-

TYFwFhX7usRx9w9p31fGWbk6h41AqhqsY9

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-10-02

2022-10-02 4146

4146 Research

Research

-

Summary:Yield curve control is the next saga in the global monetary policy experiment. What does it mean for the economy and what are the future consequences?

Yield curve manipulation

In our long-term BTC basic theory, an important theme is that in a world where the current intensive monetary policy may not deal with, but will only aggravate more systemic problems, the current centralized monetary policy of the global central bank continues to fail. The central bank's attempt to solve this problem, which resulted in failure, depression and economic destruction, can only further aggravate the dissatisfaction of financial and economic organizations. Thus, it opens the door to replace the system software. For us, this model, or even a key part of it, can be BTC.

In order to provide a stable, sustainable and beneficial world monetary management system, central banks face one of the greatest tests in history: dealing with the sovereign debt dilemma of the world's territories. In response, we will see more monetary and economic policy experiments developed and released rapidly around the world to try to maintain the current management system. One of the current policy experiments is called yield curve manipulation (YCC), which is very important for future life. In this article, we will introduce in detail what YCC is, its many historical examples and the future development hazards of YCC marketing promotion.

YCC Historical Time Example

To put it simply, YCC is a way for the central bank to manipulate or endanger interest rates and total capital costs. In fact, the central bank sets ideal interest rates for special debt instruments in the market. They continue to buy or sell special debt instruments (i.e. 10-year bonds), no matter what measures are taken to maintain the special interest rate hook they want. Generally, they purchase with newly printed currency, which increases the pressure of monetary inflation.

YCC can be carried out for many different reasons: maintain a relatively low and stable interest rate to stimulate a new economic development, maintain a relatively low and stable interest rate to reduce borrowing costs and interest rate debt payments, or deliberately create inflation in a deflationary environment (to name a few). Its success lies in the credibility of the central bank in the market. The sales market must "firmly believe" that the Central Bank will implement this current policy at all costs.

