-

No Policy Pivot In Sight: “Higher For Longer” Rates On The Horizon

Dylan LeClair

Dylan LeClair 2023-02-02

2023-02-02 4462

4462 Research

Research

-

Summary:TSBeS41QE9WVi3pWPmedG89kwuJfF9mA2N

The next FOMC meeting will be held on February 1, when the Federal Reserve meeting will decide the next interest rate policy. This article includes how the sales market expects the Federal Reserve meeting to look. Readers should be concerned about the change in the expected path and the potential second-order utility of the above change.

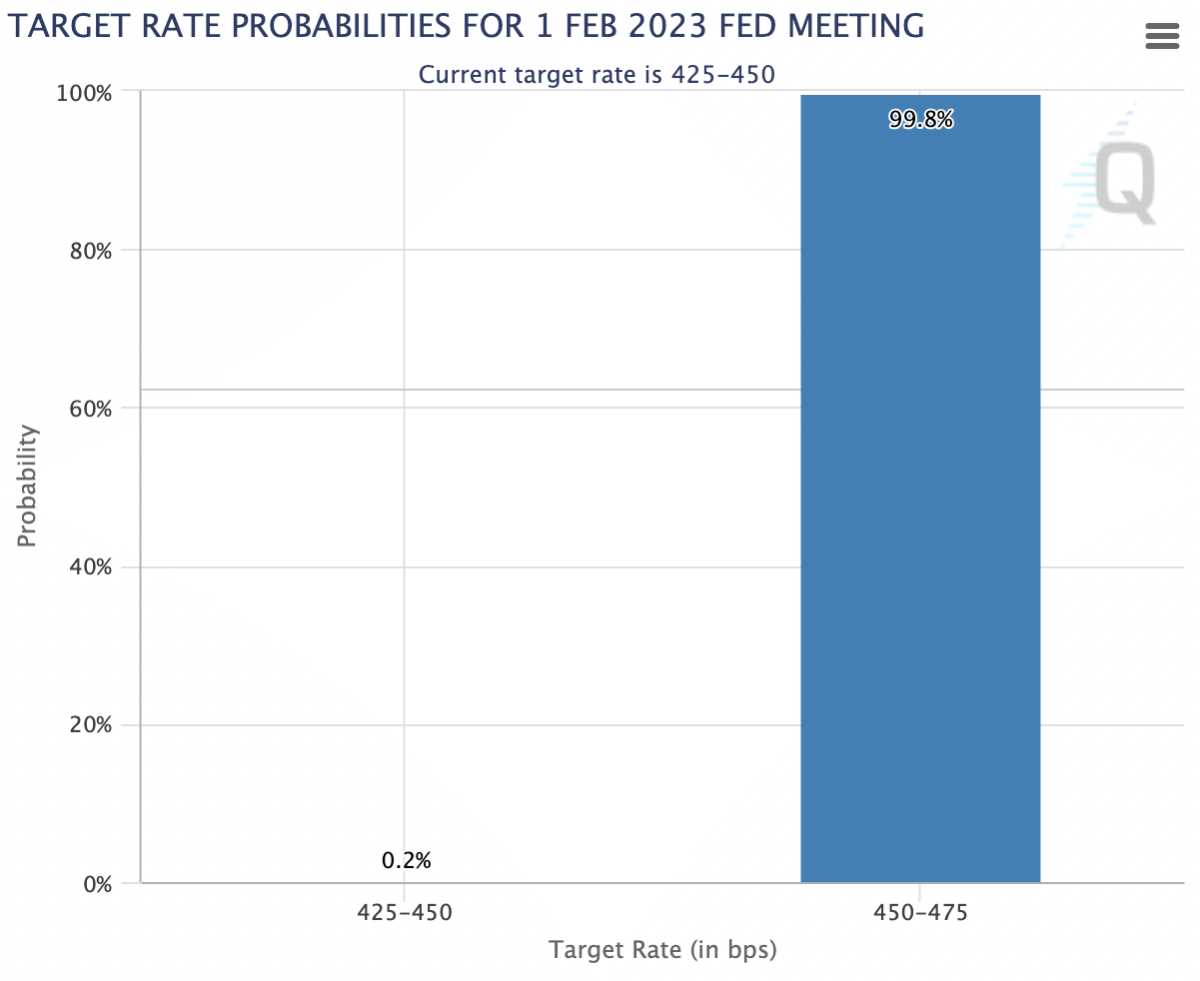

At this stage, the expectation is to raise interest rates by 0.25%. The market has a clear rate of nearly 100% for this result, and the policy interest rate is set at 4.5% - 4.75%.

