-

3 signs Arbitrum price is poised for a new record high in Q2

Yashu Gola

Yashu Gola 2023-04-16

2023-04-16 3091

3091 Market

Market

-

Summary:Arbitrum is relatively cheap versus its top Ethereum L2 rival, Optimism, which may lead to a rise in ARB price over the next few months.

Following the long-awaited Shanghai update from Ethereum, Arbitrum's ARB token has become one of the best-performing digital currencies.

It is worth noting that the ARB price increased by 4.28% on April 13th, reaching $1.36, the highest level in two weeks. This is an 18% increase from the previous day's bottom point of 1.15 US dollars, when Shanghai updated its ability to withdraw pledged loans through Ethereum.

ARB/USDT daily price chart. Origin: TradeView In summary, Arbitrum is an Ethereum Layer 2 (L2) extension solution dedicated to reducing online transaction congestion and transaction fees. Therefore, the sales market generally believes that Ethereum growth is an L2 chain benefit.

The following are three reasons why ARB may once again hit a bull market in the second quarter, retesting its historical high of $1.60.

Deeper application of ARB

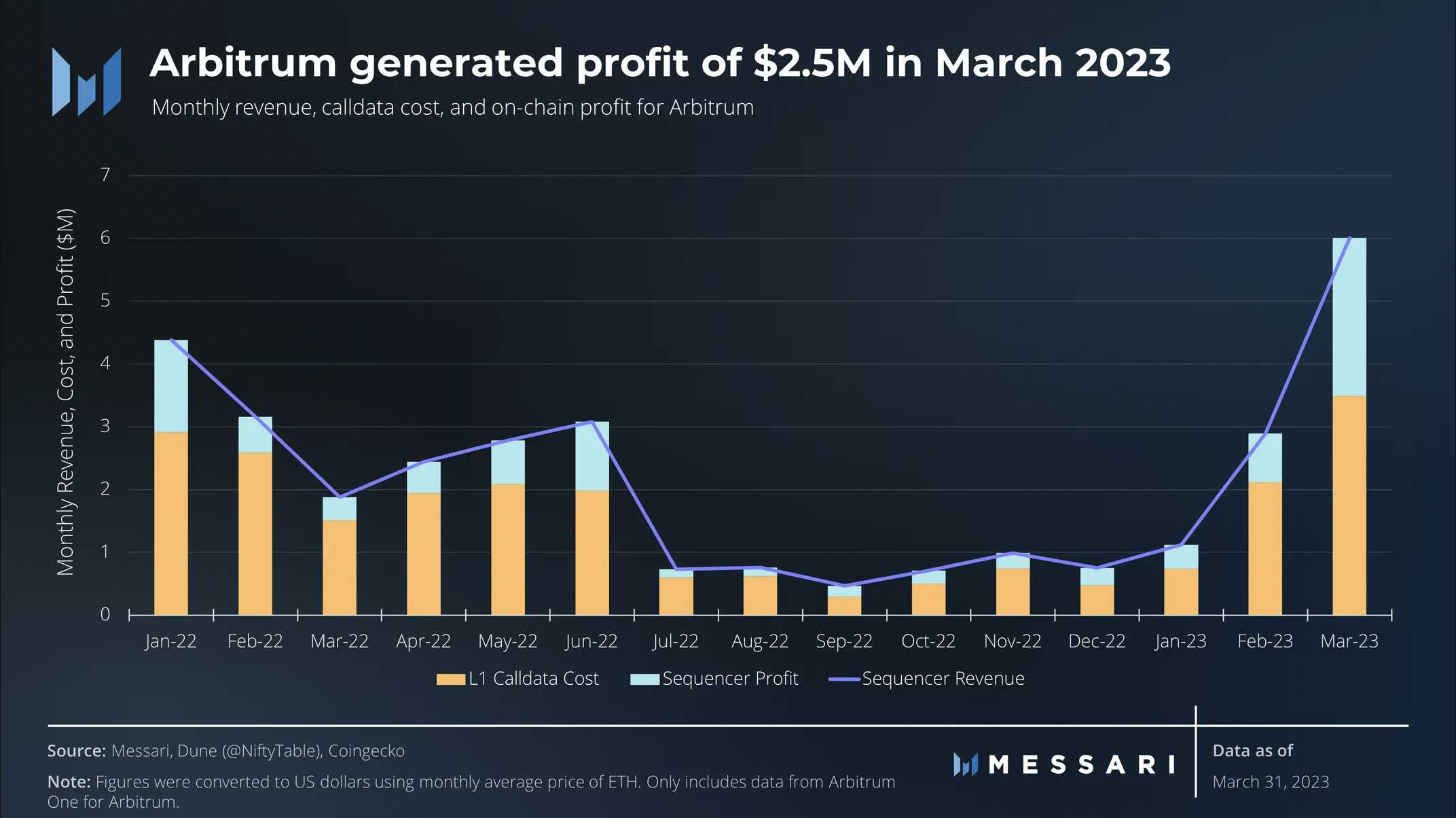

According to Messari's information, Arbitrum generated a profit of $2.5 million in March 2023 based on sequencing.

The financial performance of Arbitrum in 2023. Material origin: Messari It is worth noting that the sequencer profit means the difference between the revenue generated by L2 chains and the expenses paid to basically L1 chains - all of which are calculated using Ethereum's Ethereum (ETH) tokens, rather than ARB.

This profit will eventually flow into Community Governance DAO of Arbitrum, because it will become more and more blockchain technology in the near future.

The encoding sequencer can establish a large obtainable value (MEV) by assigning customer transaction requirements, which is also a limitation of Arbitrum.

However, Messari researcher Kunal Goel affirms that once MEV runs blockchain technology sequencing, ArbitrumDAO may complete the monetization placement of MEV based on bidding for blockchain production rights. Thus opening up opportunities for ARB as a pledge loan token.

Goel emphasized that "DAO may impose ARB pledge loans on sequencers to politically regulate incentive mechanisms and allow for significant reductions in any wrongdoing, similar to validators in proof of equity networks," he added:

Thus adding value to dynamic passwords, as user specified protocols provide higher security factors

