-

Fed liquidity injections drive down US Treasury yields, but not Bitcoin price

Marcel Pechman

Marcel Pechman 2023-04-16

2023-04-16 2861

2861 Market

Market

-

Summary:Regulatory uncertainty and the recent enforcement actions taken against major crypto exchanges reduces the odds of Bitcoin breaking above $30,000 in the short-term, but investors are still bullish.

Bitcoin (BTC) may have demonstrated overall strength after successfully defending the $28000 applicability in fabricated rumors about Coin Security, but an interesting and high-quality development to note is that after the Federal Reserve selected emergency liquidity for banks, the correlation between Bitcoin and traditional channels has become increasingly small

These changes in the position of the central bank have led to changes in the market for treasury bond bonds, as traders seek to avoid rising inflation and work pressure. Bitcoin seems to be agnosticism about this fitness campaign. Its price has been struggling around 28000 dollars in the past week.

In addition, on April 3, the interest rate of five-year treasury bond bonds fell to 3.50% from 3.70% in the past week. The strong demand for debt instruments will also reduce expenses, resulting in a decrease in returns. The $152.6 billion outstanding loan from the Federal Reserve's applicable loan program has been a driving factor.

The lack of trust in financial institutions by the public has also prompted them to carefully consider what the Federal Deposit Insurance Corporation (FDIC) is and how its Federal Reserve meetings will no longer manipulate the trajectory of inflation. It is still difficult to solve the problem of how Bitcoin can serve as a reliable store of value during disaster periods, but the 70% increase so far this year undoubtedly proves this.

Investors have reduced their cash trading positions

According to data from Bank of America, the total assets of monetary funds in the United States reached a record high of $5.1 trillion. These instruments are invested in short-term debt securities, such as US treasury bond bonds, certificates of deposit and commercial acceptance bills. In addition, Private Equity Fund Manager and Investment Analyst Genevieve Roch Decter, CFA, indicates that investors have already collected $100 million through banks, due to higher returns from currency funds.

Although Bitcoin investors view digital currencies as a haven for the soul to resist inflation, an economic downturn can also reduce the need for goods or services, which may lead to deflation. In March, after the release of the US ISM Purchasing Managers'Index data, the risk increased significantly. This indicator is 46.3, which is the lowest standard since May 2020 and less than the analyst's forecast of 47.5, indicating a contraction in economic development.

According to Jim Bianco, a macroeconomic investment analyst at Bianco Research, this is the 16th time since 1948 that this level has reached such a low point, and in 75% of these cases, economic downturns have followed.

Let's study the indicator values of Bitcoin derivative products to confirm the current market influence of technical professionals.

Bitcoin derivative traders did not go bankrupt under FUD

Bitcoin Q1 futures trading is very popular on shark and hedge arbitrage platforms, with transaction prices generally slightly higher than the spot trading market, indicating that merchants require more money to delay longer payment times.

Therefore, the annualized interest rate premium for stock index futures contracts in the physical and mental health market should be between 5% and 10%, which is called futures trading premium and is not unique to cryptocurrency markets.

