-

Price analysis 4/5: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

Rakesh Upadhyay

Rakesh Upadhyay 2023-04-16

2023-04-16 3030

3030 Market

Market

-

Summary:Bitcoin continues to face resistance near $29,000 and Ether has decided to take charge of the wider crypto markets' bullish momentum.

As cryptocurrency investors explore proactive start-up factors, Bitcoin (BTC) remains at an important psychological level of less than $30000. This did not prevent MicroStrategy, a business intelligence company, from adding 1045 Bitcoin to the cat market, which has now surged to 140000 Bitcoin.

Even after a significant recovery from the bottom point in November 2022, the raw material indicator values of network resources indicate that the current rise is a rebound from the bear market.

Generally speaking, it is not until the last bear gives up that the bear market can rebound. This indicates that the recovery of Bitcoin is likely to have more to go before addressing its disadvantages.

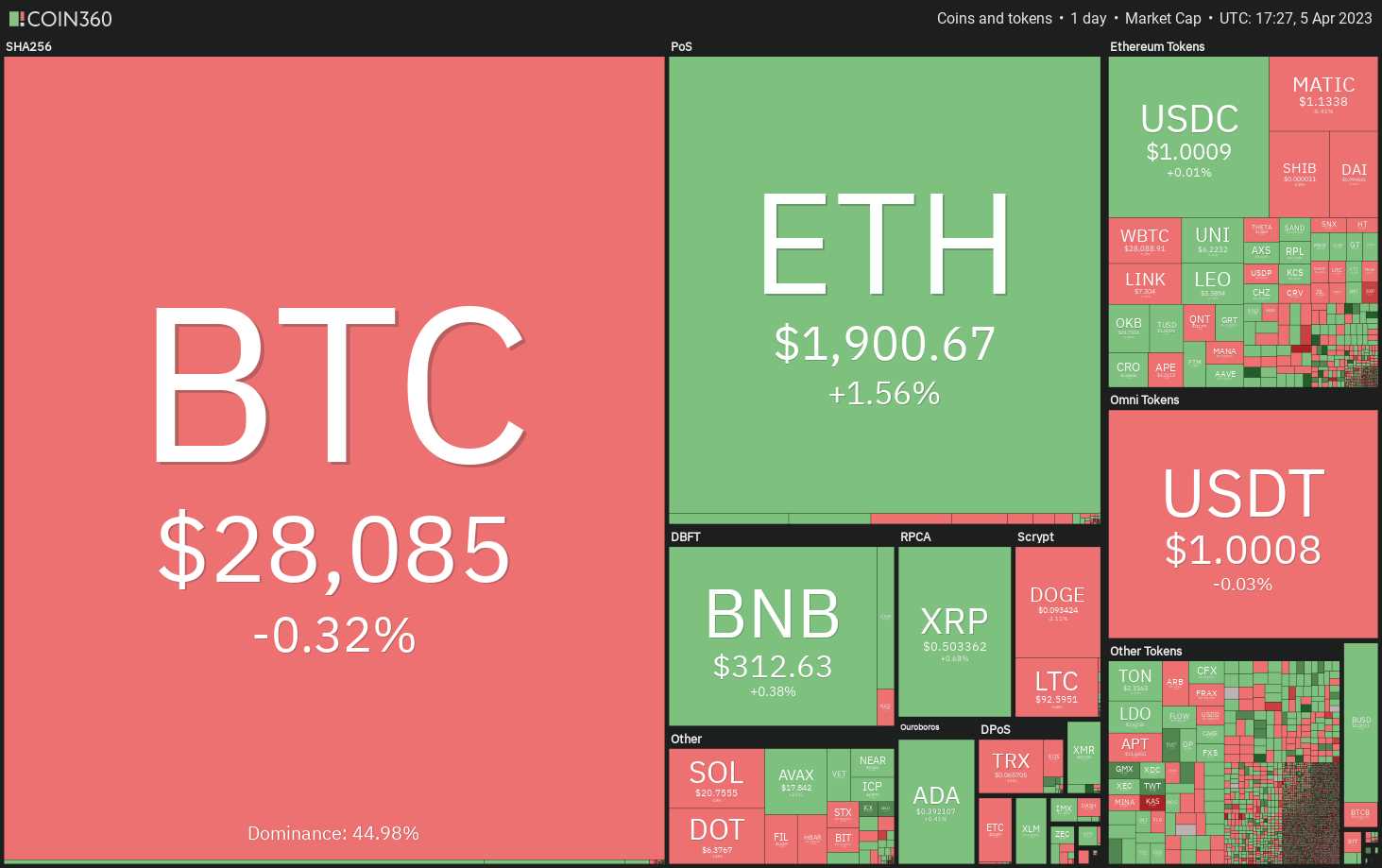

Daily cryptocurrency sales status. Material origin:Coin 360 A data survey conducted by financial investment firm Brown Brothers Harriman found that although cryptocurrencies are entering winter, institutional investors are still interested in the cryptocurrency industry. A survey shows that 74% of institutional investors are "very/very interested" in enhancing the open-ended nature of exchange traded funds related to cryptocurrencies.

Will Bitcoin continue to move northward and rise above $30000? Will this measure push up alternative currencies? Let's study the data charts of the top ten cryptocurrencies.

Bitcoin Price Analysis

On April 5th, the duo once again attempted to push Bitcoin above $29000, but the long candlestick in the candlestick showed that the bears were actively selling in higher quality.

BTC/USDT daily curve chart. Origin: TradeView Short sellers will try to use their strengths to lower their prices below the 20 day average system ($27273), which is a key level to pay attention to. If these support points split, some short-term duos may withdraw their trading positions. This may be related to retesting the $25250 reverse head and shoulder (H&S) patterned collar and opening the door.

Conversely, if the selling price rebounds at the 20 day daily moving average, it will indicate that the duo is once again fully committed to defending this level. It may increase the probability of an upward pressure level of $29185. If such a situation occurs, the BTC/USDT ratio is likely to soar to $30000 and then to $32500,

Analysis of Ethereum Price

