-

Ethereum is going to transform investing

Alex O’Donnell

Alex O’Donnell 2023-04-23

2023-04-23 4397

4397 Market

Market

-

Summary:Expect to see tokenized securities proliferate in the years ahead — along with heavy investments in Ethereum staking pools.

Ethereum is often portrayed as the enemy of traditional finance in the Manichaeism government procurement process contest. In fact, there is no contradiction at all. Ethereum has not changed the traditional financial markets department, but has improved it. Quickly, these two systems will inevitably become intertwined

The core concept of Ethereum is that self regulation, openness, and disintermediation are closely related to financial enterprises, which can be achieved within the existing regulatory framework. Ethereum has already taken the first step towards organizational selection, and with its unprecedented internet blockchain technology, it is basically destined to become an important clearing layer for global financial investment.

Maintaining neutrality in a multipolar world

Ethereum is not intended to provide a stateless alternative currency or anonymous economic development. What it provides is very simple: maintain neutrality.

Ethereum is the first truly fair and just referee in the global financial system, and its arrival is very immediate. The international stability generated by the superior influence of the United States has weakened, and the domestic politics of key economies are also becoming increasingly unstable. In a multipolar world, the financial system urgently needs to address the need to maintain reliable road standards.

ofThanks to Ethereum, 'altcoin' will no longer be a disgrace

The software used by Ethereum to clear transactions and store data cannot actually be damaged. This is partly due to its unprecedented blockchain technology in the consensus layer, which spans over 500000 validators and is distributed across over 10000 physical connection points in dozens of countries. Although there is anxiety in the opposite direction, over time, Ethereum is moving towards more blockchain technology development trends, rather than becoming less and less.

It is certain that Ethereum will never replace the traditional legal authority of contracts and dispute resolution. The agreed upon rules, which are inviolable and fair, prevent the formation of thousands of disputes from the beginning.

Dealing with authorization and delegation challenges

From Celsius to FTX and Silvergate, the "cryptocurrency winter" event reflects more of the shortcomings of traditional finance than the failure of cryptocurrencies. In every case, the most typical challenge of delegation of authority deteriorates due to lax regulation and excessive centralization.

From a historical perspective, the default method to address these issues has always been regulation. Naturally, strict supervision is necessary, but Ethereum has brought more fundamental solutions. Blockchain smart contracts and distributed accounting without trust can completely eliminate certain aspects of authorization delegation issues.

Quickly, Ethereum and the business scale chain will penetrate into traditional banking or investment management. From bank card accounts to retirement asset allocation, almost all investors will self manage their assets in untrusted blockchain smart contracts, and carefully regulated entry will result in almost no friction in the tokenization of circulating currency.

