-

TE9UG87qRwDMwVvTws5uz2jHYgixyvUeio

Dylan LeClair

Dylan LeClair 2022-11-03

2022-11-03 3062

3062 Research

Research

-

Summary:As the market hangs on the edge of continued rally or turning over, hawkish or dovish commentary may drive exceedingly volatile market reactions.

November Federal Open Market Federation Conference

The global market focused on the Federal Open Market Federation meeting in November. At this point in the global liquidity cycle, it seems that every asset class is part of the same potential transaction. In 2022, when the Federal Reserve Meeting officially started the fastest tightening cycle in modern history, the strong view of the Federal Reserve Meeting, the world's central bank of debt dollars, has continued so far.

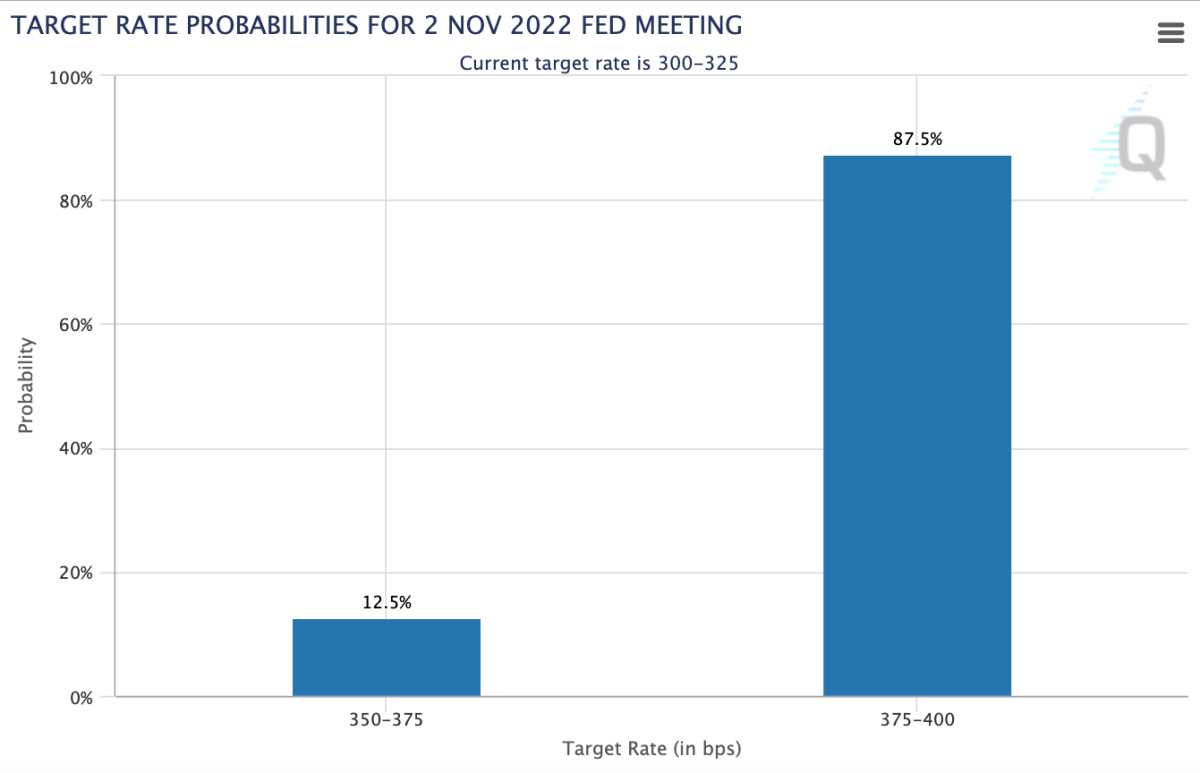

It is widely believed that the interest rate increase is 75 percentage points, and this plan will raise the policy interest rate to 4.00%.

