-

You’re Still Early: An Objective Look At Bitcoin Adoption

Sam Rule

Sam Rule 2023-02-09

2023-02-09 4426

4426 Research

Research

-

Summary:How many bitcoin users are there? How should we define a bitcoin user? An analysis for categorizing and tracking user growth compared to other estimates.

Note: All data and analysis are not included in the text. The whole book can find its own.

Bitcoin users adopt

One of the most effective examples of Bitcoin is the growing network effect. Bitcoin must be adopted and demanded if it wants to grow again in the future. This demand comes from either the deeper capital growth injected into the Internet or the growth of the number of Internet users.

However, it is very difficult to define the property of the application of Bitcoin Internet or Bitcoin users. There must be many definitions, mainly depending on who you ask. This paper is committed to summarizing and analyzing various definitions and possibilities of Bitcoin users, defining the best choice for Bitcoin adoption, and contributing its own strength and possibility to Bitcoin users at this stage.

How to determine the Bitcoin user?

There is no "appropriate" answer when defining Bitcoin users, but we have considered the following questions when clearly proposing the boundary:

It is better to consider the application of Bitcoin users in stages or in various ways. Considering some rough classification of different user categories:

Inadvertently interested: users have all kinds of Bitcoin or Bitcoin product categories. This may be a person with $5 in his old wallet, a part of GBTC, or a person who has bought a little bit of Bitcoin on Coinbase. Distributors/investors: users who often buy Bitcoin or Bitcoin related products. Key interests and hobbies depend on accounting profits based on the implicit price appreciation of Bitcoin. You can store it by yourself or use the safekeeping solution. Likely spends 1-5% of its net value on Bitcoin/Bitcoin products. Medium and heavy users: users who store a considerable portion of the net value of funds in Bitcoin based on their own storage and/or active on-chain or Lightning trading. The key is to be interested in independent currency lending and currency internet. It is likely that more than 5% of the total assets will be allocated in Bitcoin.Many surprising adoption data we see now usually track this type together. Maybe it is the correct way to open the high-level view of the potential adoption and the first contact, but it can't tell us the total number of users who use Bitcoin for the main purpose: scattered point-to-point cash, and users can also store and trade value on the network in independent currency. Ideally, I hope to track the growth of medium and heavy users to reflect the practical application of Bitcoin.

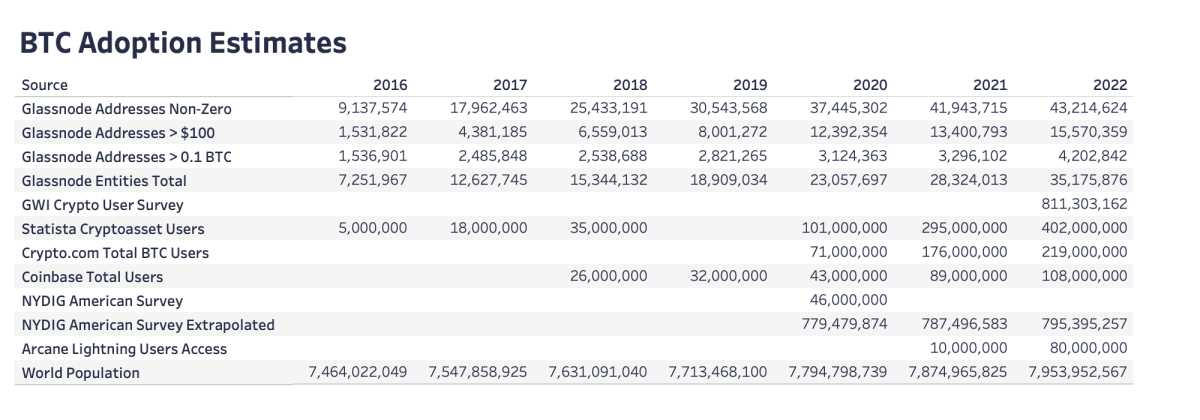

The following is a summary of some important Bitcoin user forecasts published in the past six years to help you understand the level of change in this forecast. Take a look at random interested users. The number will vary from 200 million to 800 million in 2022. This information comes from survey samples and data processed on the chain, including transaction center users. All of these scientific studies have different definitions and methods of measuring the adoption rate, which shows how difficult it is to predict today

