-

Solana on-chain and derivatives data highlights the limitations of SOL’s potential price breakout

Nivesh Rustgi

Nivesh Rustgi 2023-04-19

2023-04-19 4487

4487 Market

Market

-

Summary:SOL price recently rallied by 30%, but on-chain data suggests that the network’s growth challenges could restrict Solana’s upside.

Solana has seen two positive and proactive development trends this week, one being the launch of Saga Android smartphones powered by Solana blockchain technology, and the other being the first retail trading debut of Grayscale Solana Private Equity Fund stocks.

This trend, coupled with a more comprehensive market outlook, has led to a 29.05% increase in the selling price of Solana (SOL) on April 11th, reaching a higher monthly summary of $26.03.

Although the release of mobile phones has played a positive role in promoting the Solana ecosystem, the quotation of Saga mobile phones seems too high, with each market value exceeding 1000 dollars. Even so, this smartphone has been positively described in terms of customer experience and quality.

Amy Wu, a standalone digital currency investor, emphasized that with the release of smartphones worldwide, there are more opportunities to obtain more "Saga exclusive dApp, mobile game rewards and incentives, which will make it easier to confirm the $10000 equity premium." It remains to be seen how the Solana Charity Foundation should lead cadre mobile marketing efforts and resist current giants such as Samsung and Apple.

The assets of the Grayscale Solana Trust management method are only $2.9 million, which is relatively low compared to the 24 hour daily trading volume of SOL exceeding $500 million and is unlikely to have an impact on the market.

There are also warning data signals indicating that there is a lack of improvement in the value of indicators on the chain, and the derivatives market is mainly optimistic, with the possibility of a significant adjustment.