Ethereum (ETH) rebounded from its 20th daily moving average ($1778) on April 3rd and increased frictional resistance above $1857. This means that the latter segment of the upward movement gradually increases.

ETH/USDT daily curve chart. Origin: TradeView There is a possibility of a rebound to $2000, and this path is very clear. This level may become a strong frictional resistance, and if the duo flips over the $1857 level as a support when they fall again, it will indicate that the customer is in control. ETH/USDT pairs are likely to try to bounce back to $2200.

The time for bears is running out. If they want to start over again, they must stop the increase and lower the price below $1857. If they can achieve this, the radical duo may be entangled. This is likely to cause the loan currency to first fall to the 20-day daily moving average and then fall to $1680

BNB Price Analysis

From the long tail of the candlestick on April 3rd, National Bank of the United States (BNB) fell below the support line of $306 and was bought by a large amount of money from both sides.

BNB/USDT daily curve chart. Origin: TradeView The duo attempted to further strengthen their trading position by pushing the price up to $318 with frictional resistance above the head. If they can do this, it will likely indicate that the correction process has ended. BNB/USDT is likely to rise to the strong pressure level of $330 first and then to $338.

On the contrary, if the price cannot be raised by $318, it will indicate that bears have used every small rebound to carry out sales. It may lower this to a 200 day SMA ($291) for individual stocks, which could become a strong support point.

XRP Price Analysis

On April 3rd, XRP (XRP) fell below the 38.2% Fibonacci reduction level of 0.49 yuan, but the long tail on the candlestick showed strong stock buying at a moderate level.

XRP/USDT daily curve chart. Origin: TradeView The price increased on April 4th, and the duo attempted to lead the price towards a frictional resistance of $0.56. However, on April 5th, the long lamp core in the candlestick indicated that the merchant presented a serious challenge to the duo around $0.53.

If the price continues to decline, bears will try again to lower the price below the 20 day daily average ($0.47). If this level drops, XRP/USDT may fall to $0.43.

On the other hand, if the customer pushes the price above the top area of $0.56 to $0.58, it may cause the price to soar to $0.65 and then to $0.80.

Cardano Price Analysis

The price of Cardano (ADA) is a 20 day daily moving average ($0.37) and the collar in the opposite direction is squeezed and formed in the middle.

