-

Crypto Lender Genesis Is On The Chopping Block As Contagion Continues

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-11-20

2022-11-20 4624

4624 Research

Research

-

Summary:Genesis needs a $1 billion liquidity injection by Monday and Gemini sees significant bitcoin outflows as fears of insolvency spread throughout the industry.

Genesis seeks liquidity introduction

If you don't know about Genesis, maybe you should know. They represent the basic technical backbone infrastructure construction of investors in Bitcoin and the wider crypto market. For loans, trading, arbitrage, foreign exchange trading returns, etc., Genesis Trading is a company that promotes all activities in this field. Remember the considerable profits of BlockFi and Gemini Earn products in this field? Genesis is a retailer that makes profits between such platforms and financial derivatives.

Genesis held a short customer conference call to announce the suspension of redemption, cash withdrawal and new loan distribution. Because of its openness to FTX and Alameda Research, the company needs to introduce liquidity again after it has confirmed nearly 175 million dollars in FTX's trading account. As the initial reply, the head office of Digital Currency Group (DCG, the head office of Grayscale) gave 140 million dollars to the business process to maintain business stability. However, Genesis is now scrambling to explore a large number of assets. This is the main reason why Gemini Earn had to stop drawing.

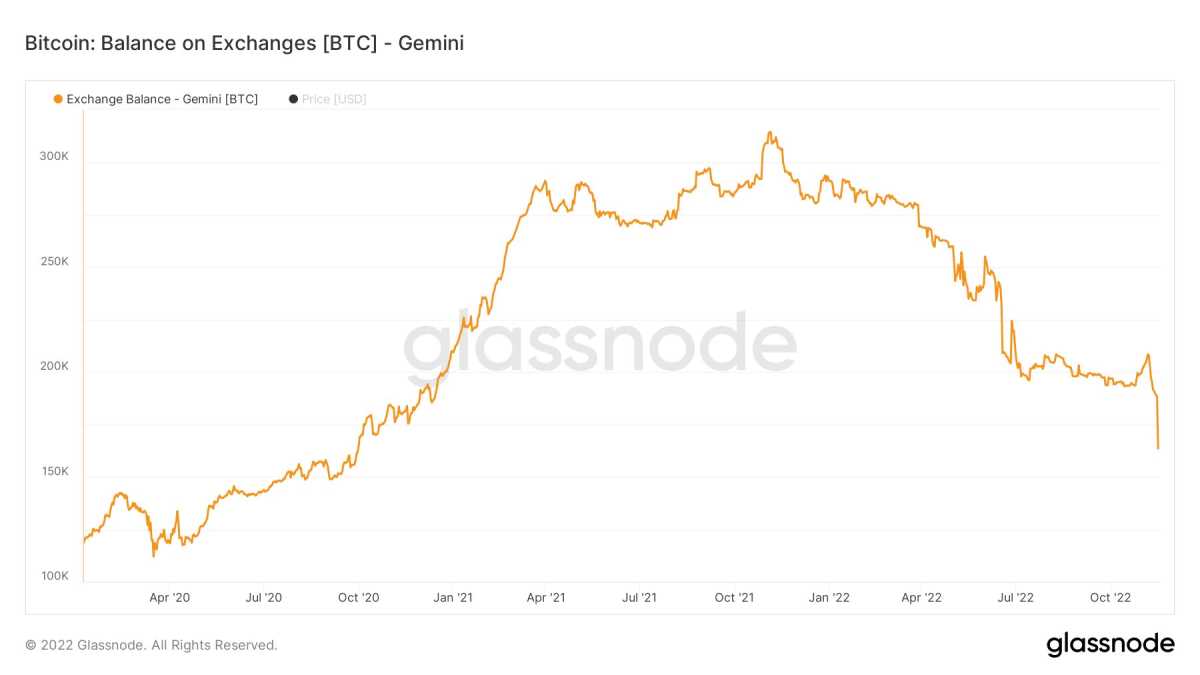

Although Gemini has always claimed that its other operations are normal, it seems that limiting Gemini Earn products and service projects on all platforms has caused a trend of taking Bitcoin off the exchange: 13% of the Bitcoin balance has been used up in the past 24 hours. As you mentioned earlier, the exchange is not the storage place of Bitcoin, especially when there is a strong possibility that another exchange (or even several) will fall