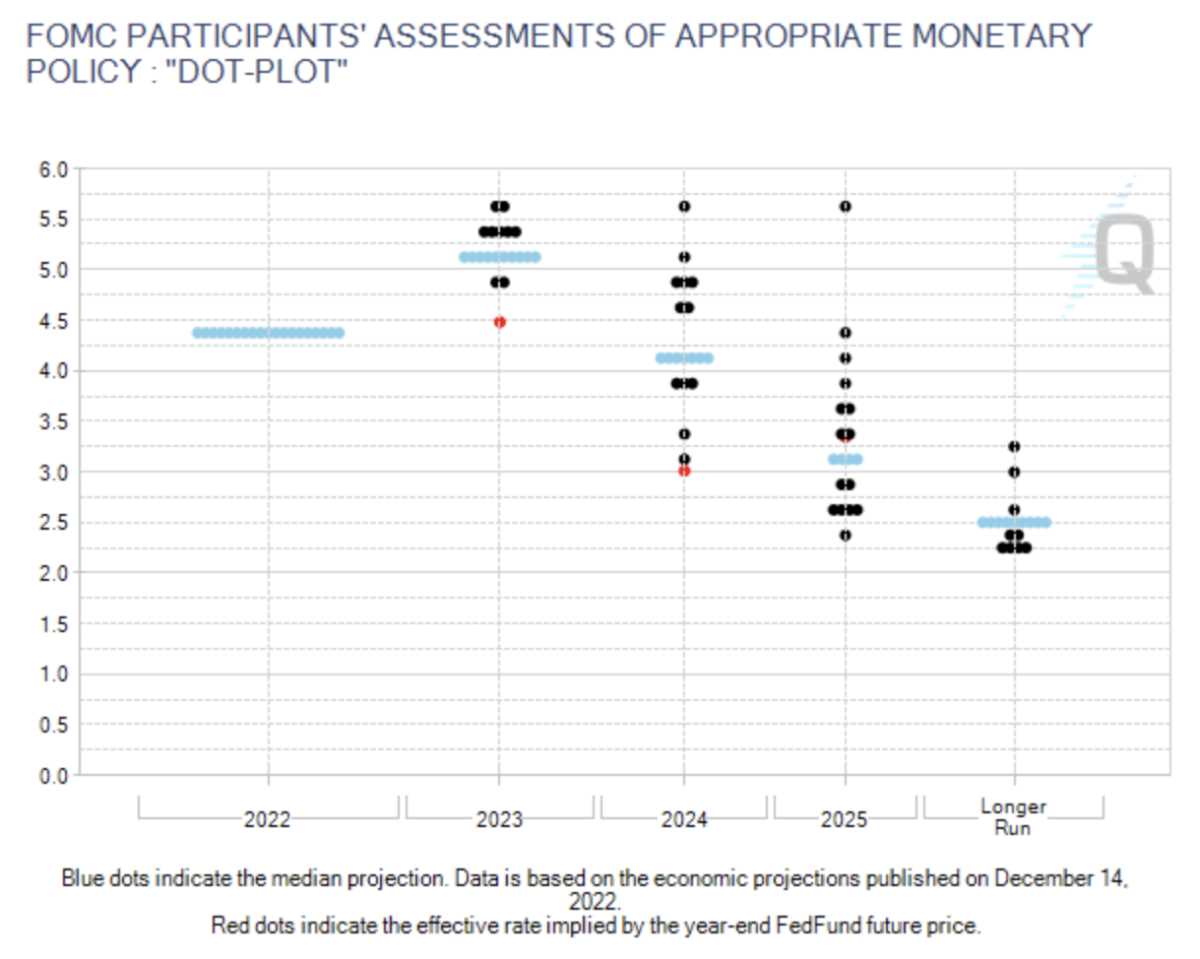

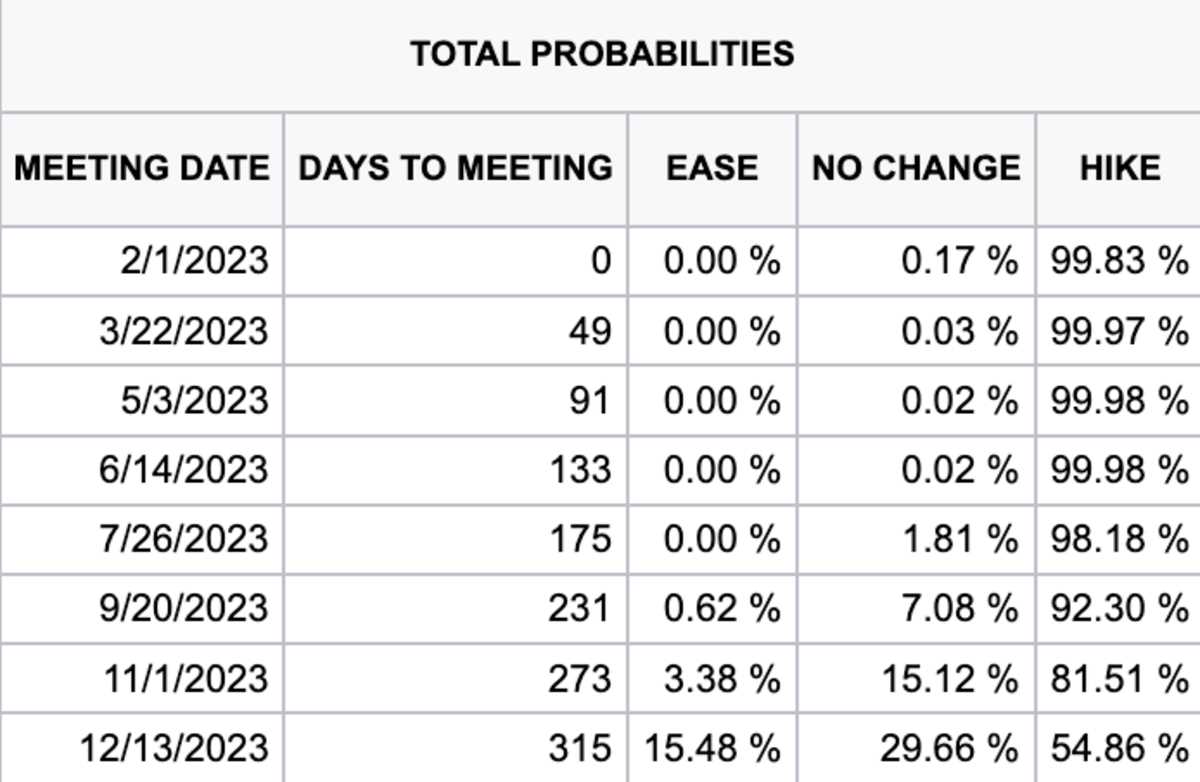

The expected path of the Federal Reserve meeting in 2023 is to maintain the interest rate rise. Several Federal Reserve directors recently stressed that the policy interest rate needs to be kept sufficiently restrictive to ensure that inflation will not resume after the first signs of slowdown, as in the 1970s

At the press conference of Jerome Jerome on December 14, he said the following two or three sentences (attention):

"So, as I mentioned, the key thing is that the overall financial industry situation once again reflects the policy control that we have adopted to reduce the inflation rate to 2%. For us, the financial industry situation has shrunk significantly in the past year. However, our policy behavior is fully developed according to the financial industry situation. But these on the contrary endanger economic behavior, human resources market and inflation." Therefore, What you manipulate is your policy behavior in communication. The business situation can not only predict and analyze our own behavior, but also take action on our behavior.

