-

Should you invest in cryptocurrencies as they bounced from the 2022 lows?

Mircea Vasiu

Mircea Vasiu 2023-04-16

2023-04-16 3770

3770 Technology

Technology

-

Summary:The cryptocurrency market remains resilient despite a wave of bad news in 2022Bitcoin trades above $30k, up 80% YTDHODL seems to be the secret of Bitc

- Despite a wave of bad news in 2022, the cryptocurrency market remains resilient

- Bitcoin's transaction volume exceeds 30000 US dollars, increasing by 80% so far this year

- With the increasing hoarding of Bitcoin in personal wallets, HODL may be the secret to Bitcoin's success

Since November 2021, 2022 has been a terrifying bear market for cryptocurrency investors. The leading cryptocurrency, Bitcoin, has fallen from $69000 to $15.5 million in just a few months.

Other cryptocurrencies are slightly inferior.

In the past year, the field has suffered a wave of negative reporting. Think about the bankruptcy and bankruptcy of FTX, which is also the largest fraud in modern history.

In addition, the $2 trillion stock market bear market is the largest (relatively short) cryptocurrency market in history. In addition, several cryptocurrency lending companies have declared bankruptcy.

In the end, over 300 lawsuits and regulatory cases scared away investors.

However, the market rebounded. It has surprising resilience and has benefited investors who firmly believe in it. For example, the transaction volume of Bitcoin exceeds $30000, which has increased by 80% so far this year.

Hoarding Bitcoin in personal wallets is a sign of proactivity

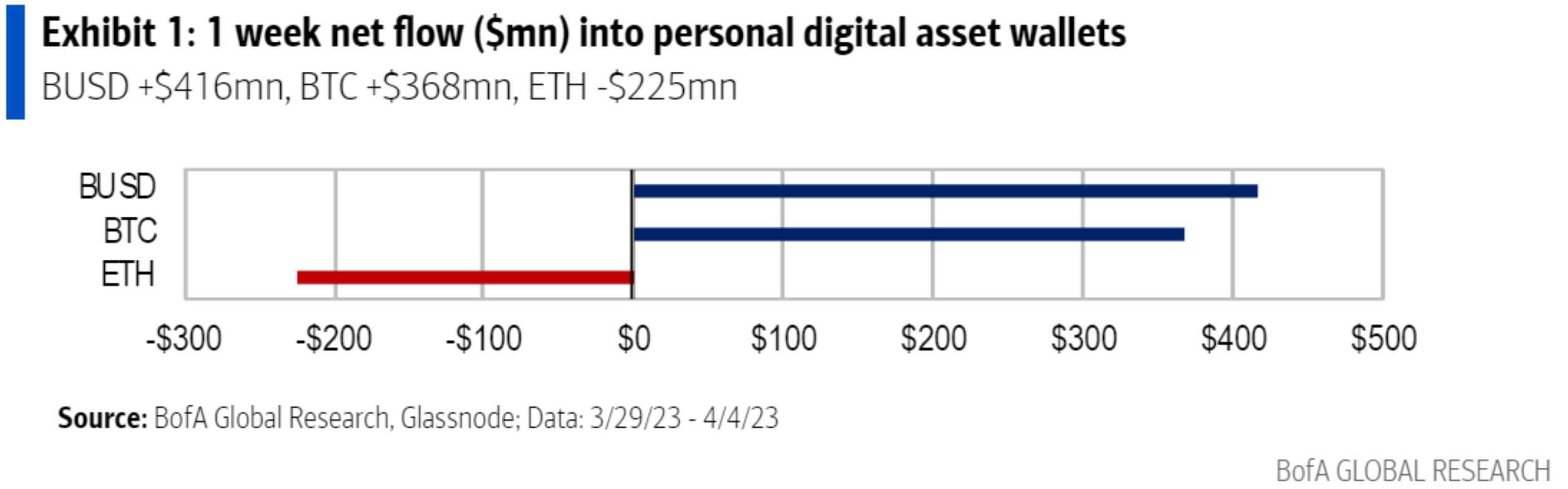

Recent research by Bank of America has shown a positive and proactive development trend in the cryptocurrency field. HODL may be the secret to Bitcoin's success. According to this study, after the price of Bitcoin jumped above 30000 yuan, my personal behavior of hoarding digital assets in my wallet increased.

Considering that Bitcoin will not be released in 20 years, it is truly impressive. Overall, the price of a Bitcoin in 2010 was 5 cents.

It reflects to some extent the uncertainty of the cryptocurrency market, where prosperity, downturn, madness, and pain are common occurrences.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.