-

Collapsing Crypto Yield Offerings Signal ‘Extreme Duress’

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-12-02

2022-12-02 3415

3415 Research

Research

-

Summary:TM5U3bSXfVsi4859pfzXRpHjZcpZchqVRz

Speculation and returns

This cycle time has long been occupied by speculation and yield, resulting in the initial Grayscale Bitcoin private equity premium arbitrage opportunity. This opportunity in the market has encouraged financial derivatives and trading institutions around the world to increase financial leverage to obtain equity premium price differentials. This is an opportunity to make money, especially early in 2021, when trade collapsed, and then we chose the large discounts we see now.

The same situation also exists in the continuous futures trading market. You can see that the 7-day average annual interest rate equity financing rate reaches 120% when it is the highest. This is also the implied annual rate of return charged by multi position to short position in the market. There are a large number of income and rapid income opportunities in GBTC and futures trading markets alone, and there is no mention of DeFi, chip tokens, unsuccessful projects and Ponzi scams that will lead to higher income opportunities in 2020 and 2021.

This is a continuous and vicious feedback loop system. Price rise will also lead to more speculation and financial leverage, leading to higher yields. Now, the circular system is solved in the reverse form. The lower price avoids more speculation and leverage, and also avoids all "yield" opportunities. The conclusion is that the yields in all regions have decreased significantly.

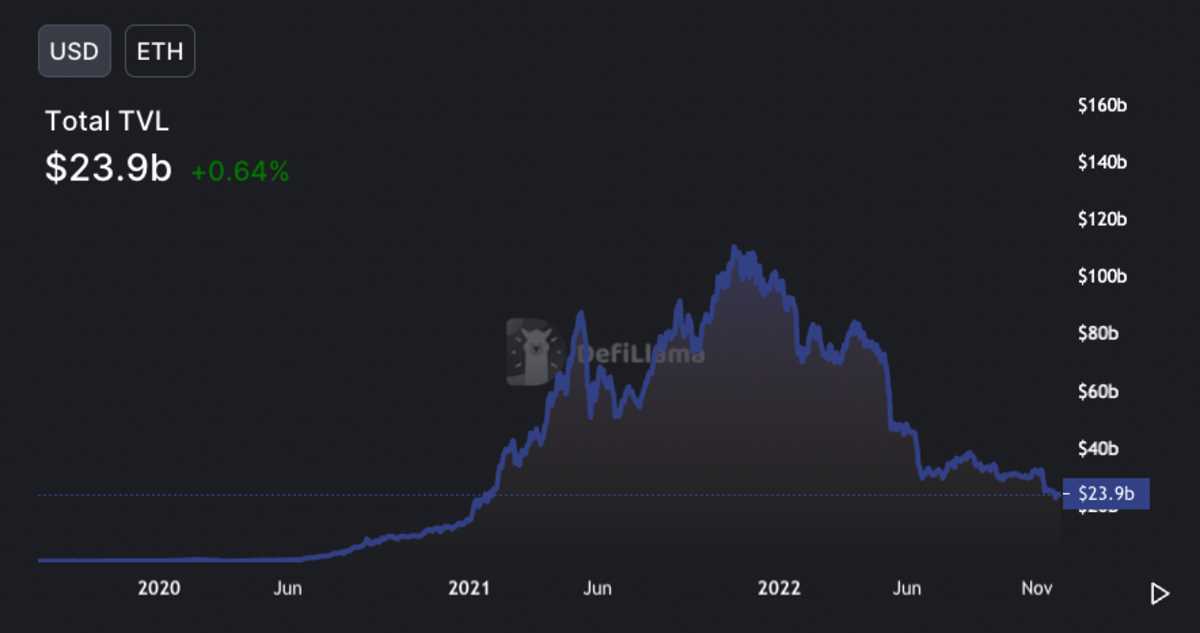

During the 2021 speculative boom, the "locked total" of the Ether DeFi ecosystem exceeded $100 billion, and now it is only $23.9 billion. This kind of financial leverage has promoted the craziness in the data encryption ecosystem and the improvement of "revenue" new products provided by the market. Most of these commodities have already run out after the completion of the representative wave

This kind of dynamism adds to the rise of Bitcoin and digital currency revenues resulting in the rise of commodities, from Celsius to BlockFi to FTX. Funds and traders have won considerable price differentials, while at the same time returning some profits to retail customers, who leave their money in the trading center to obtain a little interest and income. Retail consumers have little understanding of where the revenue comes from or the risks involved. Nowadays, every short-term opportunity in the market seems to have disappeared.