"I think we should add that our key is not to take measures in the short term, but to take continuous measures. Naturally, many things will change the situation of the financial industry over time. What I want to say is that our judgment today shows that we have not adopted sufficient restrictive policy views, which is why we should say that we expect that the continuous interest rate increase is undoubtedly moderate."

List price in short-term inflation

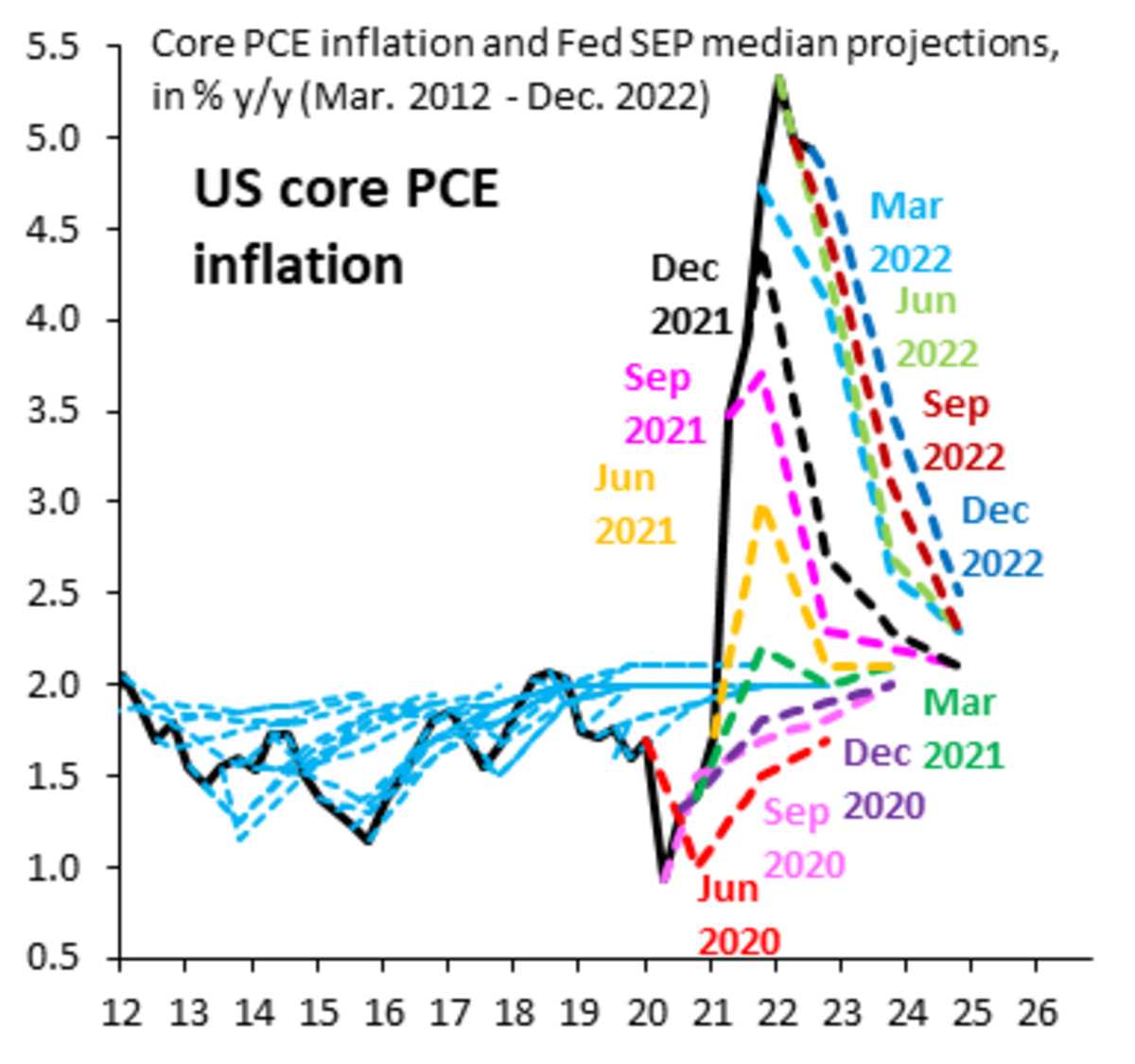

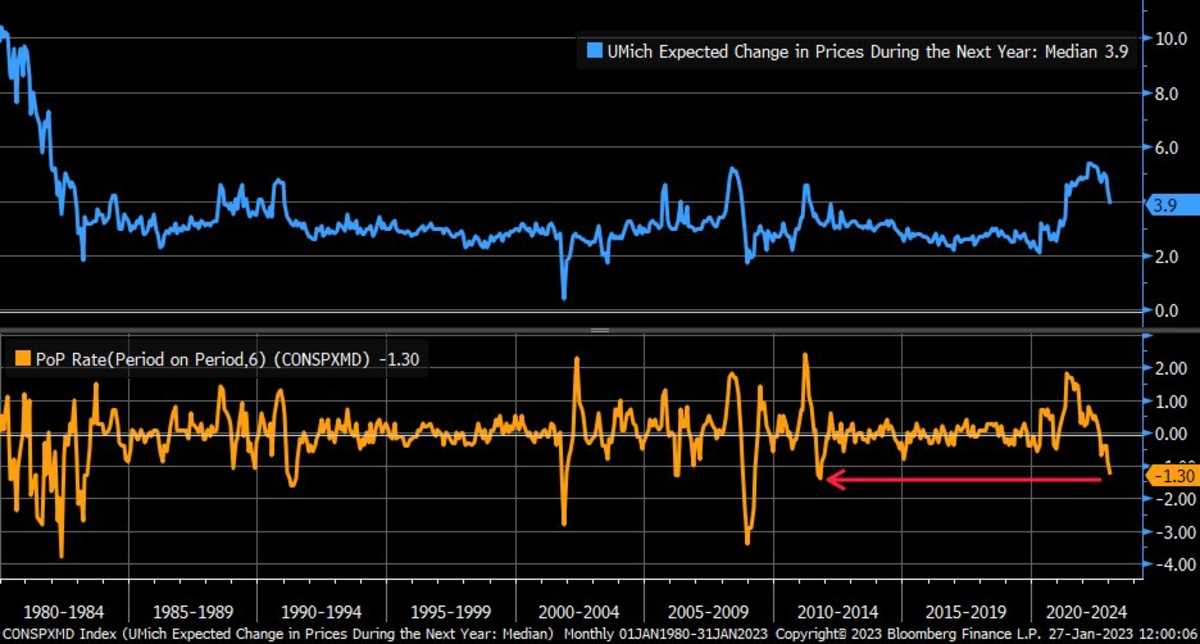

At the beginning of this year, risky assets around the world have been on the rise. As investors are increasingly predicting, the inflation anxiety that will confuse assets in 2022 will weaken in 2023 and later. Although the optimistic expectation of reducing inflation will definitely focus on risky assets, which will lead to the return of lower interest rates, it is wise to keep in mind the hasty nature of the inflation forecast at the Federal Reserve meeting, as shown below. Return to the 2% target has basically been expected