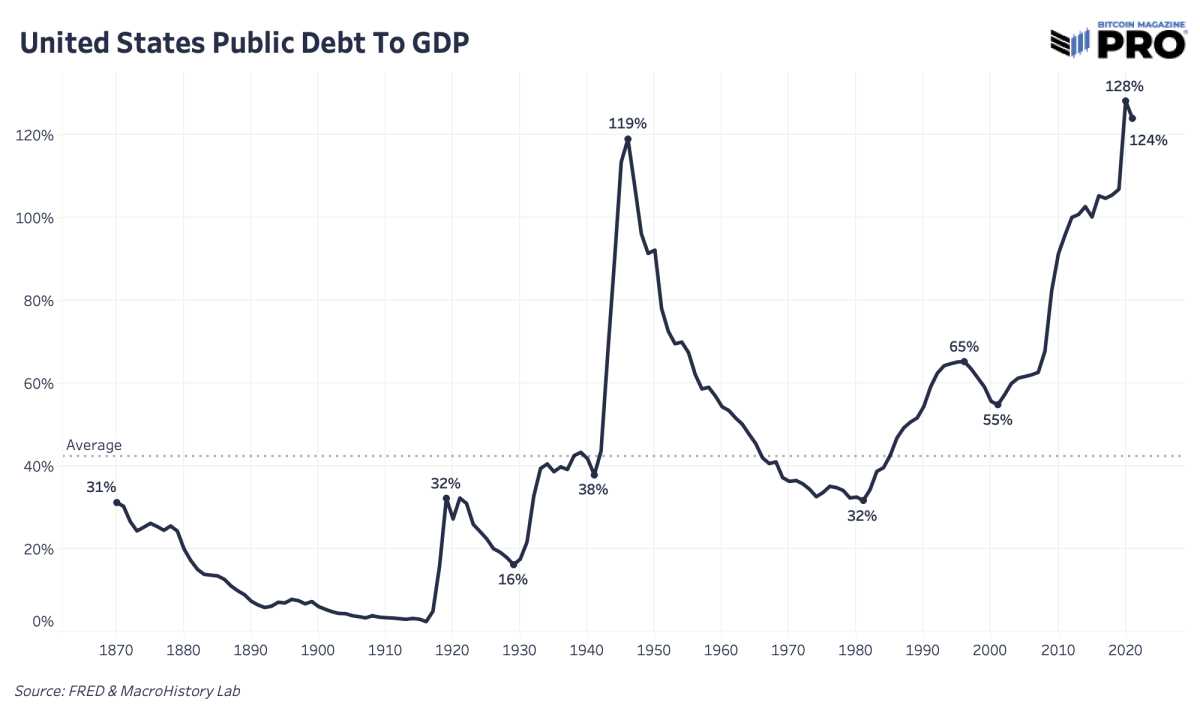

The largest example of YCC appeared in the United States after World War II in 1942. Foreign countries spent a lot of debt expenditure to finance the war equity, while the Federal Reserve meeting limited the rate of return to maintain the low cost and stability of borrowing. During this period, the Federal Reserve meeting controlled the short-term or long-term interest rate of short-term bills at 0.375% and the interest rate of long-term bonds at 2.5%. Based on this, the Federal Reserve Meeting chose to give up the manipulation of the balance sheet and the money supply, and all three increased to maintain a relatively low interest rate hook. This is also a way to solve the problem that public debt cannot keep rising rapidly compared with gross national product (GDP)

YCC present stage and future

In fact, the European Central Bank (ECB) has been implementing the current YCC policy under another flag. The European Central Bank has been selecting bonds and trying to manipulate the difference between the middle yields of the most powerful and weaker economies in the European region.