NFT load-bearing Solana ecosystem

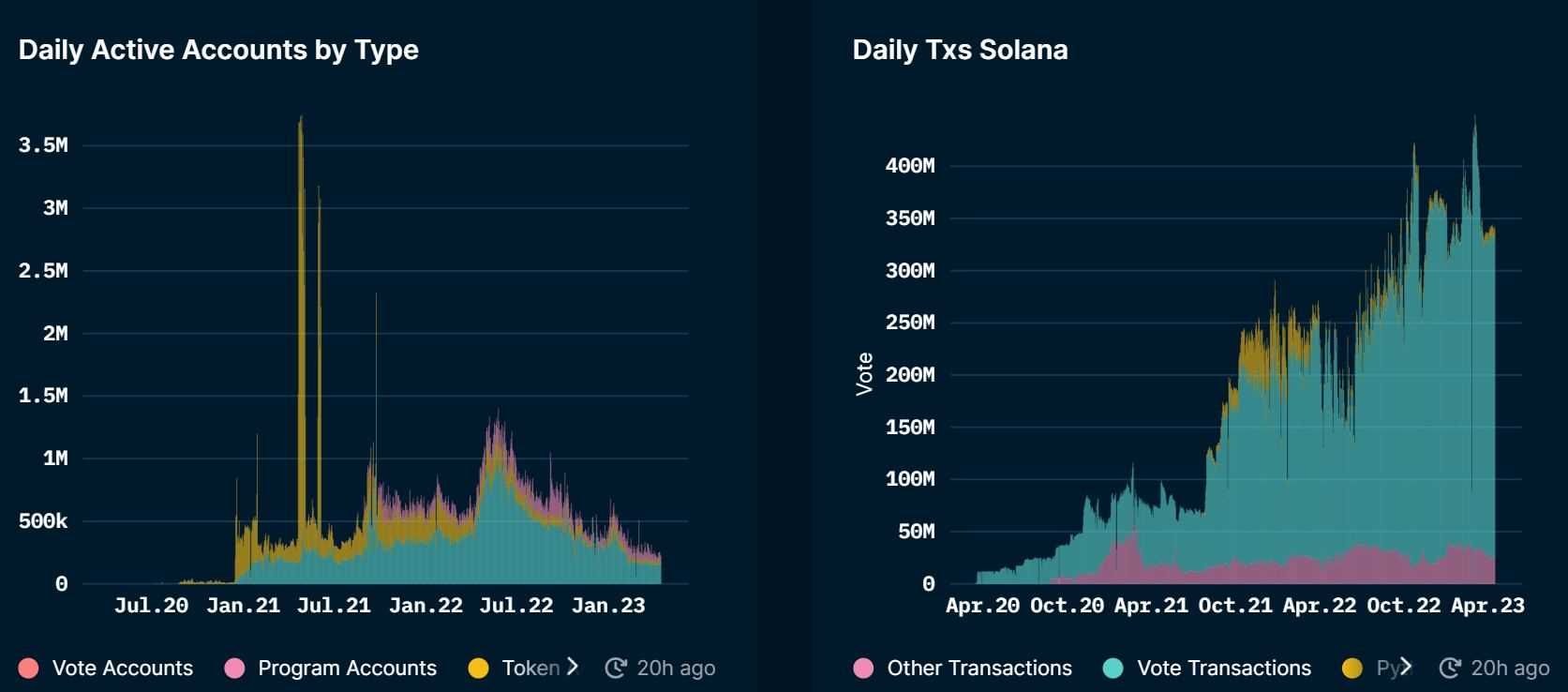

Solana's daily trading volume reached a historic high in April, demonstrating a sustained growth trend. However, the total number of active accounts per day has dropped to the lowest level, which has raised some concerns.

Solana's daily active accounts and total transactions. Material origin: Nansen The decentralized financial (DeFi) ecosystem in Solana dissipated after the collapse of FTX, resulting in a significant outflow of liquidity. According to DefiLlama's information, the deposit amount of Solana DeFi application software is less than $300 million, among which the value of Solana's locked liquidity is removed from the top ten of the DeFi blockchain.

The application of DeFi in the Solana ecosystem is limited to negotiable pledge loan agreements, with decentralized exchanges and loan contracts relegated to the second tier. It seems that non intangible tokens (NFTs) carry an ecosystem.

A Delphi result shows that as of February 2023, Solana's market share in NFT trading has increased from 6% of NFT total revenue to 14% in less than a year. This is the second largest NFT ecosystem after Ethereum.

The report added, "Solana NFT ecosystem is driven by trader. Compared with Ether NFT customers, these people are more incentive in terms of money and have higher transaction frequency."

