-

TM1nrNwEL6TmJxGcGGqEsEGHa4SZ6SQxPR

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-11-19

2022-11-19 3485

3485 Research

Research

-

Summary:A look into the next potential dominoes in the crypto native contagion, along with a comparison of the recent historic levels of withdrawals.

We are now in the midst of field infection and market anxiety. Although FTX and Alameda have already fallen, deeper participants from stock funds, market making, exchanges, mining companies and other companies will learn from them. This is a script similar to the one we saw in the previous crash caused by Luna, but it has a higher impact on the market. This is also the appropriate elimination of unreasonable capital allocation, speculation and excessive financial leverage accompanied by the dissipation of the wave of world economic liquidity.

In other words, everyone quickly jumped down a Donomi domino. Of course. Most of the information that closely surrounds the balance sheet and hides the financial leverage in the system is uncertain, and it seems that there will be real-time latest information and dynamic discharge every 30 minutes. The exchange is now under camera, and the market has been concerned about their every move and payment. It is likely that no exchange will perform as poorly as FTX and Alameda in terms of user assets, but no one knows which exchange can or cannot survive a bank run.

As the market reaction shows, Crypto. Cronos token (CRO) of. com fell 55% in one week, and was relieved on the last day. In the past two days, there has been a hyperbolic trend of withdrawal development in the exchange - bank run. According to the interview of the reporter, the CEO ensures that the withdrawal solution is normal to anyone, and they will survive

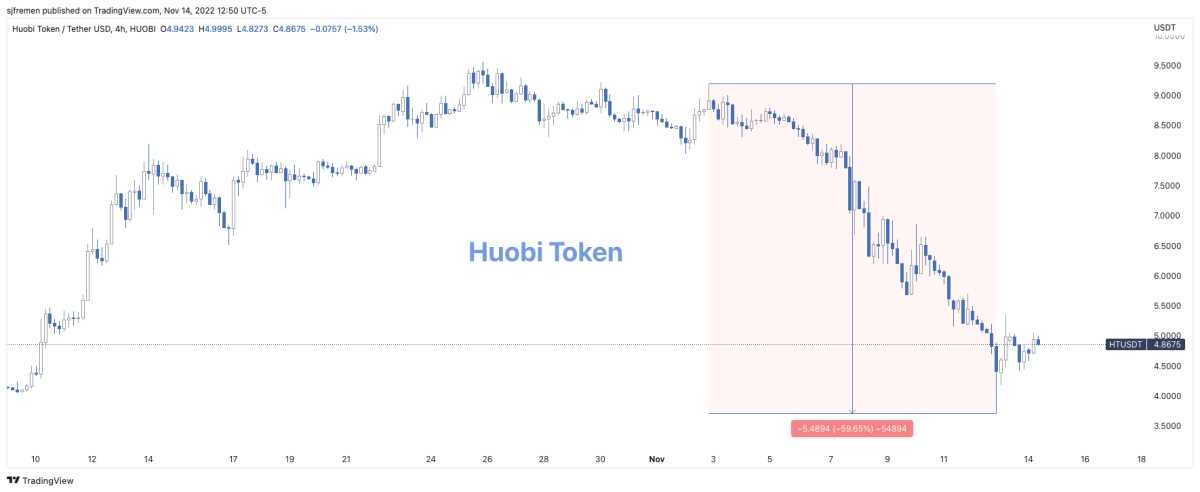

Fire Coin Token (HT) has gone the same way, falling nearly 60% in the past two weeks. Huabi recently brought his asset list on the website, which shows that the HT owned by Huabi Global and its customers is about 900 million dollars. At present, it is not clear that the proportion of fire coins in the world's 900 million US dollars, but this is very scientific and reasonable. Exchanges everywhere are scrambling to give confirmation of foreign exchange funds in a certain way to try to calm the market

