-

Bitcoin Price And Risk Assets Jump In Correlated Move

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2023-01-20

2023-01-20 4347

4347 Research

Research

-

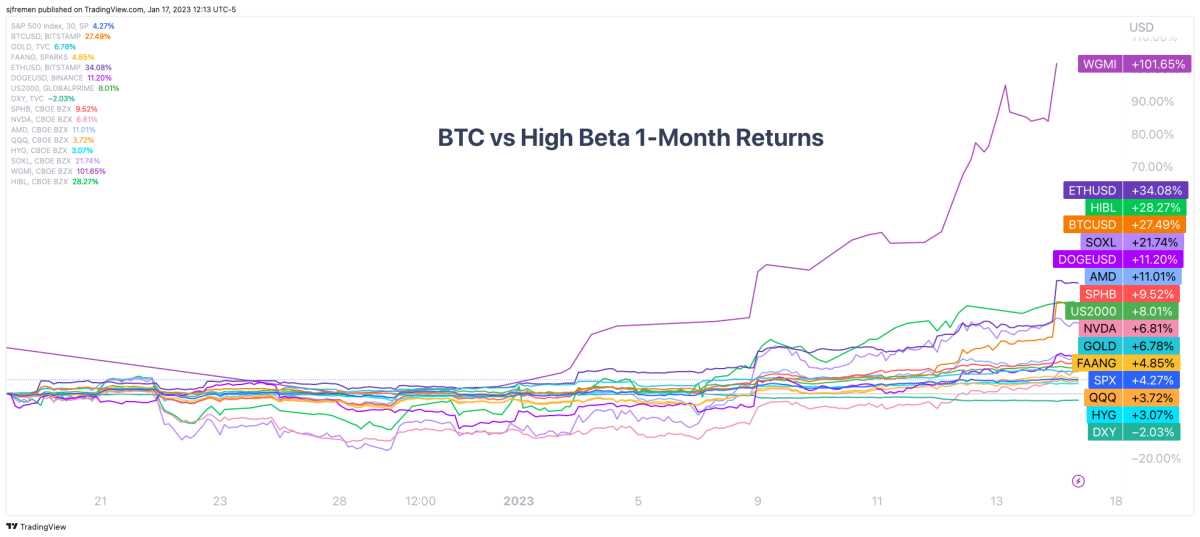

Summary:Bitcoin price correlates with high-beta stocks in the recent move upward. Global liquidity is increasing as financial conditions loosen.

A single Bitcoin bounce or a high detection? In any case, Bitcoin holders are celebrating the gradual release in 2023. Bitcoin has already shown some obvious momentum, and has shown its effectiveness in the daily average system and the total demand of each important short-term price in the chain. In fact, every key high-beta mobile game in the market shows the same strength, which makes everyone more cautious about the tightening of this new empty order mentioned last week in "Bitcoin broke to $21000, and the empty order was destroyed in the biggest extrusion molding since 2021"

Although we would like to see Bitcoin rise alone, there are many signs in the market that the situation is likely to reverse. It has been seen that the most oversold stocks in 2022 will have a relatively valuable rebound, a temporary extrusion, and the next round of open market operation public offering (FOMO) will fall below the end of 2022

