-

Is Volatility In The Bitcoin Price Coming Soon?

Sam Rule

Sam Rule 2022-10-23

2022-10-23 4817

4817 Research

Research

-

Summary:Everyone is waiting for the next big breakout or breakdown before allocating again. Compressed historical volatility tells us that it’s right around the corner.

Lack of volatility

One of the industry trends that you want to be concerned about now is the lack of volatility. The stage of high spot market volume and the stage of low derivatives trading volume are basically harmless to the market. The bear market in the stock market is famous for honing investors' carefulness. You have seen some fluctuations in the recent consumer price index (CPI) inflation information, but the historical volatility of Bitcoin is still at the historical bottom.

Nowadays, everyone wants to see a way to get rid of the Bitcoin price positioning; Large scale accumulation generally leads to more ascension movement. It is indeed a good thing that the historical volatility of Bitcoin is less than that of the US point and roll sales market, but now it is even less than the average bond and stock ETF. This is when you understand that the sales market is completely out of order. Otherwise, it shows that people lack interest in Bitcoin and are considering more measures. Otherwise, the whole asset situation of Bitcoin will suddenly change. We focus on the former one. The historical time shows that such record breaking high volatility levels are not easy to continue for a long time, which has caused some very obvious price increases and collapses.

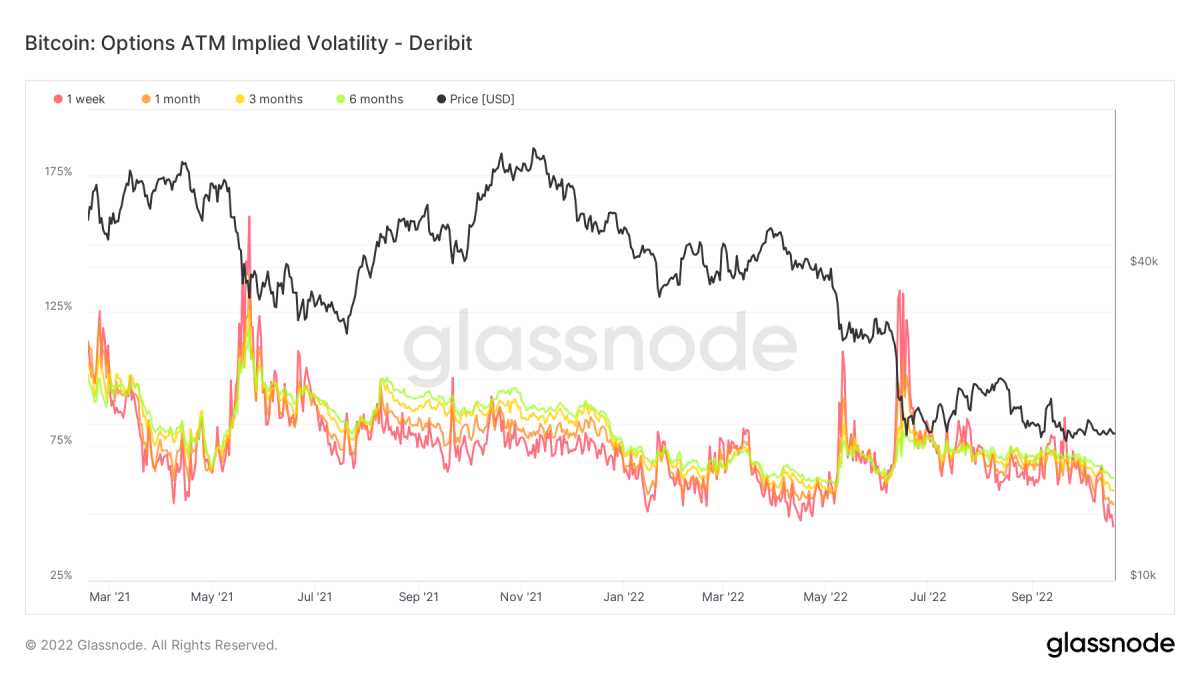

Even the implied volatility of the industry based on option pricing remains at some record breaking bottoms (and continues to decline) in different durations.

In the four major events of low percentile historical time fluctuation, you can see that in 2018, there were three increases and one significant decline to the lowest. This is a small sample size, from which we can get a specific view, but it seems that there will soon be a new action. The price simulation in 2018 is one we discussed before - especially considering our own estimate that the S&P 500 index will have a relatively low bottom before the end of the cycle time. Introduce the previous article, "What should you expect when you expect fluctuations":

"Although the recent lack of volatility of Bitcoin is likely to indicate that the financial leverage and speculative frenzy of the bull market have almost dissipated, our vision remains in the huge legacy market, looking for signs of vulnerability and volatility, which may become a short-term/medium-term headwind turnover."

About previous articles:

- Monthly report in January 2022

- 4/22/22-GBTC discount collection

- 10/4/22 - If you expect fluctuations, what should you expect

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.