-

Public Miner Capitulation Takes Shape With Core Scientific On The Ropes

Dylan LeClair And Sam Rule

Dylan LeClair And Sam Rule 2022-10-30

2022-10-30 3510

3510 Research

Research

-

Summary:Miner capitulation is here. Core Scientific talks about potential bankruptcy, highlighting that cash resources will be depleted by the end of the year.

Key Science Reasonably Dismantle and Surrender

In the past many months, we have been paying attention to the reasons for a large number of public miners to surrender. According to the news report, Core Scientific, the largest selling mining enterprise, will face bankruptcy according to the hash rate and mining transport aircraft. The highlights of SEC filing are as follows:

- Core Scientific has terminated all debt repayments.

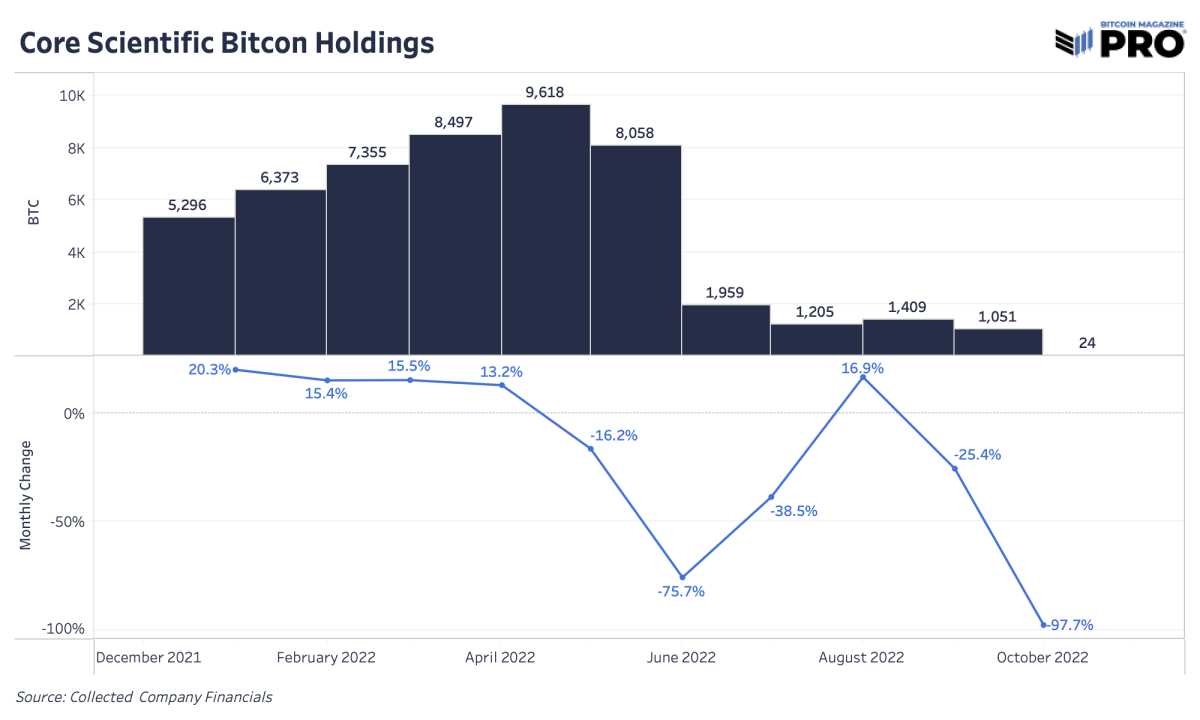

- Bitcoin ownership is now 24; They sold 1027 cars last month.

- Cash network resources will be consumed at the end of the year or earlier.

- Core Scientific claims that Celsius owes them $5.4 million.

As a leader in the mining industry, Core Scientific had more than 9600 bitcoins at its peak, and now it has basically consumed all its assets. Today, the year-on-year growth rate of position cost is worse than the summer surrender and sale we saw in June 2022. However, the sales operation in June was much larger (6099 Bitcoin). This is a more warning data signal for this industry, so now we are not necessarily concerned with the key scientific and reasonable property, but the property and ownership of all other bitcoin miners

Core Scientific has promoted Bitcoin production and hash rate according to the world's largest debt to equity ratio of 3.5. Now, the debt will be full at the worst time, trying to raise more total equity, the price is depressed, and the sales market lacks the preference of the financial industry.

At this stage, the company's liquidity lies in two independent variables: the rise of bitcoin price and the reduction of power engineering cost. Our own view is that with the constant stagnation of Bitcoin price and the increase of its electric charge (especially the electric charge of the miners who take charge of Bitcoin), both cases will be amazing luck. From the profit in the second quarter, compared with previous years, the revenue and cost of Core Scientific increased from 67% to 92%. The relatively high cost of electricity consumption is a key factor.

The biggest risk related to mining stocks and the rising hash rate is not only whether the enterprise survives and reaches the other side; Some meetings, some not easy. On the other hand, as an investor, you must ask yourself whether your equity in the enterprise will be diluted substantially in this process.

At present, for us, compared with Bitcoin itself, the general downturn of miners is predictable.

