-

Ether price struggles to maintain support as regulatory challenges and network issues weigh

Marcel Pechman

Marcel Pechman 2023-04-25

2023-04-25 3869

3869 Market

Market

-

Summary:Ether options volume hints at bearish sentiment as the $1,850 support falters.

Since April 21st, the price of Ethereum has been unable to maintain a support point of $1850, similar to the gradual rebound to the level before $2100 on April 13th. Considering the 13.5% price fluctuation within 6 days and the long settlement of $548 million in financial leveraged futures from April 19th to April 21st, investors have no reason to doubt the existence of customers.

Firstly, for centralized trading centers, the regulatory environment seems to be becoming increasingly stringent. For example, Bybit, the company's headquarters in the United Arab Emirates, announced that each user must undergo "Know Your Customer" (KYC) identity authentication before May 8th in order to implement and obtain order information. Prior to May 8th, the monthly withdrawal limit for non KYC customers was 100000 US dollars (USDT).

Gemini, the cryptocurrency exchange headquartered in the United States, announced on April 21st that it will launch a derivative product service platform overseas. The uncertain regulatory environment drives the company to explore other regions, although only users from selected regions can browse new services. The roster does not include the United States, Australia, and most European countries except Germany and Switzerland.

Ethereum internet in a desperate situation

Due to its low application rate in decentralized application processes (DApps), the Ethereum Internet is likely to also face its own problems. Firstly, the Ethereum (ETH) deposit amount for Ethereum blockchain smart contracts fell to its lowest level since August 2020. This in-depth analysis has already eliminated the impact of local Ethereum chips, while the latter has gradually allowed for withdrawals in the near future.

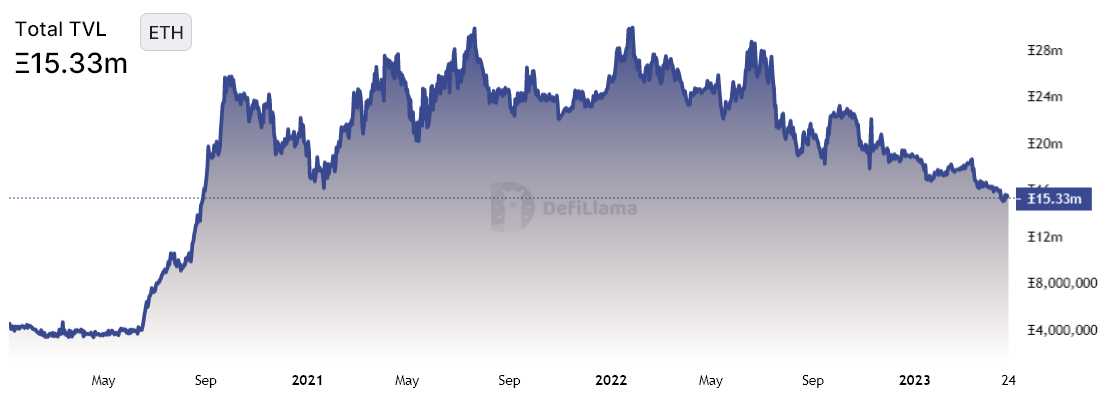

The total savings of Ethereum network applications in ETH. Origin: DefiLlama According to DefiLlama's information, on April 24th, the total lockdown amount of Ethereum DApps reached 15.3 million ETH. By comparison, six months ago, it should have been 22 million ETH, a decrease of 30%. In contrast, the BNB (BNB) TVL in the BNB intelligent chain decreased by 20%, and the MATIC (MATIC) savings of Polygon Internet decreased by 11%.

In addition, the dominance of Ethereum Internet in stabilizing currency savings and other aspects has reached the minimum standard of 12 months, which is 54%, less than the 64% in December 2022. On the other hand, due to the relatively low transaction fees, Tron Internet is the ultimate winner of stable currency. In contrast, since February 2023, the average transaction fee for Ethereum Internet has been above $4.