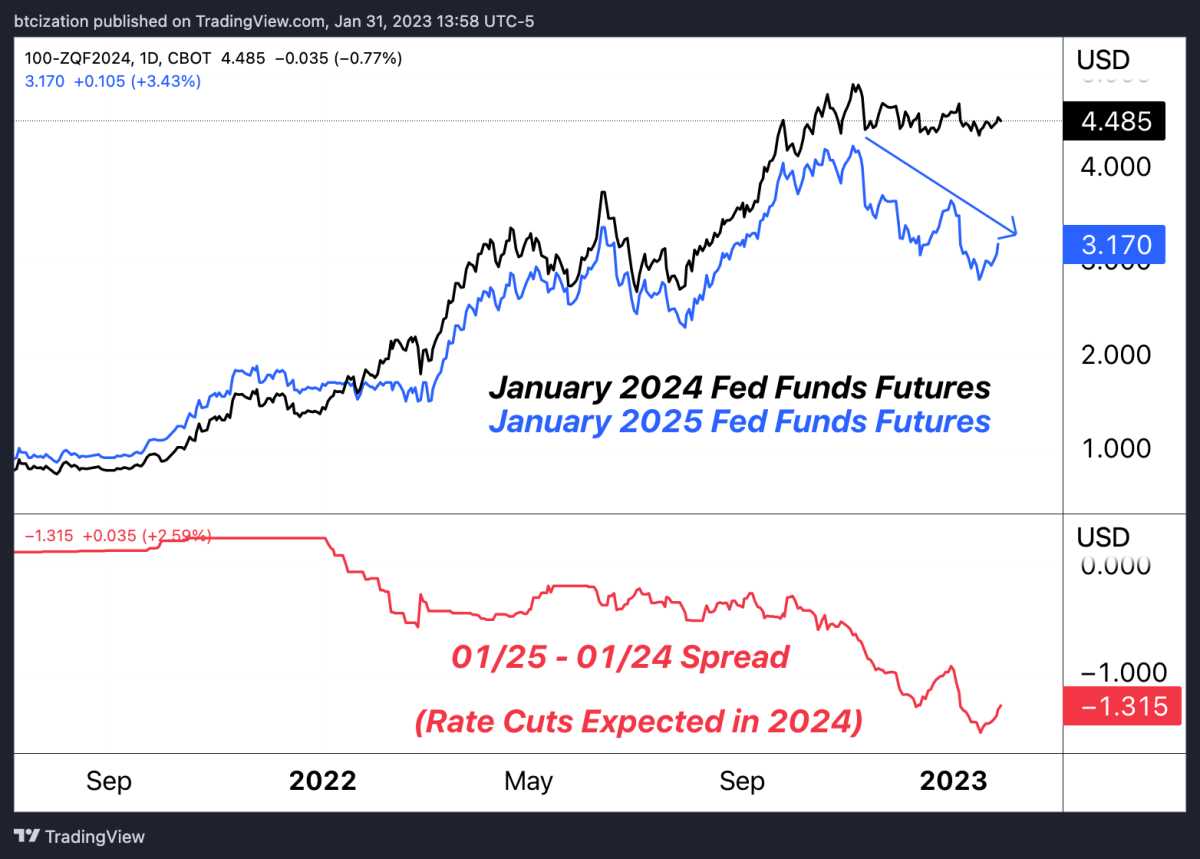

With the reduction of inflation and the increase of policy interest rate, the sales market feels that there will be a "sufficient limit" policy in 2023, and the expenditure will be reduced by 1.31% in 2024

Once inflation is unshakable in customer expectations and human resource markets, historical time shows that in order to resist inflation, central banks of all countries should pay great efforts to tighten policy interest rates.

As Liz Ann Sanders of Charles Schwab said, the change in inflation expectations in six months has been the biggest since 2011, which shows that monetary tightening is now beginning to harm China's real economy

With the interest rate increase of 25 percentage points tomorrow, the market will pay close attention to the content and theme of the speech of the current Chairman Jerome on the way of future policy interest rate. For us, "long-term rise" is the main theme that the Fed meeting will continue to communicate with the market.

However, in a sufficiently long period of time, the inevitable conclusion is obvious. Ask the US Treasury Department about his forecast and analysis

Source: US Treasury

Do you like the specific content?Order nowAccept PRO article content directly from the outbox.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.