-

Public Bitcoin Miners Fight For Survival

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-12-13

2022-12-13 4441

4441 Research

Research

-

Summary:Hash rate had its first major drawdown since July 2021 and public miners are feeling the pressure as tough conditions may last for a sustained period of time.

Record downward difficulty coefficient adjustment

With the rise of electricity and energy inflation, the debt burden and the decline of Bitcoin prices, the mining industry has been hit again. At the end of November, the hash rate dropped by 13.1% from the highest point in history. However, in the significant decline of hash rate since 2016, compared with the very few decline periods that exceeded 15% in those days, this is still relatively small.

The latest 7.32% downward difficulty coefficient adjustment is the most direct reply to each hash rate offline. At this stage, the hash rate is about 250 EH/s, 7.84% lower than the historical maximum of about 273 EH/s. This is also the biggest downward adjustment since July 2021. At that time, I saw a series of downward adjustments after China's mining restrictions. This should bring some temporary relief to the miners at this stage, but it is too early to say whether the decline of the hash rate has ended.

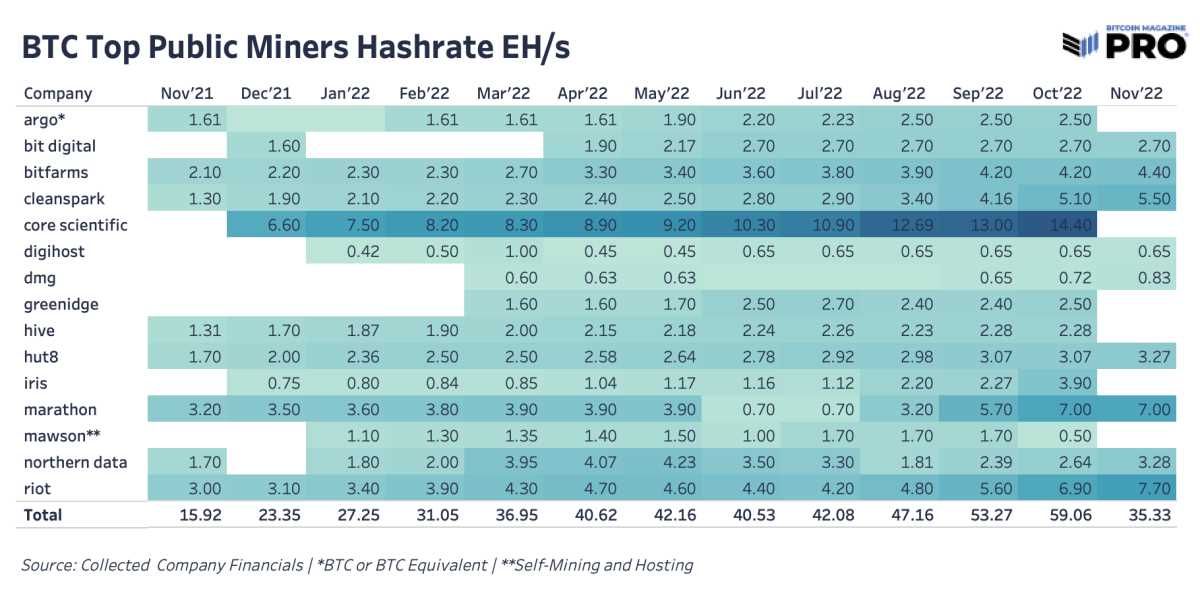

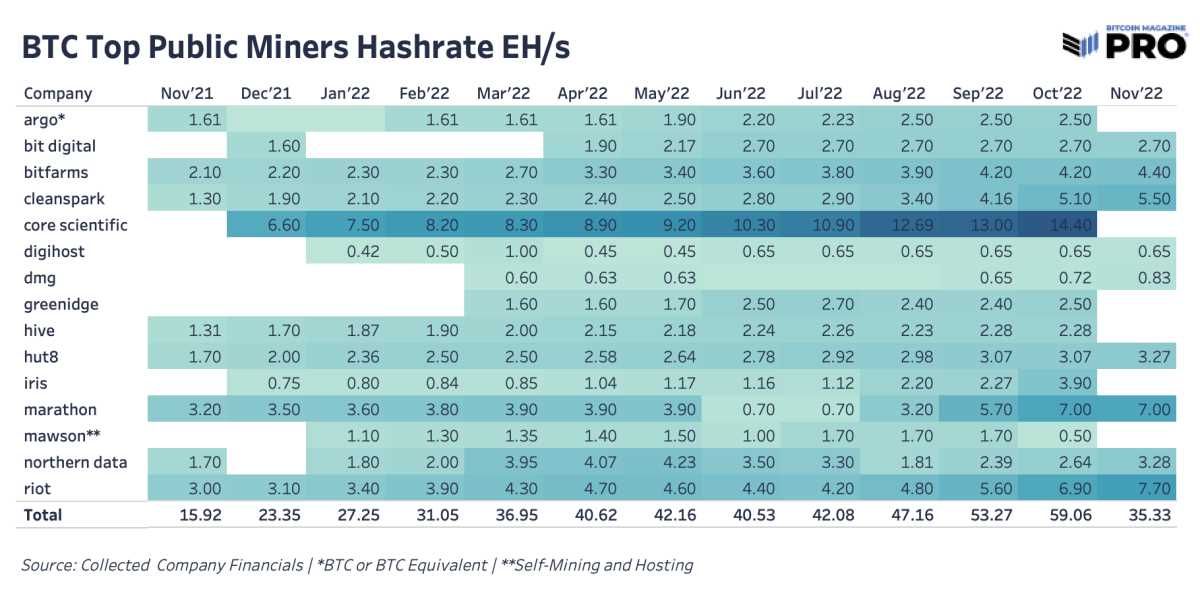

Even though the hash rate has declined to a certain extent recently, we haven't seen the notice from key public miners. The hash rate of most public miners is either similar or increasing last month

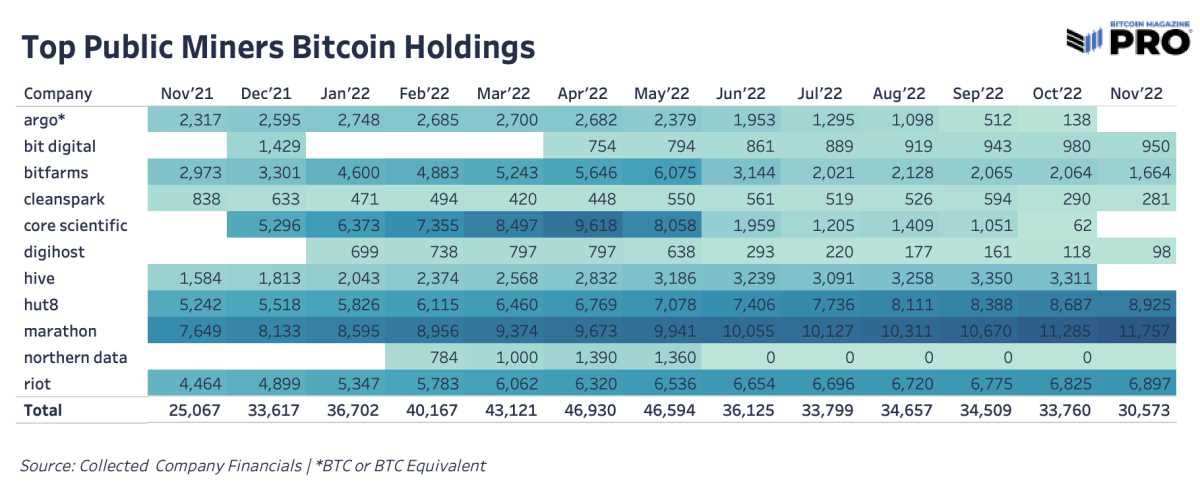

So far, from the perspective of those who update the monthly summary production, the ownership of Bitcoin has increased significantly from the bonds of Riot, Marathon and Hut 8, the largest three countries, accounting for 27579 Bitcoin. Bitarms has sold a very large amount of assets in its finance, which may be related to the repayment of its current liabilities

As far as Bitcoin is concerned, according to the yield and Bitcoin data from this year to now, the main performance of miners' individual stocks has fallen again this year. Hash price The bear market in the stock market is still active, which is the key argument for our assessment of the development prospects of the project investment in public miners and Bitcoin at this stage. In fact, any mining enterprise that performs well in Bitcoin in the short term is all an opportunity to re price the sales market.

