-

Bitcoin Hash Rate Is Exploding Higher. What Are The Implications For Mining Equities?

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-10-09

2022-10-09 4266

4266 Research

Research

-

Summary:Bitcoin’s hash rate has endured a series of significant price drawdowns only to emerge stronger than ever. We look at potential implications for bitcoin miners.

The new hash rate is always high

Just two months ago, the expansion of bitcoin hash rate in 2022 looked bleak. Bitcoin prices have plummeted, gross profit margins of miners have been reduced, and senior executives of large and medium-sized public miners have increased their holdings of bitcoin. At present, it is a mature opportunity to rethink the surrender of miners in the market. Fast to the present: the price has gradually dropped from the bear market of the stock market to $25000, while the hash rate published online has soared to a new historical high of nearly 250 EH/s. The fluctuation and increase of Bitcoin price did not affect the hash rate this year. Since July, the hash rate has not completely decreased with a 30 day growth

These are also some good cloud computing platforms that can be used to show why the bitcoin hash rate has exploded so much. Public miners have implemented expansion plans. However, this does not mean that large and medium-sized mining enterprises have not encountered additional work pressure. Compute North is the largest big data center operator and one of the bitcoin discovery and escrow service providers. It applied for bankruptcy protection a few weeks ago. They provide mining service projects for 84 different mining entity lines of enterprises such as Marathon data, Compass mining and Bitdog data. On November 1, 2022, large-scale auction will be carried out for the current properties of Compute North, mainly including mining utensils, equipment and the whole big data center.

During the "C" collapse period, the "C" mining enterprises declared bankruptcy as early as July. In other words, it is obvious from the recent bankruptcy case of Compute North that large and medium-sized miners are still under pressure. They are not out of danger yet. We have been wondering whether to complete the mining surrender in this cycle. Because the price level has already stopped moving, the hash price (except for the hash rate) has again encountered some strong friction resistance, and the expansion of the hash rate is taking place.