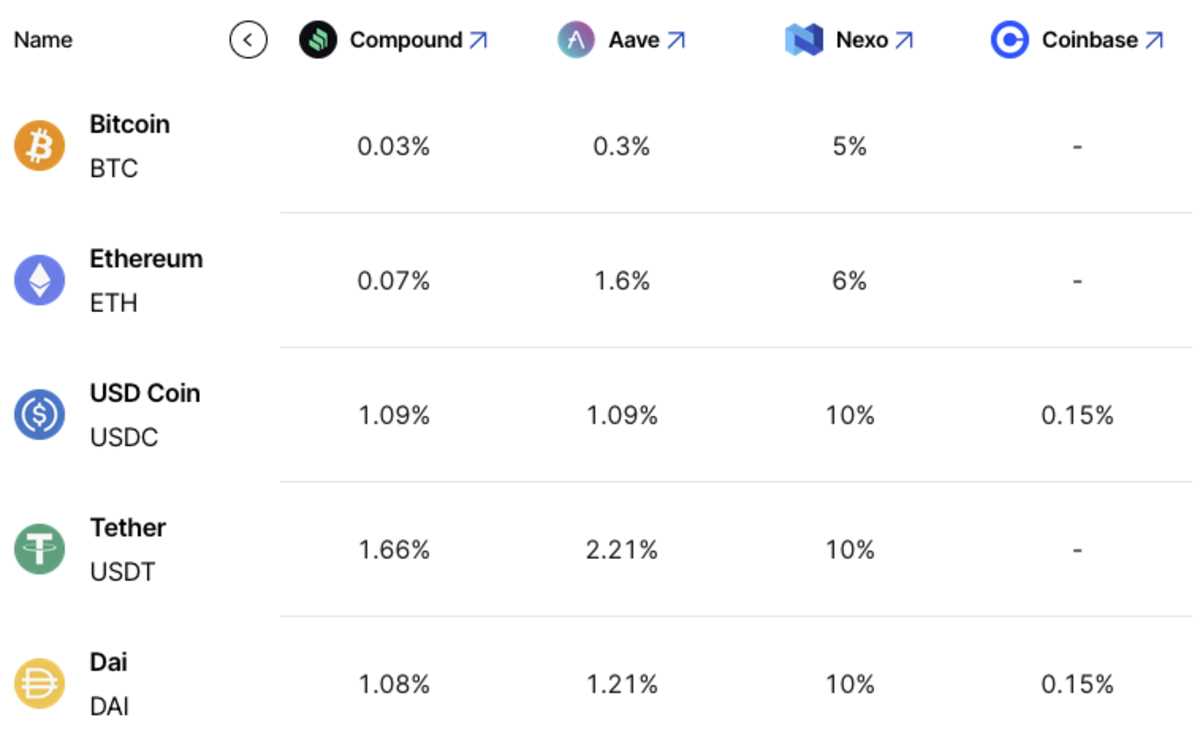

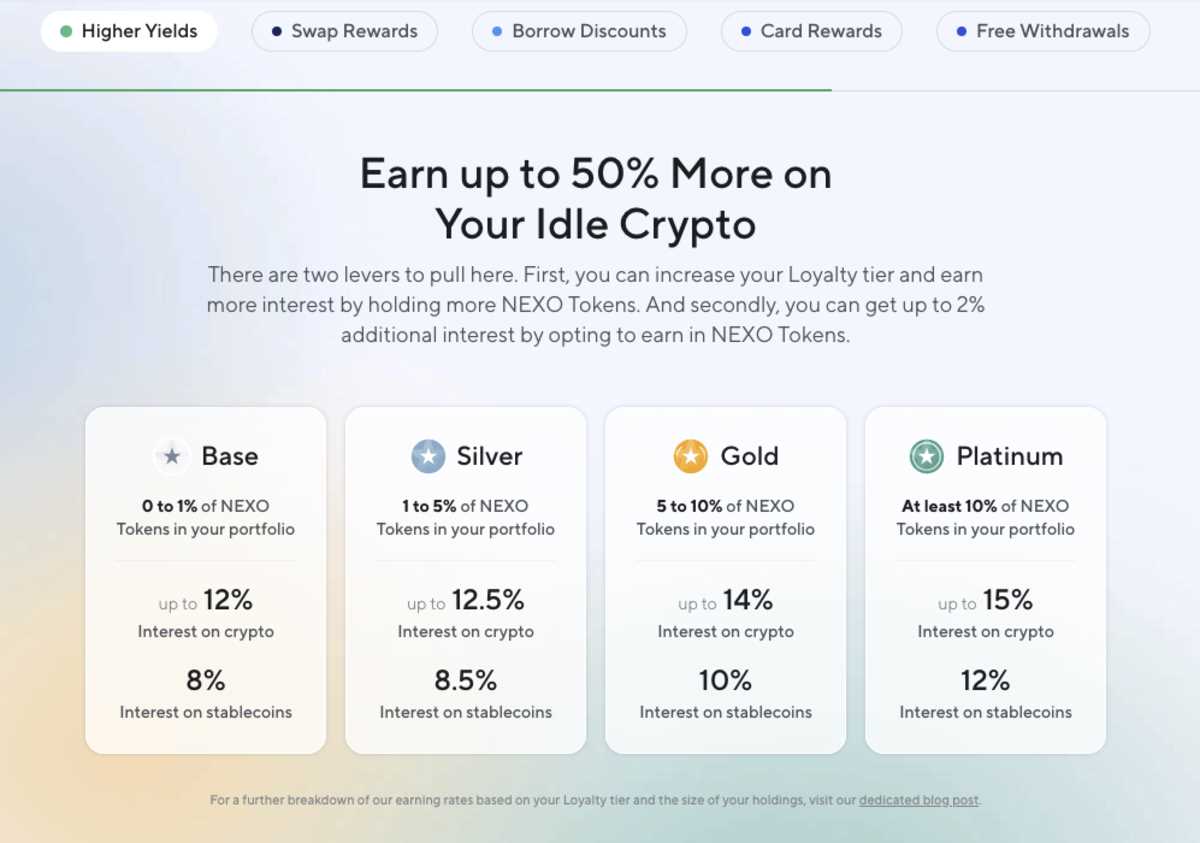

In the case that most speculative pornographic transactions and yields are fading, how can enterprises give a high yield that is far higher than the traditional "zero risk" interest rate in the market? Where does the revenue come from? Not for all specific enterprises, but Nexo as an example. The interest rate of USDC and USDT is still 10%, but that of other DeFi service platforms is 1%. The same is true for Bitcoin and Ethereum, which are 5% and 6% respectively, but most of the other interest rates do not exist elsewhere.

