-

Miners Are The Biggest Risk Facing The Bitcoin Price

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-10-28

2022-10-28 3748

3748 Research

Research

-

Summary:TEpA3sHq62o5kVK69mzJzvGmzf9x2uW57Y

With the soaring hash rate, the amount of information in 2018 continues to rise

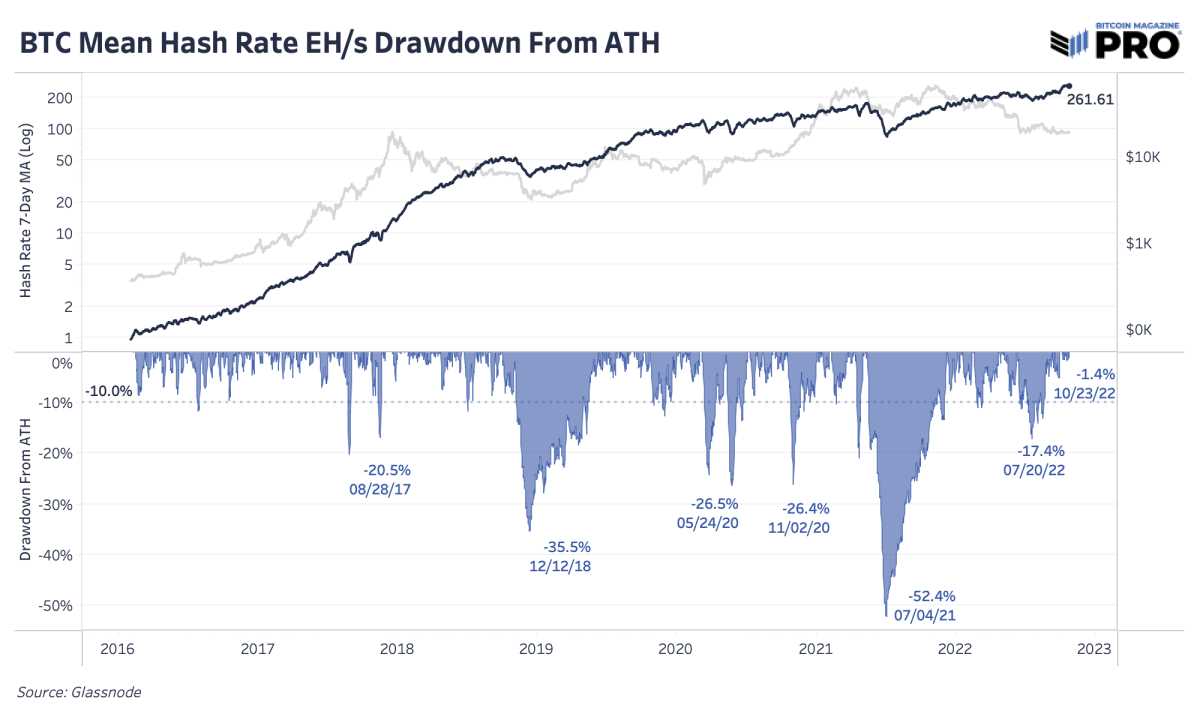

On October 23, the difficulty coefficient of Bitcoin excavation increased by 3.44% (previously adjusted to 13.55%). With the soaring hash rate, the difficulty coefficient of Bitcoin excavation rose again to a new historical high. As the price of Bitcoin has been limited to around 20000 dollars in the past few months, you have noticed that the market cycle in 2018 has something in common with the market cycle set before you today

