-

Preparing For The CPI Reading: Market Braces For Volatility

Sam Rule

Sam Rule 2022-10-15

2022-10-15 4091

4091 Research

Research

-

Summary:Markets await the highly anticipated September consumer price index data release. A higher CPI could easily take yields higher and risk assets lower.

The market is fully prepared for unexpected CPI

The PPI data of the United States will be released on October 12, 2022, which is also the day before the expected customer price index is released in the morning of the next day. To put it simply, it is not a good luck for some people who estimate CPI to be less than the consensus. Although the overall PPI decreased significantly, the year-on-year (MoM) increase was higher than expected, 0.4% (0.2% widely), and the overall change this year was 8.5%. Compared with CPI, PPI is less harmful to timely market changes, because it ignores the inflation costs communicated to end-users. However, this is an inflation indicator value, which can judge whether the company is experiencing accelerated price rise and tends to be the same as CPI.

The CPI consensus is 0.2% month on month (MoM). Therefore, even if it exceeds 10%, it may cause the market to continue to fall again, thus killing the hope for the future of the support point of the Federal Reserve meeting

This is not the only sign that CPI is higher than consensus. Previously, you mentioned the inflation forecast analysis data of the Cleveland Federal Reserve Nowcasting, which predicted and analyzed 0.32% overall month on month change of CPI and 8.2% overall change of this year. In other words, 17 of the recent 19 new forecast reports are actually smaller than the CPI reading. Recently, this special tool is closer than most consensus forecast analysis, but has always underestimated specific CPI data. Please be cautious when more conservative CPI forecasters predict that the analysis consensus will get rid of.