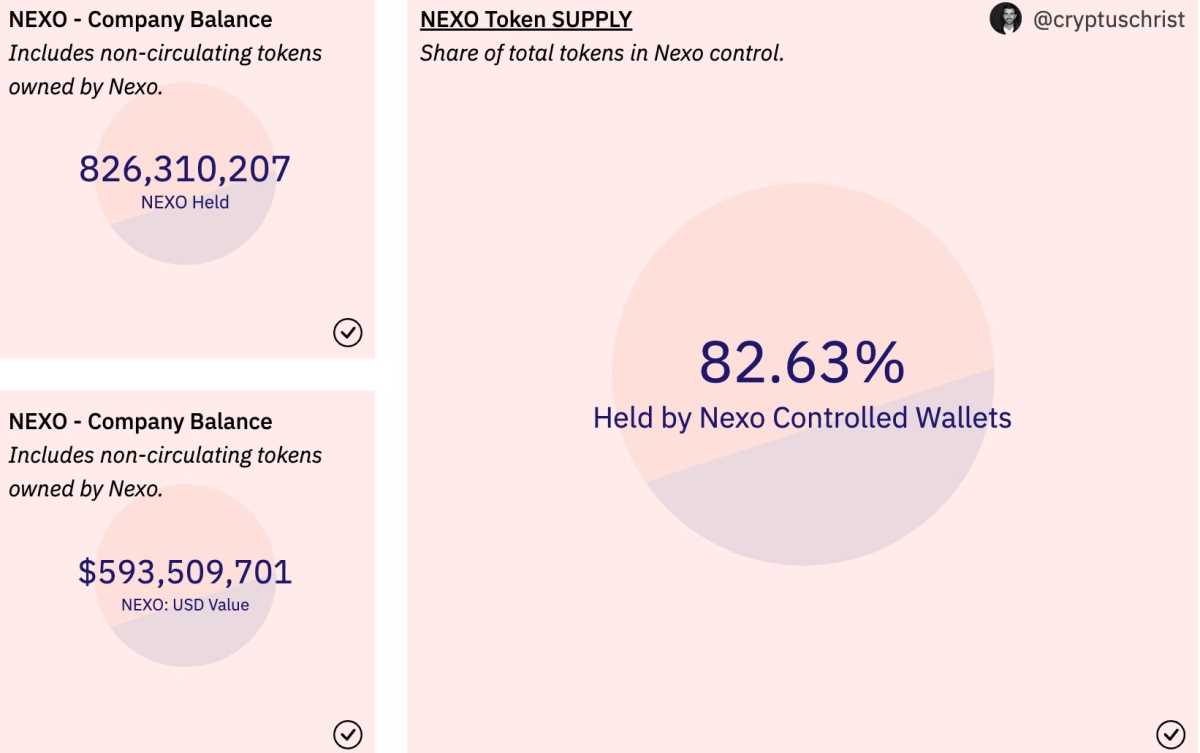

This high borrowing rate is pledged by Bitcoin and Ethereum, and 50% LTV (loan to use value ratio) is given. Many other speculative tokens can also be pledged, and LTV is also slightly lower. Nexo shares specific case clues about its business operation and methods. As we have found again and again, with the smooth progress of this industry, we can never know what organizations are trustworthy or untrustworthy. However, the key points are:

- Is 13.9% of the loan terms a sustainable business operation model in the bear market of the stock market? Is it not easy to lower interest rates further?

- Regardless of Nexo's risk management and control practices, does the counterparty risk of having customer balances in many trading centers and DeFi agreements improve at this stage?

Here's what we learned:

The original ecological bank credit of data encryption is irrational -- an indicator value that can not be fully quantified but can not be fully seen through some data and market indicators -- and it has gradually declined from the excitement of 2021, and now it seems extremely negative. That means everythingThe restThe commodities that bring you the original "yield" of data encryption may be under great pressure, because the commodity explosion arbitrage strategy that promotes the yield in all bull market cycles has all disappeared.

The rest, and what will flash out in the deepest part of the stock market bear market, is undoubtedly the property/new projects built on the most solid foundation. In the eyes of many people, there is Bitcoin and everything else.

Readers should assess the counterparty risk of all methods and avoid all remaining yield commodities in the market.

Previous similar articles:

- The more of them

- Swap war: Binance sniffs the fragrance of FTX/Alameda rumors

- Counterparty risk arises rapidly

- Data Encryption Infectious Disease Aggravates: Who Will Swim Nude?

- Infectious diseases continue: Genesis, the borrower of key data encryption, is the next blockchain to be truncated

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.