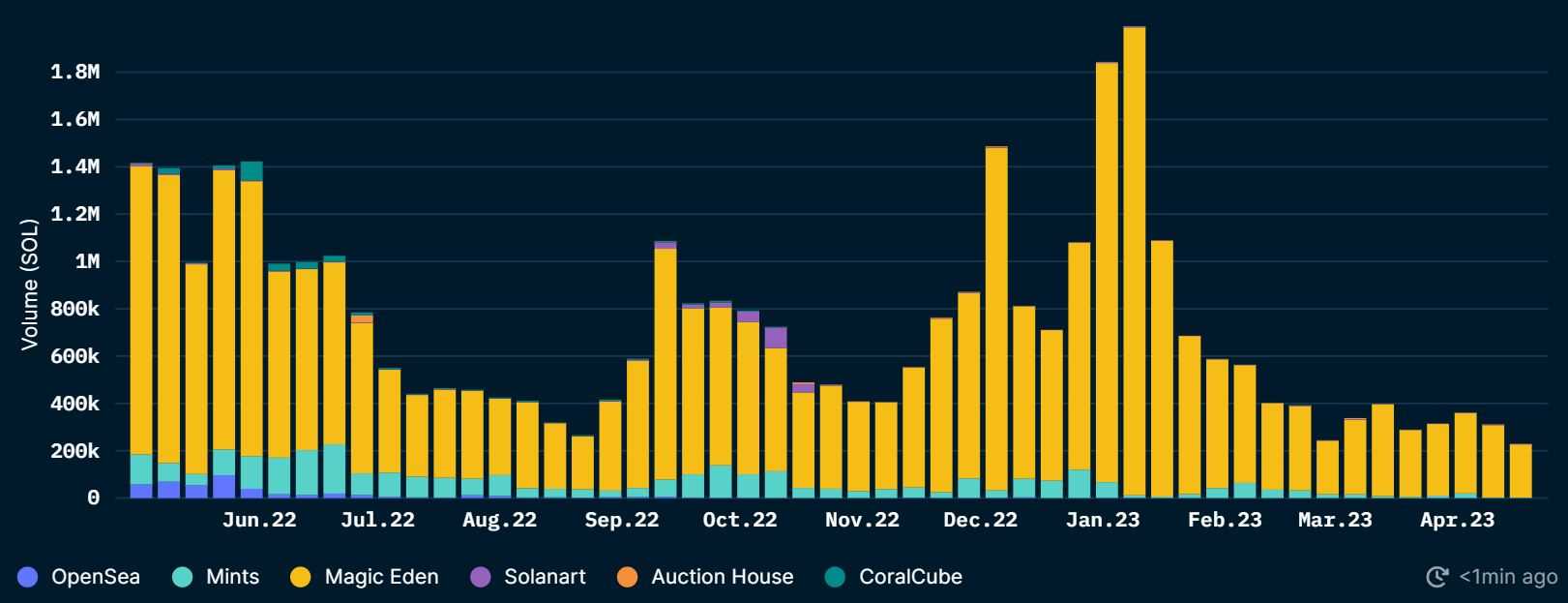

However, since February 2023 until now, NFT trading volume has been below the level of November 2022, which is a worrying sign.

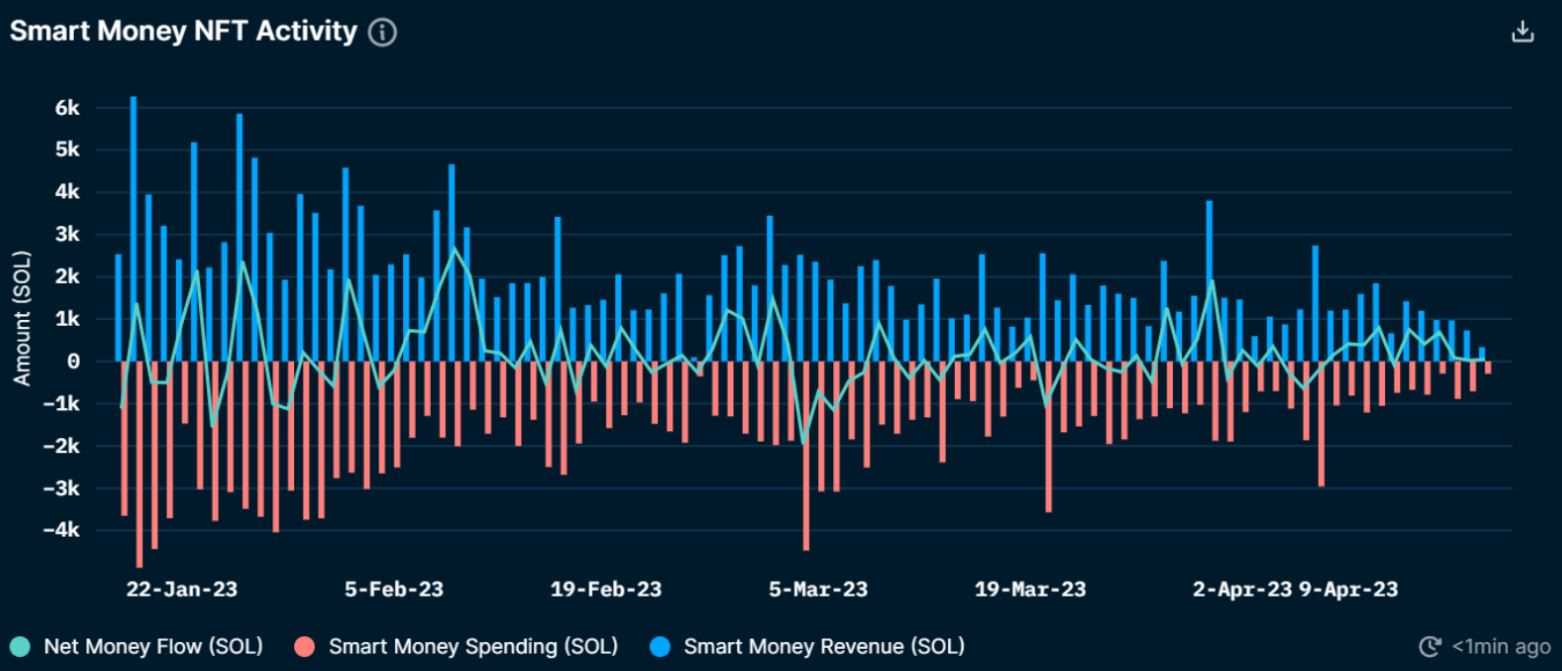

NFT trading volume in the Solana market. Material origin: Nansen In addition, intelligent coin lending activities have significantly reduced, and the expenses and profits of the "intelligent coin lending" wallet have decreased. Nansen marked the detailed address of the lively and dynamic buying and selling as "intelligent loan currency"

