-

Bitcoin Volatility Hits Historic Lows Amid Market Apathy

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2023-01-08

2023-01-08 5188

5188 Research

Research

-

Summary:TVrXTefUDpXx9bbqE73ohdBijTzsqUt64X

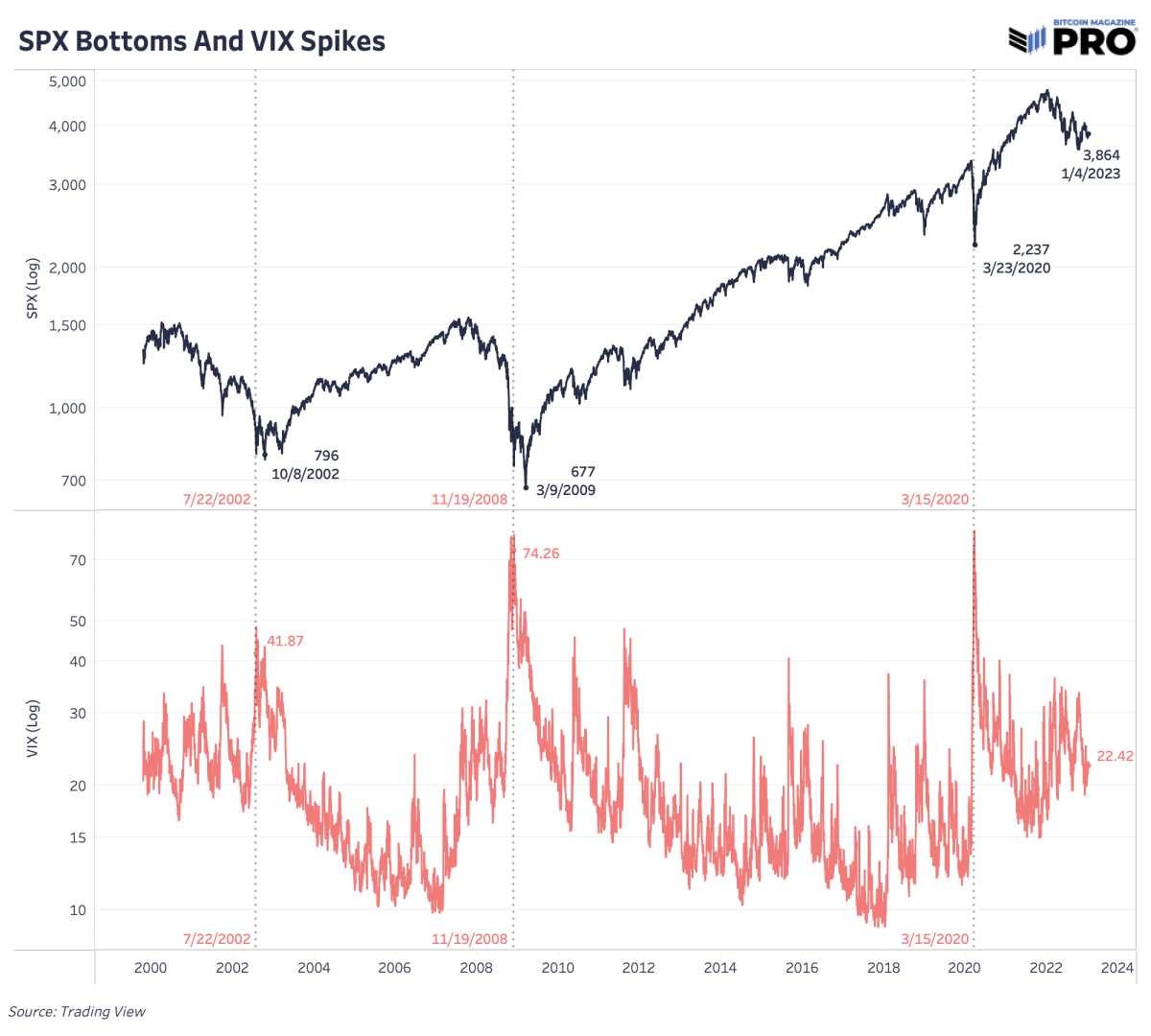

As people enter 2023, I hope to focus on the latest release of bitcoin trading volume and volatility after the latest wave of capitulation. Last time, everyone mentioned that this dynamic will be in the "Bitcoin Dead City" in October. They explained that the very low trading volume and high volatility cycle of Bitcoin prices, GBTC and stock index futures markets are a worrying sign of the next round of decline. This will begin in early November.

Fast forward, the trend of reduced trading volume and high volatility returns. Although this may mean that the market will fall again, it is more likely to mean a conceited and fatal market that few participants want to touch.

Even within the surrender period in November 2021, the volatility is still at the lowest level in history. Sometimes, when the market has to wait for a big change, the market will feel the most painful. The price of Bitcoin adds to this pain. Since we haven't seen the explosive growth of market volatility, this has defined the market support point and the most important change of specificity in the past.

Although there are many ways to measure, classify and possibly market the turnover of Bitcoin, they all show the same items: September and November 2021 are the best time to buy and sell. Since then, the volume of spot trading and continuous futures trading markets has been steadily decreasing.

After the bankruptcy of FTX and Alameda, the overall market strength and liquidity were also severely hit. Their destruction has resulted in a very large liquidity gap, which has not been filled due to the lack of market making in this field.

Up to now, Bitcoin is still the most liquid market in any other digital currency or "token", but compared with other asset markets, Bitcoin is still relatively illiquid, because the whole market has collapsed in the past few months. Relatively low market strength and liquidity means that the property is vulnerable to more fluctuations. As a single and large order may cause more harm to the market price

