-

Expecting Volatility In An Uncertain Market

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-10-07

2022-10-07 3765

3765 Research

Research

-

Summary:Volatility thrives in market uncertainty and comes out the most in bear markets. It helps to examine the volatility conditions throughout past cycles.

Daily news report: fluctuation

Have I been fully prepared for the increase of volatility? With the deep bear market, the market will generally become more and more unstable. With the growth of variability, insufficient liquidity and boredom, more and more market participants gradually expect the market to go to extremes: either the market has already stopped falling, a new bull market cycle will become a major turning point of the Federal Reserve meeting, or because of the collapse of Credit Suisse, France, it will be urgent to limit the decline and increase the margin settlement date. Everyone keeps an eye on the trend of each key market and gives him some data signals. The price positioning gradually expands, and some (possible) weekly or monthly changes are reduced to one day.

Even though he is one of the best investors so far, Stanley Druckenmiller also found that today is one of the living environments that are very difficult to understand:

"I have been doing this for more than 45 years. This is the difficult natural environment I have encountered in the reaction of the current policies of the new pandemic, war and madness abroad and around the world. You have full confidence in the prediction and analysis of the next 6 to 12 months."

For most people, it is better to sit still and hesitate, have a large emergency hedging position, and plan to deploy after the market is stable or quiet.

We still feel that there may be a new bottom point, and the timing of individual stocks, risky assets and Bitcoin has not been finalized.

