-

Bitcoin Faces The Liquidity Steamroller Of Global Markets

Sam Rule

Sam Rule 2022-10-21

2022-10-21 3551

3551 Research

Research

-

Summary:One of the most important factors in the market is liquidity. The global reduction in liquidity has sent asset classes to new lows and destroys wealth.

Liquidity is dominant

Up to now, one of the most important factors in all sales markets is liquidity - liquidity is defined in many ways. In this article, we will introduce some ways to think about global liquidity and the impact of Bitcoin.

A high-end view of liquidity is the balance sheet of the central bank. Because the central bank has become the border customer of your sovereign debt, mortgage applicable securities and other financial derivatives, it provides more liquidity for the market to purchase assets with higher risk curve. The seller of bonds is the buyer of different assets. When the system software has more reserves, assets, assets, etc. (no matter how you describe them), they need to go to a place.

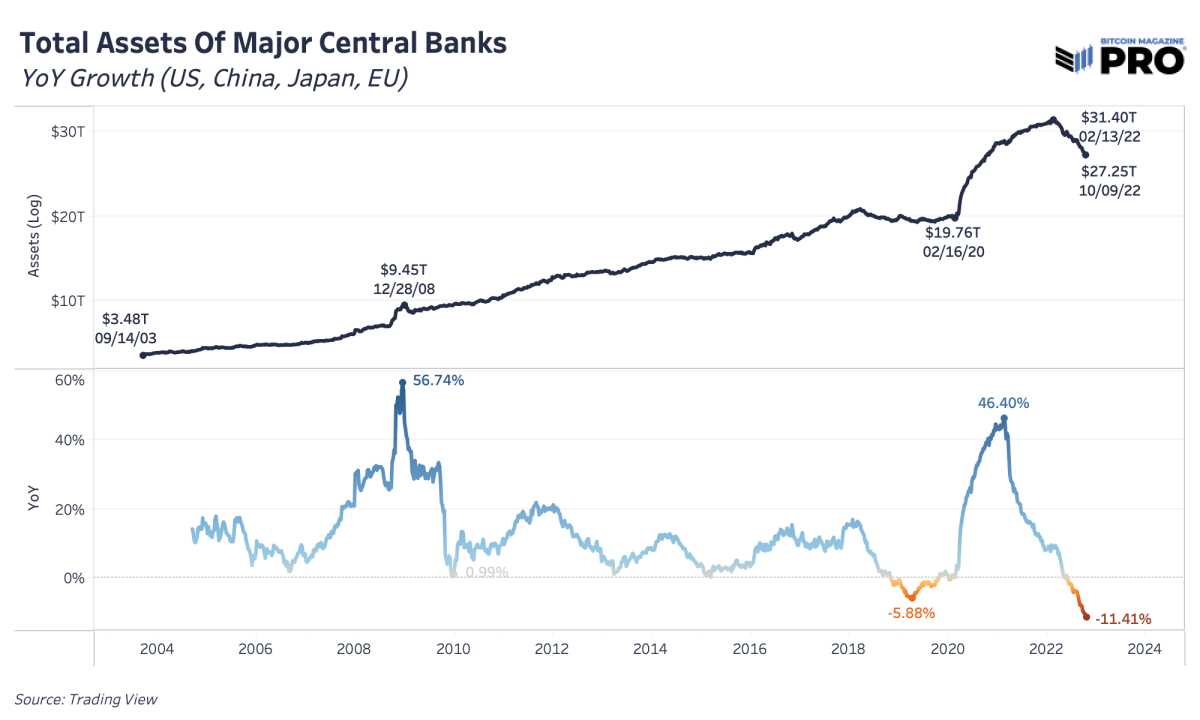

In many ways, this has resulted in one of the largest increases in the valuation of global asset companies in the past 12 years, which is consistent with the new era of quantitative easing policy and debt monetization experiment. Earlier this year, the balance sheet of central banks in foreign countries, China, Japan and the European Union reached $3.1 billion, nearly 10 times higher than the level in 2003. It has been a growth trend for several decades, but the fiscal bureau and fiscal policy in 2020 will make the balance sheet reach a record breaking level in the stage of global distress.

Since the beginning of this year, I have seen the highest value of the central bank's assets and its global attempt to reduce this balance sheet. The highest value of the S&P 500 index appeared two months before we saw all quantitative tightening (QT) measures today. It is not the only factor to promote the price quotation and company valuation, but the price and cycle time of Bitcoin are also subject to the same harm. The highest annual elasticity coefficient of key central bank assets appeared a few weeks before Bitcoin first pushed up to a new historical record of about 60000 US dollars (March 2021). In the past 18 months, whether it is the direct relationship and popularity of the central bank or the market's perception of this kind of influence, these have been an obvious macroeconomic driving force for all markets

The total market value of Bitcoin is only a small part of the global capital, and it faces the pressure of liquidity in other global markets. If we use Bitcoin as the framework of the liquidity sponge (more important than other assets) - absorbing all the excess money supply and liquidity in the system during the expansion of difficulties - then the substantial convergence of liquidity will come from another perspective. In addition to 77.15% of the inelastic and illiquid supply of Bitcoin, and many of its final HODLERS, the adverse impact on the market is much greater than that of other assets.

One of the potential drivers of sales market liquidity is the money supply in the system, the global M2 in US dollars. M2 money supply includes cash, bank draft deposits, demand deposits and other forms of liquidity loans. The regular expansion of global M2 supply occurs in the period of global central bank asset expansion and bitcoin cycle time expansion.

We will consider Bitcoin as a currency inflation hedging transaction (or liquidity hedging transaction), rather than a "CPI" (or price) inflation hedging transaction. Inflation, with the passage of time, there are more and more departments in the system, which has promoted the rise of many asset types. However, in the eyes of many people, Bitcoin is an asset with good design schemes up to now, and it is one of the main assets with good performance against the continuous devaluation of money in the future, the expansion of money supply and the expansion of central bank assets.

It is unclear how long the actual reduction of the Fed's balance sheet will last. You only saw that the balance sheet problem of $896 million decreased by about 2% during its peak period. Finally, for us, balance sheet expansion is the only option to maintain the operation of the entire monetary system, but so far, the sales market underestimates how far the Federal Reserve Meeting wants to go.

The lack of practical fiscal policy choices and the inevitable trend of expanding balance sheet is one of the most sufficient direct evidences of Bitcoin's long-term success. In the next phase of decline and economic crisis, what can policymakers of the Central Bank and the Finance Bureau do?

About previous articles:

- 10/7/22 - Not Your Average Decline: Relieving the Largest Financial foam in History

- Report from August to February, July: Long live macro economy

- 2/18/22 - Relatively high uncertainty and relatively low liquidity

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.