-

Price analysis 4/7: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

Rakesh Upadhyay

Rakesh Upadhyay 2023-04-16

2023-04-16 4618

4618 Market

Market

-

Summary:Bitcoin’s failure to clear the overhead resistance at $30,000 is attracting profit-booking in select altcoins.

Bitcoin (BTC) has been trading for less than $29000 in the past few months. There is still disagreement among investment analysts regarding the recent market outlook for Tecoin. Although some people believe that Bitcoin may rise by another $30000, others believe that the local market has already reached its peak.

Mike McGlone, a high-end macroeconomic investment analyst at Bloomberg, stated that as bank liquidity levels remain anxious, digital currencies and their stock markets, as well as oil and copper, are likely to be unable to maintain the recent rebound.

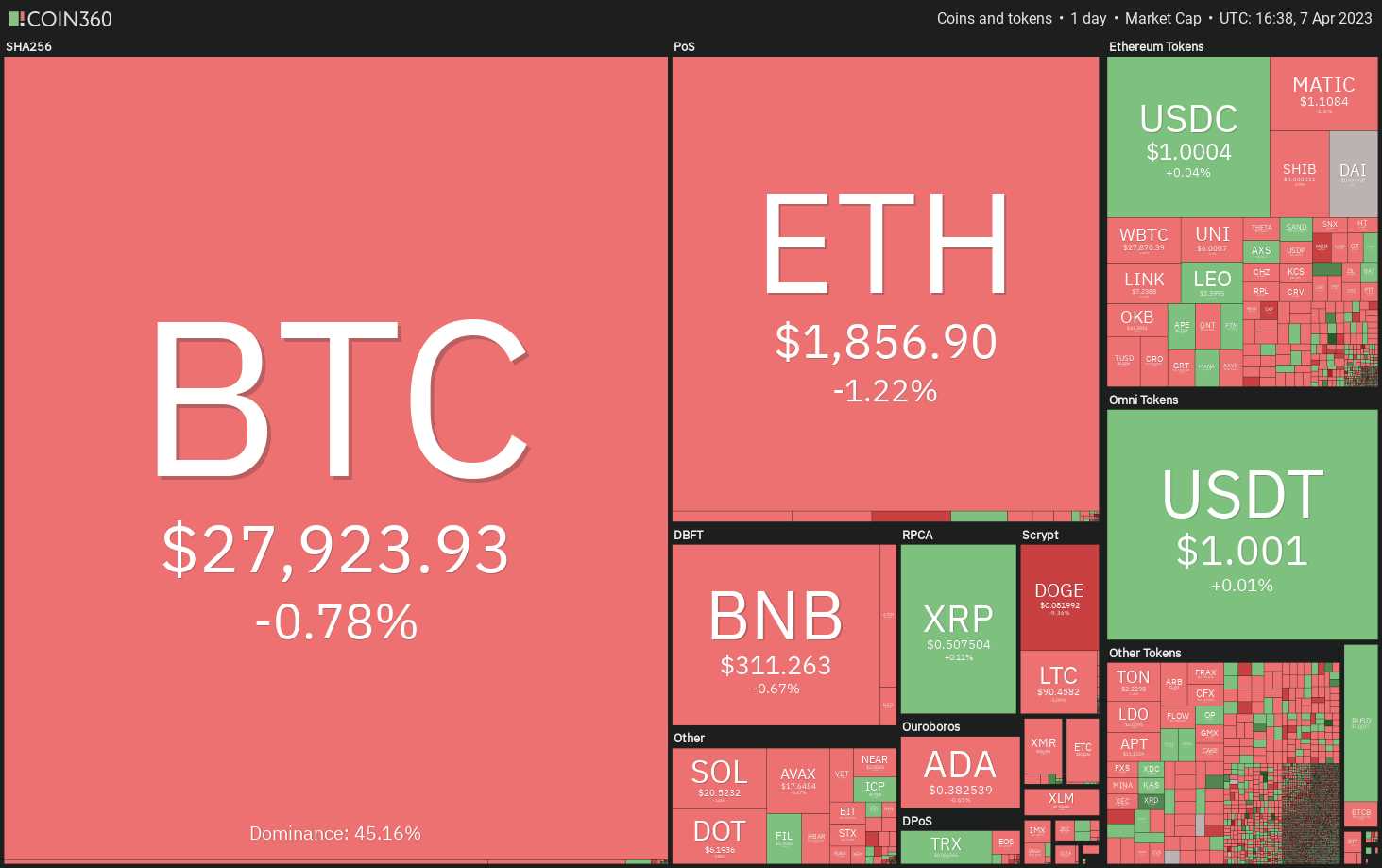

The main performance of the cryptocurrency market on a daily basis. Material origin:Coin 360 On the other hand, Howard Scaramucci, the founder of Crossover Asset Management, said in an interview with Yahoo Finance that the bear market in Bitcoin's stock market is likely to have ended, but he added that that is just speculation. However, Scaramucci emphasizes that in the long run, Bitcoin has repeatedly outperformed other asset classes.

Will Bitcoin plummet at its current level? Or will the duo rearrange and push the price above $30000? Let's study the data charts of the top ten digital currencies and find the answer.

Analysis of Bitcoin Price

Bitcoin (BTC) has formed a symmetrical triangle around $29000, indicating uncertainty in the direction of both bulls and bears.

BTC/USDT daily curve chart. Origin: TradeView The rising 20 day index average (EMI) (US $27406) and the Relative strength index (RSI) higher than 58 indicate that the duopoly has small advantages. If the price jumps back from the support level, the customer will attempt to push the BTC/USDT pair over the top of the triangle.

If they can do this, it will gradually move up for the partner. The purpose of the triangle lifting method is $31280.

On the contrary, increasing support levels will lead to short-term skewing of advantages towards bearish positions. Subsequently, the pair of digital currencies is likely to plummet to an improvement level of $25250. Customers should do their best to maintain their standards.

Analysis of Ethereum Price

