-

Using Bitcoin Derivatives To Discern Speculation From True Momentum

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-09-30

2022-09-30 4464

4464 Research

Research

-

Summary:Analyzing bitcoin derivatives gives a window into the state of the market conditions and can provide clues for when bitcoin has reached an absolute bottom.

This paper includes some recent behaviors of the Bitcoin derivatives market and the relationship between Bitcoin and the continuous evolution of the traditional financial system.

Asset markets around the world have been acting violently, with various loan currencies fluctuating significantly, bond sales increasing, and Bitcoin briefly rising and diverging, which satisfied both sides.

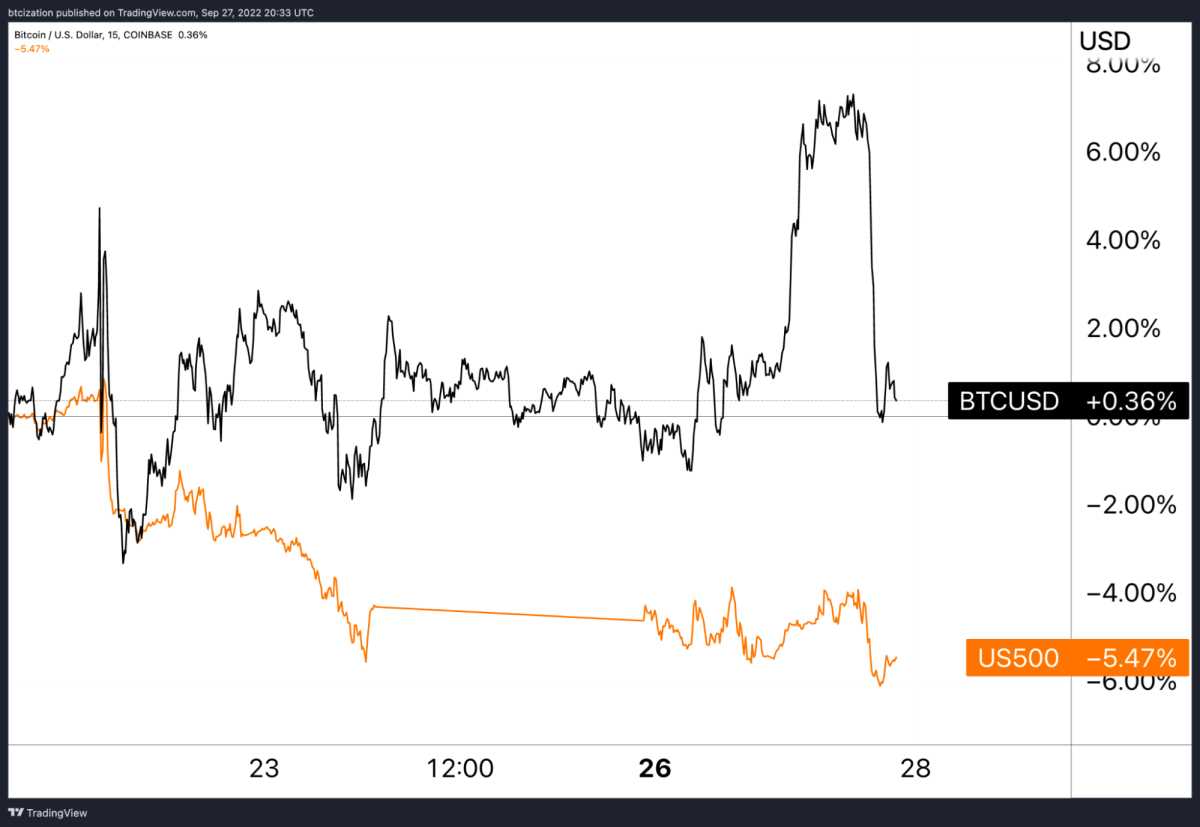

With Bitcoin falling below 20000 US dollars, there is a rumor that there may be a linkage. Bitcoin rose by more than 7%, while US stocks fell by about 4% last week. Although we naturally want to see Bitcoin eased in the increasingly volatile environment of the past financial system, we are still skeptical of the latest conclusion because the data information does not recognize this conclusion.

