-

‘Pop or drop?’ Bitcoin analysts decide if BTC price will beat $30K

William Suberg

William Suberg 2023-04-16

2023-04-16 2810

2810 Market

Market

-

Summary:Bitcoin is giving off fresh signals that it’s soon time for a BTC price surge, but old support may need a retest first.

Bitcoin (BTC) once again came under pressure at the US Wall Street League on April 10th, but cryptocurrency investors are betting on the next important breakthrough.

After the BTC/US dollar closed at its highest monthly closing point since June 2022, there is a new positive attitude towards the $30000 increase.

According to statistics from Coindigraph Markets Pro and Trading View, the macroeconomic buying and selling week started very well, with a current focus of $28200.

Bitstamp for Bitcoin/USD 1 day candles. Origin: TradeView However, due to significant frictional resistance, Bitcoin remained in a solid but increasingly narrow trading range for most of last week.

The viewpoint is that the longer such things continue, the more intense the final breakthrough should be - whether it is upward or downward.

When it comes to what BTC pricing behavior will do next, Coindegraph will pay attention to the positions of some popular investment analysts.

Raw material indicator value: Will Bitcoin "rise or fall

The order book data information has played a leading role in determining price adjustments, and the latest report from Coinsafe warns that fluctuations are imminent.

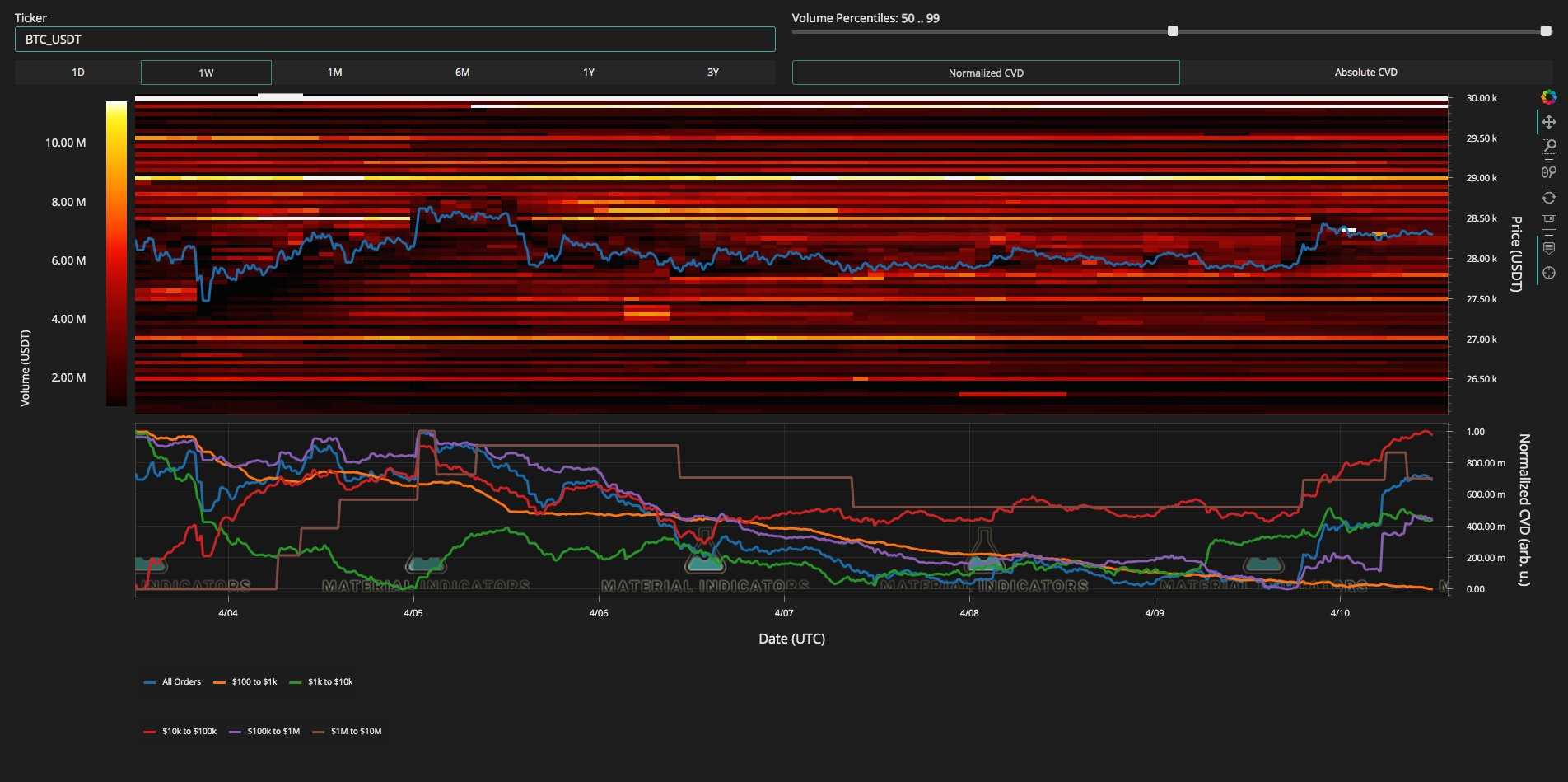

According to a snapshot update uploaded to Twitter based on the raw material indicator values of the detection network resources, the liquidity of buyers and sellers has mainly decreased from the price close to spot trading to a relatively low and relatively high level.

On the contrary, this has also brought more unstable fluctuations in indoor space within the sales market, enhancing the probability of significantly breaking away from development trends.

Material Indicators commented, "It will be an interesting week. FireCharts indicates that the undulating route has been double eliminated. The key is, will BTC rise or fall after experiencing all this.

This week's CPI and PPI reports may be metal catalysts, but as you saw yesterday after the close of W 焟 candle, liquidity may also be pulled down

BTC/USD order book data information (Coin Security Network). Origin: Raw Material Index Value/Twitter Reliable Cryptocurrency: Bitcoin Price Copy Breakthrough 2020

For the popular trader Credible Crypto, before the historical time of breaking through 20000 US dollars by the end of 2020, Bitcoin has once again begun its preparations for the bull market.

In his opinion, in terms of price behavior, today's $26000 to $29000 is "very similar" to the $8000 to $10000 in midsummer.

In a perfect world, BTC/USD will fall to around $27500, consolidating this area as support before the bull market surges, with charts attached.

Comparison of BTC/USD before and after. Origin: Reliable Data Encryption/Twitter As reported by Cointelgraph, reliable cryptocurrencies are not the only investors who have focused on commonalities with past Bitcoin bull markets, and 2019 has also become a focal point.

Individual Stock Loan Coin Snake Lizard: Bitcoin's "Decision Point"

In addition, Stockmoney Lizards, a financial information service network resource, believes that the vast majority of the current range is likely to show an "increase" in results

Regarding: CPI will cause a US dollar massacre -5 things Bitcoin should remember this week

In the latest data chart prediction analysis, it focuses on setting a series of higher bottom points for BTC/USD, and maintaining the same frictional resistance around USD 30000.

It feels that as Bitcoin reaches the 'decision point', it will lead to a win-win situation for both sides

BTC/USD annotated data chart. Origin: Stockmoney LIzards/Twitter The interpretation released on the same day reinforced the view that if the pressure level "has already been tried x times but has not broken through, it may be a sign that the pressure level has weakened and the possibility of breaking through is relatively high

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.