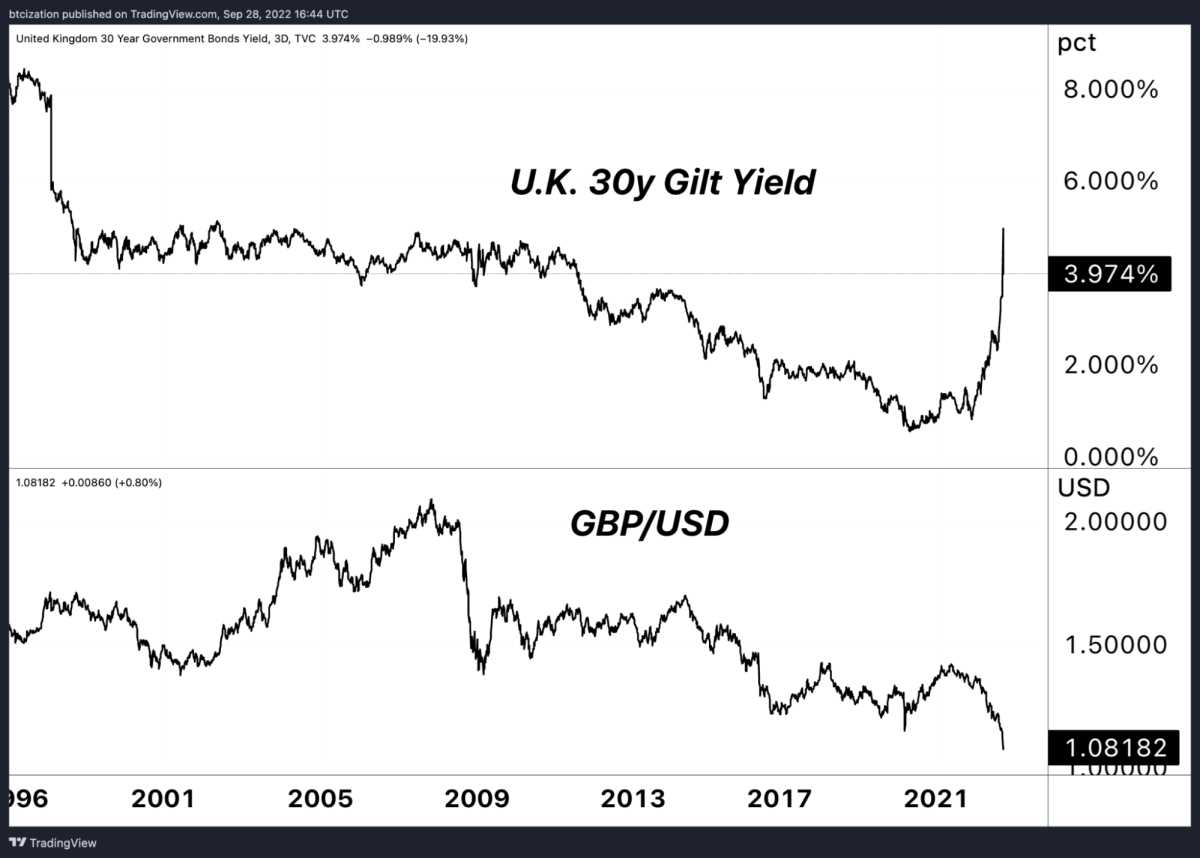

The rate of return is too high and too fast, and the economic development cannot operate normally. The bond sales market is short of border customers at this stage. Since the territorial sovereign bonds encountered the most embarrassing year in ancient China, the main performance has been so far. This also makes the European Central Bank have no choice but to become the final customer. If QE is restarted and the original bond purchase is not enough, we can easily see the progress of the planning towards a more strict and longer term YCC return rate limit

It is reported that the European Central Bank intervened to block the rapid development of gold marginal bonds because of the possibility of additional deposits in the US pension management system. The US pension management system has about 15000 Euros of assets, most of which are invested in bonds. Some pension insurance funds hedge the fluctuation risk of transactions based on the bond derivatives of the so-called debt driven project investment (LDI) equity investment funds. As the price of long-term US territorial sovereign bonds continues to fall, derivatives trading positions with the above bonds as collateral are increasingly exposed to margin call risk. Although the details are not critical, the key to understanding is that when the monetary tightening becomes an implicit systematic tightening,The central bank intervened.

Although the current policy of YCC may "kick the can" and limit the distress hazard in a short time, it will release a whole set of adverse effects and secondary effects, which must be resolved.

YCC is essentially the end of all "market transactions" in the financial and economic system. In order to maintain the special capital cost on which all economic situations depend, this is a more proactive intermediate plan. This was done in order to avoid a complete collapse of the management system. However, it has been proved inevitable that the monetary management system with the currency as the core as stipulated by law is close to the end of the retention period.

YCC allows government departments to reduce the overall interest rate of loan interest payments, reduce the borrowing costs of future debt loan rollovers, and thus extend the territory's sovereign debt foam. According to the absolute amount of public debt, the speed of the future fiscal deficit rate and the huge spending service commitment of the power of control (medical insurance, social security, etc.) for a long time in the future, interest rate expenditure will continue to occupy more tax market share from the declining tax base under pressure.

FINAL NOTES

The initial application of yield curve control is a worldwide strategy. It is used for abnormal conditions. Therefore, even if you try to release a project with the same YCC or YCC, you should also send a warning data signal to most people, telling them that there is a fatal error. Today, there are two kinds of the world's largest central banks (close to three) that actively implement the current policy of yield curve manipulation. This is also a new opportunity for monetary policy and monetary experiment. Central banks will make every effort to stabilize the economic situation, and the conclusion is undoubtedly that more currencies are depreciating.

If there was once an event marketing about BTC's place in the world today, that would be so. As we said, the current macroeconomic adverse conditions need to be removed for a period of time. The decline of Bitcoin market may be a short-term conclusion under the condition of severe fluctuations in the stock market. The wave of current monetary policy and ruthless liquidity that must be released will be very large. It is also a good way (if the sales market wants it) to reduce the Bitcoin market so as to accumulate higher trading positions and ensure another sharp shrinkage in the global economic recession. However, we believe that missing the next important increase is a really missed opportunity.

Previous similar articles

- 9/23/22 - The territory's sovereign debt and currency dilemma are developing continuously

- Monthly report from August to February, July: Long live macro economy

- 9/7/22 - Europe: Territory Sovereign Debt Foam Plastic Donomi dominoes

- 7/20/22 - Warning: bear market rebound

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.