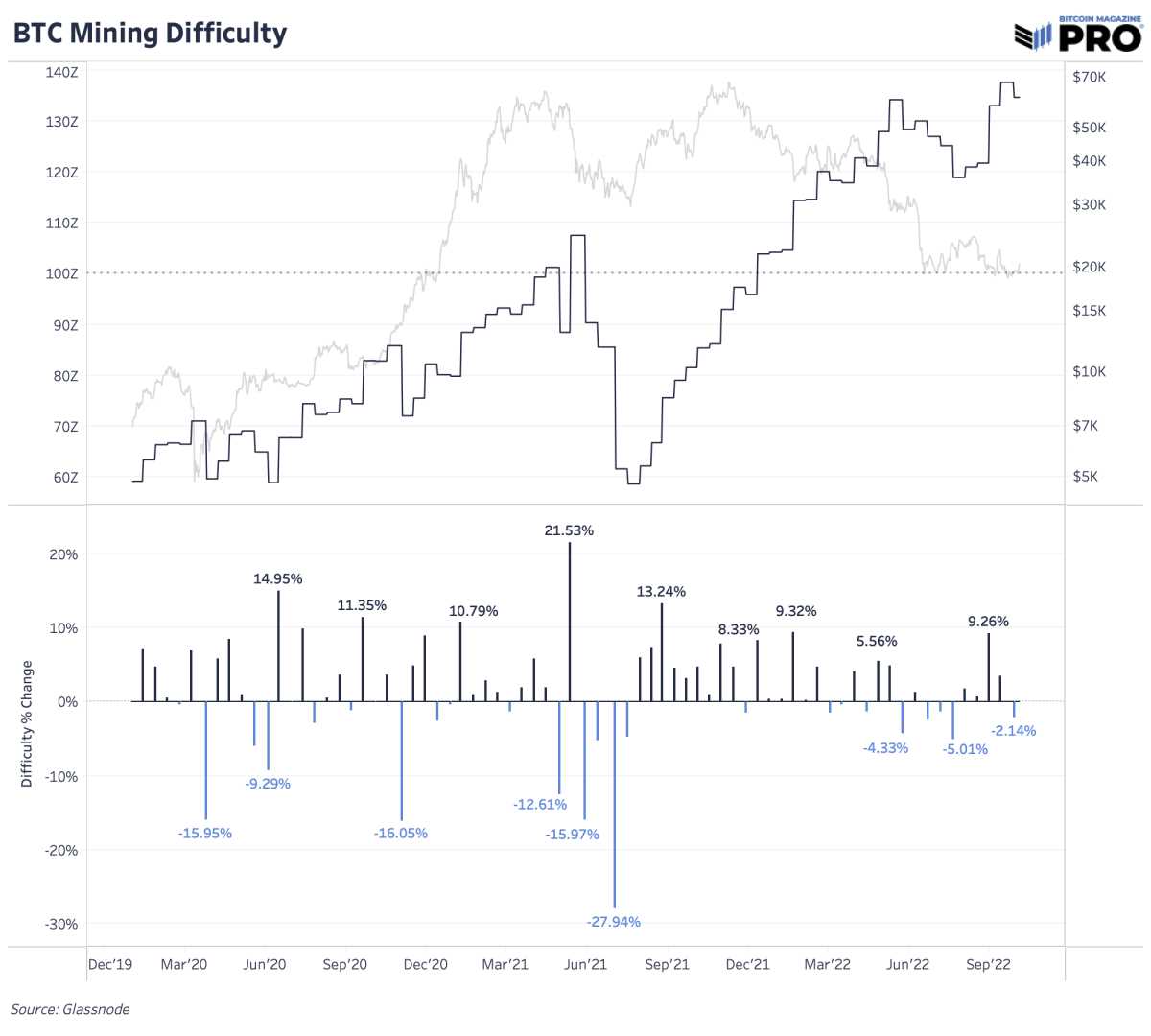

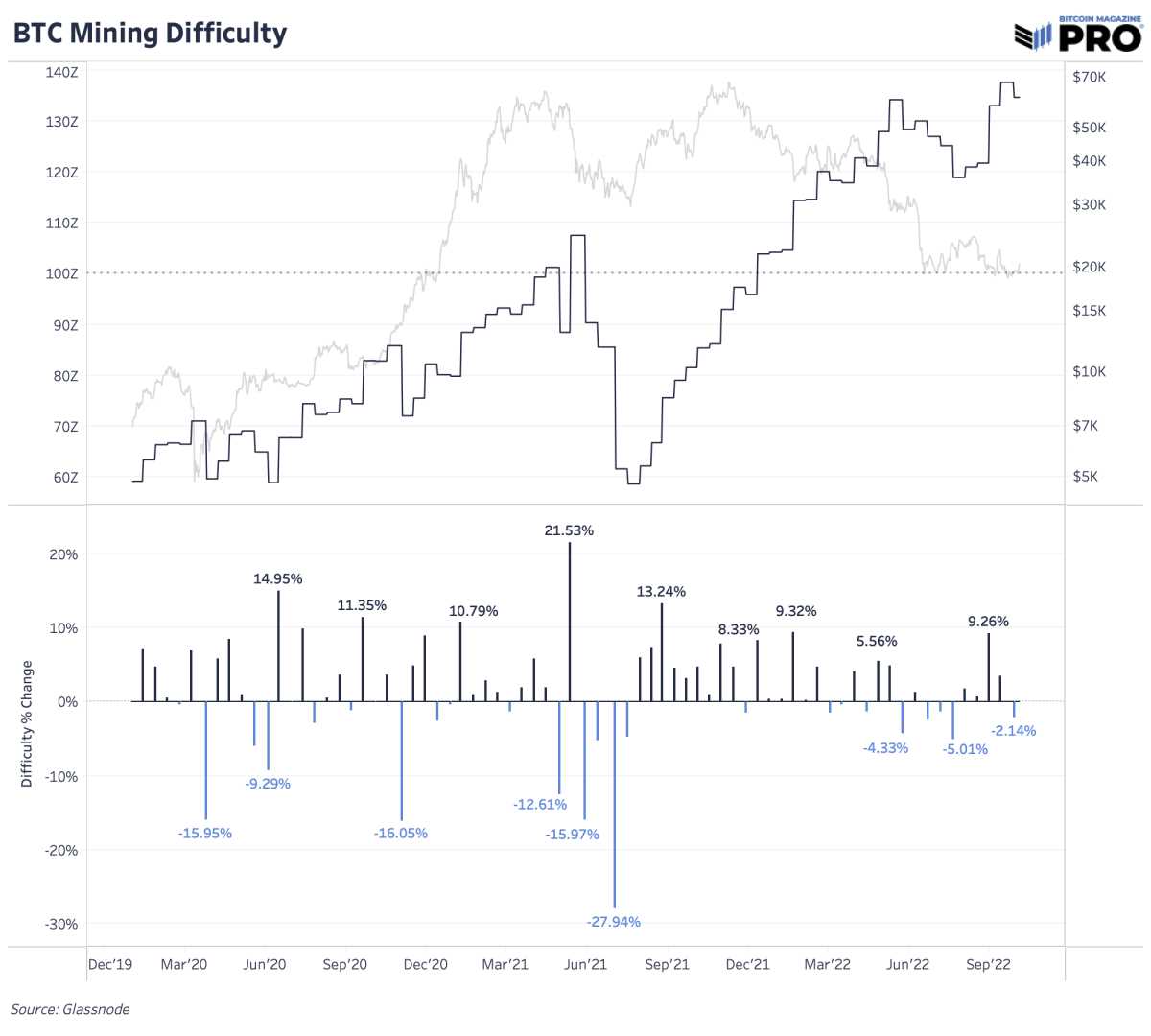

After hitting a record high, just before the hash rate exploded last week, the mining difficulty coefficient showed a very large negative adjustment, which was 2.14%. However, this seems to be a short-term relief. As of now, the next difficulty adjustment of estimation looks like a 13.5% malignant change when writing this article. We have not seen such a change since China banned mining. This kind of adjustment is bad news for the current operating capacity of mining enterprises, because the hash price may face further pressure.

To maintain excellent performance in Bitcoin mining for several periods of time, it is necessary to have surprisingly excellent operations.

This is why the stock market investment related to Bitcoin mining is likely to be very profitable (you can choose one of the big winners), or it may be a complete disaster.

In our work on December 21 last year, we talked about the following aspects:,

"According to the evaluation, compared with the performance of Bitcoin itself, you should know that due to the working capital of its business and the company valuation in the stock market, the miners can and are very likely to perform better than Bitcoin at the stage of rapid rise in hash prices.

"However, in the long run, measured by Bitcoin, the income of every mining enterprise will decrease in the way of Bitcoin. And because the profit multiplier of enterprises trading in the stock market of the world of zero interest rate is too high, even Bitcoin mining stocks expressed in Bitcoin will tend to zero over time (again, because of the interest multiplier in the era of zero interest rate law currency pricing)."

Since then, compared with Bitcoin itself, the stock prices of the trading mining enterprises announced have continued to fall

