-

TC9trU67Bhxz4rsduqKqn8sQcjA9EwtszC

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-11-06

2022-11-06 3405

3405 Research

Research

-

Summary:More announcements from public bitcoin miners on potential capitulation. Debt needs to be paid and cash is tight due to high hash rate and a low bitcoin price.

Development trend of new public mining

After writing about the probability of public mining enterprises surrendering, and reporting on the possible bankruptcy path of Core Scientific, a wave of news and development of mining companies occurred, indicating that the risk of the whole market has been generated. The key risk is the miners' accumulated debt, and the lack of cash flow to pay the debt interest rate due to the extrusion of gross profit rate. Another risk is the hash rate (ASIC mining machine), which is used as collateral for loan secured debt financing.

In the performance so far this year, the market performance of public mining enterprises is again seriously less than Bitcoin. This is not a trend, but now, with the gradual collapse of miners and the occurrence of survivors, the difference in sales performance has gradually expanded significantly. Miners on the verge of bankruptcy fell by more than 90%, while the decline of "relatively strong" miners selected by the market was between 60-70%

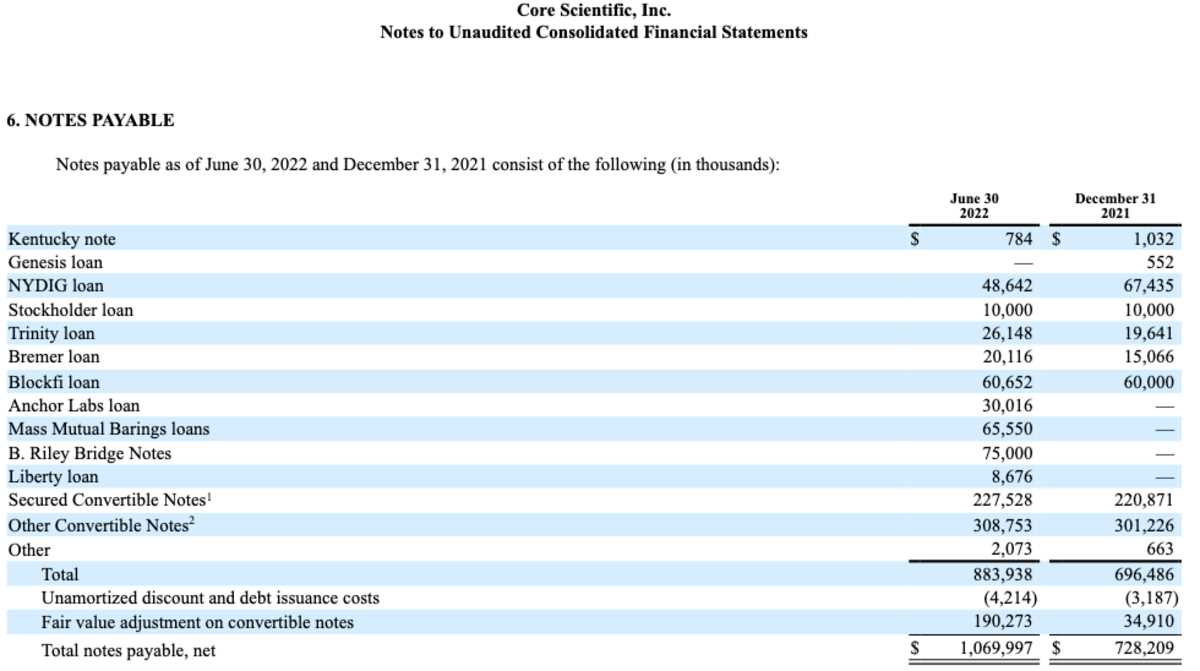

Gradually, from Core Scientific, there is a detailed list of enterprises entrusted with owed funds, including BlockFi, NYDIG and Anchor Labs. In general, the debtor was entrusted with about 1 billion dollars, and even MassMutual Barings (an investment management company under Mutual Life Insurance Co.) is still on the short list

Argo blockchain is one of the lowest level blockchain technologies, down 93.23% this year. They released the biggest mining news report of this week. Previously, they announced that the $27 million fundraising in the plan could not be passed. Earlier this year, NYDIG allowed Argo to lend $70.6 million. In August, Argo also used some of its Bitcoin holdings to reduce the BTC applicable loans they obtained from Galaxy Digital.

Iris Energy's equity financing version update this week focused on“At this stage, the nominal monthly gross profit rate of Bitcoin coin digging of $2 million can be generated, and the total amount of principal and interest payment liability required for each month is $7 million.”After borrowing $71 million from NYDIG, Iris has nearly 36000 equipment, which is likely to be transferred soon. This equipment is guaranteed by the ASIC machine loan to repay an outstanding loan and face the risk of debt restructuring. Unless they can reach the new agreement before November 8, the enterprise will entrust such loans.

That week, Stronghold Digital Mining realized the debt restructuring agreement with NYDIG, delivering 26200 miners to obtain $67.4 million in debt. Stronghold also extended another part of its debt to 36 months instead of 13 months to buy a large amount of cash sports ground. This measure is a strategic action, committed to "rapidly reduce the leverage ratio of the balance sheet and improve liquidity".

CleanSpark has been in the development stage recently, and can purchase ASICs at a lower price. But last month, it sold a large number of its Bitcoin holdings (mining 532 BTC and consuming 836 BTC) to adapt to rapid growth operations. Although many key miners are still maintaining their HODL scheme and Bitcoin account balance, experienced miners will take advantage of this property to improve opportunities or equity financing operations when necessary.

