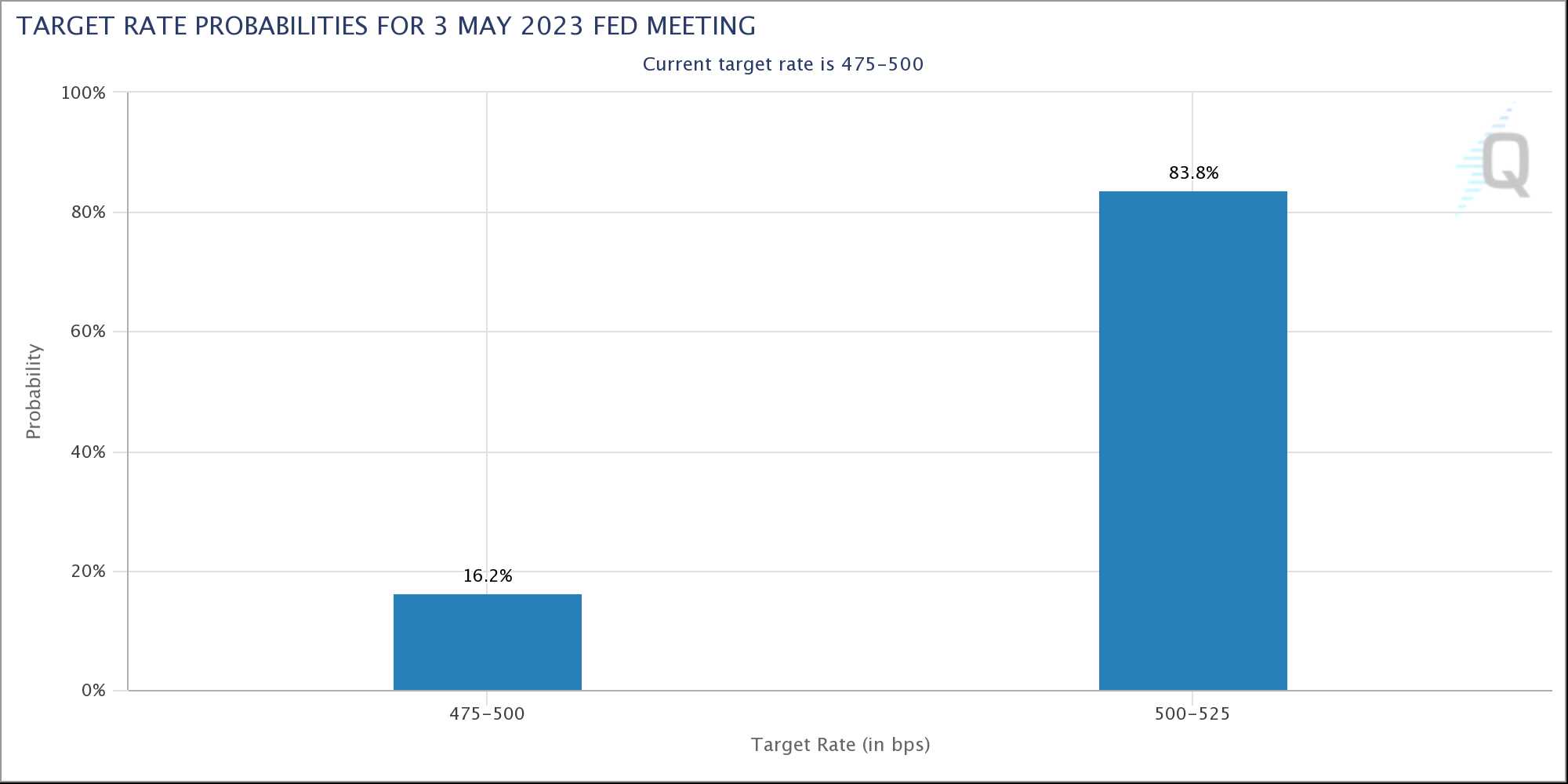

Some analysts believe that although the Consumer Price Index (CPI) and Operator Price Inflation (PPI) indicate that inflation has slowed down faster than expected, there is still a high possibility of a decline in Ethereum prices in the near future. The highly sought after FedWatch specialized tool still predicts that the Federal Reserve meeting will raise interest rates on May 3rd.

Annual interest rate forecast analysis. Source of materials: Chicago Mercantile Exchange The macro environment of interest rate hikes caused by inflation and implicit severe crackdowns in foreign fields will continue to harm the price of Ethereum, slightly hindering the potential for short-term price growth and development. Various factors such as proactive and strict regulation, specific relaxation, and interest rate hikes may prove to be sustained metal catalysts for price growth. The price fluctuations of Ethereum are likely to continue.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.