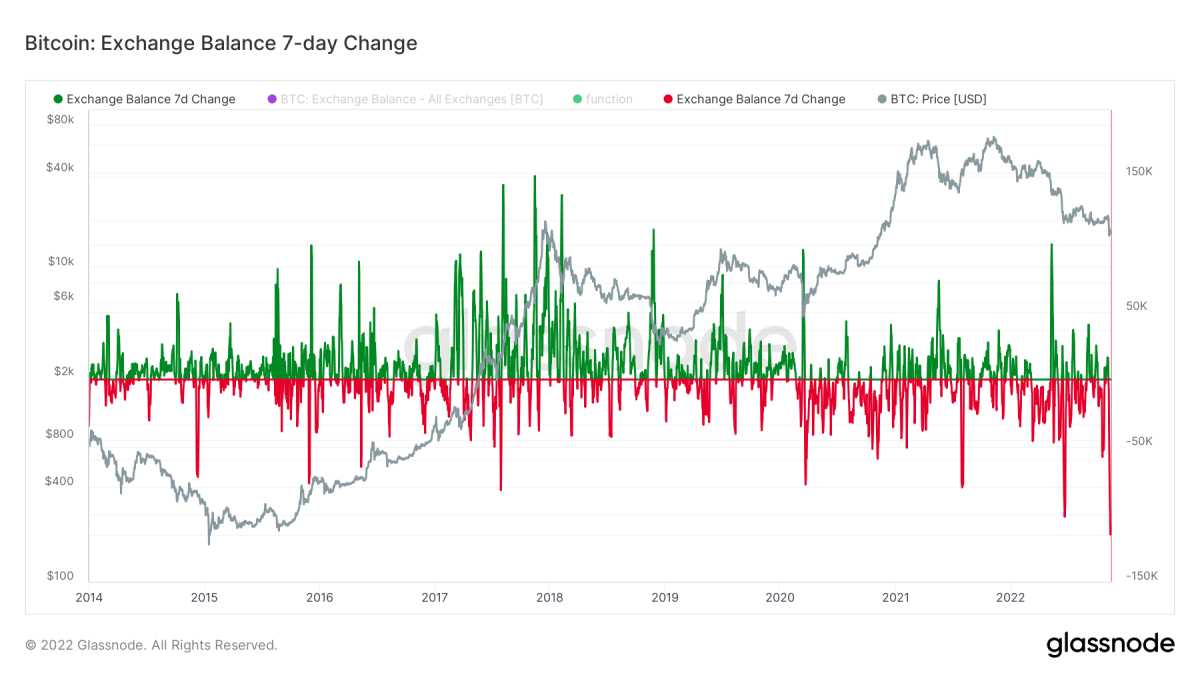

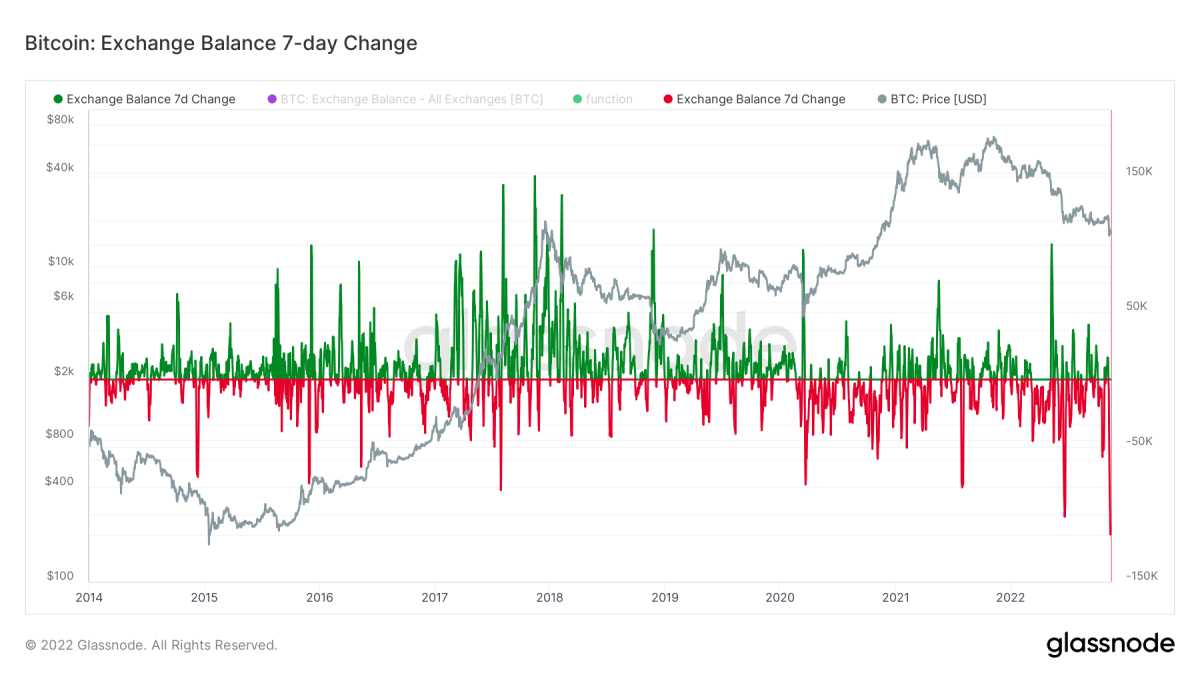

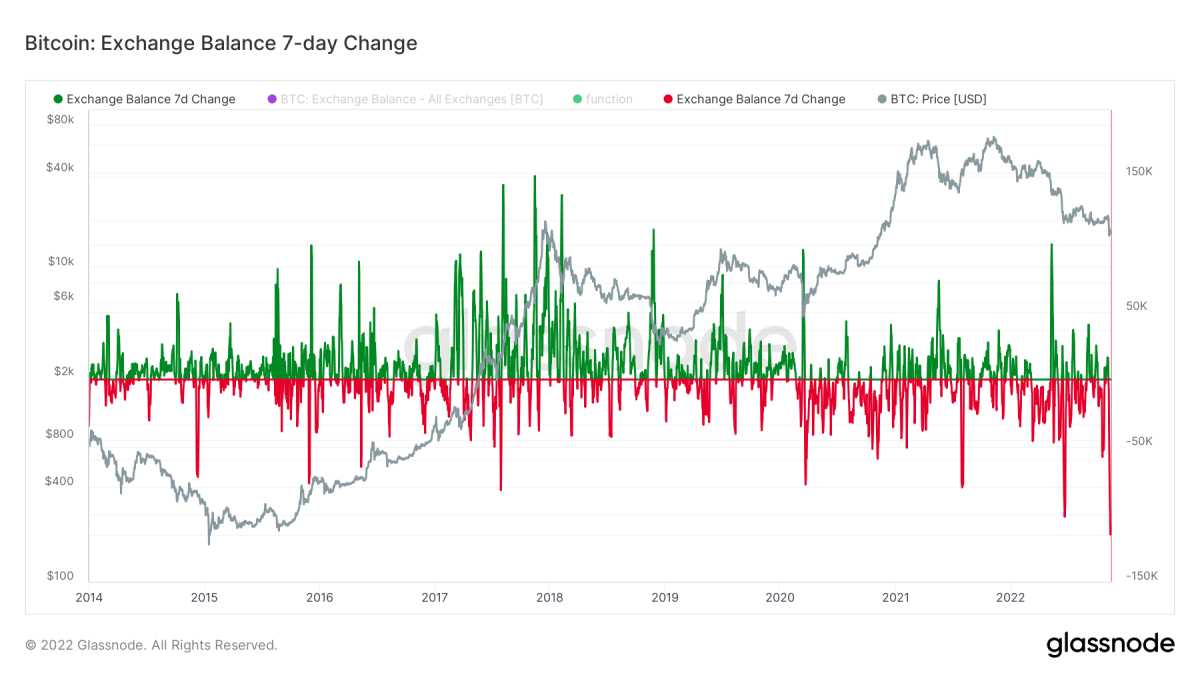

In terms of Bitcoin leaving the exchange, the recent three key market anxiety events have similar development trends: COVID collapse, Luna collapse in March 2020, and the current FTX and Alameda collapse. When Bitcoin escapes from the exchange, the risk of the exchange and the counterparty becomes the main risk. In general, this is a welcome trend. Over 122000 Bitcoins have been discharged from the exchange in the past 30 days. It is precisely the lack of clarity, recognition and excessive financial leverage of the autocratic monarchy that has caused the recent decline.

It is a way to develop and solve such risks by allowing more Bitcoin suppliers to store their own bitcoin. In other words, it is a general and unlikely assumption that all Bitcoin will be stored independently and will not be easily returned to the market. It is very likely that market participants have taken all possible precautions, whether they intend to store Bitcoin for a long time or send it to the exchange later.

In the past, the input and output of bitcoin from exchanges were mostly price signals. However, with the growth of more paper bitcoin, packaged bitcoin in other chains and bitcoin financial products, bitcoin trading flow can more represent the development trend of customers at this stage. Although the recent two major exchange losses mean that local prices have stopped falling. Today, only 12.02% of Bitcoin supply exists in exchanges, less than 17.29% in 2020. Although we have only achieved half of the current month, November 2022 will become the largest month in history