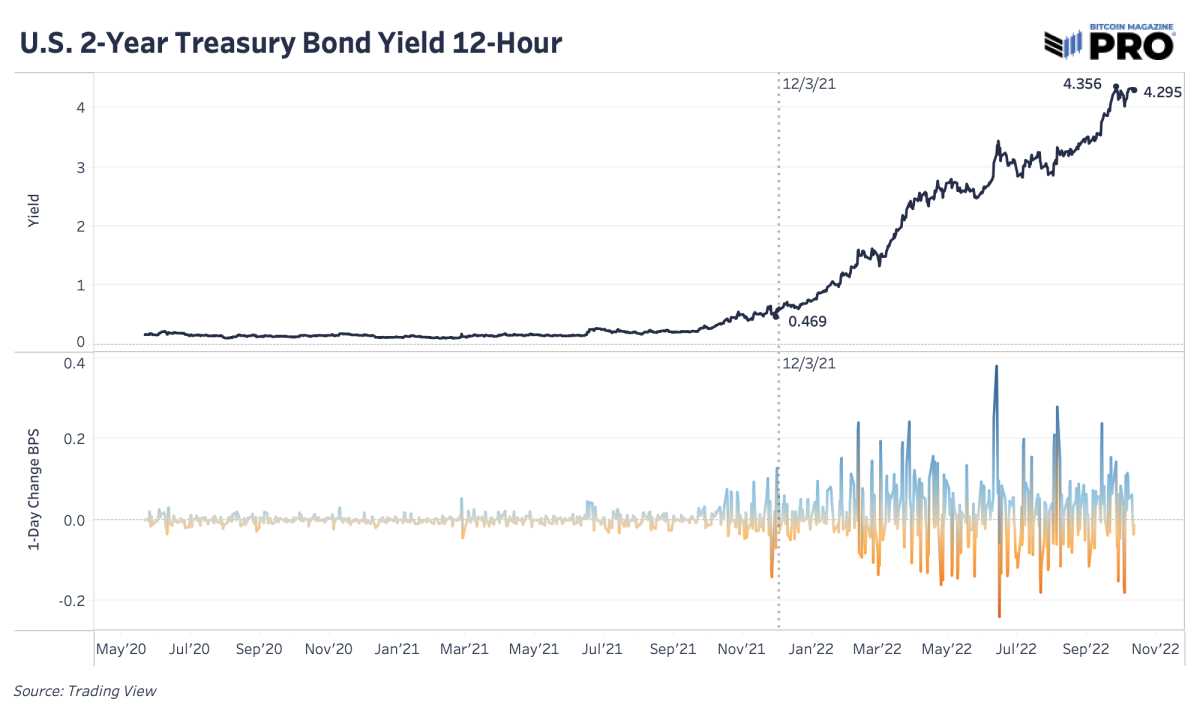

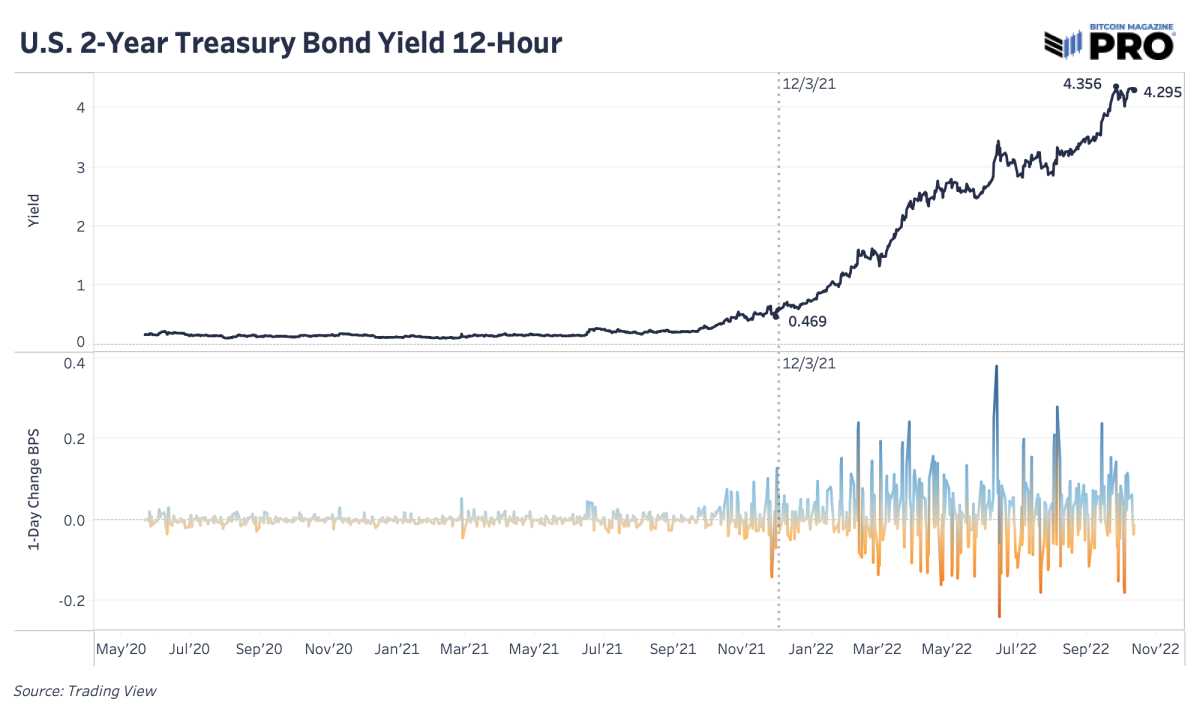

Although PPI data can let us know the direction of CPI, they will not harm the market as the CPI data of last year. One of the key indicators of market thinking is the interest rate of the two-year US treasury bonds, which is only slightly lower than 4.3% at this stage. As of today, the latest upward trend has stalled and stopped, which may indicate that the market is not ready to accept the message of the Federal Reserve's latest interest rate rise to 4.5% until they see the CPI data

Compared with the consensus position, CPI is anyone's guess, but the market seems to be waiting for the next direction until the data goes out. In addition to the data, the most important worry in the middle and late period is that CPI will also maintain a 5-6% growth rate in a few months. Because of the serious backwardness, the rent inflation is a key component, which may be further aggravated before it is converted. Health services were a component of the sharp increase in August, and rose again because of the higher impact of sticky labor costs, which are still rising. Although the price of crude oil has risen in the past two weeks, with the cash flow of bulk commodities again, the short-term factors of electric energy in September's data are likely to decrease. However, with OPEC's production cut and the shortage of demand in winter approaching, the latest oil price is likely to recover very easily.

What does it mean for BTC?

In the next article, everyone explained that Bitcoin market lacks historical time uncertainty at this stage. This is not easy to continue, and the market will fluctuate in some way. CPI data can easily become a metal catalyst. If we want to see upward movement, our own structure is still, which will be a temporary rebound to severely crack down on empty orders, retrieve liquidity, and possibly reverse the decline. The sharp CPI may cause the market to step into many liquidity tracks and control the loss at a level slightly lower than 18000 dollars. This is the phenomenon of unexpected bearish stock market in CPI. Again, take a look at the direction of the individual stock market to confirm the development trend in the short term.

In general, the game is now careful. BTC will still exist with the fiscal policy once again proven ineffective and/or completely destructive. Many people will realize that it has never "died", and its position in the world today will exceed the relevance of Gobeta.

Previous similar articles:

- 7/13/22 - Inflation: the number one enemy

- August/September 22-July CPI: What do you pay attention to?

- 9/13/22-CPI inflation drives the market to reprice

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.