-

Where Will The Bitcoin Price Bottom?

Sam Rule

Sam Rule 2022-10-16

2022-10-16 4006

4006 Research

Research

-

Summary:September’s CPI release comes in hot and sparks one of the most volatile days we’ve seen yet. The BM Pro team’s thoughts on where a bitcoin low price could be.

CPI fluctuation is not disappointing

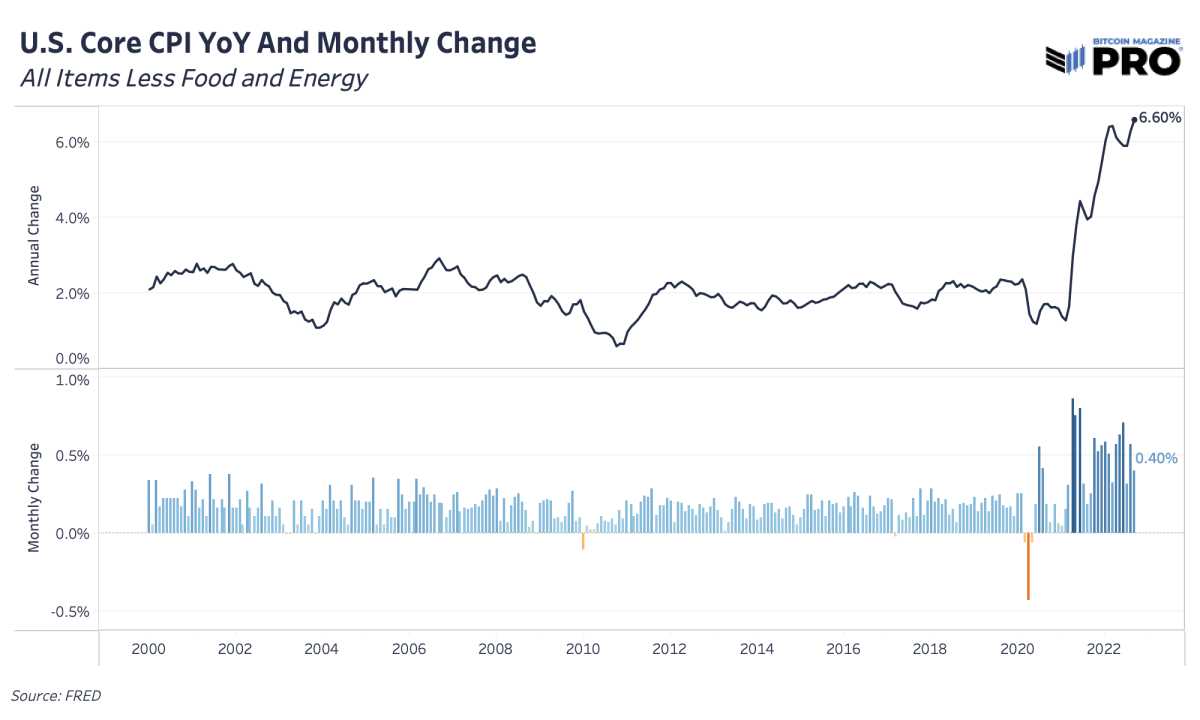

In the next article, you explained that CPI may rise unexpectedly and bring new ups and downs - that's what you get, and more. Since most of the specific contents have been elaborated, we will not explain the factors that cause the joy in detail, but the key conclusion is that the key CPI has increased by 6.6% year on year, and the monthly growth rate is 0.4% year on year. Housing (rent, housing composition, etc.) and health services are the main driving factors. This is also the fastest time that the overall key CPI has changed since 1982. To compare each component of the previous three months, please refer to this data chart