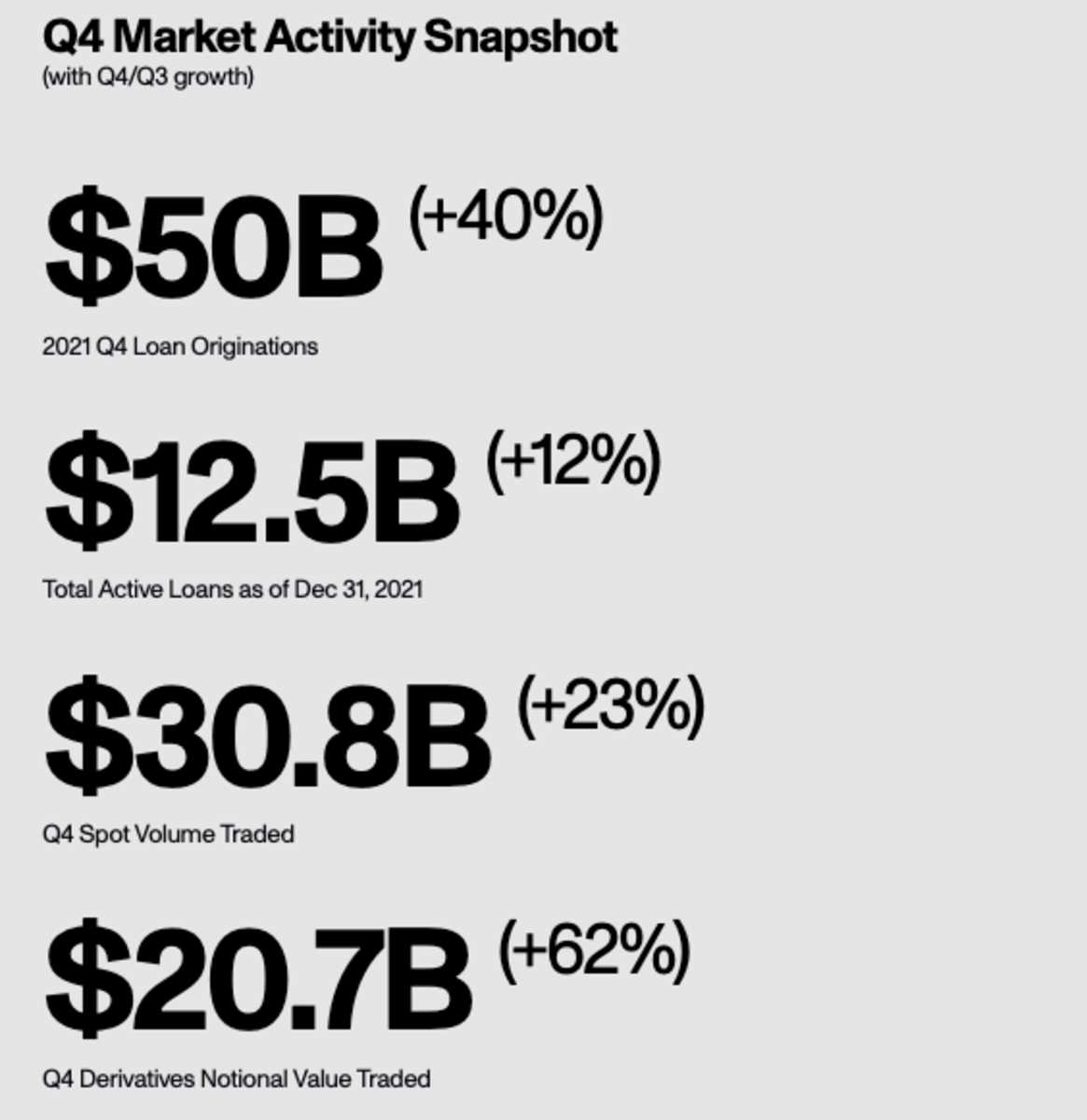

In order to enable you to master the scale of business, Genesis has 50 billion dollars of loans distributed in a quarter and 12.5 billion dollars of active loan accounts at the peak of the 2021 sales market. However, the distribution of loans and active loan accounts also experienced a significant decrease, falling to US $8.4 billion and US $2.8 billion respectively by the end of the third quarter of this year. As early as July, Genesis paid a claim of $1.2 billion to Three Arrows Capital. The claim was recovered by DCG to preserve the records of Genesis. Part of the loan is secured by the equity of GBTC, ETHE, AVAX and NEAR tokens

We can learn from the process on the chain that Genesis has used its diplomatic exchange platform to conduct many interactions with Alameda, Gemini and BlockFi; FTT is also the top dynamic password received and uploaded in this process. If Genesis does not share a large number of key points, we do not know the level of risk and capital required to make customers more detailed. However, DCG of the head office did not intervene to introduce another liquidity, which is a warning data signal, indicating what consequences this may lead to. According to media reports, Genesis has sought to obtain a billion dollar bank credit fusion immediately. Not very good.

In the worst case, the shortage of funds provided by DCG may cause the problem of relevant available quick assets. DCG and Grayscale have disbanded private equity funds before, which is not impossible. This is an unlikely path, but it is definitely worth mentioning, because Grayscale is a large bitcoin holder of Grayscale Bitcoin Trust, with nearly 633,600 bitcoins. Very easy. This may be a control problem or another limitation (nobody knows). DCG cannot provide financial support to Genesis

Circle is a foreign investor in the stable currency USDC, which is also related to Genesis. However, they noticed that his Circle Yield goods only accounted for 2.6 million dollars of outstanding pledged loans. If so, it would be insignificant.

In the next few days, you may hear that you want to know more about Genesis, because they want/have to invest before Monday. If the withdrawal of cash is still suspended and the assets are locked up, this will lead to a severe blow to the list of intermediaries in this field. Genesis reflects the exact reason why the all-round diffusion of despair in FTX and Alameda Research Center has not ended. Breach of contract and bankruptcy are wave after wave, not all at once. It will take weeks or even months to see where the biggest system vulnerability is, and where there are liquidity, counterparty and/or failure problems.

In addition, most key participants and market makers need to obtain cash from exchanges to support their own balance sheets and reduce counterparty risk. The market liquidity is relatively weak, and the period of uncertainty has been improved. Although it seems that the sales market has found a temporary bottom in all the negative article titles last week, in a short time, the uncertain downward pressure still far exceeds the growth potential.

Previous similar articles:

- The more of them

- Swap war: Binance sniffs the fragrance of FTX/Alameda rumors

- Counterparty risk arises rapidly

- Data Encryption Infectious Disease Aggravates: Who Will Swim Nude?

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.