You can't pay too much attention to it. At this stage, the natural environment of Bitcoin trading is more US dollars than Bitcoin itself. With different maturity dates and soaring yields on currency loans, the use value of assets around the world will also plummet, which may lead to a settlement date when all assets will be sold at the same time.

As we like to say, all foamed plastics are dissipating. As the basic property of foamed plastics, US debt continues to bleed.

Let's go back to Bitcoin. When was the stage of outperforming the market? Can we predict that there will be more major performances in the near future?

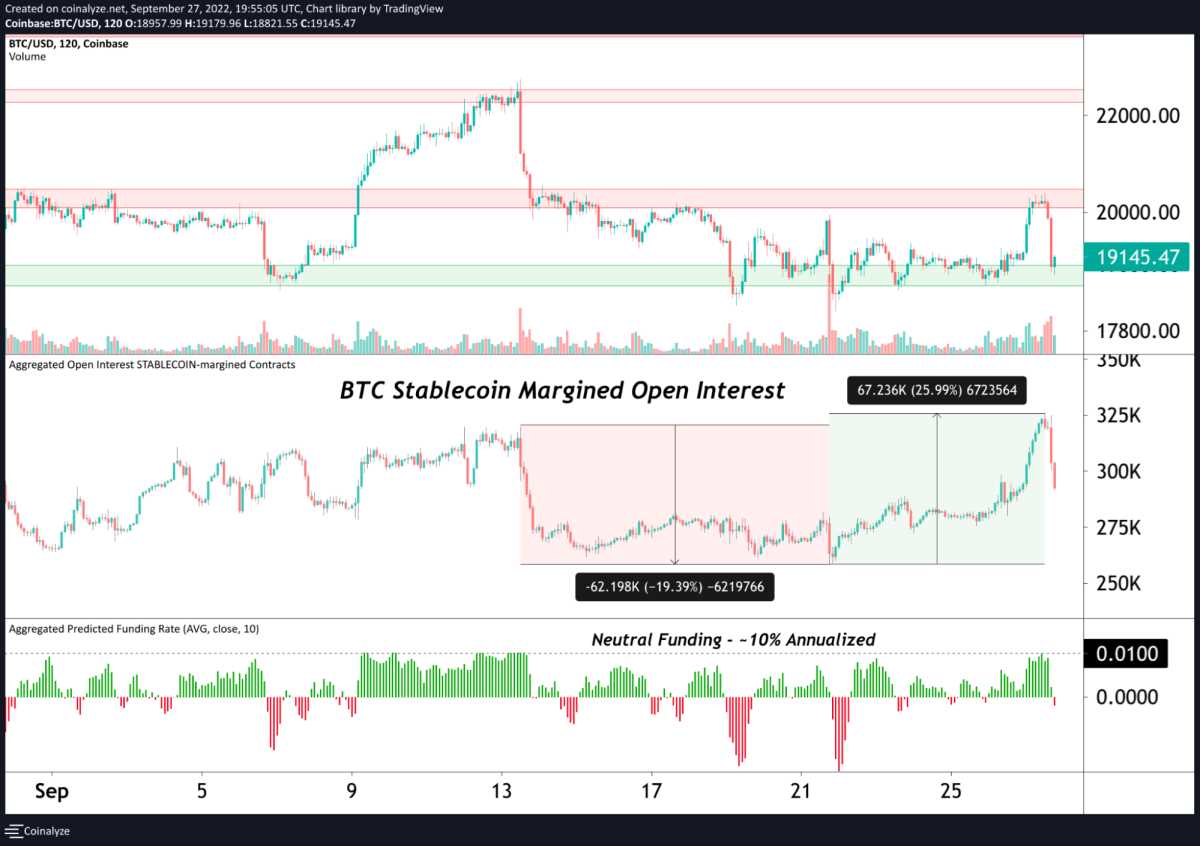

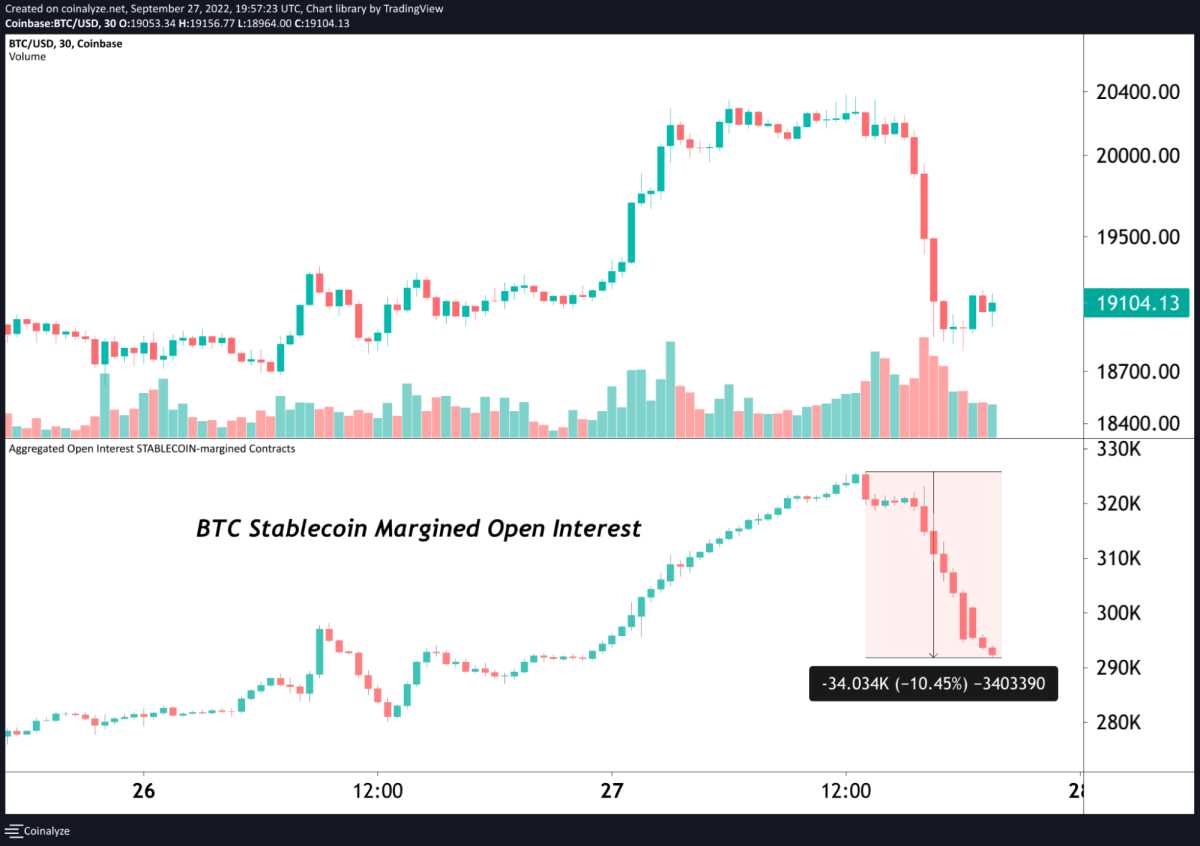

The simple answer is that the type of consumption that is taking place - long positions in the Bitcoin futures market - has never been sustainable.

