-

Bitcoin traders expect 'big move' next as BTC price flatlines at $28K

William Suberg

William Suberg 2023-04-16

2023-04-16 3373

3373 Market

Market

-

Summary:Bitcoin stays stuck in an ever-decreasing trading range, but market participants are already eyeing a potentially explosive resolution for BTC price.

Bitcoin (BTC) further narrowed its narrow trading range on April 8th as risky assets await a new metal catalyst

Bitstamp for Bitcoin/USD 1 hour candles. Origin: TradeView Expecting BTC prices to be 'irrational' and follow the sideways trend

Coindigraph Markets Pro and TradeView statistics show that Bitcoin/USD is struggling around $28000 on Bitstamp.

After almost no unexpected surprises during the Wall Street buying and selling week in the United States, this will continue to be sideways for the composition until Sunday.

Although some people call for short-term goals of $25000 and $30000, the increase in order book liquidity on both sides of futures prices seems to provide users with increasingly smaller bargaining options.

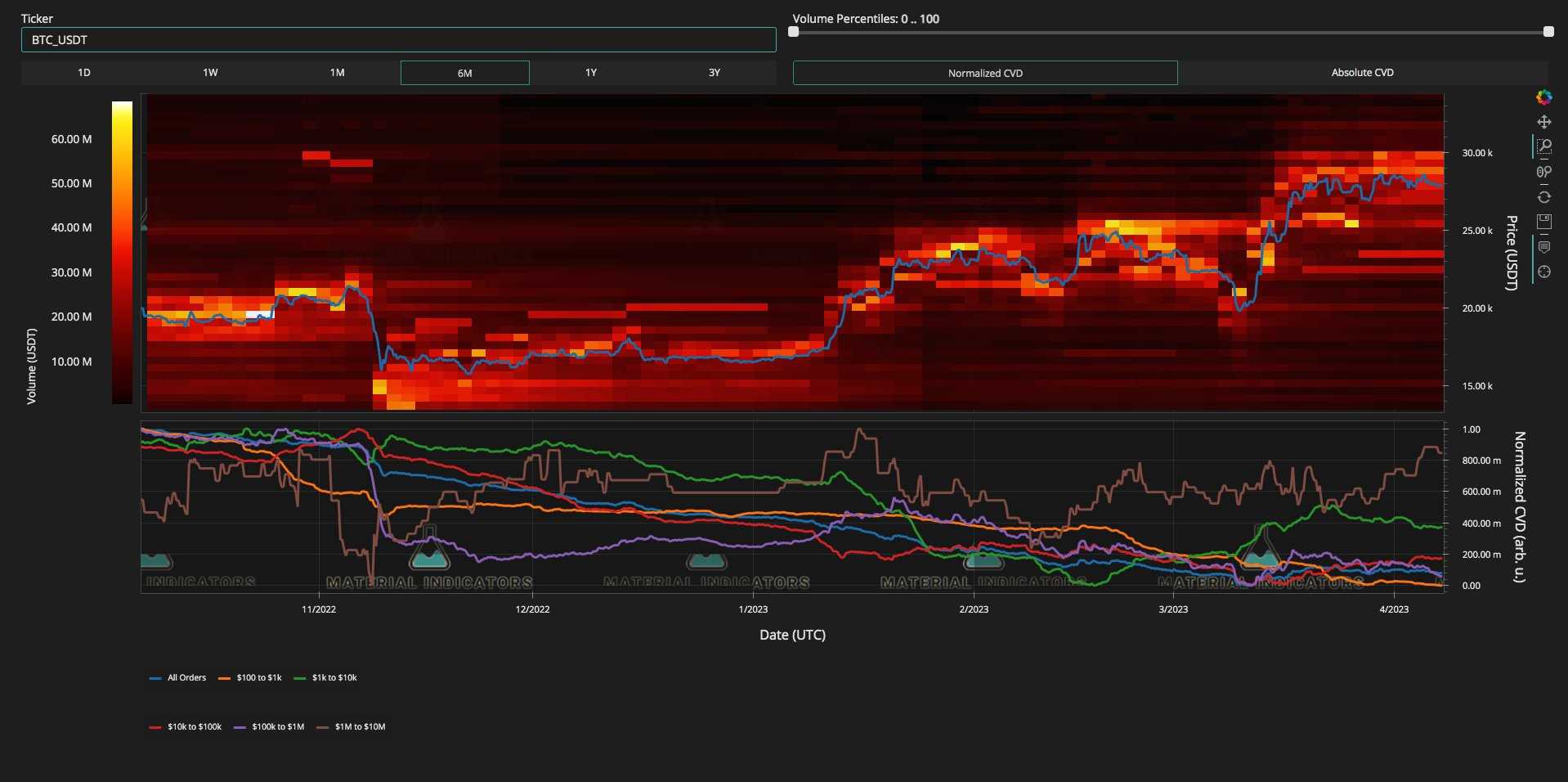

This type of liquidity remained reasonable on the same day, and the regulatory network resource raw material index values captured this phenomenon in the order book of Coin Security Network.