One of the best hopes for the collapse of an exchange in this field so far is that bitcoin customers will feel more insecure about their counterparties and management rights in the future. For more than a decade, many people have been discussing the necessity of their custody right against the world's first blockchain technology data bearer property. However, as FTX may be reliable and trustworthy, this point is often ignored. Fraud can really change that.

This kind of dynamism, and the probability of contagion in many aspects of the encryption space, led users to escape to their own custody. Last week, Bitcoin on the exchange showed a significant decline from week to week, which was - 115200 BTC.

Interestingly, this kind of sales is unique, because unlike sales in recent years, it is not caused by the storm of Bitcoin being sent to the exchange, but by the implosion of the collateral encrypted by the lack of liquidity data. There are not many (or in the case of FTT, everything) customers.

As you have attached great importance to the local infection risk of data encryption in the past six months, you strongly require readers to understand and discuss their own regulatory market prospects; If there is nothing, in order to rest assured.

FINAL NOTES

"We must trust financial institutions to own our money and transfer it with electronic devices, but they lend money with almost no part of their reserves in bank credit foam plastic. We should trust them to maintain our own personal privacy and believe that they will not let identity thieves steal our own accounts."-Quantum chain on FTX

Previous similar articles

- The more of them

- Swap war: Binance sniffs the fragrance of FTX/Alameda rumors

- Counterparty risk arises rapidly

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.