-

Despite Strong On-Chain Metrics, Macro Headwinds Remain

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-12-08

2022-12-08 4242

4242 Research

Research

-

Summary:Bitcoin has seen major capitulation from all-time highs and on-chain indicators suggest the worst may be behind us, but significant macro challenges remain.

On chain data trend

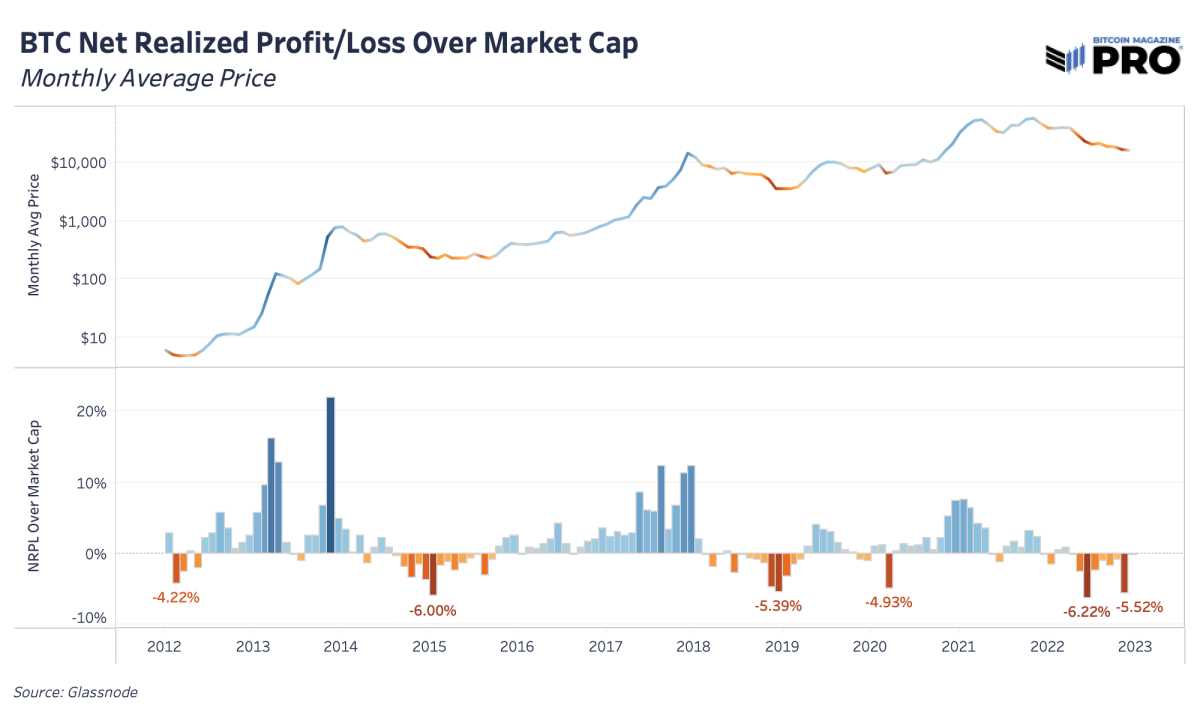

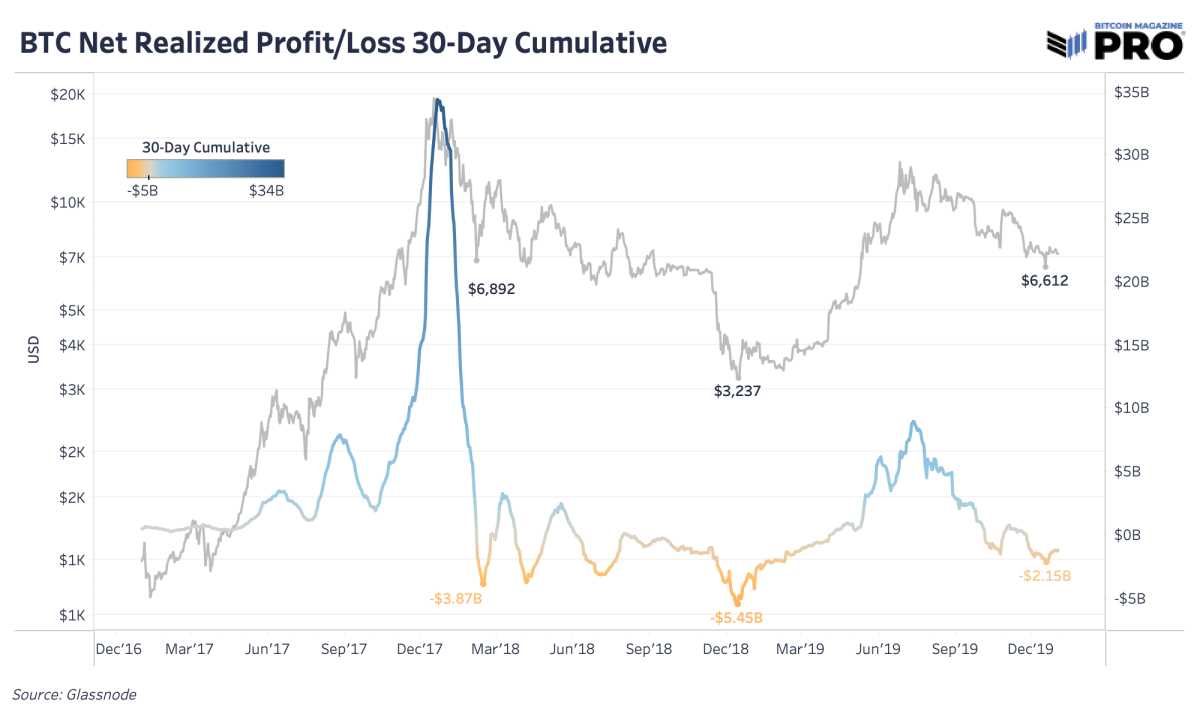

November is a sad month. According to the income and property loss data information completed on the query chain, you can see that this will be correct for many people who have to sell Bitcoin. Before the price of Bitcoin stops falling, a typical symptom you want to see is the duration of forced selling, surrender and increased loss. One way to deal with this is to query the total realized profits and losses compared to the total market value of Bitcoin every month. You can see this bottom data signal in November 2022, especially in the Terra/LUNA crash in July 2022, COVID anxiety in March 2020, and the end surrender of the cycle time in December 2018

Looking at the time of 2018, the ending feature is the deficit achieved by excess, although this is very different from the joint level of forced liquidation, financial leverage on personal balance sheet and forced liquidation of paper Bitcoin that you have seen this year