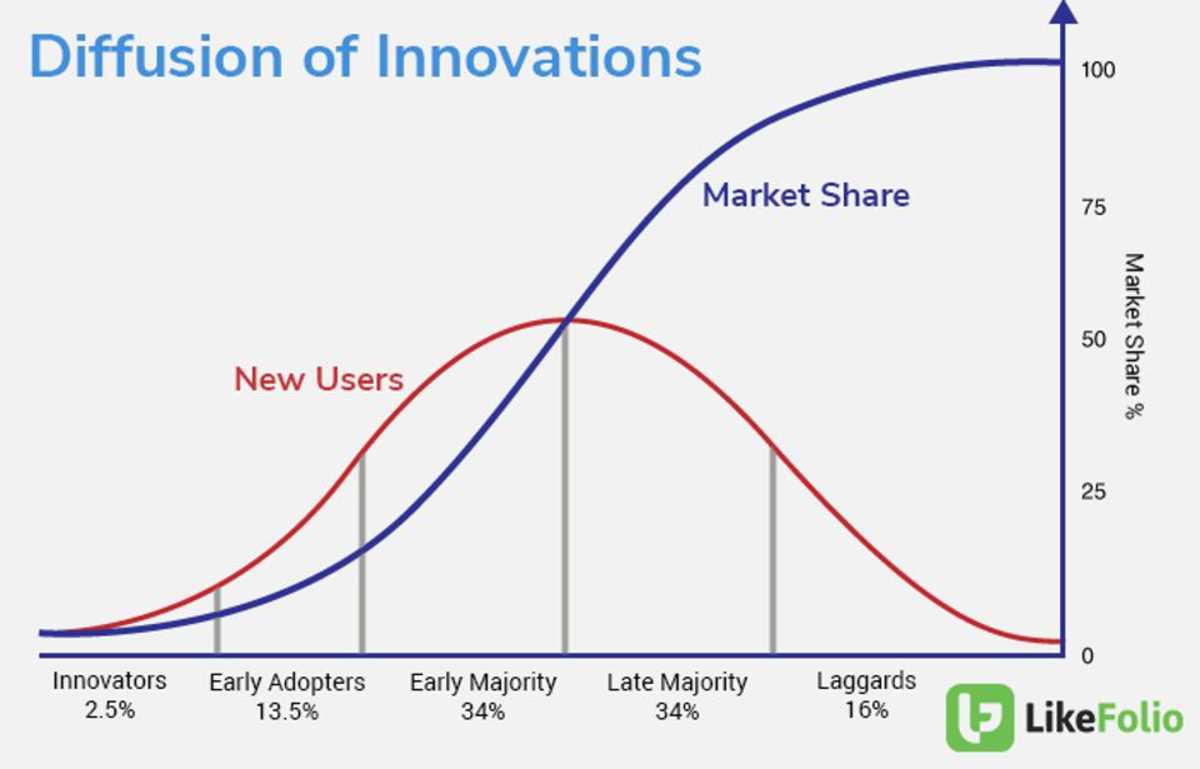

Technical adoption of S curve: Internet and Bitcoin

The application of new technology will generally experience the S curve cycle time in person when obtaining market share. The retention rate of population shows a typical statistical bell curve. The S-curve just reflects the common adoption of new technology applications over time.

Many of the classic prediction and analysis on the adoption of S-curve use a deeper insight to track the growth of Bitcoin, rather than the adoption of big data. Most of them may track all kinds of interested users: these users who have any contact with Bitcoin, from purchasing a bit of Bitcoin at the trading center to owning a Bitcoin wallet with a value of $5, and from Bitcoin users to deposit more than 50% of their total assets in their accounts.