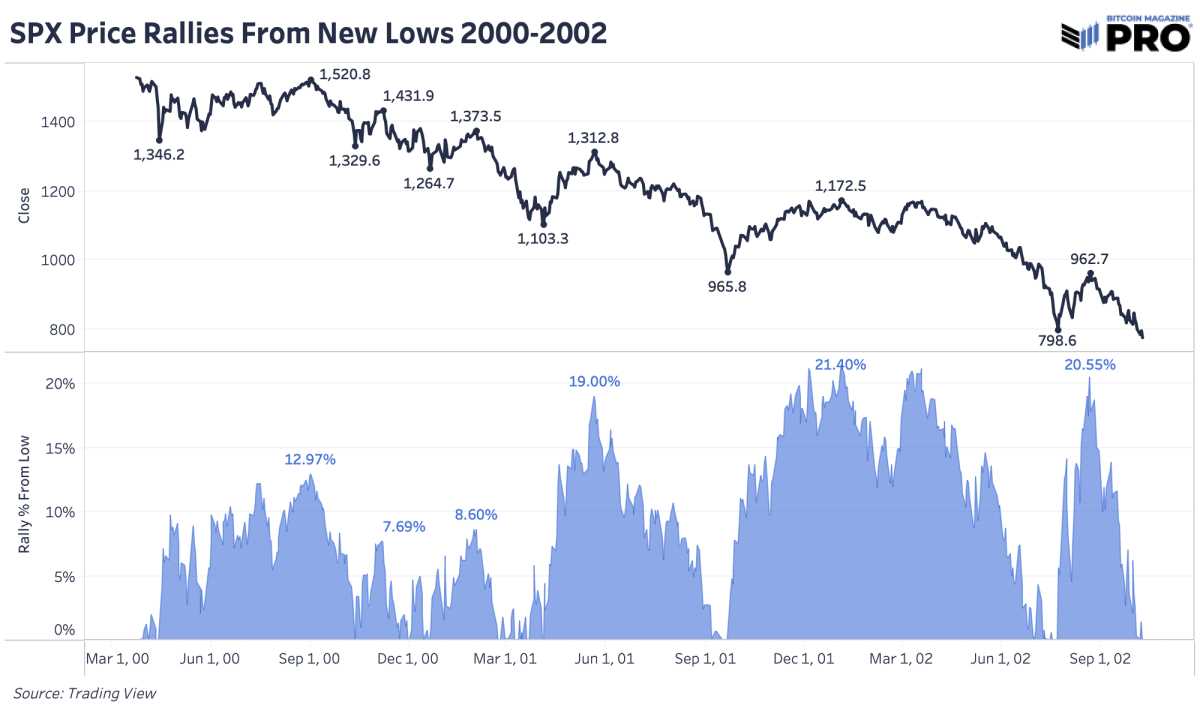

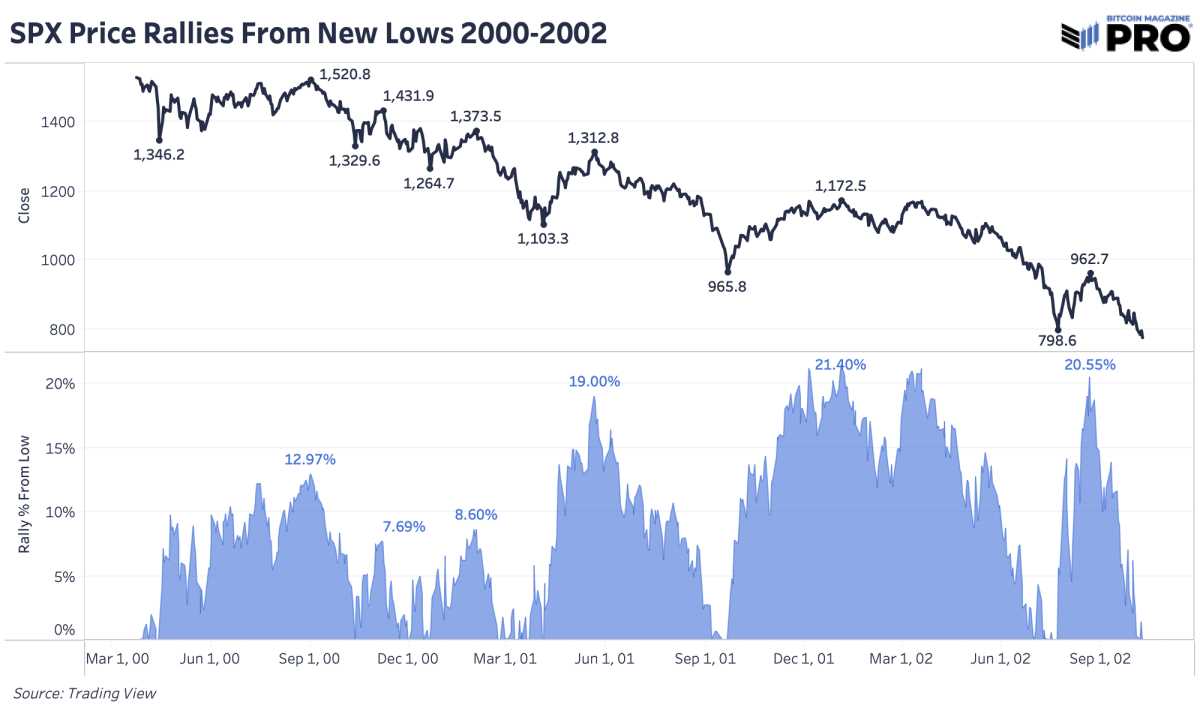

We will remind readers that so far, we have seen the strength of the bear market rebound, and the similar rebound strength in 2000 and 2008. There are other cycle times that must be studied and compared, but these are only a few recent examples.

It has been seen that SPX bounced back 17.41% from the bottom, and Bitcoin reached $25000. However, this has not changed the trend of its next decline. For us, the decline trajectory in the middle and late periods continues. Even in the final collapse of 2002 and 2009, the value of the S&P 500 index rose by more than 20% before falling. With the excessive coverage of the horror of higher leverage ratio and global doomsday news in the market, we must remember that there is no free lunch

Another interesting point to pay special attention to is that bear markets are generally short, with an average of 10 months. This 10 month standard will enable us to achieve today's level. However, there is an argument for a useful creative idea that must be made clear that the destruction we are seeing at present refers to the online adjustment of the annual interest rate and debt volume to a different historical stage. We haven't even reached the most typical regular profitable bear market.

Because bonds, currency loans and global stocks continue to be traded in the constant fluctuation, the recent historical time fluctuation and implied fluctuation of Bitcoin seem to be very weak compared with historical norms.

Although the recent lack of volatility of Bitcoin is likely to indicate that the leverage effect and speculative frenzy of the bull market have almost dissipated, we will still look at the huge legacy market and look for signs of vulnerability and volatility, which will turn upside down in the short term/mid to late.

Although the price behavior of Bitcoin around the world seems increasingly uncertain, the Bitcoin Internet still has little impact on the terms of the protocol. Although its rate fluctuates greatly, it is still fully used as a neutral currency asset/clearing layer again.

Dida Dida, the next shopping street.

Previous similar articles

- 2/23/22 - What's going on in the financial market

- 6/6/22 bear market of individual shares

- 7/11/22 - When did the bear market end?

- 9/1/22 - Inflation bear market troubles investors

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.