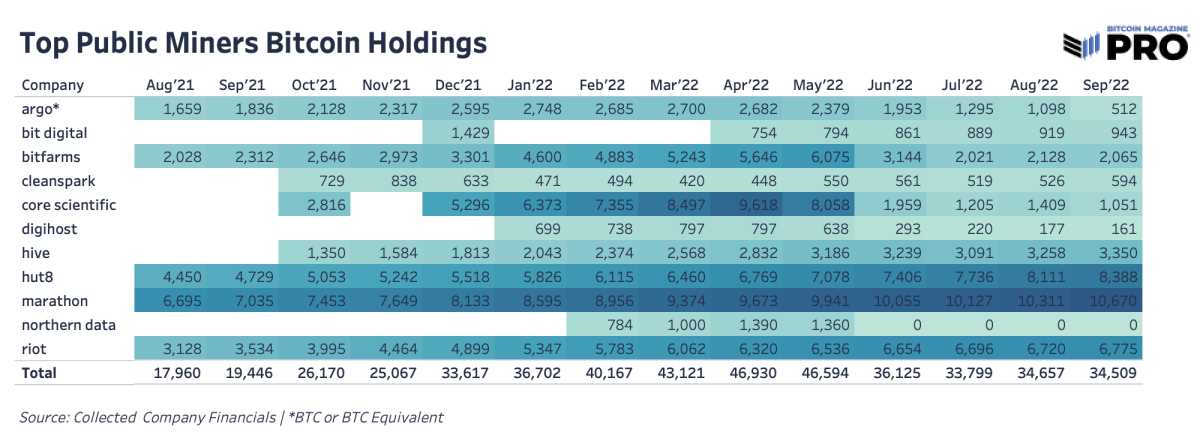

In 2022, the price of Bitcoin will decline and the hash rate will continue to rise, which will add great pressure to the public and private mining businesses. In this year, you can see that the public miners chose to give up their Bitcoin holdings. Due to the decrease of income and the significance of the Finance Bureau, the balance sheet was under great pressure.

At the peak value stage, the bitcoin ownership of public miners exceeded 46000 BTC, but it has declined by 26% since then. As the bonds of bitcoin countries come from the demand of acquiring more assets, paying off debts, and providing financial support for operations and expansion programs, they are sold. Although it is possible and roughly numerical, the top public miners account for more than 20% of the bitcoin Internet hash rate. Public miners not only sell bitcoin they hold, but also expand and collect their hash rate, which will have a profound impact on the sales market

With the hash price reaching the historical bottom again, and with some physical lines terminating mining and settling their properties (in the form of Bitcoin and ASIC), the probability of miners' surrender/settlement will increase until the hash rate decreases

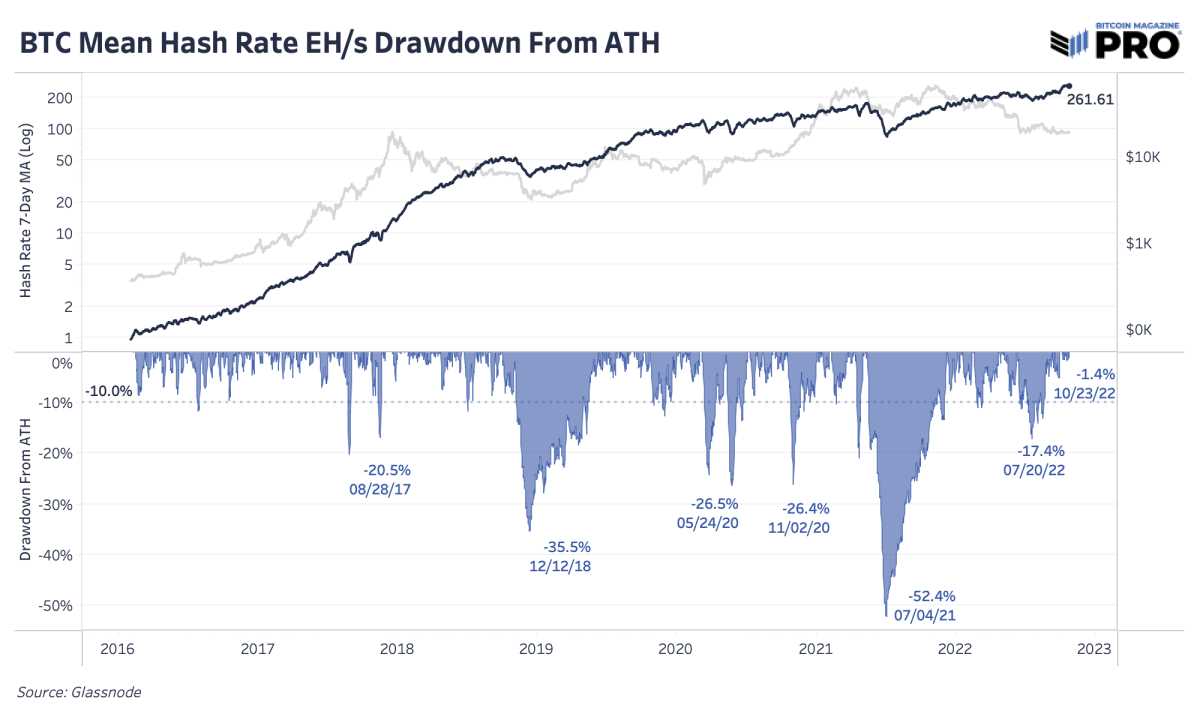

In addition to the 2021 mining restriction in China, Bitcoin has experienced a significant peak valley decline (7d MA) of about 35% in the past. In the eyes of many people, this bear market cycle of the stock market is not easy to end until there are weak miners. This will be analyzed by temporary but valuable reduction of the hash rate, and then the mining difficulty coefficient will be reduced to reduce the standard for the surviving participants.

Although earlier this summer, in the first phase of the cryptocurrency market's transition from emptiness to reality in June, the "surrender" itself appeared, but the hash rate has already risen vertically. The latest Bitmain Antminer S19 XP (a world leading miner), a new transport team, has just been deployed by the largest miner group.