Cold on the chain

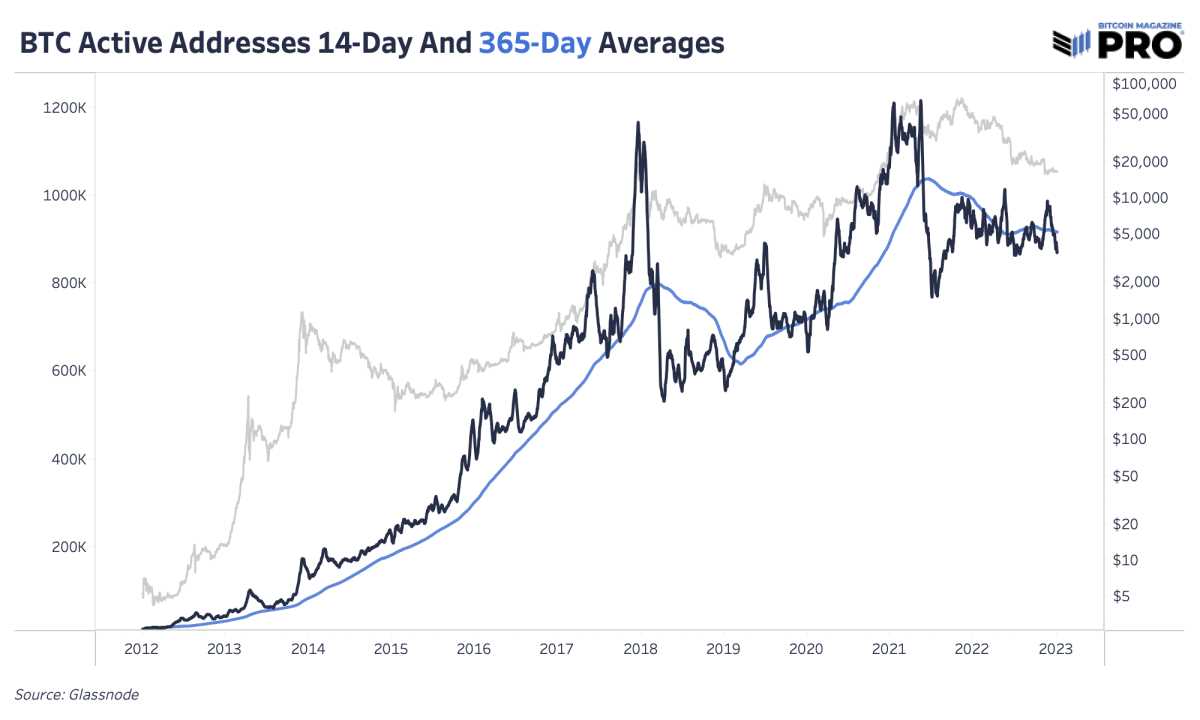

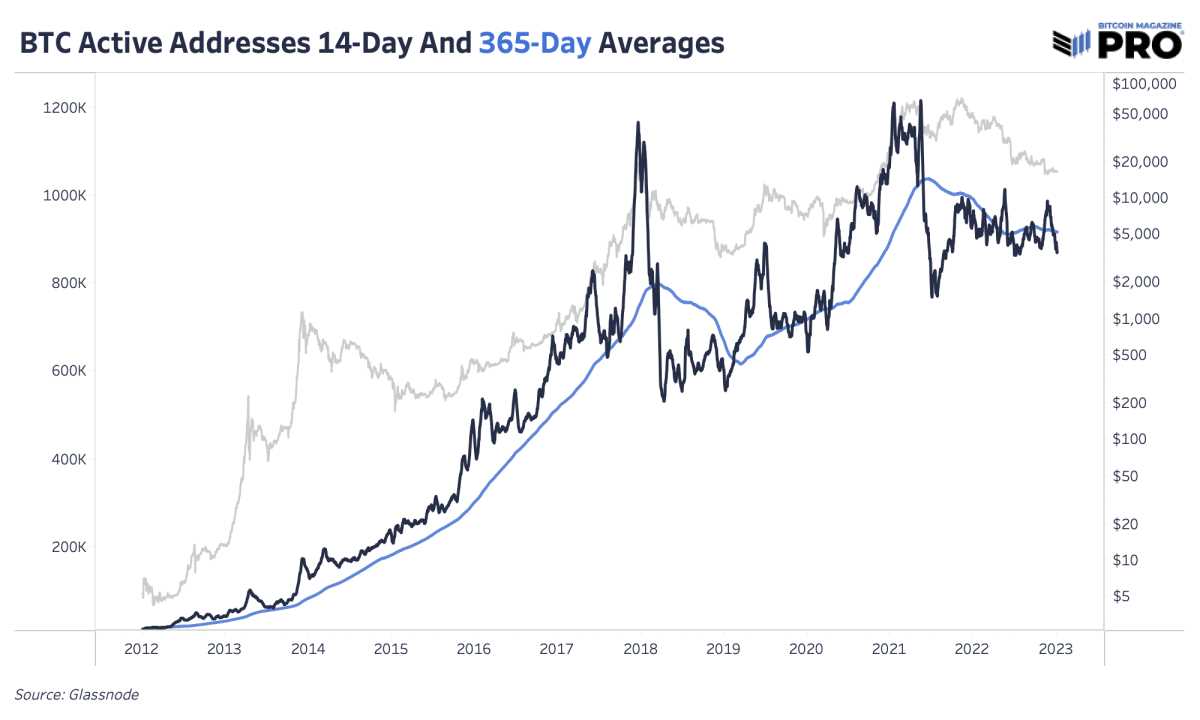

As often expected in the current natural environment, we also see more market complacency when querying the data information on the chain. Although the total number of subject activity addresses (as the only detailed address of the publisher or recipient of the subject activity) continues to increase over time, in the past few months, the total number of detailed addresses of the subject activity is still very stagnant. The following figure highlights that the 14 day moving average value of the theme activity address in the previous year is less than the operating average value. In the previous bull market environment, it has been seen that the increase of active addresses has greatly exceeded the current development trend

Because of the shortcomings of detailed address data information, it is not difficult to find the same development trend by querying the data information of the subject activity entity line of Glassnode. In a word, the bear market reversal of the stock market is the conclusion of many factors, including the improvement of theme activities on the fast growth chain of new customers

In the "When will the bear market end?" released on July 11, we have already realized the impact of surrender according to the price, and the real pain in the future is surrender according to time.