TeraWulf, another Bitcoin miner, has dropped 92.38% so far this year. Compared with other miners (86%), its total debt to equity ratio is also high. A debt of 120 million US dollars will be gradually repaid at an interest rate of 11.5% in the spring of 2023.

Because large and medium-sized private lending organizations such as BlockFi and NYDIG did not disclose how many mining debts were on their financial statements, it is uncertain how many mining bankruptcy risks some of these loan companies will face in the near future. This kind of borrowing may be an effective component of a wider range of financing activities, and has the strength to solve the risk of contract breaking, but it is worth paying attention to and better understand the dynamics, as long as we expect that more miners will encounter the pressure of debt contract breaking and/or restructuring portfolio in the coming months.

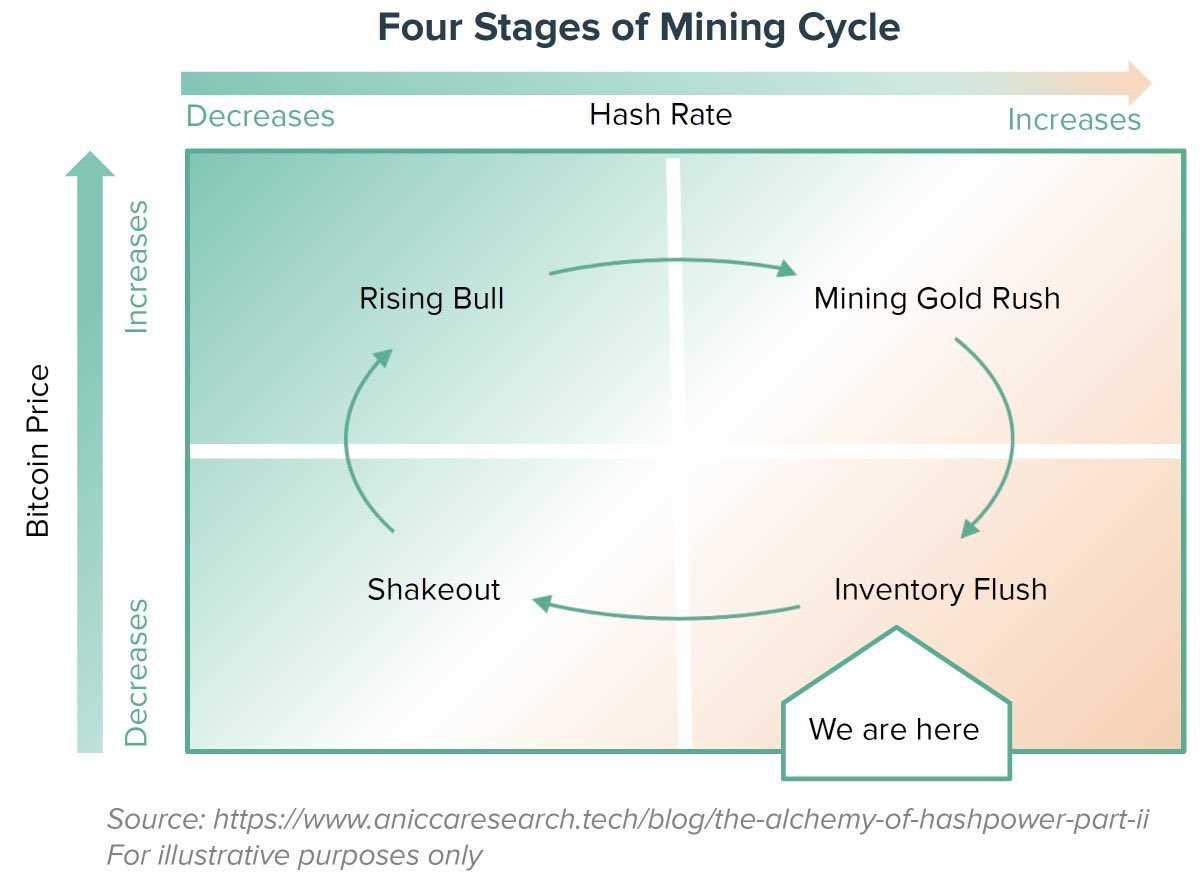

According to Fred Thiel, CEO of Marathon Digital Holdings, about 20 public miners will face the risk of bankruptcy in the case of a perfect storm for enterprises. Undoubtedly, miners with higher business scale and better influence have explored hidden and beneficial recycling business, which will happen soon. As with other industries in the past, the integration of large and medium-sized industries is inevitable. It seems that public bitcoin coin digging is ready to enter the next stage of its life cycle. It is very likely that everyone will enter such a world, where there are only a few major bitcoin miners and many miners with much smaller business scale.

Similarly, with this cycle time moving from the lower right to the lower left, it is completely possible that power energy manufacturers with sufficient public and personal cash will gradually accumulate ASICs to fully prepare for the next bull market

FINAL NOTES

Today, the inherent risks in the Bitcoin sales market are still the weaknesses that are put on the surface by a single line. From the perspective of exploring the temporary equilibrium between the buyer and the seller, it is encouraging that there is no valuable price adjustment in such a $20000 range. However, with the increasing number of coal mine accidents and the possibility of a large number of fund leverage in the market, the pain of the participants in the field has decreased significantly. Bitcoin is the first one to be sold. At this stage, the price is 20000 dollars. However, people have to doubt whether the business scale of border buyers is enough to resist the hidden selling pressure.

Everyone is suspicious, because some miners are facing a particularly big reversal against the wind in such an environment, and the data encryption loan companies that survived the difficulties in summer are under increasing pressure

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.