Fully considering the hash rate and challenge level at this stage, the work pressure is really increasing for us, but the representative outbreak has not occurred.

Towards deep-sea mechanism

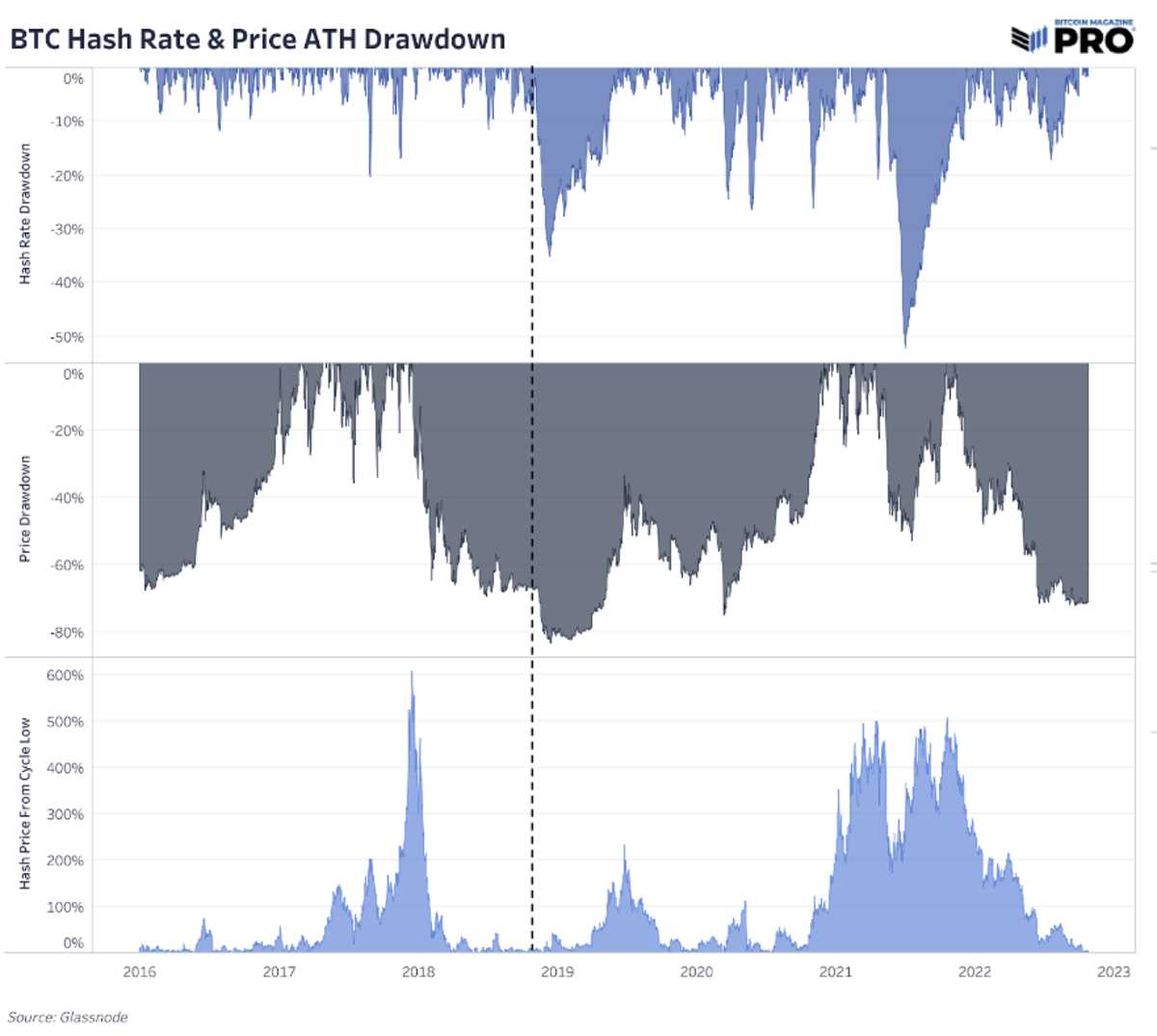

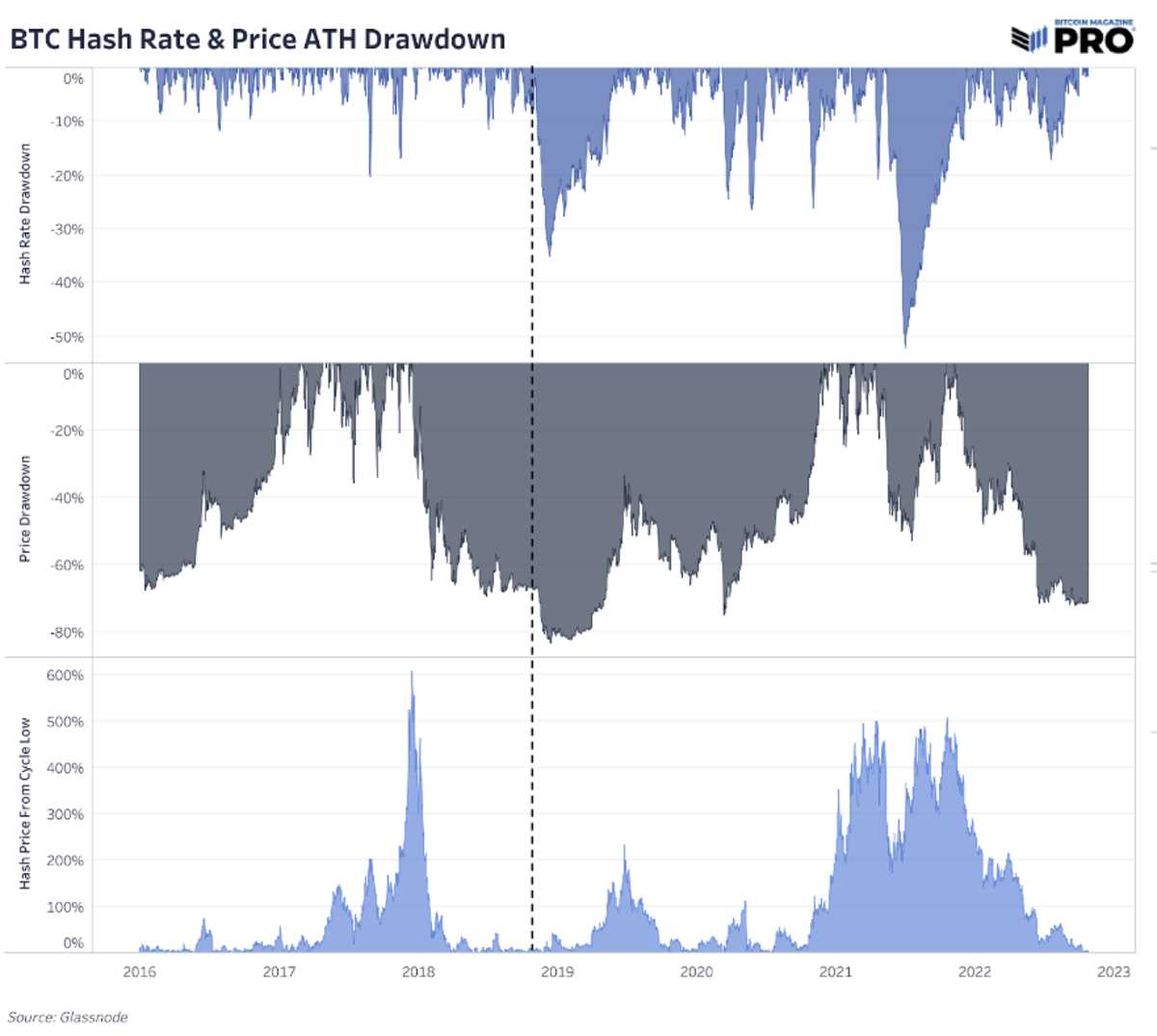

It is very easy to see that with the sharp drop in the hash rate, the further work pressure of Bitcoin prices and mining revenues has driven a large number of people who own Bitcoin back to the sales market. The following chart shows the comparison of hashing rate, price movement track and acquisition percentage between 2018 and now

If there is a reason for the last segment of decline, this is the reason. However, our data driven approach allows us to focus on this point, which has a very high probability of being eliminated. In the next table, observe what happened when the price stagnated in the Bitcoin sales market last time. As the hash rate soared to a new record every day (Reminder: slash)

Although it is not easy to repeat the mistakes in history, it is usually rhymed. Our own data-driven approach makes our team more and more careful about the mining industry and the Bitcoin sales market after that may face pressure in a short time.

Although we can't say for sure that this will happen, when the uncertainty of Bitcoin property itself drops sharply, the greater the hash rate, which is higher than the previous history (about when some of the largest CapEx transactions were carried out for its mining infrastructure construction), and higher than 71%, the more likely it will be that the miners will finally surrender. This is not a prediction analysis, but an analysis based on the information in front of everyone.

About previous articles:

- 10/6/22 - Hash rate hit a record high: impact on individual mining stocks

- 7/26/22 - Bitcoin hash rate increased by 17% from the highest in history

- 7/5/22 - Public miners gradually sell Bitcoin bonds

- 6/29/22-Mining Hash Price Stock Market Bear Market

- 12/21/21 - Performance assessment of chain mining and public mining

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.