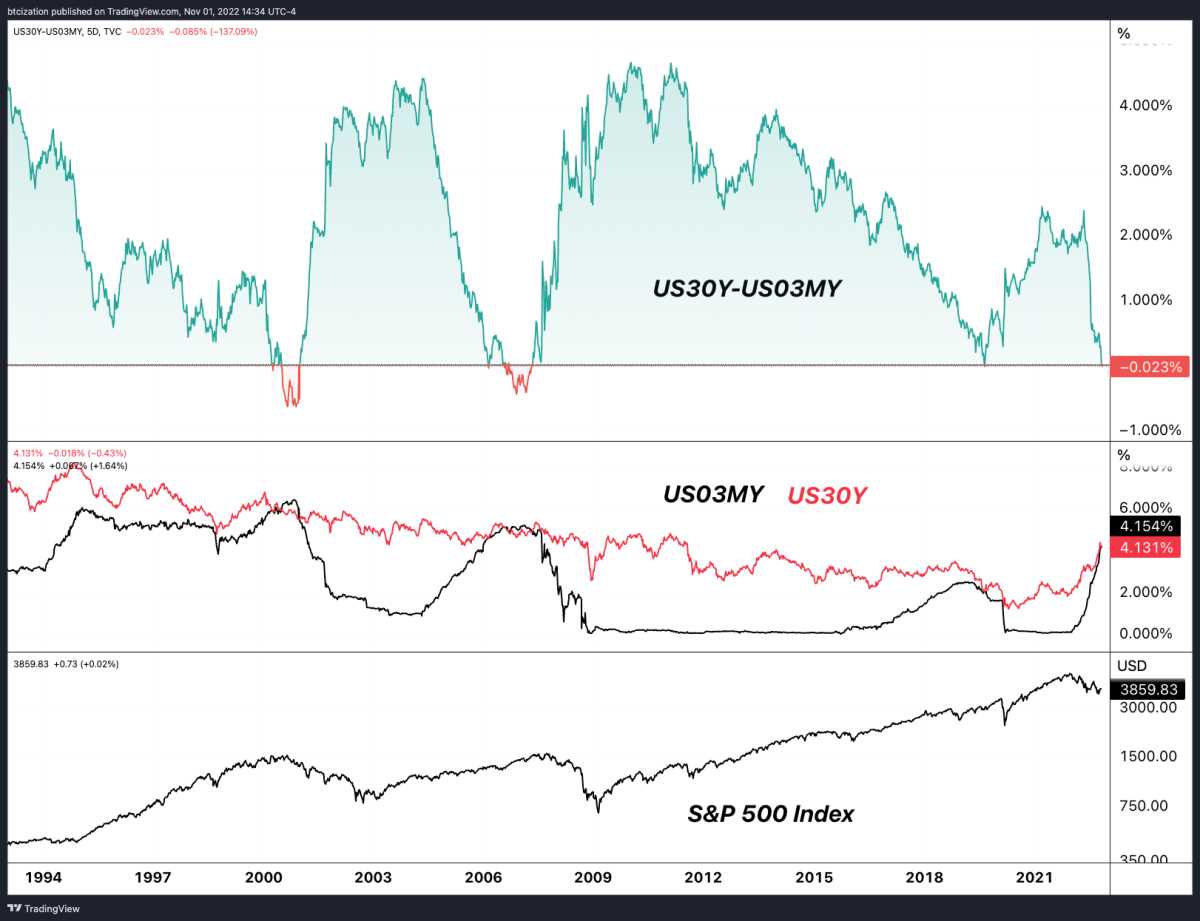

Most of the interest rate increases have been recorded in front of the US debt curve, which has caused various reversals on various maturity dates.

As far as bond yield is concerned, in all the extremely important durations, there has also been a reversal - this situation generally occurred before the economic slowdown, because the rise in short-term returns will inhibit long-term capital project investment because of the "attractive" short-term returns. Lend your money to the US government for 30 years and then lock it in at 4.13%, or re evaluate it at 4.13% after 3 months? The duration risk really exists. Under the global record breaking inflation environment, the pace of tightening cycle time makes investors anxious about the long-term market prospect of bonds. No kidding

It can be said that the meeting of the Federal Reserve is still behind the curve. According to his mandate, he should not "let" inflation pressure out of control. At the same time, he is still adding fuel and vinegar with the zero interest rate policy and the purchase of US $120 billion of quantitative easing bonds every month. Because of this error and its subsequent impact on credibility, the Federal Reserve is trying to cause pain in the labor market and asset prices until inflation concerns weaken.

This is a bold attempt to develop the strategy, and is doomed to be unsuccessful. But they are likely to destroy everything while exploring. However, economic development in the name of GDP estimates (not adjusted for inflation) and the labor market continues to heat up. The sales market seems to firmly believe that the relevant policies of the Federal Reserve Conference are in a new system.