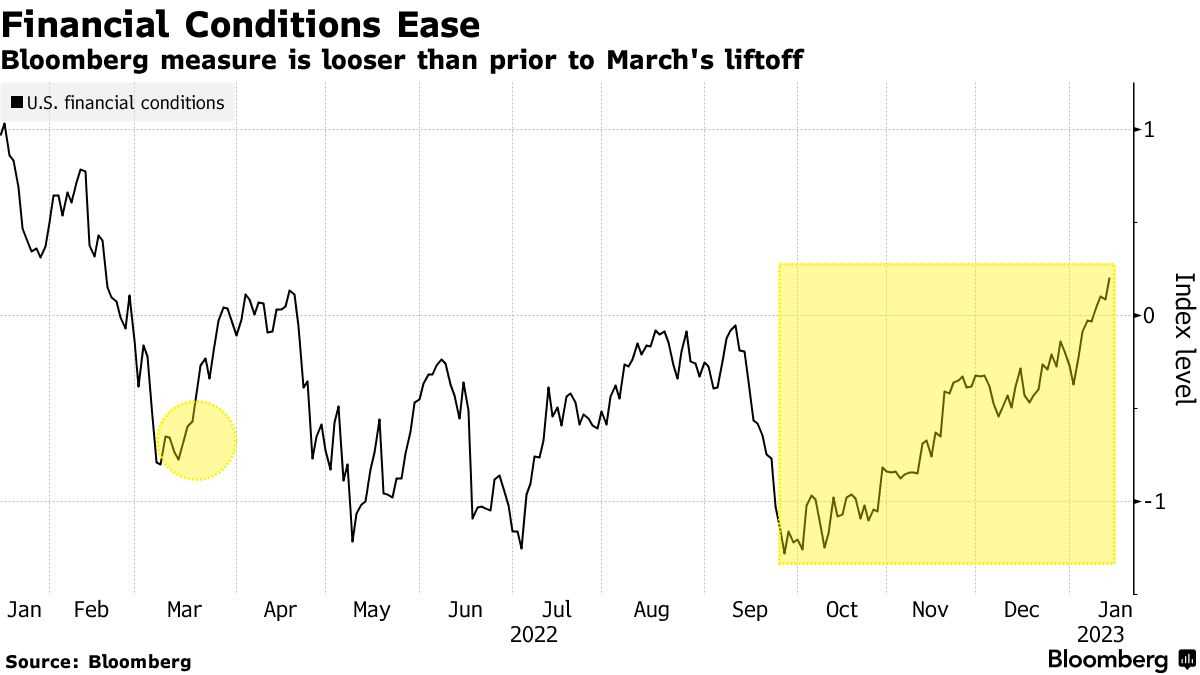

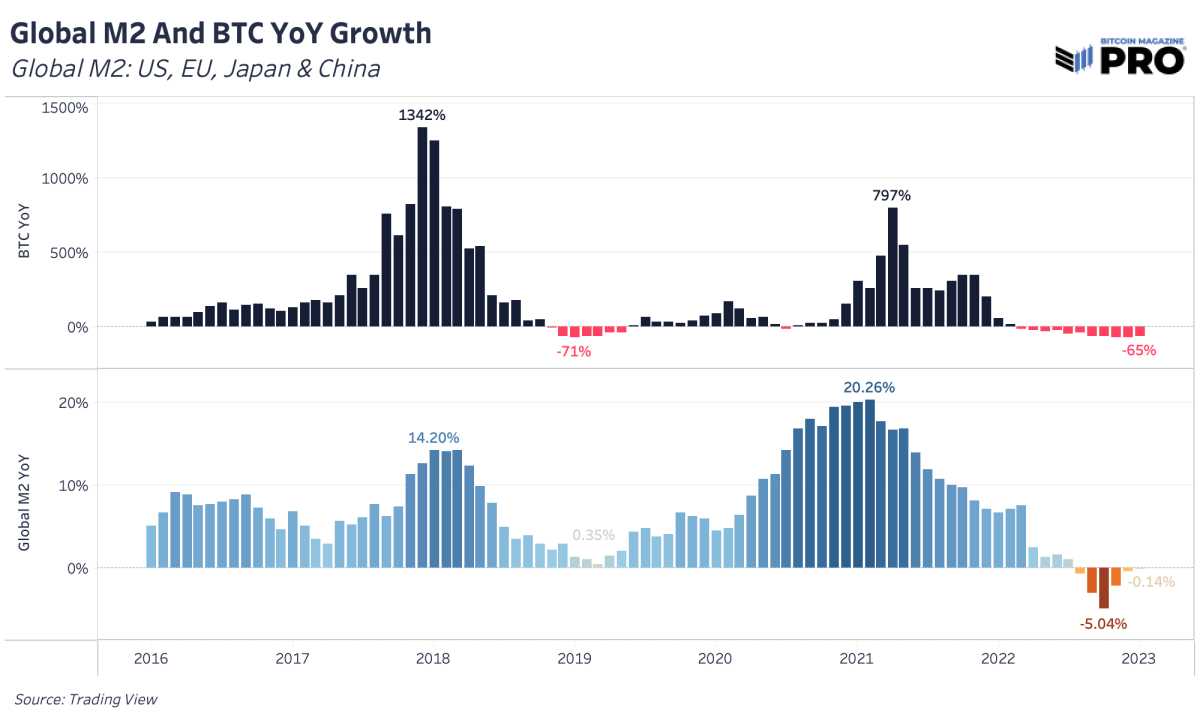

With the US dollar weakening for a short time, the National Financial Situation Index (NFCI) of the United States has relaxed, and the speed of M2 loan supply contracts in the world is much slower than in the past few months. The recent risk rebound has brought the implied stock market volatility to the lowest level

The physical model of net liquidity that you mentioned in the previous article shows that it has been somewhat closed compared with previous years, but it has basically not changed in the past few months. If we should see a continuous rise, we expect that the improvement of net liquidity in the coming months will become an important driving force for this measure.

In the minutes of the recent meeting, the members of the Federal Reserve expressed concern about the "unnecessary loose financial conditions" caused by the soaring risk assets, and then limited her unremitting efforts to reduce inflation.

With the Central Bank of Japan deciding whether to relax fiscal policy, this may lead to the relaxation of futures arbitrage. For us, this is also one of several ways in which the US dollar is likely to fall at the same time with the weakening of the global stock market index. Due to the increase in the cost of US assets, individual stocks are repriced.

Do you like the specific content?Order nowAccept PRO article content directly from the outbox.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.