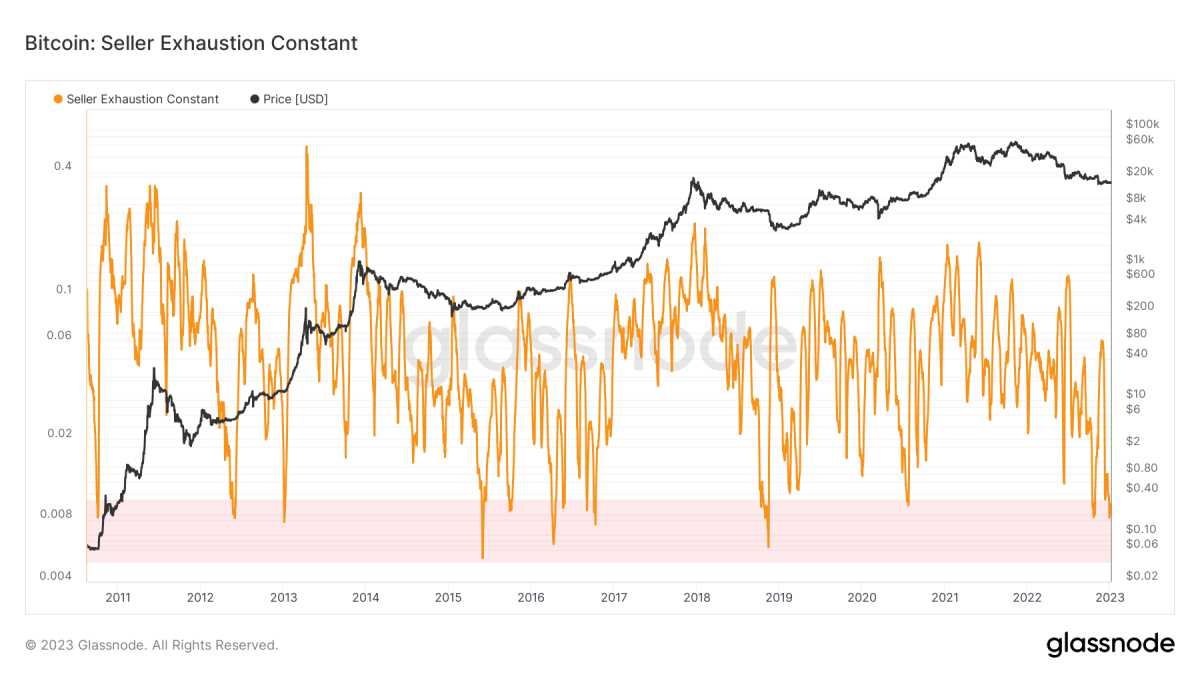

"Looking back on the bear market cycle time of Bitcoin stock market in the past, two completely different surrender links can be found:

The first is based on the surrender of price. Through a series of large sales and settlement, the asset shrinkage is 70% to 90% lower than the previous historical peak.

"The second stage is all based on time surrender, and the market finally finds the balance between supply and demand in the deep downturn." - Bitcoin magazine PRO

I always believe that surrender according to time is our position today. Although the pressure on rate work will definitely increase in a short time - taking full account of the adverse trend of macroeconomic policies still exists - the situation that is likely to continue to exist in the short term, the middle and later period seems to be a continuous fluctuation period, with very low volatility, which makes the traders and HODLER suspect when volatility and exchange rate appreciation will return.

Do you like this specific content?Order nowReceive PRO article content directly from the outbox.

Previous similar articles:

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.