-

SSV Network price forms 2 extremely bearish patterns

Crispus Nyaga

Crispus Nyaga 2023-01-21

2023-01-21 3951

3951 Technology

Technology

-

Summary:SSV Network is a fast-growing provider of liquid staking infrastructure.The developers launched a $50 million ecosystem growth fund.It has formed a ri

SSV Network is a growing provider of working capital infrastructure.

The real estate developer has launched a $50 million ecosystem improvement fund.

It has formed a developing wedge and a bearish swallowing mode.

With investors waiting for the upcoming renewal of Ethereum Shanghai, the liquidity project investment performed well.Lido DAOAs the largest provider of working capital project investment, it has developed into the world's largest DeFi provider. SSV, a leading provider of working capital infrastructure, has increased its tokens by more than 91% this year.

SSV Operating Ecosystem Fund

SSV Network announced that it will launch a new $50 million ecosystem fund to cultivate its ecosystem. First, SSV itself did not provide liquid pledge. In turn, it cooperates with Lido and other escrow providers to give distributed system verifier technical (DLT) solutions. By doing so, most developers can focus on what they are best at.

The SSV network indicates that the fund will be used to develop and design developers of DVT technology. A year ago, the real estate agent released a fund of US $3 million. Some of these funds have been managed to Anker, Stader, Moonstock and other enterprises. As you have said, SSV will still allocate US $10 million in 2022Here。 In a statement, the joint head of the SSV network said:

"The security layer of distributing Ethereum has never been so critical. At this stage, the agreement is maintained by a small number of enterprises, which operate all blockchain technologies during business consolidation. The purpose of DVT is to distribute the security of Ethereum by providing efficient and convenient browsing of public goods of open source systems."

The key metal catalyst for the SSV token price is undoubtedly the upcoming Shanghai renewal, which will enable the Ethereum holder to withdraw his token. Another metal catalyst for this token is undoubtedly the online announcement of SSV's main network, which will also be announced in many months. Its survey network has been started and operated. There are 763 network operators and 5307 verifiers in life, of which 168824 ETHs are pledged. At the current price, this large amount of money is worth more than 260 million dollars.

SSV Digital Currency Price Forecast

SSV data chart for TradeView

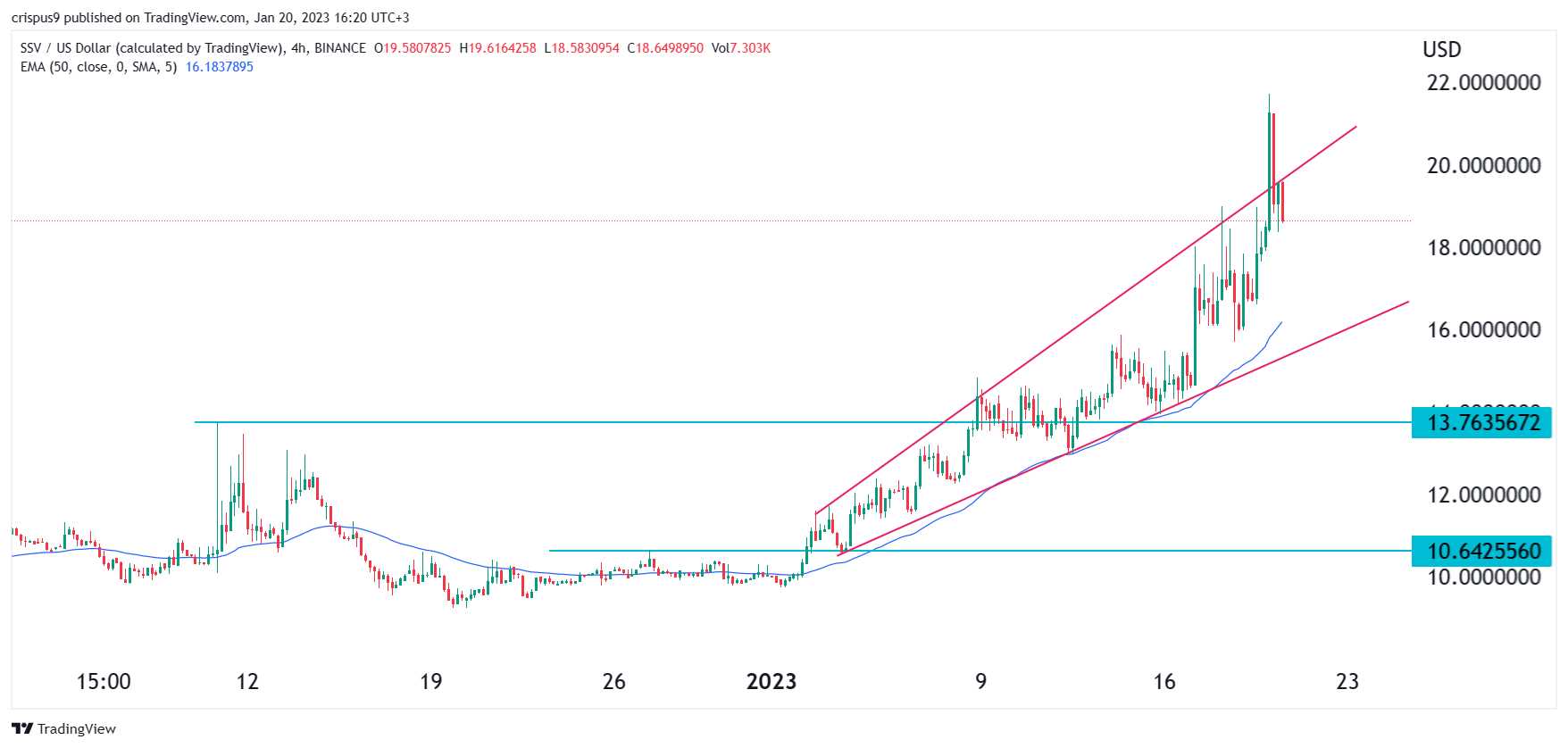

The 4H chart shows that the SSV network price has been in a relatively stable upward trend for many months in the past. However, a closer look shows that many bearish modes are now emerging. Tokens constitute a bearish swallowing mode, which is generally a warning data signal. In addition, the token forms a wedge of raising and widening. In the product price forecast, this model is a bearish signal.

Therefore, the development prospect of SSV digital currency price is bearish, and the next level worthy of attention is undoubtedly the back of the rising wedge of US $16. The situation of this transaction is invalid and the cut will be higher than US $21.67 this week.

How to purchase SSV network dynamic password

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.