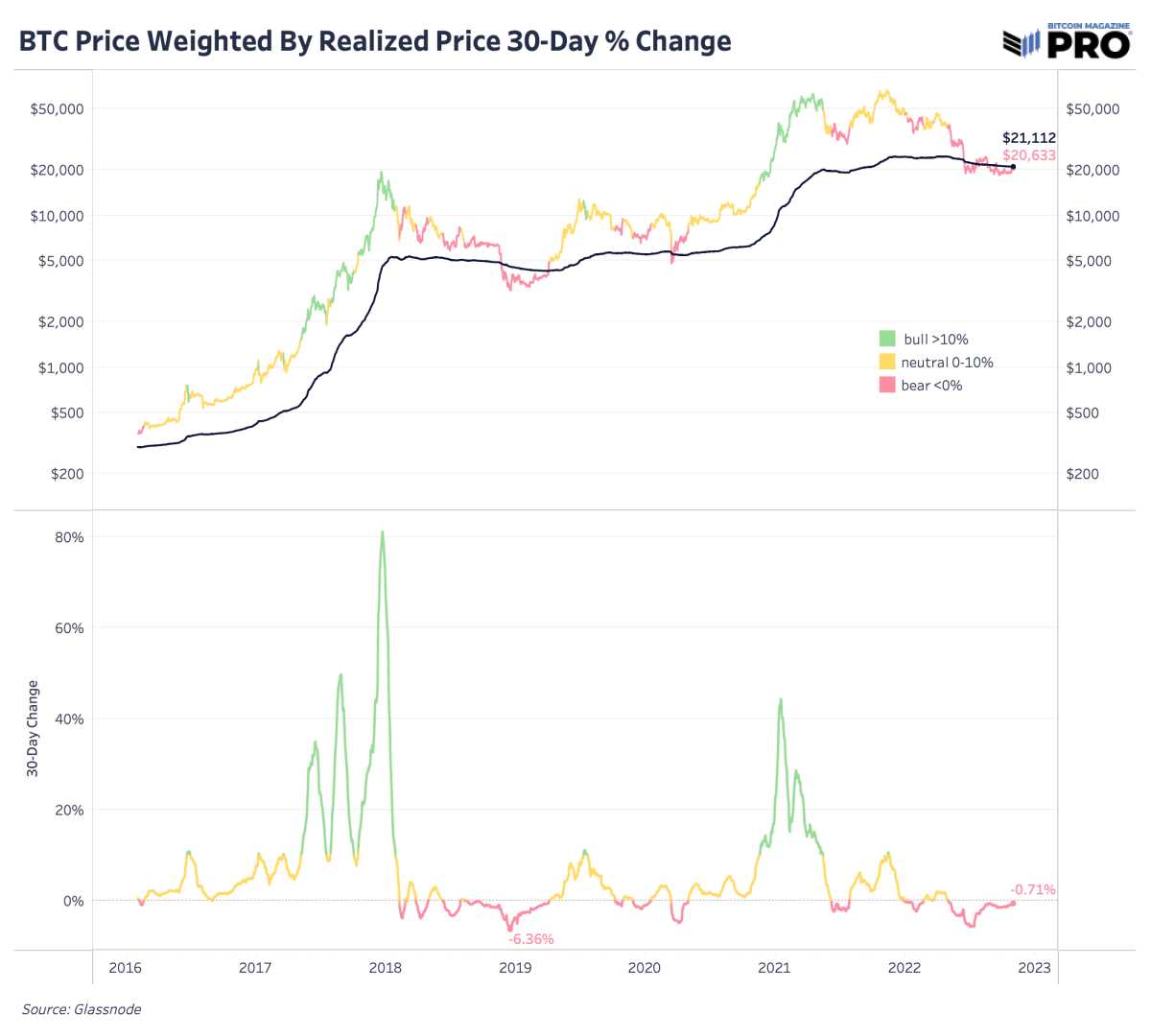

Below you can see the Bitcoin market and the average chain holder's cost (completion price). BTC is in the most typical bear market integration link, and many people will certainly have more pain. At this stage, anxious/leveraged investors sell their stocks to prudent and well capitalized investors, creating a standard for the next bull market

About previous articles:

- 10/20/22-BTC Dead City

- 9/16/22 - Five Important English Data Charts to Watch Today

- 7/20/22 - Warning: Bear Market Party

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.