The increase in Ethereum (ETH) gradually decreased from $1943 on April 5th, indicating that bears have effectively maintained their psychological level of $2000.

ETH/USDT daily curve chart. Origin: TradeView The first installment applies to $1857. At this level of retreat, the ETH/USDT pair is likely to fall back to the 20 day Index Value Moving Average (EMA) system ($1794). If the Mavericks want to maintain the integrity of their upward movement, this is still an important level of defense they need.

If the price jumps back from the 20 day moving average, the duo will try again to get rid of the $2000 problem. If he does this, it could potentially increase the composition by another $2200.

On the other hand, if the price falls below the 20 day moving average, it may induce trader to take profits in the short term. Subsequently, it is highly likely that the loan currency will drop to $1743, followed by $1680.

BNB Price Analysis

The gradual decline of BNB from its 20 day moving average ($314) indicates that bears have fiercely defended this level.

BNB/USDT daily curve chart. Origin: TradeView The 20 day moving average slowly declines, with RSI slightly below the center point, which is a small advantage for bears. If the support point of $306 cracks, the BNB/USDT pair may fall to $300, followed by a 200 day SMA ($291).

If both sides need to stop the decline, he will have to push the price above the timely friction resistance of $318. This may be related to opening the door in the upper resistance zone between $338 and $346.

XRP Price Analysis

In the past period, XRP has maintained a position above $0.49 at the 38.2% Fibonacci reduction position, indicating that the duo has been buying in shallow declines.

XRP/USDT daily curve chart. Origin: TradeView The upward 20 day moving average ($0.47) and a positive range RSI indicate that the duo has an advantage. The customer will then attempt to deliver the price to the upper resistance zone of $0.56 to $0.58. The closing of the market above this area will mark the beginning of the next phase of recovery.

On the contrary, if prices cannot rise in the upper regions, it will indicate that bears maintain activity at a higher level. Subsequently, the merchant will attempt to lower the price below the 20 day moving average. If such a situation occurs, the loan currency may fall to $0.43.

Cardano Price Analysis

Bears are not allowed to lift Cardano's ADA (ADA) over the collar and create a reverse pattern design for the head and shoulders (H&s).

