-

Ethereum Shanghai hard fork: ETH price set for more gains versus Bitcoin in April

Yashu Gola

Yashu Gola 2023-04-16

2023-04-16 4482

4482 Market

Market

-

Summary:Ethereum price has gained momentum in April, even against Bitcoin, as the much-anticipated Shanghai hard fork is just days away.

In 2023, the BTC of Ethereum (ETH) fell by over 7.5%. But ETH/BTC may completely resolve the losses so far this year in April, due to the long awaited distance between Ethereum and the hard fork in Shanghai, which is only a few days away.

The update is scheduled to take place on April 12th, allowing Ethereum chip holders to receive approximately 1.1 billion ETH rewards. As of April 8th, the significance exceeds 2 billion US dollars

ETH price experienced significant technical rebound

Many experts point out that in the long run, hard forking is an upward trend for Ethereum. For example, there is a heated discussion in Shanghai to assist Ethereum in surpassing BTC in April.

As of April 8th, ETH/BTC has risen by approximately 4.75% to 0.066 BTC, rebounding nearly 8% since March 20th

Jumping back is to some extent reasonable, especially when ETH/BTC falls to the historical upward trend line support point. Nowadays, the probability of a long-term bull market adjustment that increases resistance towards the downward trend line is marked as a "selling area" in the figure below.

ETH/BTC three-day price chart. Origin: TradeView According to Bocai's development prospects prediction analysis, the target price of Ethereum by June is 0.075 BTC, which is a 10% increase from the current price level. In addition, the overall upward target for April may be a 50-3D index value moving average system (50-3D EMA; red wave) around 0.069 BTC.

On the other hand, the key closing point below the 200-3D EMA (dark blue wavy pattern) around 0.066 BTC, which is consistent with the support/pressure level around 0.067 BTC, may delay or, in the worst case scenario, invalidate the setting of up and down positions.

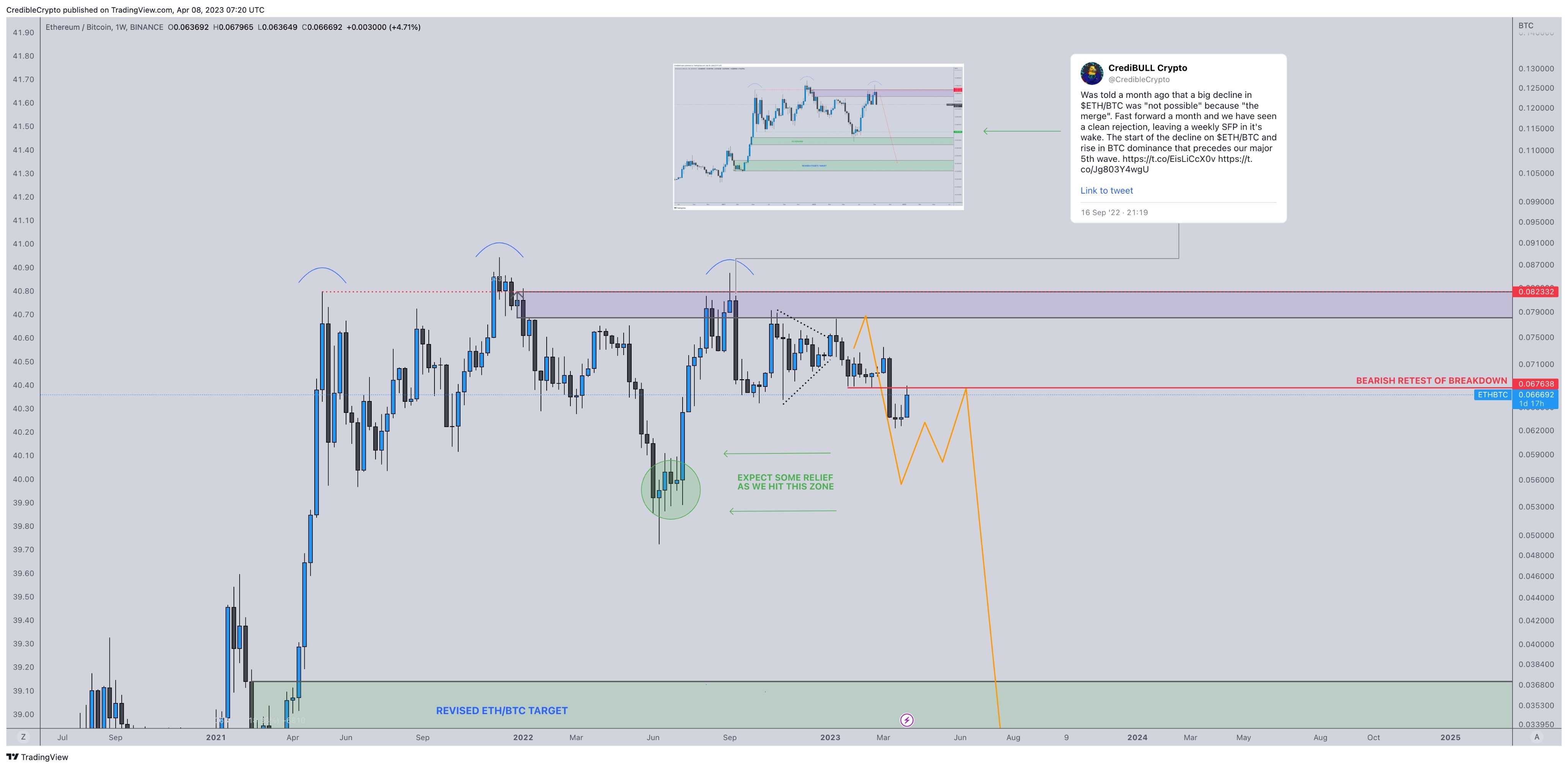

This negative view echoes the position of independent investment analyst CrediBULL Crypto, who predicts strong sales work pressure around the 0.067 BTC pressure level, which will lead to a 50% decline in 2023

Ethereum/BTC weekly price chart. Origin: TradeView/CrediBULL cryptocurrency Ethereum and the Prospects of the US Dollar Market

In 2023, the ETH/USD ratio increased by over 50%, possibly due to similar upward trends in the cryptocurrency sales market elsewhere.

The decline of the US dollar, the reduction of foreign treasury bond bond interest rates and the expectation of US interest rate hikes helped cryptocurrency to rise in all directions in the first quarter. This metal catalyst is likely to remain highly anticipated until the Federal Open Market Committee meeting in May.

Therefore, it is possible for Ethereum to maintain its current year's increase in April within the range of $1800 to $2000 until a decision is made at the Federal Reserve meeting.

Regarding: The three important price indicators of Ethereum hold a skeptical attitude towards the recent increase in Ethereum

In addition, the critical improvement at current levels may result in a long-term increase in the overall ETH price target for the second quarter exceeding $3000.

Ethereum/USD three day price chart. Origin: TradeView On the other hand, empty orders will attempt to lower prices below $1800, with a moving average around $1600 as the overall target for a decline.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.