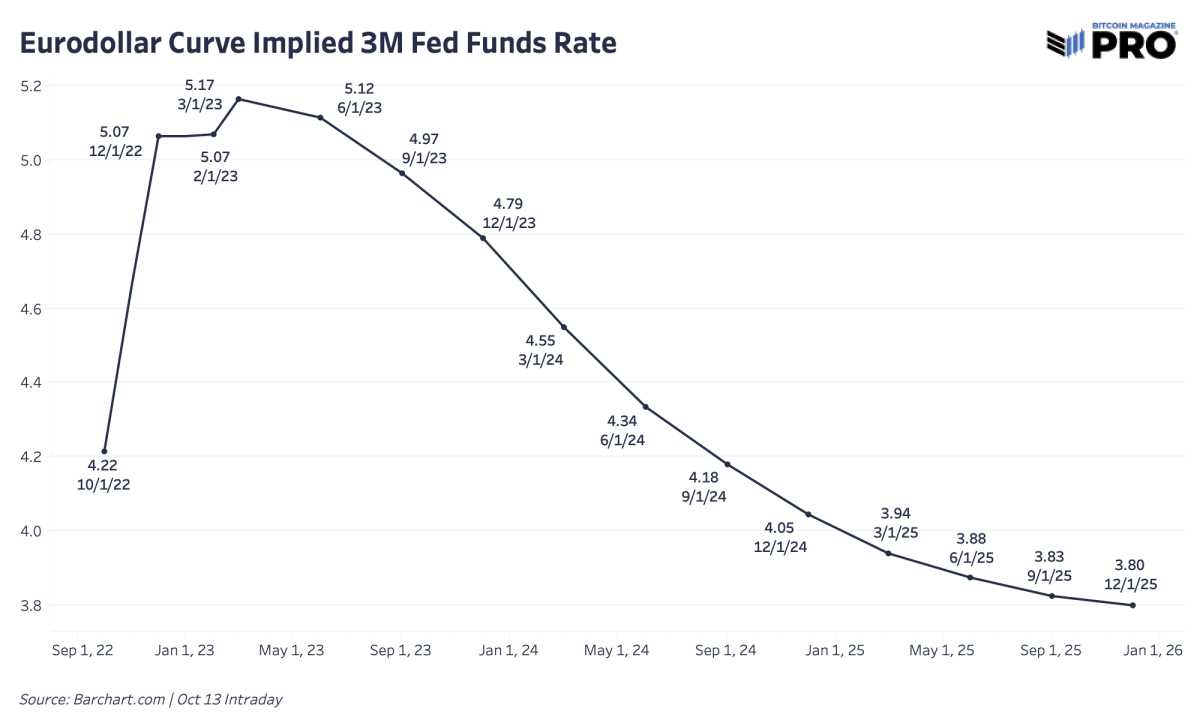

For the annual interest rate, the reserve ratio implied by the European sales market indicates that it will be slightly higher than the maximum value of 5% in March 2023, and then the central bank will cut the interest rate at the end of the year

What is the low price of Bitcoin?

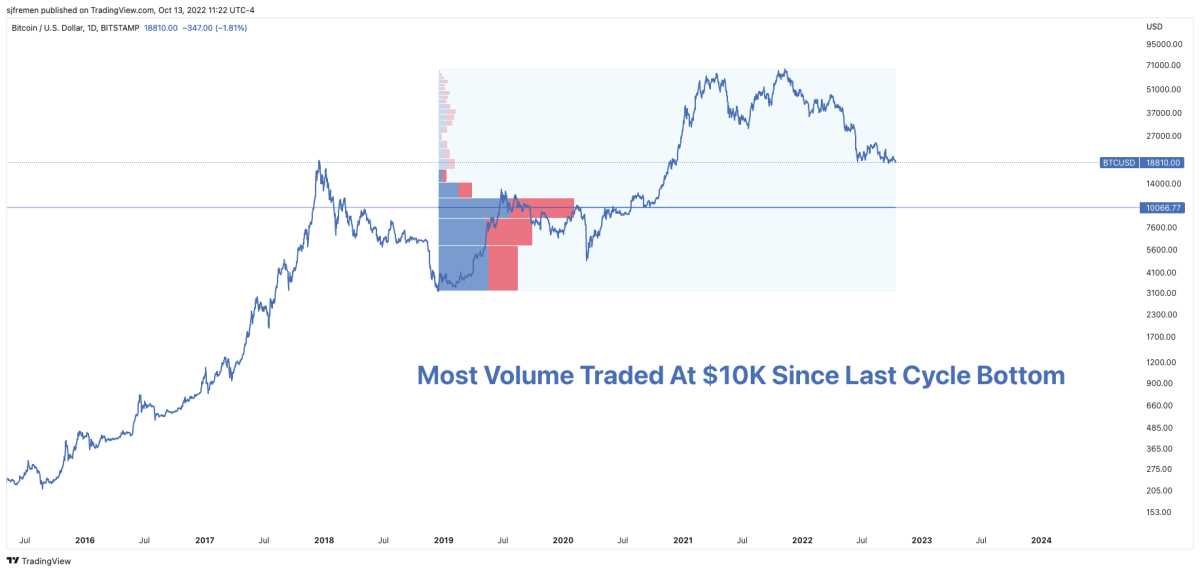

With the distance between falling to 18000 dollars getting closer, Bitcoin is facing the lowest risk so far this year. It is necessary to look at many important minimum price levels to identify where the price may end. First, let's take a look at the fixed turnover category of Bitcoin since the bottom of the last cycle in December 2018. The majority of trading volume in the market is around 10000 dollars, which is also an important psychological level. In the fierce downturn, 10000 US dollars is an area where many people in the market have basic spot transaction costs, and may gradually feel that some real shrinking pains or lack of confidence