ADA/USDT daily curve chart. Origin: TradeView The rising 20-day daily moving average and an RSI above 59 indicate that both sides are in control. A rupture and closure above the collar will complete the flip pattern design. ADA/USDT is likely to gradually develop a new upward trend, with a target of $0.60.

If the bear needs to regain control, he will have to pull the price back below the moving average system. If he does this, both sides may be forced to close their positions in the short term, resulting in long positions being closed. Subsequently, it is highly likely that the loan currency will fall to $0.30.

Analysis of Dog Coin Prices

Bitcoin (DOGE) rebounded from its 20th daily moving average ($0.08) on April 3rd and skyrocketed above the strong frictional resistance of $0.10.

DOGE/USDT daily curve chart. Origin: TradeView The long candlestick in the candlestick on April 3rd and 4th indicates that bears are trying to effectively defend the $0.10 level. A small subjective factor that benefits customers is that they did not compromise with bears.

If the price remains above $0.09, the probability of increasing to $0.11 will also increase. This is also the last key obstacle to the bull market, as lifting this obstacle is likely to open the door for an increase to $0.16.

Alternatively, if the selling price drops at $0.11, it would indicate that bears are primarily active to a higher extent. Subsequently, the DOGE/USDT ratio may fluctuate widely between $0.11 and $0.07 for a period of time.

Irregular Graph Price Analysis

Polygon (MATIC)'s close sideways consolidation around the 20-day daily moving average ($1.11) was confirmed to rise on April 4th, but the duo has been working hard to leverage this advantage.

MATIC/USDT daily curve chart. Origin: TradeView Short sellers will attempt to pull prices back below the 20-day daily moving average and entangle radical bulls. If he passes, the MATIC/USDT ratio may drop to $1.05, followed by a significant drop to $0.98 for the 200 day SMA engine.

Conversely, if the selling price rebounds at the 20 day daily moving average, it will indicate that the duo is trying to convert this level into a support. There is a slight frictional resistance at $1.17, so if both sides raise this level, the MATIC/USDT pair is likely to rise to $1.25 and then to $1.30.

ofAccording to the new Bitcoin price data, the market price of Bitcoin will double to more than 200000 dollars in 2025

Solana Price Analysis

Solana (SOL) continues to buy and sell in a small range. Generally, after a stage of relatively low uncertainty, uncertainty will also increase.

SOL/USDT daily curve chart. Origin: TradeView If the price rises and the market closes above the downtrend line, it will indicate that the duo has already run over the bears. This may trigger a new surge, possibly by an additional $27.12. If these levels are amplified, the SOL/USDT ratio may rebound and soar to $39.

Another possibility is that the selling price falls or cannot remain above the downtrend line. In such a situation, bears will attempt to lower the price below $18.70 and test the key support points around $15.28.

Polkadot Price Analysis

Polkadot (DOT) continues to surge towards the 61.8% Fibonacci retracement of $6.85. To this extent, bears may sell at their best.

DOT/USDT daily curve chart. Origin: TradeView The 20-day daily moving average ($6.22) remains a major level to consider. If the selling price drops at 6.85 dollars, but the daily average of 20 days bounces back, it will show that the hot plate has already turned to be proactive, and trader have bought down individual stocks.

This will increase the probability of an increase of $6.85. Subsequently, DOT/USDT may attempt to jump back to the opposite direction of the H&S pattern on the collar. Merchants must lower the price below $5.70 to gain the upper hand.

Bitcoin Price Analysis

Bitcoin (LTC) jumped below its 20-day daily moving average ($89) on April 1st and rose above the downtrend line. However, from the long candles on April 3rd and April 5th, it can be seen that the bulls are facing a higher degree of positive frictional resistance from bears.

LTC/USDT daily curve chart. Origin: TradeView The upward 20 day daily moving average and positive range RSI indicate benefits for consumers. There is a small frictional resistance at $96, and if this frictional resistance is exceeded, LTC/USDT may experience frictional resistance on the stiffness head that may soar to $106.

If a bear wants to block the increase, he will have to immediately pull the price back below the 20 day daily moving average. Subsequently, this may drop to $85 for the shoes. This is a critical level to be concerned about, as resting below this level will indicate that the bear is back in the game again.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.