Now, let's turn our focus to the surrender probability of the ASIC market. As the world's largest selling mining enterprise Core Scientific (measured by the hash rate) suffers from the anxiety of liquidity/capital adequacy.

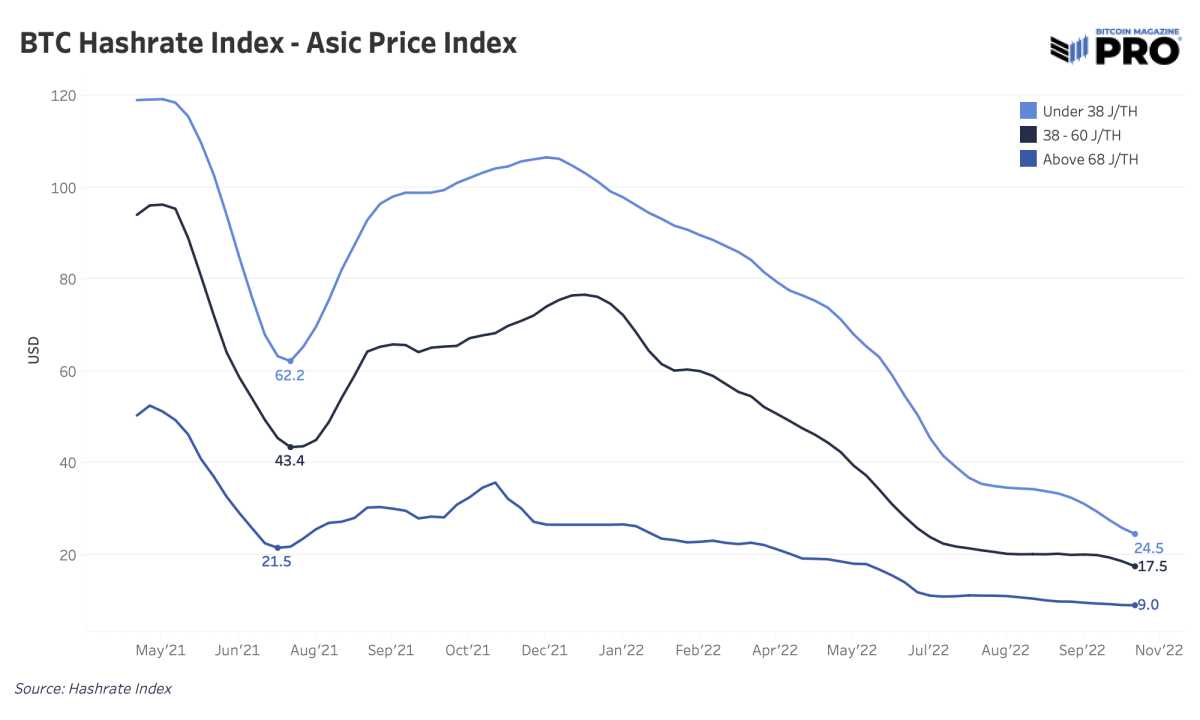

Even without the recent development trend, the price of ASIC has been at the lowest level in history, just like the best seller. Luxor's Hash Rate Index shows how depressed the prices of different machine efficiency categories are in the table below. With the extensive use of new and lower cost drilling machines by miners, this has added further downward pressure on the price economy for the old mining methods. With the increasing demand for new drilling rigs such as S19 XP and other newly upgraded hardware configurations to maintain competitiveness, the sales pressure of the old model is also very high. Even under the cheapest electricity and energy costs, this old model specification is not desirable or futile. In the worst case, old equipment is only free.

Although Core Scientific will have many choices, such as asset restructuring, Chapter 11 bankruptcy or implicit collaboration; Selling and settling part of its 130000 miners fleet may be another option. The increased sales pressure of miners can only increase a lot of work pressure on the depressed price. The further decline of the ASIC price will also affect all the miners who guarantee or finance to their ASIC companies, because the ASIC price is likely to fall further. Now, we will quietly wait for what kind of work pressure this will cause on the hash rate in the middle and later stages. If we see a significant decline in the hash rate in the next three to six months. For us, if the peak valley hash rate does not decrease by 20%, the cycle time will not end

Finally: Bitcoin coin digging is a cruel business. At this stage, the last remaining bear is going to be killedMarket cycleAnd the regeneration of the next bull market.

Only the strongest can survive.

About previous articles:

- 10/25/22 - There is no difference this time: miners are the greater risks faced by the Bitcoin sales market, and the cycle time of 2018 is repeated

- 10/6/22 - Hash rate hit a record high: impact on individual mining stocks

- 7/26/22 - Bitcoin hash rate continues to rise by 17%, setting a new record

- 7/5/22 - Public miners gradually sell Bitcoin bonds

- 6/29/22 - Mining Hash Price Stock Market Bear Market

- 12/21/21 - Performance assessment of chain mining and public mining

Hint:The information provided on this site does not represent any investment suggestion. Investment is risky, and you must be cautious when entering the market.

ShilianFan group:Provide the latest hot news, airdrop candy, red envelopes and other benefits, WeChat: rtt4322.