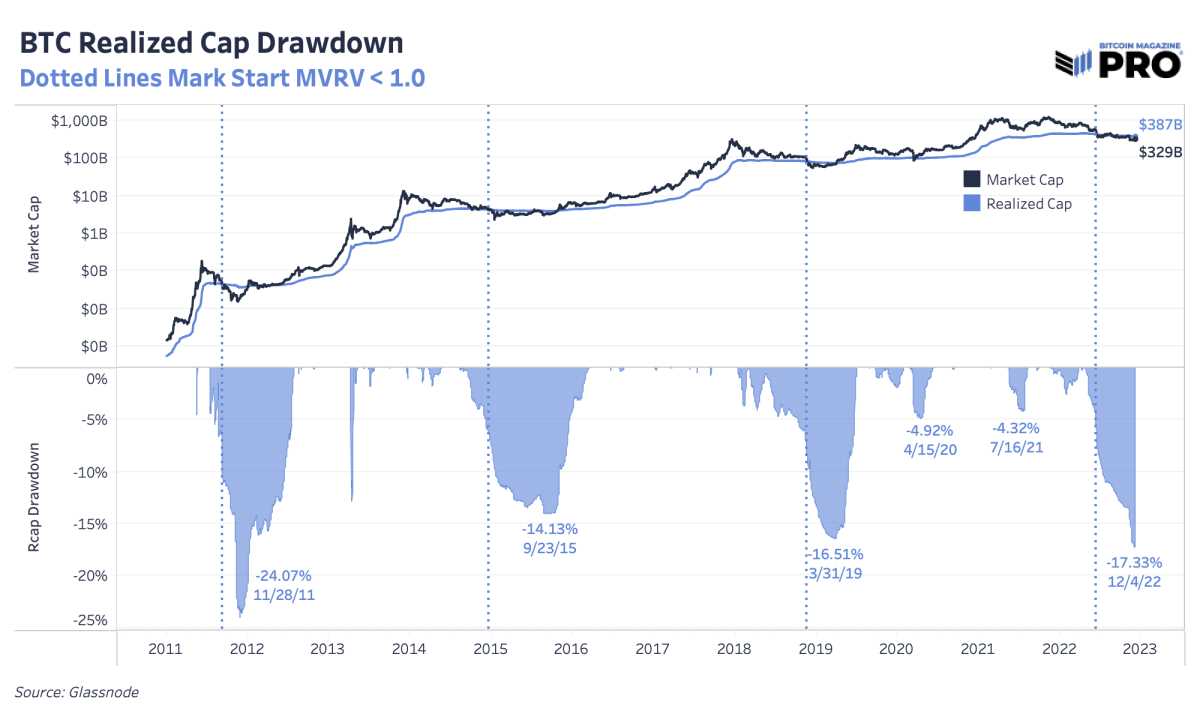

The decline of Bitcoin price at this stage has been discussed several times, and how it compares with the past in the past few months. Another way to deal with regular price drops is to care about the realized market value of Bitcoin, that is, the average variable cost of the Internet is basic. It tracks every UTXO and finally moves the latest published price. With the great uncertainty of the price, the specific price is a more lasting perspective of the rapid growth of capital inflow of Bitcoin. At this stage, the market value has decreased by 17.33%, far higher than 14.13% and 16.51% in 2015 and 2018

For the duration, we have a total of 176 days when the price is less than the specific price of Bitcoin. This is not for several days in a row, because the price may be temporarily higher than the specific price, but during the bear market period, the price is less than the specific price. In terms of environment, the trend in 2018 is temporary, about 134 days, and the development trend in 2014-15 has experienced 384 days.

On the one hand, the realized market value of Bitcoin has been severely hit in the next round of surrender. This is a bottom data signal full of expectation. On the other hand, it is reasonable to say that the price less than the specific price is very easy to continue for another six months from the historical period, while the lack of surrender in the stock market is still the main counter wind turnover and concern