If you think all the price targets for BTC, ETH, DOGE, or all other altcoin are coming soon, then it's too naive, "he said with a cautionary tone in the attached comment.

The only guarantee of digital currency is that this type of property is one of the most risky properties and there is no guarantee

A special warning was focused on the recent bet made by Coinbase management Balaji Srinivasan on the price of Bitcoin, who called for a high price of $1 million per Bitcoin within the next three months.

Material Indicators added that liquidity reflects hot sectors, and previous attention to such liquidity changes was very easy to "suppress" price adjustments.

BTC/USD order book data information (Coin Security Network). Origin: Raw Material Index Value/Twitter In addition, Micha ë l van de Poppe, CEO of the founder of the online trading platform Eight, continued, "Bitcoin is about to enter a very peaceful Sunday.

"The market price remains stable. The longer you stay in such an area, the greater the driving force will be. According to the fact that you will gradually increase from 15000 dollars, I think we will see a strong trend. At this stage, the support point of 27600 dollars is still maintained."

BTC/USD annotated data chart. Origin: Micha ë l van de Poppe/Twitter Regarding: Zhu Su's trading center has a trading volume of $13.64 akshually, and Huobi is in trouble: Asia Express

Daan Crypto Trades, a popular trader and investment analyst, also believes that the innovation of Bitcoin seems to be guaranteed.

He summarized on the same day: "The sales market is particularly boring, with very little chance of fluctuations. This stage is usually before significant fluctuations.

As reported by Cointelgraph, in terms of the volatility index value of the Bollinger Line indicator, Bitcoin/USD is currently experiencing the smallest fluctuations in the market in 2023, which is also a classic example of improvement.

Bitstamp for Bitcoin/US dollar 1-day candles, with Bollinger line indicators. Origin: TradeView Fidelity: The Stock Market "Announces itself"

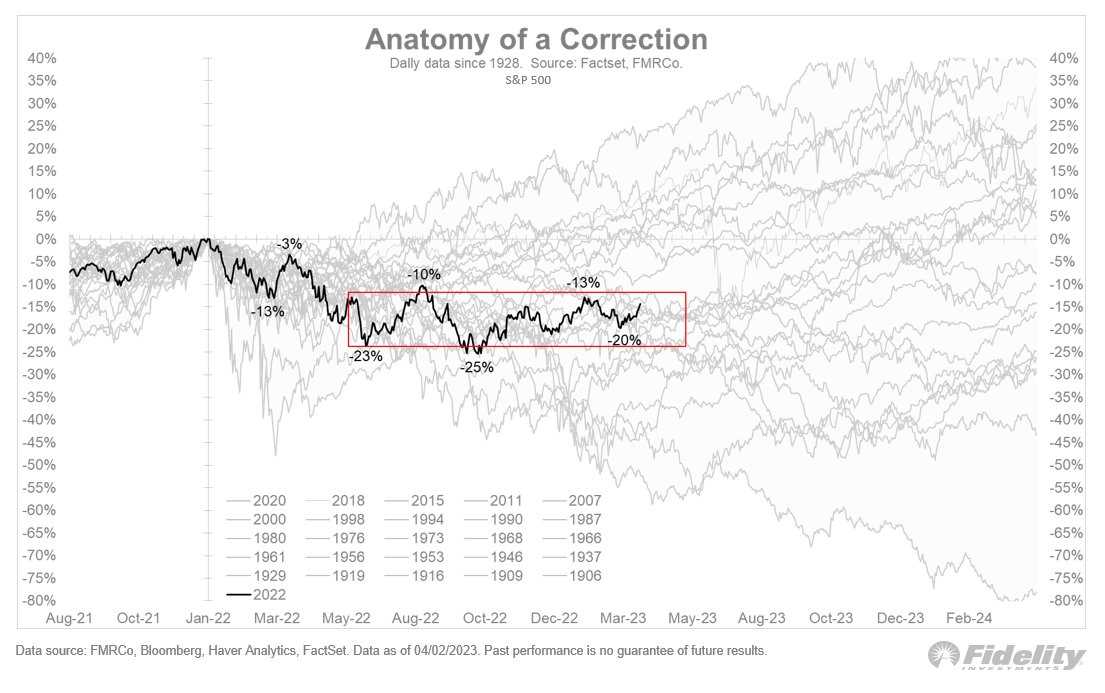

From a broader environmental analysis perspective, Jurrien Timmer, the global macro head of investment management company Fidelity Investment, has summarized a similar perspective on the US stock market.

Related: Bitcoin "encounters friction resistance", and the decline of foreign money supply is large since the 1950s

In his Twitter analysis on April 7th, he mentioned that although there was a revival in 2023, the S&P 500 index had already fluctuated in a 9-month range.

He concluded, "Where will the sales market go next? As you can see, it has been a period of great momentum.

Like Bitcoin, the S&P 500 index will eventually rise, but its direction is still not specific and heavily relies on the Federal Reserve meeting.

He concluded, "We only have three months left between 2023, but there has been nine months of buying and selling time (since the end of June).

This is a long time, and the sales market will eventually develop in one direction or another

Annotated data chart for the S&P 500 index. Origin: Jurrien Timmer/Twitter Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.