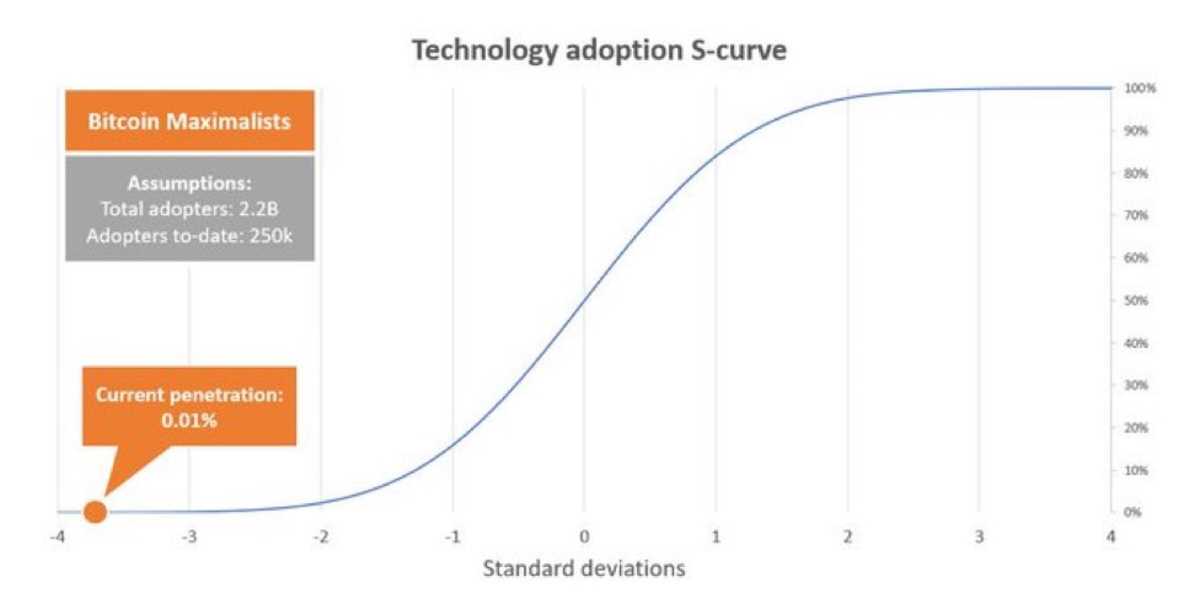

Tracking casual and interested users can help you roughly calculate the same application curve as the Internet. However, if we are really interested in tracking the valuable and long-term adoption of Bitcoin, we will think that tracking the total number of medium and heavy users is a stronger way to test the adoption of Bitcoin, and describe our initial level in the life of Bitcoin. When inquiring about the most popular analysis that circulated before (including the following points), they described a picture, that is, the adoption of Bitcoin is much farther than we expected

In 2020, Apersius wrote an article to analyze the adoption of Bitcoin in a similar way we started in this article. Its results show a similar view with our own: the coverage rate of Bitcoin is far lower than the 10-15% or about 500 million users that are widely used at this stage. In fact, he pointed out that for us, the proportion of "medium and heavy users" using Bitcoin is 0.01% of the world's population.

address

The place where it is easy to gradually possible users is the address on the chain. The address cannot be converted into the total number of users, but can be used as a rough indicator of overall growth. As new users get Bitcoin or Bitcoin holders use many different addresses to diversify their ownership at this stage, the number of different addresses with Bitcoin amount may continue to grow, which is a common personal privacy practice.

Since 2012, I have seen the explosive growth of addresses, from 1 million addresses to nearly 42 million unique addresses. Assuming that everyone's average address is 10 (this is just a rough guess), the upper limit of Bitcoin users who create their own address is about 4.2 million

From the perspective of US dollars, only 5.3 million addresses have Bitcoin worth at least US $1000. Again, using the rough assumption of 10 addresses for each person, we have less than 1 million users who use Bitcoin worth $1000. The median wealth per capita in the world is US $8360, and the allocation of US $1000 to Bitcoin will account for nearly 12% of the main market share. For some people, this is a relatively small allocation, but considering that Bitcoin is global and has a high adoption rate in less affluent countries, this standard may be appropriate

We explained other ways to analyze Bitcoin users in an article on Substack. No matter what method you use to reduce data information, few people around the world will be called medium and heavy users, and they will also store Bitcoin independently as an important threshold.

result

The interpretation in this article focuses on defining and tracking the growth of Bitcoin users in a reliable form.

People pay attention to the low adoption rate, not to persuade readers to compare with the growth of the network effect of the special currency, but to pay attention to the great opportunities for its potential growth in the future

Do you like the specific content?Order nowAccept PRO article content directly from the outbox.

Agreement terms:

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.