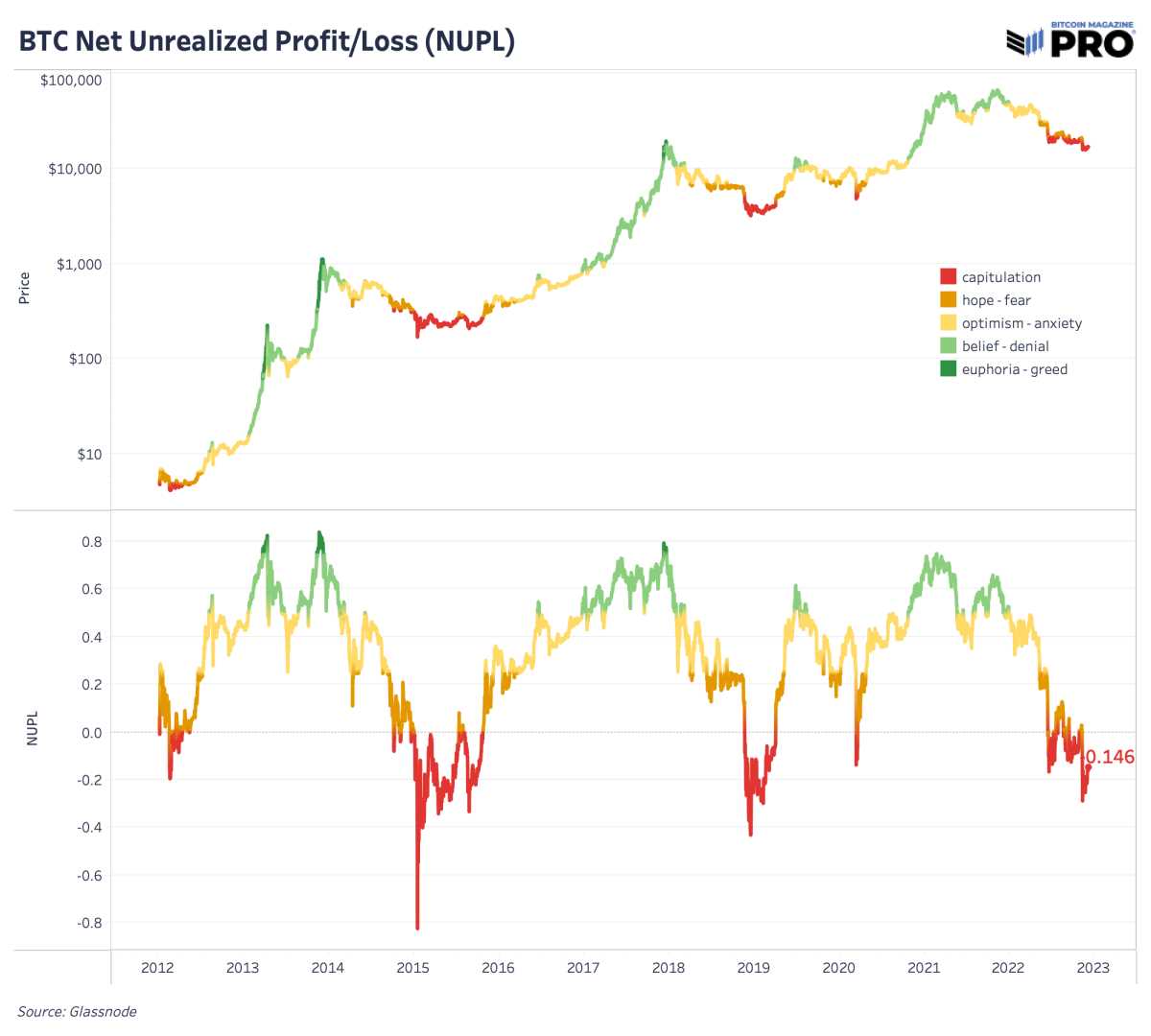

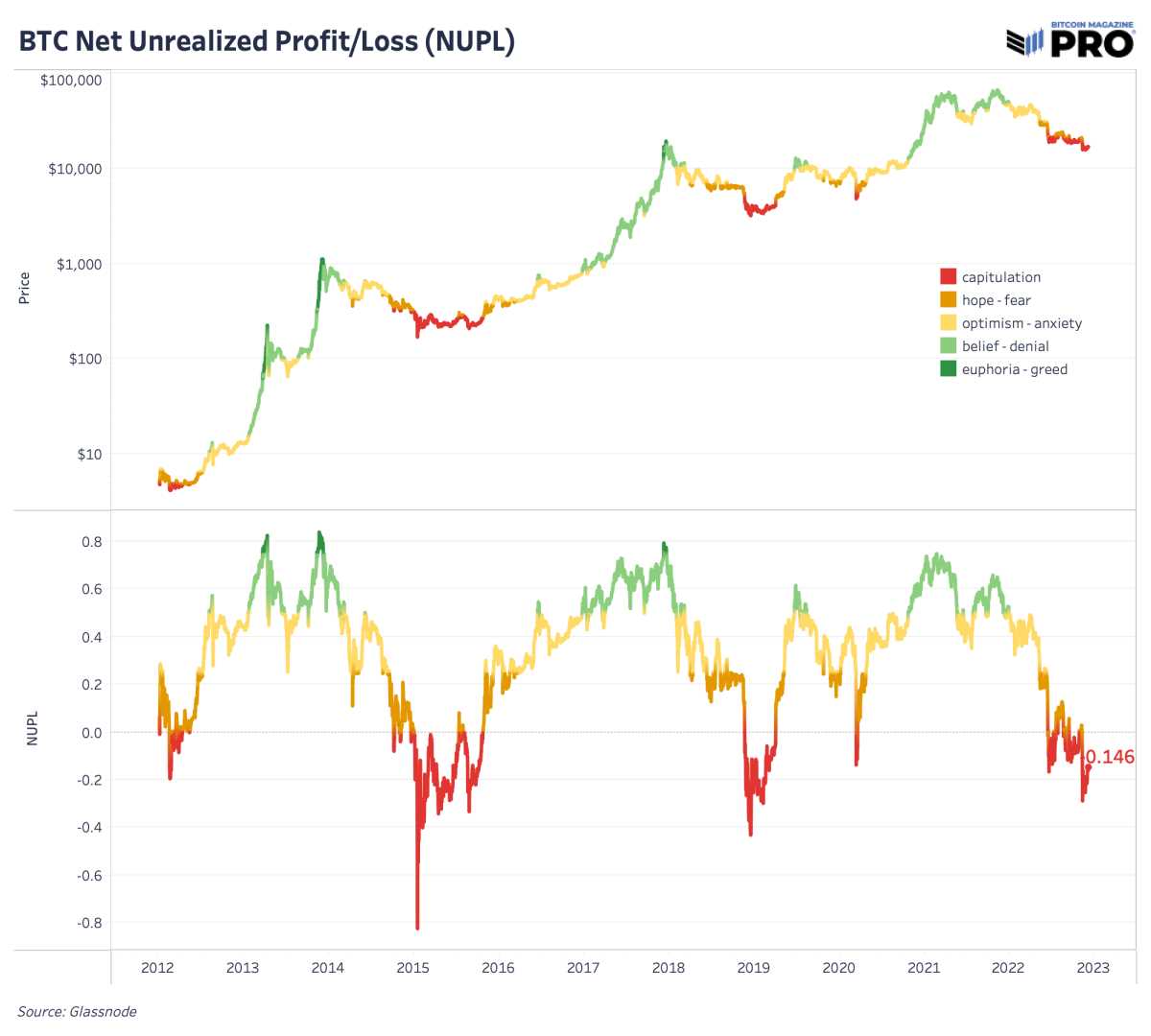

According to the proportion of net unrealized profit/loss (NUPL), we are firmly in the surrender phase. NUPL can calculate by subtracting the realized market value from the market value and dividing the conclusion by the market value, as described above in this paper prepared by Tuur Demester, Tam á s Blummer and Michel Lescruwaet.

Can't be denied: We are firmly in the surrender phase for the original ecological cycle time of Bitcoin. At this stage, only 56% of the goods in circulation and supply are transferred to the chain in a profitable way for the last time. On the premise of a two-week moving average, the supply of less than 50% moved above the real-time exchange rate for the last time, which was only the deepest phenomenon at the previous bear market bottom of the stock market.

When the bitcoin rate is fully considered, the molecular structure side of the formula is cheap in history. With the increase of the hash rate and its account books providing a layer that can not become a clearing layer for the world's use value, Bitcoin Internet insists on generating a blockchain every 10 minutes in an uninterrupted way. Speculation, financial leverage and fraud in the last cycle have been successfully flushed, and Bitcoin shares have changed hands again.

Compared with the historical selection of Bitcoin, Bitcoin is objectively cheap. The key to the truth recently is the true score. The circulation cycle time of the world and the current movement track have been discussed in detail. Although Bitcoin's ancient history was very cheap, it was not immune from the sudden appreciation of the US dollar, if nothing was true. The exchange rate is relative. If the US dollar is squeezed higher, everything else will fall - at least temporarily. As always, the size and duration of posts are important to everyone.

There are 80 trillion possibilities for metal catalysts with a soaring BTC/USD rate

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.