-

Bitcoin holds $30K, but some pro traders are skeptical about BTC price continuation

Marcel Pechman

Marcel Pechman 2023-04-16

2023-04-16 2994

2994 Market

Market

-

Summary:BTC traders are cautiously optimistic due to Bitcoin traditional assets, but there are still some macro headwinds to be aware of.

After ten months of pressure in the important price zone, the price of Bitcoin (BTC) has finally broken the $30000 level. The BTC price increased by 6.5% on April 10th, and everyone is looking forward to the end of the long awaited 12 day extremely low fluctuation period. The price is struggling around $28200. The bull market now firmly believes that the bear market in the stock market has officially ended, especially considering that BTC has risen 82% so far today.

Another interesting piece of information is that on April 10th, after the S&P 500 index rose only 0.1% and WTI oil trading fell 1.2%, the link between Bitcoin and traditional markets has long been confirmed. Bitcoin traders are likely to predict that the Federal Reserve's deposit and loan rates will eventually reverse.

The risk of stagflation may be the main reason for the linkage

Higher interest rates make fixed income investments more attractive, while companies and households face additional costs for debt mergers and acquisitions. The recent reversal of the US central bank's tightening policies is known as an increase in risk assets. However, the anxiety about economic stagflation - the stage of increased inflation and negative economic growth - is undoubtedly the worst situation in the stock market.

Fixed income traders are betting that the Federal Reserve meeting may raise interest rates again, as the latest economic development data shows appropriate resilience. For example, the 3.5% unemployment rate in the United States released on April 7th is the lowest level in half a century so far.

According to Bloomberg News, the US bond market shows that the probability of the Federal Reserve meeting increasing the standard by 0.25% on April 29 is 76%. The harm of commercial banking difficulties to this industry has also increased variability, with Morgan Bank, Wells Fargo Bank, and Citigroup scheduled to release their first quarter sales results on Friday.

Bitcoin has risen above 30000 yuan, which should be the first direct evidence of investors' cognitive ability shifting from risky market agents to rare digital currencies, which may benefit from a period of inflationary pressure and sluggish economic growth.

Two main factors directly determine whether rebound is sustainable: the application of high leverage ratio enhances the probability of forced liquidation during normal price adjustment periods, and whether pro traders use stock index futures specialized tools to price the market with a higher probability of distress.

Bitcoin futures trading mainly shows soft improvement

Bitcoin's Q1 futures trading is very popular on shark and hedge arbitrage platforms. However, the transaction price of this fixed fixed fixed month contract is generally slightly higher than that of the spot trading market, indicating that merchants require more money to delay settlement.

Therefore, in the physical and mental health market, stock index futures contracts need to be traded at a daily chemical premium of 5% to 10%, which is called futures trading premium and is not unique to the digital currency market.

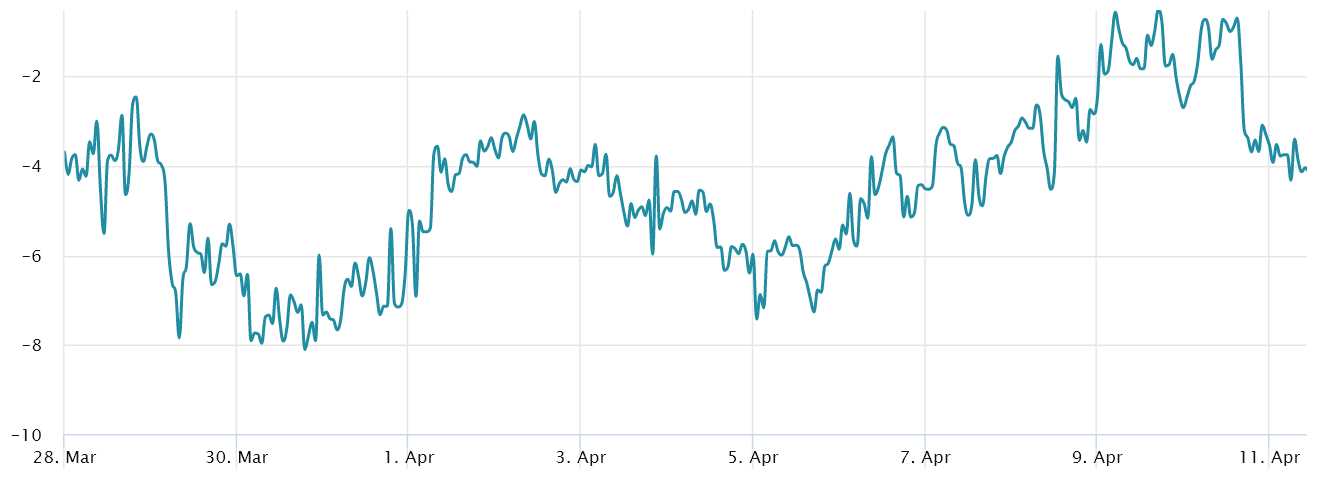

The annualized interest rate premium for Bitcoin 2-month futures trading. Origin: Laevitas.ch Bitcoin traders have been very cautious in the past few weeks, even though they have recently broken $30000, the need for financial leverage duo has not skyrocketed. However, the premium for Bitcoin futures trading has slightly increased from the recent bottom of 3% on April 8th to the current 4.2%. This indicates that customers did not misuse financial leverage, and the basic spot trading market has Engel's law, which would be very healthy for the market.

Bitcoin stock index futures traders remain neutral

Traders should also analyze the stock index futures market to understand whether recent adjustments have caused investors to become increasingly optimistic. When the hedge arbitrage department and market making deduct too much expense for rising or falling maintenance, 25% Delta error is a significant sign.

In short, if traders predict that Bitcoin prices will also decline, the skewed indicator value will rise above 7%, and the excitement stage often shows a negative 7% skewed value.

ofMicroStrategy Bitcoin bet changed color, and the price of Bitcoin soared to 10 months higher

Bitcoin 60 day stock index futures with 25% tilt: Origin: Laevitas.ch At this stage, the deflection of the stock index futures delta of 25% has gradually changed from the requirement of connection between put options and put option on April 9 to the appropriate discount of 4% for defensive put option on April 10. Although this indicates a slight increase in self-confidence, it is not enough to break free from the appropriate 7% optimistic threshold.

Fundamentally, the Bitcoin options and futures markets indicate that technical professionals are slightly more confident, but not overly optimistic. There is an opportunity to link with the traditional market, as investors have shown confidence that the digital currency market will benefit from higher inflationary pressures and traders' firm belief that the Federal Reserve meeting cannot continue to raise interest rates.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.