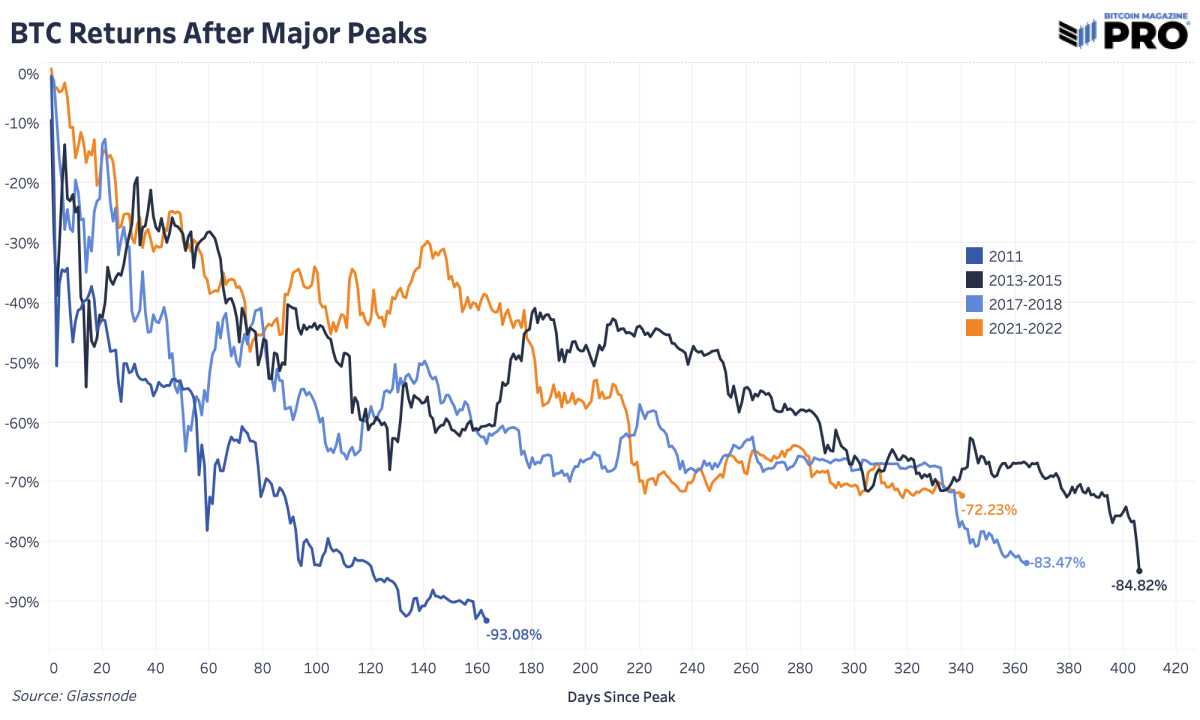

In terms of bear market and cycle time duration, let's review the regular shrinkage of Bitcoin at the current stage and previous cycles. At this stage, everyone has dropped 72.23% from the highest closing price of 67589 US dollars in history. If we will see the decrease of the larger cycle is lower than that of the fourth cycle, for example, about 80%, then we will see the price of about 13500 dollars. If we assume that the cycle time and the sudden rise of stock valuation will be worse, for example, about 85%, we will finally see the price around $10100. The optimistic situation is that we have found a long-term bottom at $18000, and we will not see a large shrinkage of more than 73%

From the perspective of chain franchise, a more meaningful completion price industry is the completion price held by 10-100 BTC address groups. Recall that the specific prices are based on the basic forecast value of the average variable cost of the price moved before and after UTXO. This special population accounts for about 22.6% of the total commodity circulation supply. This group will certainly reflect a considerable number of long-term holders. It is reasonable to think that in a deep and continuous bear market, long-term holders have not experienced the pain or surrender we have seen in the past.

Previous similar articles:

- 7/13/22 - Inflation: the number one enemy

- July 19, 22 - Bitcoin short sellers are squeezed

- 7/20/22 - Warning: bear market rebounds

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.