With the rapid increase in the number of positions not closed compulsorily, which caused the market price to rise, tens of thousands of dollars of capital flowed into Bitcoin and became net merchants within a few hours

The firm belief in the Bitcoin derivatives market and judgment under the market cycle time state is as follows:

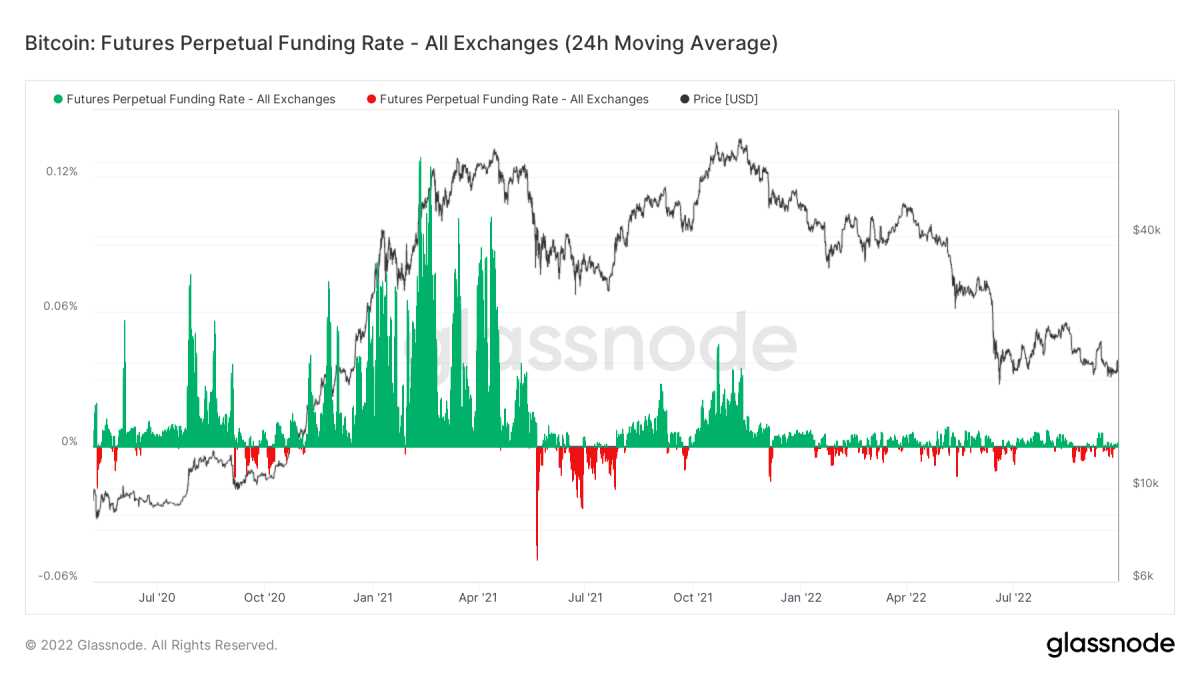

When the variable interest rate is obviously negative, spot trading marketing and leverage are eliminated first. The variable interest rate in the commercial complex of continuous futures trading can let us know whether double or empty orders are too radical.

When the equity financing interest rate is obviously negative, this may be because the promotion price of forced closing long positions is lower than the spot trading market, or because the aggressive short positions push the price lower. Compared with the mania of 2021, the interest rate of equity financing under current market conditions is much lower.

It is estimated that the fluctuation of the left market may lead to large-scale settlement of Bitcoin derivatives, resulting in a price lower than that of the spot trading market, and a flood of empty traders. The permanent futures financing interest rate (variable interest rate, encouraging traders to settle at a price close to the spot market interest rate) will continue to fall.

From the level of market decline in 2020 and 2021, we haven't seen this yet.

It is possible that there is no market today.

Relevant issues:

- 1/21/22 - daily crash - Bitcoin is less than 40000 dollars

- 3/8/22 - daily slump - zero risk interest rate of Bitcoin

- 3/9/22 - Daily slump - negative derivative mentality

- 5/20/22-BM Pro Daily Bitcoin Derivatives Status

- December 8, 22 - Speculative rise - assessed derivatives interest soared

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.