Intelligent currency income (dark blue), expenses (bright red), and net cash flow (emerald green). Material origin: Nansen Solana Price Behavior

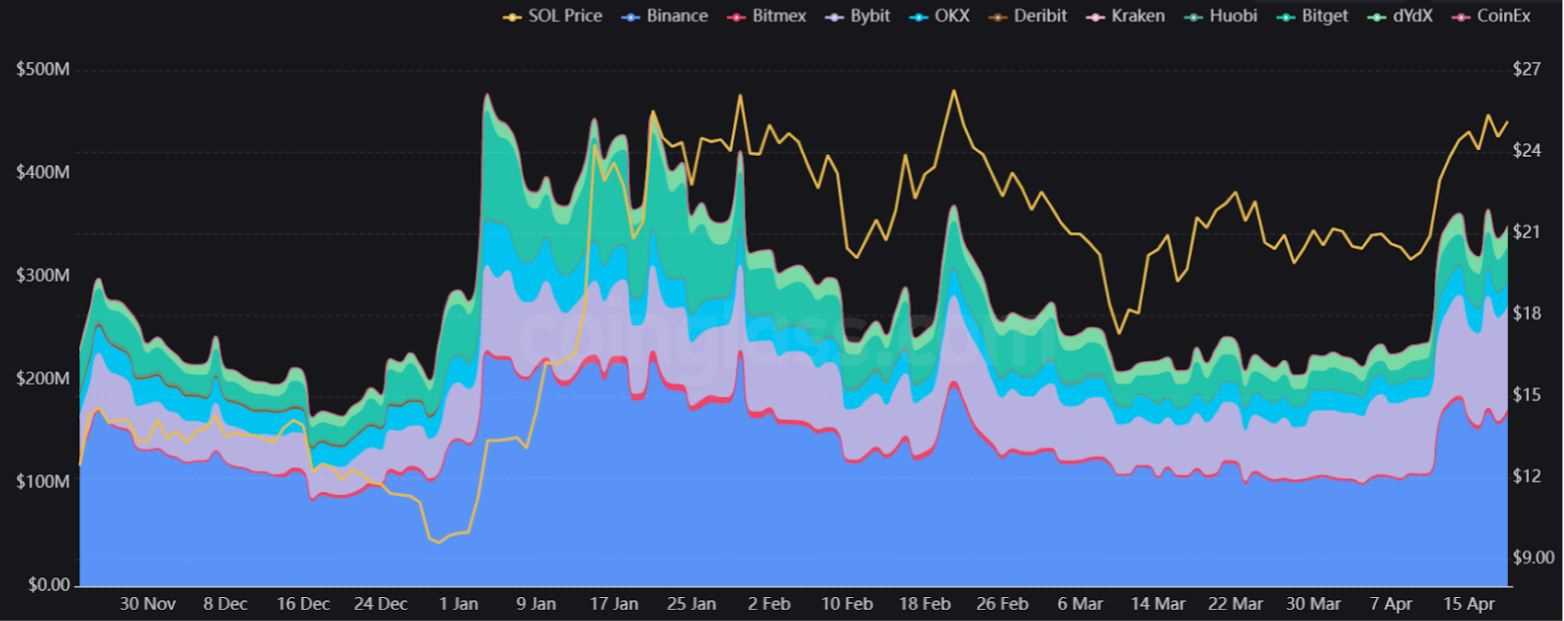

According to statistics from Coinglas, the number of open positions in SOL contracts has skyrocketed to a higher level in 2023, rising from $239 million to $365 million within 48 hours after April 11th.

The increase in SOL prices is in line with the surge in OI trading volume, indicating that the trading volume of derivative products has promoted the latest upward trend.