Occupy the market share of optimism

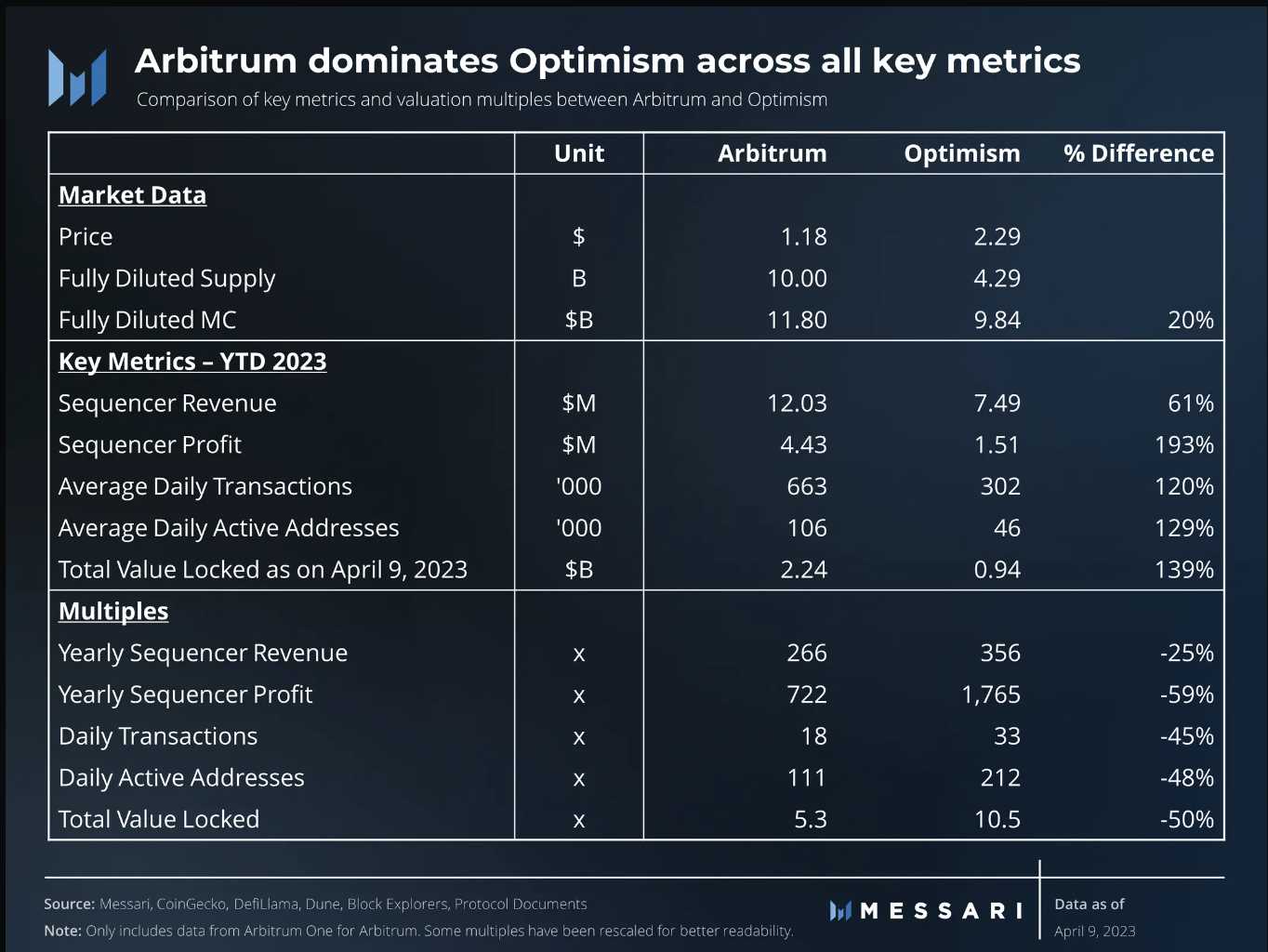

For most of 2022 and 2023, Arbitrum has surpassed its top Ethereum L2 competitor Optimism in most major metrics.

For example, in 2022, Arbitrum generated $22 million in sequencer revenue and $6 million in profits. In addition, Optimism's sequencer revenue and profit were $18 million and $4 million, respectively.

Similarly, in the first quarter of 2023, the revenue and profit of Arbitrum will exceed $4 million and $3 million of optimism respectively.

The main indicators of Arbitrum and Optimism. Material origin: Messari For most of 2022 and 2023, the overall locked in value of use (TVL) of Arbitrum was also higher, and its dominance further increased after ARB airdropped supplies in March.

As of April 13, Arbitrum's TVL was $2.27 billion, while optimism's TVL was $0.93 billion.

Optimism and Arbitrum TVL. Material origin: Defi Llama Goel stressed: "According to the current sales market price, ARB buys and sells at a price less than OP in most valuation multiples.".

The ARB Price in the Triangle of Descending and Increasing

The continuous increase in the price of Arbitrum has broken through, perhaps in a sustained manner.

Regarding: ARB price up to $2? Bocai indicates that Abbitrum, a competitor of Ethereum L2, will double in April

When prices merge between downward resistance and horizontal support, this pattern is called a downward triangle. He dealt with the price increase section and pursued the direction of previous development trends.

ARB entered a similar improvement phase on April 13th, previously surpassing the triangular moving average with persuasive trading volume

ARB/USD four hour price data chart. Origin: TradeView The ARB/USD ratio currently rose to $1.60 in the second quarter, which is an excellent level so far, up 20% from the current price level. The overall goal of this increase is to be detected after summing the main spacing between the moving average of the triangle and the entry point.

On the other hand, there is a risk of short-term adjustment in the ARB price due to its overbought relative strength index value in the four hour data chart. In such a situation, the upward moving average of the triangle is undoubtedly the overall goal of a possible decline of 1.20 yuan.

Disclaimer:As an open information publishing platform, shilian only represents the author's personal views and has nothing to do with shilian. If the article, picture, audio or video contains infringement, violation or other inappropriate remarks, please provide relevant materials and send it to: 2785592653@qq.com.

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.