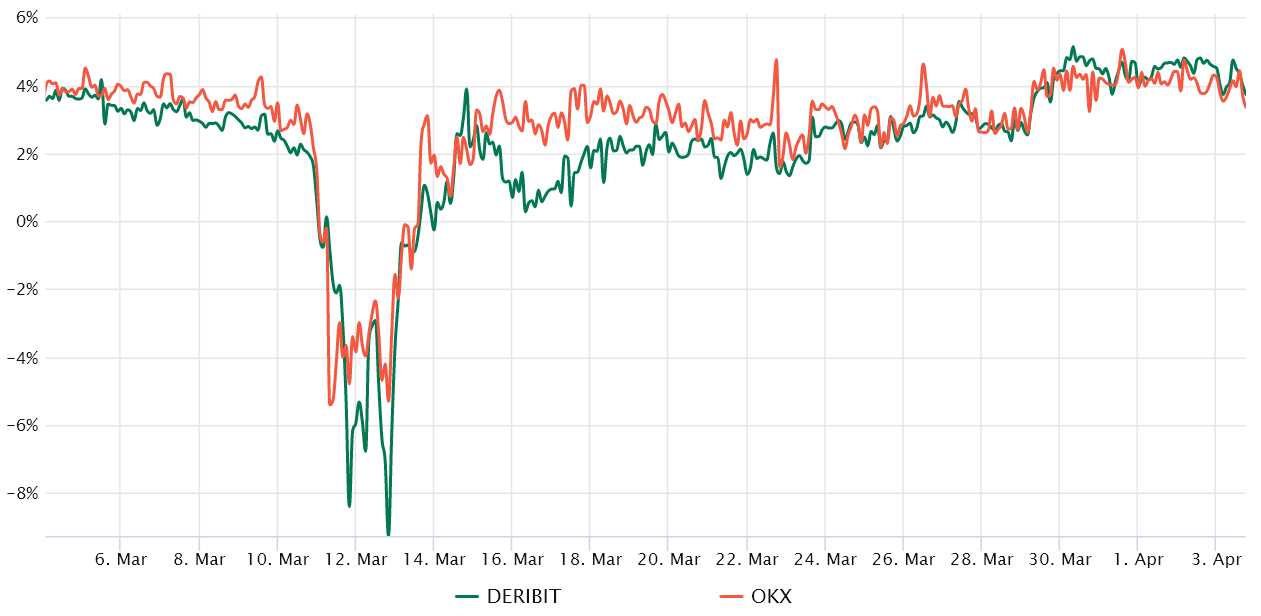

Bitcoin February futures trading annualized interest rate premium. Origin: Laevitas.ch Since March 30th, the premium for Bitcoin futures trading has been struggling around the neutral to bullish threshold, indicating that although the price of Bitcoin is still close to $28000, technical professionals are unwilling to become bullish.

The lack of dual requirements for financial leverage does not necessarily mean a decrease in prices. Therefore, traders should investigate the options market of Bitcoin to understand how dolphins and market makers determine the probability of future price adjustments.

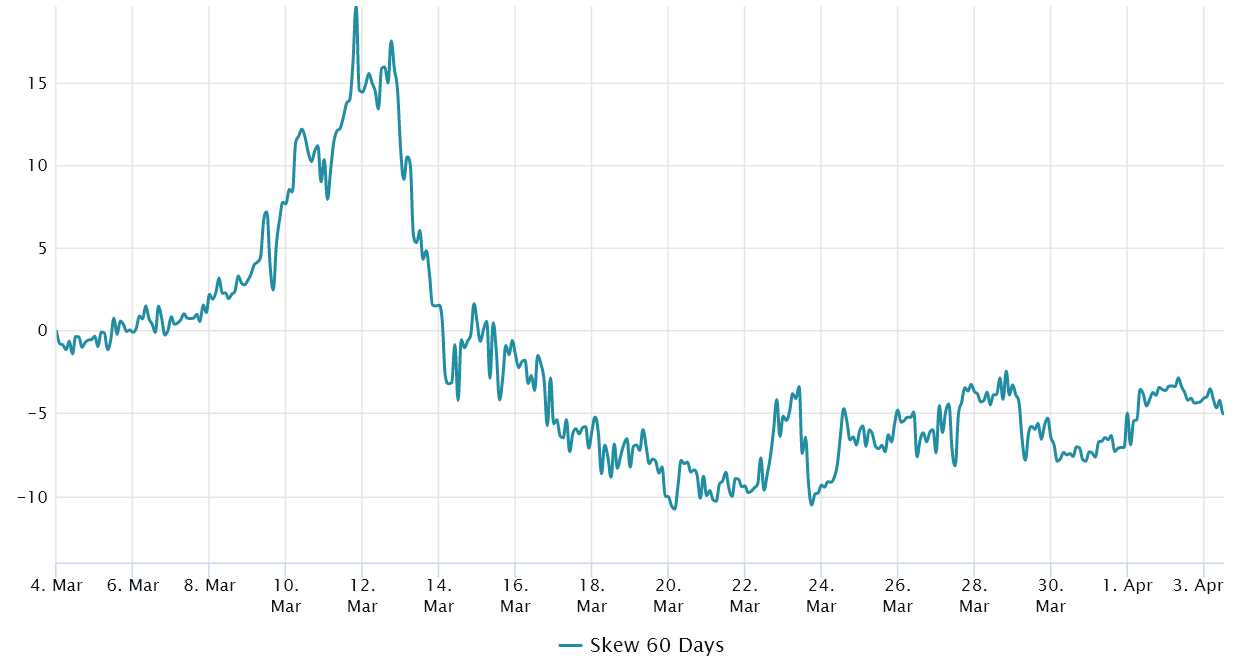

A 25% delta bias indicates when market making and hedging arbitrage units have overcharged their fees in order to maintain their ability to rise or fall. In a bear market, stock index futures traders increase the probability of price decline, causing the skewed indicator value to rise above 8%. On the other hand, the bull market usually sends the deviation index value below - 8%, which indicates that the need for call put option is reduced.

ofAfter rumors of CZ's arrest, Bitcoin prices rebounded, and traders were concerned about the next $30000

Bitcoin 60 day stock index futures 25 million lta skewed: Origin: Laevitas The inclination rate of 25% is currently - 5, because the transaction price of defensive put option is slightly lower than that of neutral put option. Fully considering the recent FUD generated after CFTC filed a lawsuit against Coin Security on March 27th, this is a rising indicator value. Regulatory authorities have accused Coinsafe and CZ of violating regulatory compliance and derivative product laws by offering transactions to US users without applying for registration with market management organizations.

So far, Bitcoin has performed exceptionally well due to the baking industry driving the Federal Reserve meeting to distort its current credit tightening policies. However, as long as there is regulatory variability in key cryptocurrency exchanges, Bitcoin is unlikely to increase by $30000.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.