This is not surprising. In terms of Bitcoin and US dollars, the gross profit margin of mining enterprises has been squeezed relentlessly with the decrease of earnings.

Since the price of Bitcoin hit a record high, all the announced trading mining enterprises are in a low state at the property level, without exception

Although the individual stocks related to mining will certainly increase in value with the valuation of the companies hit at this stage, the development of mining machinery and equipment and the incentive mechanism of mining economy can basically ensure that the rate of bulk containers will rise further from here.

Our first phase before the introduction,

However, the dynamics involved in the assessment and announcement of bitcoin miners are somewhat different. Unlike other "product" manufacturers, bitcoin miners try to save as much bitcoin as possible on their financial statements. Related to this, the future development, supply and sale of Bitcoin seems to be 100% established.

"With this information, if investors evaluate such stocks at the price of Bitcoin, and if investors apply data-driven methods for distribution within the right period of the market cycle, they can achieve a significant outperformance over Bitcoin itself."

In the future, mining related stocks and their ASICs will again be fully prepared for their huge performance compared with Bitcoin itself. It's not long enough for us.

Previous similar articles

- 12/21/21 - Performance assessment of chain mining and public mining

- June 29, 22 - The price of mining bulk containers bears in the stock market

- 7/5/22 - Public mining and gradually selling Bitcoin bonds

- 7/11/22 - When did the bear market end?

- July 26, 22 - Bitcoin hash rate increased by 17% from the highest in history

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.