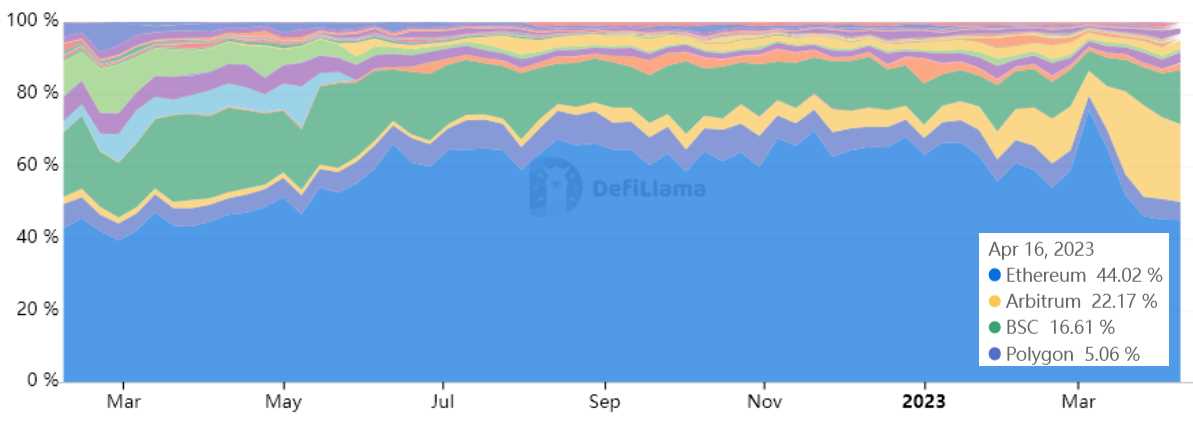

The market share of the Ethereum Decentralized Exchange (DEX) reached a peak of 75% in the week ending March 5th, but steadily decreased to 44% in the week ending April 16th.

Weekly DEX quantity differentiated by chain. Origin: DefiLlama The increase in DEX trading volume was Arbitrum, which increased from 7% to 22.2%, and its BNB Smart Chain, which has increased from 5.1% since March 5th to 16.6%. Some people may say that the success of the expansion solution of Ethereum Internet must reflect the optimism of the price of Ethereum, but this relationship is not so immediate.

Pro trader focus on bullish

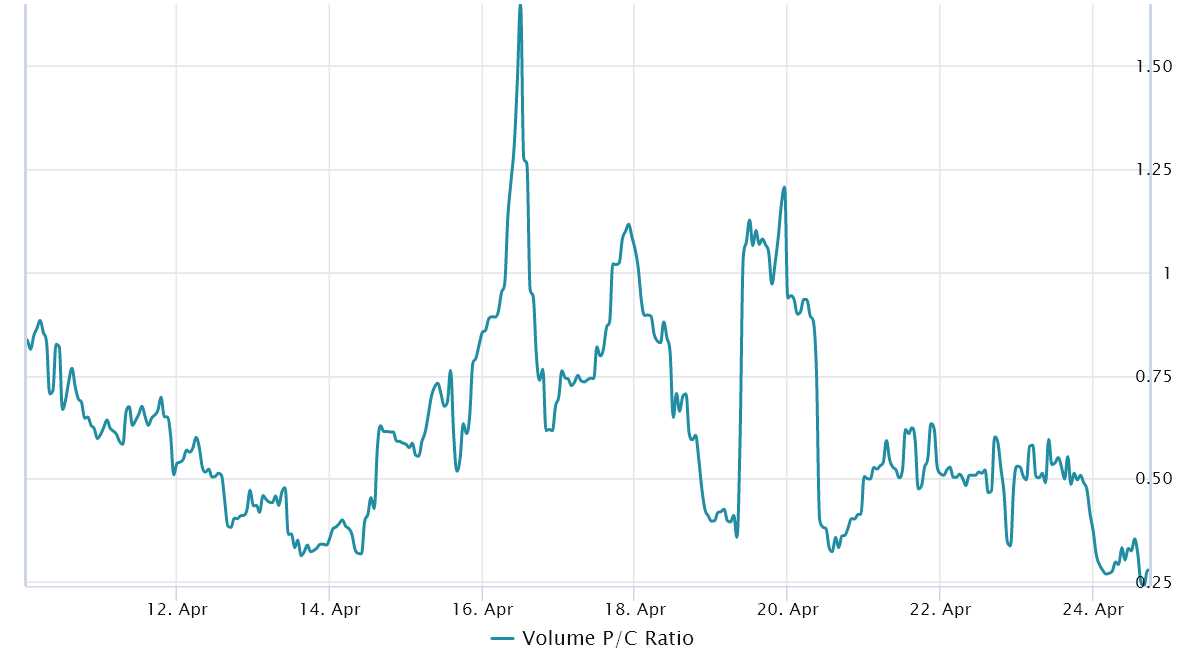

In order to know whether the technical professional trader will mark the price for a higher probability of ETH price decline, the option market should be analyzed. Trader can measure hot spots by considering that more theme activities are bullish (buying) stock index futures or bullish (selling) stock index futures. Generally speaking, call stock index futures are used for call countermeasures, while put option are used for call countermeasures.

The ratio of 0.70 put option to call stock index futures shows that the annual interest rate of the put option that is not forced to close the position lags behind the call stock index futures, so it is a call. In contrast, the 1.40 indicator focuses on put option, which can be called a call.

ofEthereum's price drop compared to Bitcoin suggests a significant decline in April

The proportion of put option in the total number of ETH stock index futures. Material origin: Laevitas The ratio of Ethereum stock index options to put option and call stock index futures has reached the minimum standard for more than three months, indicating the need for overcapacity for neutral put option. At this stage, the total number of defensive put option is more than four times that of neutral call option.

From the perspective of the uncertain regulatory environment and the role of market competition networks in the United States, it is unlikely that the Ethereum price will remain applicable at $1850, regardless of whether the second tier technology is applied or not. Derivatives traders clearly demonstrate a higher probability of negative price changes.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.