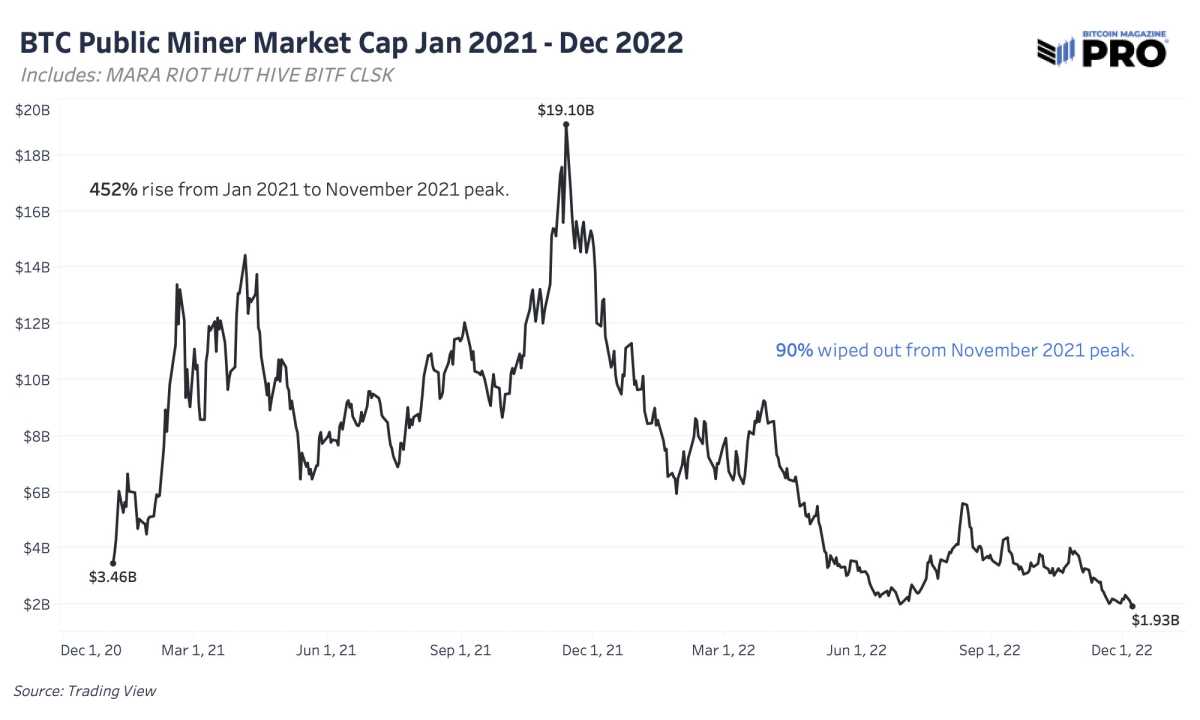

By querying the total market value of the agent Bamboo Basket composed of six public bitcoin miners, we can know what has been erased from the value of bitcoin since 2021. In November 2021, the use value of Bitcoin will reach the highest value of 19.1 billion US dollars, an increase of 452%. But in less than a year, 90% of its value will be erased from the sales market.

Although the worst situation of the decline of deferred income tax and hash price (miners' earnings per tera hash) in the public miners' sales market has occurred, we estimate that the tough standard is likely to last for a period of time, which will squeeze many investors. The recent downward difficult adjustment has added some relief, but it is not enough for many miners who bought most of the equipment in 2021. They estimate that the "worst phenomenon" is 30000 yuan

In the global environment of soaring energy demand and annual interest rates, many network operators are facing a very difficult natural environment, especially the agent management equipment. As a customer intermediary, enterprises expect to profit from the mining of Bitcoin. In terms of the current situation of the mining industry, the most important thing is that some of the largest escrow equipment in this field either has already closed down, or is in debt, or there is no spare ASIC to deploy hash rate.

We will pay close attention to the Hash rate and the development of the mining industry. Although this field was severely hit in 2022, we suspect that it has not yet got out of its predicament.

The magic of Bitcoin and the bourgeoisie is that only the strongest can survive. In any case, the blockchain will continue to be mined every 10 minutes or so.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.