-

US September Inflation Data Is In: BTC, Gold and Key market Indices Show Upside Trends

Nancy J Allen

Nancy J Allen 2022-10-18

2022-10-18 3284

3284 Trending in Crypto

Trending in Crypto

-

Summary:US inflation data for September was released on October 13th.Persistent inflation signals more Fed rate hikes.Data on unemployment claims were also re

- US inflation data for September was released on October 13.

- Persistent inflation indicates that the Federal Reserve will further raise interest rates.

- Unemployment benefit application data has also been released.

The Bureau of Labor Statistics (BLS) released consumer price index (CPI) data for September. The following is a summary of the impact of monthly and annual inflation data on the market. In addition, the unemployment benefit application data was released at the same time yesterday

Inflation has risen since August and declined slightly since September 2021

Inflation rate in September (August data) monthly Of every year Headline 0.4% (0.1%) 8.2% (8.3%) Fruit core 0.6% (0.6%) 6.6% (6.3%) Source: US Bureau of Labor Statistics The core inflation rate increased by 6.6% every year, hitting a 40 year high. Core inflation refers to the inflation rate of a basket of consumer goods and services (excluding food and energy). The food and energy components in the basket are different from other items and are highly volatile. The original reported inflation is actually referred to as "headline inflation". Core inflation is considered a better way to measure changes in consumer prices.

In September, consumer prices in the "whole city" rose 0.4%, and rose 8.2% in the past 12 months. The annual interest rate was slightly lower than the year ended August (8.3%). The annual interest rate was 0.1% higher than 51 economists surveyed by Bloomberg. All urban consumers account for 93% of the total population of the United States.

Transportation services, housing, food, motor vehicle insurance, new cars, household furniture and operations, education and medical services led the increase, while gasoline offset the growth in September.

In the past 12 months up to September, the energy inflation rate increased by 19.8%, including 33.1% increase in the price of pipeline natural gas (natural gas). The price of fuel as an energy commodity rose by 58.1% (non seasonally adjusted data).

From October 1 to October 7, 228000 Americans applied for unemployment insurance for the first time. This is 9000 more than the previous week, indicating that the unemployment rate is rising.

Impact of Bitcoin, Gold and the US Market

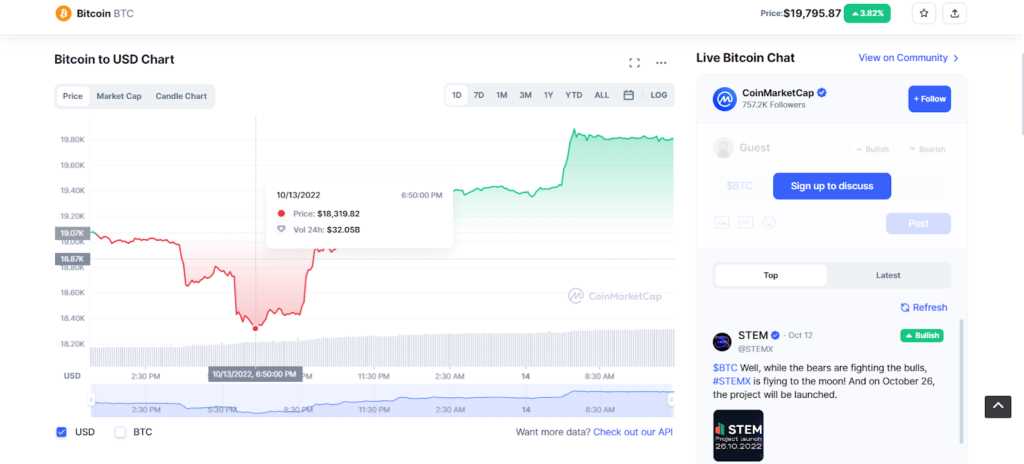

Within one hour after the release, the BTC/USD price fell by 2.1%. After the data was released, its lowest price was US $18319.82 at 6:50 p.m. Eastern Time, then rebounded and steadily exceeded the price of the previous day. At the time of writing, BTC was priced at US $19802.41 (8.09% higher than the lowest price since its release).

Source: comarketcap Gold prices fell 1.81% in almost one hour. At the time of writing, the price was 0.47% lower than the pre release level and changed hands at US $1666.22 per ounce.

From an hourly perspective, major market indexes in the United States show a gap after opening one hour after data release

The S&P 500 index fell 2.03%. However, at the end of today's trading day, its closing price was 2.2% higher than today's opening price. Bear market sentiment did not recover until 22:00. At the time of writing, the index was up 3.78%. When the market opened, the Dow Jones Industrial Average also fell (1.65%). However, the Dow Jones Index rebounded rapidly, closing 1.46% higher than yesterday's closing price.

Data released at 8:30 a.m. EDT

Source: TradeView

Source: TradeView Since prices have not fallen, the Federal Reserve may raise interest rates again. This year, the Federal Reserve has raised interest rates by 300 percentage points or 3 percentage points. Jerome Powell, chairman of the Federal Reserve, vowed to raise interest rates as long as inflationary pressures persist. The next FOMC meeting may be held in the first week of November.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.