ADA/USDT daily curve chart. Origin: TradeView The price has reached the 20 day daily moving average (0.37 US dollars), which is also an important level for duopoly defense. If ADA/USDT bounces back from the 20 day daily moving average, customers will try again to get rid of the neck obstruction. If he can go smoothly, it will mean the beginning of a new growth trend.

On the contrary, if the price drops below the 20-day moving average, it will indicate that the duo is likely to have taken profits in the short term. Subsequently, this may lead to individual stocks falling to a 200 day SMA ($0.35).

Analysis of Bitcoin Price

Trader used Bitcoin's rise on April 3 to reduce their holdings. This shows that the hot plate is still negative, and trader are selling on the rise.

DOGE/USDT daily curve chart. Origin: TradeView The significant adjustments in the past four days indicate that DOGE/USDT will buy and sell again for a period of time within the range of $0.07 to $0.11. The price has reached the moving average system, which may be a strong support point. If the price rises from the current level, it may restore the normal 50% Fibonacci blocking level of $0.09 for the loan currency.

Alternatively, if prices plummet below the moving average system, it would indicate a slight advantage for bears. Subsequently, it is highly likely that the loan currency will drop to $0.07.

Analysis of Irregular Graph Prices

Polygon's MATIC (MATIC) forms a symmetrical triangular pattern, indicating hesitation between the double headed and short headed positions.

MATIC/USDT daily curve chart. Origin: TradeView If the price rebounds from the support level of the triangle, it will indicate that the duo has maintained this level. This may cause the partner to stay in the triangle for a long time. If the price soars above the 20 day moving average ($1.11), the duo will try again to move the MATIC/USDT pair towards the resistance line of the triangle.

On the downside side, breaking through and closing below the triangular support level will indicate that bears have already run over the bulls. This may be related to the possibility of falling to 200 days SMA ($0.98) and opening the door.

ofAfter the important resistance zone increases, XRP prices increase by 30%

Analysis of Solana Price

In the past few days, customers were unable to maintain Solana's SOL above the 20 day daily moving average ($20.81), indicating a lack of demand at a higher level.

SOL/USDT daily curve chart. Origin: TradeView The 20-day moving average is similar, with RSI slightly lower than the center point, indicating that the SOL/USDT pair may stay between the downward trend line and $18.70 for a period of time. Falling below $18.70 will indicate that bears have already hit the market. Subsequently, this is likely to expand the decline to an important engine position of $15.28 for the composition.

On the other hand, if prices rise from their current levels and raise the downside line, it will indicate that the bull market has returned. This may increase the loan currency by another $27.12.

Polkadot Price Analysis

Polkadot's DOT has fallen below the 20-day moving average ($6.22), indicating that both sides have lost control. The price is likely to drop to a strong support line of $5.70.

DOT/USDT daily curve chart. Origin: TradeView If the price rebounds from $5.70, the DOT/USDT pair may try to rebound to the downtrend line and oscillate between the two levels for a period of time. The rebound above the downtrend line also clears the way for resistance levels that are likely to rebound to the opposite direction of the H&S approach that has continued to develop.

Alternatively, if the price drops below $5.70, the advantage would be a skewed position that benefits the merchant. Subsequently, it is highly likely that the loan currency will drop to $5.15. This is a critical level to be concerned about, as it may crack, which could potentially drop to $4.50.

Analysis of Bitcoin Price

The duo were unable to push Bitcoin (LTC) above $96, which made bears more daring. They attempted to increase their trading positions by dragging the price to 20 days SMA ($90).

LTC/USDT daily curve chart. Origin: TradeView If he passes, the next stop may be $85. This is a key level that needs to be noted, as breakthroughs and market closures below this level may result in retesting of the 200 day SMA ($75).

Another possibility is that the price will increase at the current level, but has not yet increased by $85. In such a situation, the LTC/USDT ratio may remain between $85 and $96 for a few days.

The 20 day moving average slowly tilted downwards, but the RSI fell near China, indicating that there will be a sideways consolidation in the near future. Customers need to eliminate management cost barriers at a price of $96 in order to extend the recovery efforts to $106.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.