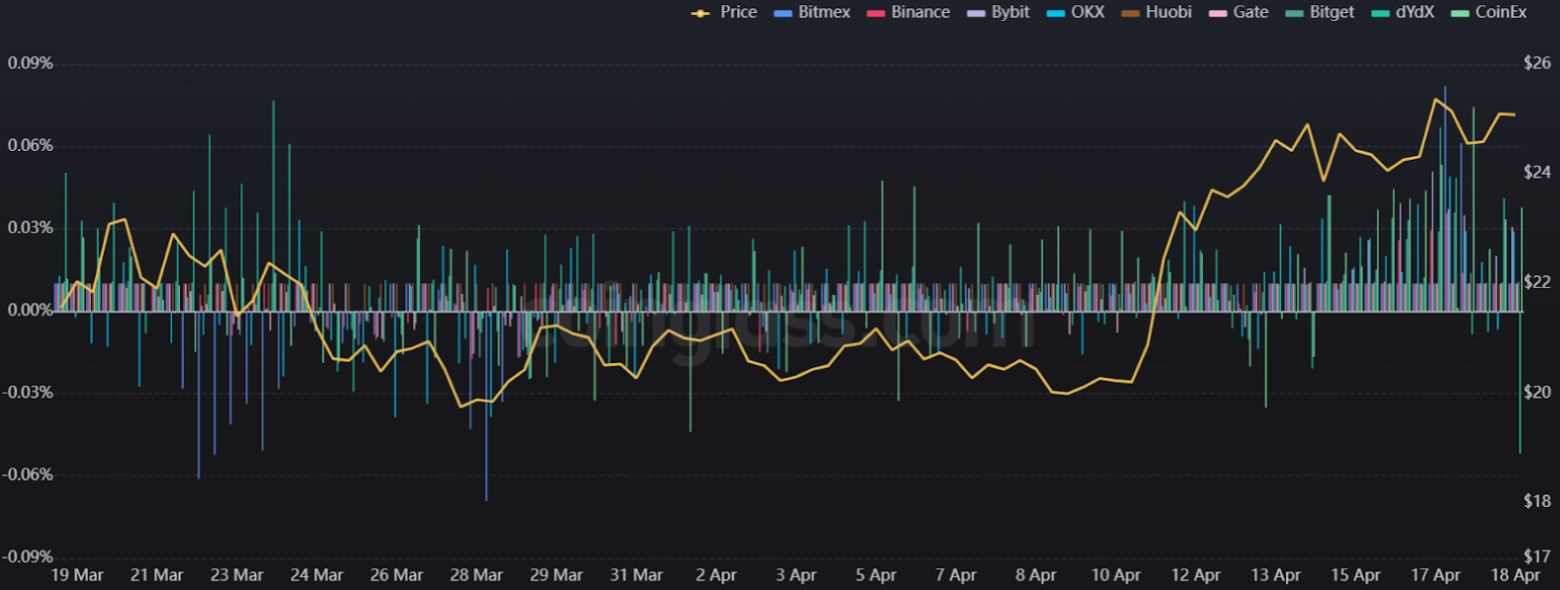

The interest amount of the open interest loan on the stock index futures contract of China Export&Credit Insurance Corporation. Origin: Coinglas The rise of OI trading volume is often accompanied by the soaring of financing interest rate of permanent swap transaction contract, which indicates that trader of financial leverage are interested in the currency. This is a bullish data signal in the opposite direction, and now the market generally experiences crowded permanent order information firsthand.

The financing interest rate for SOL permanent swap transactions. Origin: Coinglas SOL/USD is subject to frictional resistance of around $25.40 in the 50 day index moving average system and $29.76 in the 2022 fine line level. Moving Average Convergence/Diffusion (MACD) indicator value, a momentum moment indicator value, indicates a dispute between price spikes and MACD indicator values, suggesting the possibility of adjustment. This applies to the combination around 20 yuan.

ofAlthough Grayscale Solana Trust's initial retail, there is still a risk of a 20% drop in SOL prices

SOL/USD price data chart. Origin: TradeView The impressive increase in NFT trading volume in the Solana ecosystem has led to a significant decline since February 2023, with intelligent coin themed activities significantly shrinking.

The increase in financing rates for permanent swap contracts with open interest rates in SOL futures is likely to indicate that the trading volume of derivative products has promoted the latest growth trend. Overall, although Solana has made proactive progress, it is still unclear how the ecosystem should maintain price increases.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.