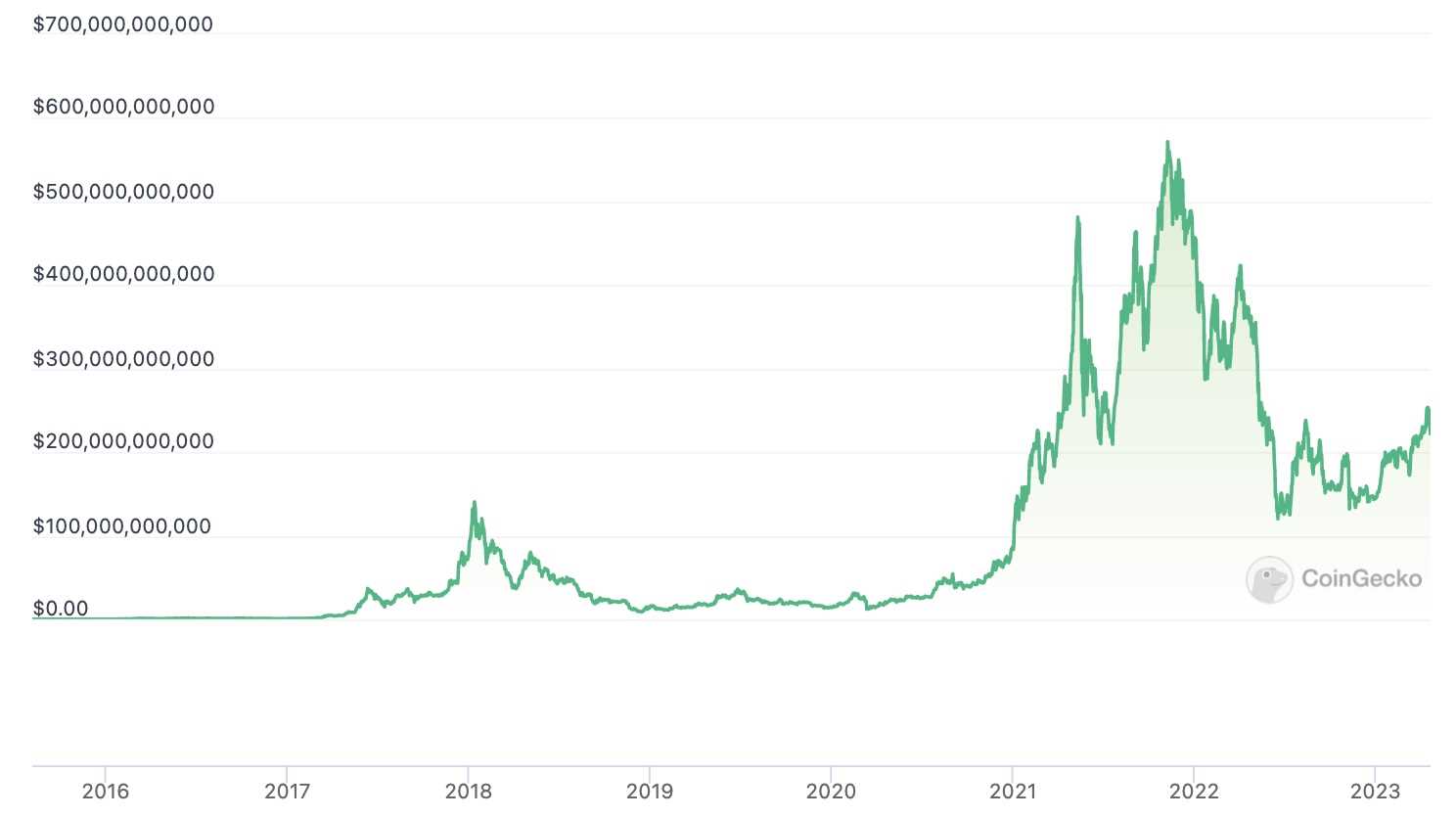

The total market value of Ethereum from 2016 to 23. Origin: CoinGecko In addition, investors and their final regulatory organizations will insist on requiring investment management companies to use unsafe chain metaphors to report fund performance. In these fields, Ethereum is not easy to violate policies and regulations, and it will improve policies and regulations. Finally, the government will be as concerned about the technical standards of blockchain smart contracts as it is about the required liquidity reserves.

The future development of Ethereum is not without approval. Approval based on identity is undoubtedly a standardized fee standard, but such seamless integration makes it almost inconspicuous. With the proliferation of central bank digital currencies, national verification will become a thorny issue. Restricting government departments to arbitrarily freeze and clean digital currency laws will accumulate a significant political driving force.

In short, Ethereum may significantly reduce personal financial industry misconduct, but its harm to national auditing will be more limited.

Awkward organizational selection

The future development of Ethereum may still be too far away, but its foundation is already here. In 2021, the overheated financial industry (DeFi) caused foreign exchange speculation to become popular, but this crazy themed activity has affected many independent innovations. This technology can now create a range of non intermediary industries and token based financial derivatives.

What is lacking is connectivity with the broader financial system. This is also a new type of regulated circulating currency that focuses on cryptocurrencies, such as Circle. This company, headquartered in the United States, laid the foundation for the digital economy through its tokenization of US dollars. Circle has now built additional critical infrastructure, such as a combination of currency and cryptocurrency accounts that immediately connect to Ethereum and expand the chain.

ofFederal regulatory organizations are about to make a judgment on Ethereum

In the near future, it is expected to see a surge in tokenized securities, with the key being the leverage ratio of fixed income assets. The Ethereum chip pool will also invest in many projects, which will be a key strategic asset for organizing the cryptocurrency sales market. Other key areas include on chain financial statements, simplified customer flow for regulatory compliance management, and organizational level identification of derivative products.

It is certain that a series of recent enforcement actions have reduced the temperature of research and development themed activities in the United States, but it will still be the core market for the upcoming wave of regulatory agreements.

Taking care of Endless Garden

The surge in regulatory pressure on cryptocurrencies, especially DeFi, signifies the end of an era. The large-scale ecosystem of Ethereum, especially those that cannot or are not easily integrated into the rapidly changing natural environment agreements, needs to be efficiently replaced. However, what remains will be better integrated into the current financial system. The cutting-edge harm of Ethereum to traditional finance has just begun.

Alex O'DonnellHe is the founder and CEO of Umami Labs, both of whom were early promoters of Umami DAO. Before joining Umami Labs, she was appointed as a financial journalist for seven years at The Associated Press, covering corporate mergers and acquisitions and issuing new shares.Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.