-

Coinbase terminates Japan operations, why is share price still up 50% in two weeks?

Dan Ashmore

Dan Ashmore 2023-01-19

2023-01-19 2786

2786 Technology

Technology

-

Summary:Key TakeawaysCoinbase is halting all operations in Japan, citing “market conditions”Last week it cut 20% of its workforce, having already cut 18% last

Key points

- Coinbase stopped all business processes in Japan for the reason of "current market situation"

- Last week, the company laid off 20% of its staff, and 18% in June last year

- With the rise of cryptocurrency, the share price has risen by nearly 50% within the year, but it is still 85% lower than the highest value

- The company has many problems, and CEO Armstrong sold 2% of the equity in October

Coinbase has recently fallen into a sad world.

Just last week, the trading center announced 20% layoffs and 18% layoffs in June last year. I wrote an article to analyze what this means for the company. The total market value of the company is less than US $10 billion, which is 90% cheaper than the price when it was launched in April 2021.

Before that, CEO Brian Armstrong unloaded her 2% stake in the company in October, and then I wrote an in-depth analysis article to explain what this would mean for a company that has been known as the torchbearer of bringing encryption algorithms into the popular circle since its high-profile listing on Nasdaq.

But today, more bad news came out. The transaction announced all business processes in Japan on the basis of "market status".

Gains in Coinbase share price

Although the negative news continued, the share price of Coinbase may have won in the first few weeks of 2023, and rose 48% only 18 days later.

This is also the largest rebound in cryptocurrency in the past nine months, with the price soaring in all directions. Although the rebound of Coinbase's share price is good news for investors, ironically, it also just reflects the existing problem - the correlation between Coinbase and the encryption market.

Almost nothing is more uncertain than cryptocurrency, so tying it to market price is not a good news. However, the performance of Coinbase lies in the encryption market, because as the price falls, the trading volume and industry interests, and its Coinbase will also fall sharply.

This is a good thing during the epidemic. The ATM has the biggest power, the annual interest rate is relatively low, and retail investors have boarded the FOMO train, and have a healthy desire to explore cryptocurrency and considerable stimulating bank bills.

However, with the change of macroeconomic environment, the data encryption field has dropped from US $300 million to US $800 billion at will, and the recent surge has warmed it to more than US $100 million.

Why did Japan stop operating?

Although in the past few weeks, the stock price of Coinbase has mainly performed well, but the decrease shows that since its listing, Coinbase has already shrunk by 85%. After two rounds of layoffs, its CEO sold 2% of its individual shares in October, and is now stopping projects in Japan.

All Japanese Coinbase customers will withdraw their equity holdings from the website before February 16. If he cannot do this, the remaining property will be converted into yen. Coinbase worked hard to expand the Japanese sales market in the previous data encryption winter, so it was a shame to leave suddenly.

However, Coinbase is not the only trading center to adopt this measure, and its competitor Kraken also announced that it would stop its projects in Japan last month. Like Coinbase, Kraken also laid off a large number of employees. After FTX crashed and surpassed the market, it laid off 30%. The dilemma of the extreme relationship between Coinbase and the encryption market once faced the trading center of the entire industry.

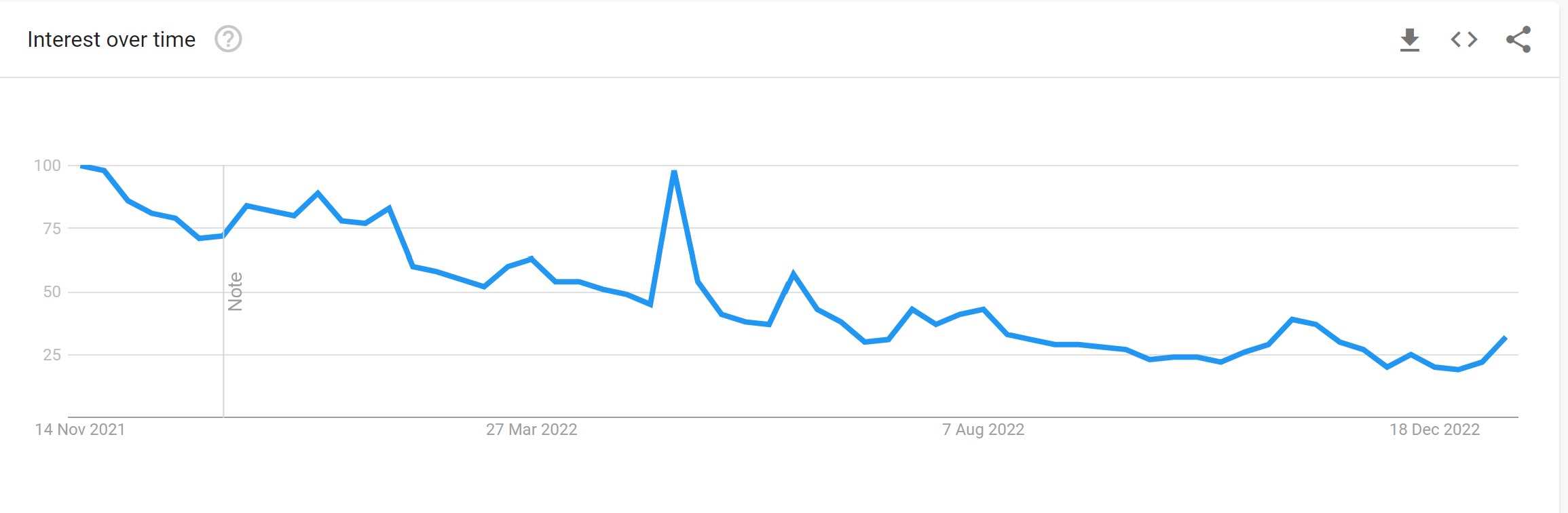

According to the data of Coinbase in the third quarter, the trading volume decreased by 44% compared with the second quarter. The decline in trading volume interests and hobbies has led to a sharp drop in share prices, layoffs, and now the Japanese business has stopped. Just look at Google trend, and you can see that the public's recognition of the trading center has decreased.

For COIN US dollar investors, they want the downturn of macro data and the rise of cryptocurrency in the past few weeks to be the sign of the future, otherwise this kind of stock price rise will be temporary.Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

For COIN US dollar investors, they want the downturn of macro data and the rise of cryptocurrency in the past few weeks to be the sign of the future, otherwise this kind of stock price rise will be temporary.Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.